$10M in reserves key to balancing 2025 Bloomington draft budget, but GO bonds unveiled as option

The proposed $145.4 million budget for 2025, which was released by Bloomington mayor Kerry Thomson last week, relies on $10 million in general fund reserves.

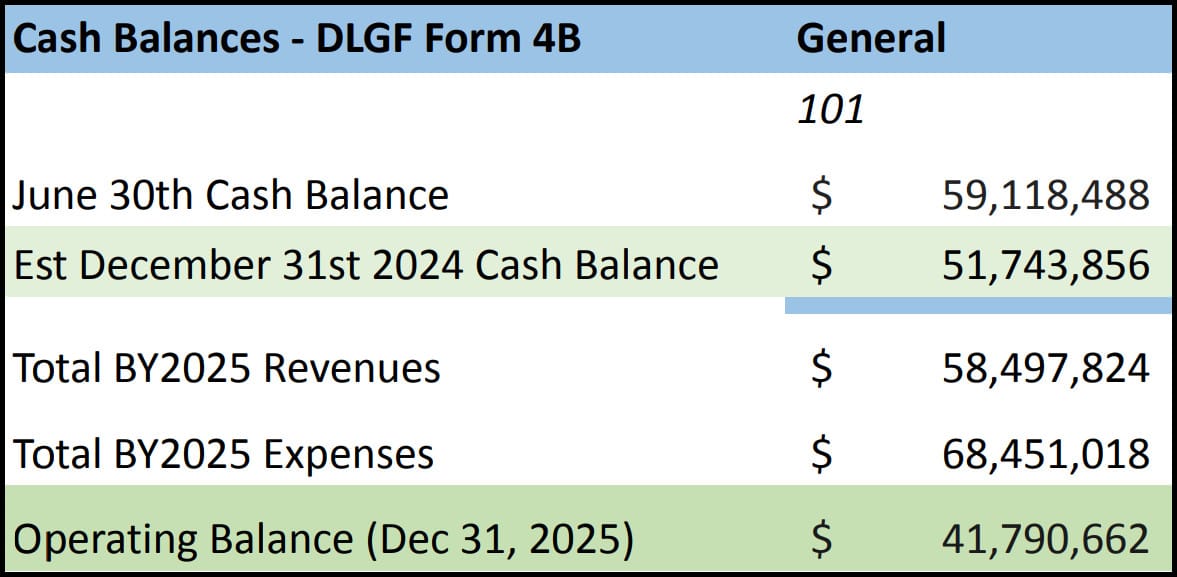

That’s a fact that is included, if not highlighted, in the 383-page budget book. Page 23 shows about $68.45 million in expenses for the general fund, compared to $58.50 million in revenues.

When Thomson’s administration introduced the proposed 2025 budget to the city council on Monday, the big news was related to the topic of tapping $10 million in reserves.

Controller Jessica McClellan told the city council that an alternative to using reserves to cover the full amount of the $10 million funding gap would be to issue general obligation (GO) bonds.

Bloomington mayor Kerry Thomson was not able to attend Monday’s meeting, due to illness.

GO bonds: How much?

Issuing GO bonds would mean using less than $10 million in reserves to cover the difference between expenses and revenues in the proposed 2025 budget.

The details would need to be worked out between the council and the administration by Sept. 13, according to controller Jessica McClellan.

That’s when the dollar amounts in the city’s 2025 budget, and the related tax rates, would need to be advertised to the public, based on the schedule the administration has set for the 2025 budget adoption. That schedule calls for the council to vote on budget adoption on Oct. 9.

McClellan told news outlets after Monday’s council meeting that she does not think the total amount of issuance for the GO bonds would be nearly $10 million. She pegged the number at around $6 million or less.

Matt Frische, with Reedy Financial Group, the city’s consultant, told the council that the general strategy his firm uses when advising municipal clients is to remove capital expenditures from operations accounts and fund them instead through a GO bond. That frees up cash in operation accounts, Frische said.

Frische said that based on an initial analysis of the administration’s proposed 2025 budget, he had identified roughly $6.7 million in capital expenditures that are in operational accounts. That would mean issuing around $6.7 million in GO bonds.

Both Frische and McClellan broke down one of the arguments for issuing GO bonds in terms of preserving the city’s existing property tax rate. GO bonds are paid for out of a property tax increase.

In the state of Indiana, the total amount of the levy gets determined before the property tax rate is set. This year, the MLGQ (maximum levy growth quotient) is 4 percent. So the levy will increase by just 4 percent, even though the total assessed value has increased by about 13 percent. That means next year’s rate, the rate that is needed to generate the levy, will be less than this year’s rate.

This year’s property tax rate is 0.8635, which is 86 cents per $100 of assessed value, McClellan told the council. The difference in assessed value growth and levy growth means the property tax rate growth will drop to 69 cents per $100, McClellan said.

Analyzed in terms of rate, not in terms of amount of property tax paid, there’s 17 cents worth of rate that could be imposed, without increasing the rate that property owners pay in 2024.

According to McClellan, maintaining the same tax rate would help Bloomington keep its proportion of LIT (local income tax) certified shares, compared to other taxing units. Certified shares of LIT are the basic category of LIT that get distributed to the individual taxing units (city government, county government, townships, fire district, library, etc.) based on their proportion of property tax levy.

The B Square has asked for confirmation that it’s really the case that the revenue generated by a GO bond tax rate would count towards the city’s share for distribution of LIT certified shares. Under state law, it looks like the first step in the calculation is to subtract the levy that is generated to cover debt. [Updated Aug. 27, 2024 at 2:40 p.m. McClellan confirmed in an email to The B Square that debt is first subtracted, which means that the property tax rate related to a GO bond would not help add to Bloomington’s share of certified LIT shares.]

Even if around $6.7 million in capital expenses has been identified by Frische in operations accounts, the amount of GO bonds issued could depend on another factor. To avoid being subject to the requirements of a “controlled project” under state law, this year the amount would need to stay under $6,106,217.

There are various options for remonstrance, depending on the amount of a controlled project.

In 2017, the threshold for controlled projects was raised from $2 million to $5 million plus a growth quotient each year. The growth quotient has increased the $5 million baseline set in 2017 to $6,106,217 today.

McClellan told The B Square that the term of the GO bond issuance could be one to three years, depending on how interest rates look.

For the past several years, Monroe County government has annually issued GO bonds.

The idea of using the proceeds from GO bonds, instead of reserves, to make up part of the shortfall between general fund expenses and revenues is not driven by low reserves—because the city’s reserves are relatively high.

The general recommendation from the Government Finance Officers Association is to keep enough reserves to cover two months of expenses, McClellan said—which is about 17 percent of total expenses. The city’s target for the major funds has typically been around 30 percent, McClellan said.

By the end of 2024, the general fund reserve balance is projected to be $51 million, which is about 70% of annual expenses, McClellan said.

Salary increases

Also on Monday night came a clarification of the section in the budget book written by human resources director Sharr Pechac about salary increases.

There is a 3-percent cost of living (COLA) adjustment for employees included in each department’s proposal, but there’s also a $6 million lump sum set aside for implementation of a wage study.

Adoption of the budget includes adoption of salary ordinances.

On Monday, McClellan said the idea would be to ask the council to adopt a salary ordinance that does not include the two additional salary grades from the wage study.

The idea would be for the administration to return to the council before the end of the year, with a proposal to amend the salary ordinance that includes implementation of the wage study and to distribute the $6 million in the budget to the appropriate departments.

The next three nights of departmental presentation city council’s budget week break down like this. (Monday’s schedule is included for reference.)

MONDAY, AUGUST 26

Mayor’s Intro

Controller’s Intro

HR Intro

Bloomington Fire Department

Bloomington Police Department / Dispatch

Community & Family Resources

TUESDAY, AUGUST 27

Economic & Sustainable Development

Parks & Recreation

Public Works

Administration

Animal Care & Control

Facilities Maintenance

Fleet Maintenance

Parking Services

Sanitation

Street Operations

WEDNESDAY, AUGUST 28

Bloomington Housing Authority

Housing & Neighborhood Development (HAND)

Planning & Transportation

Engineering

Bloomington Transit

City of Bloomington Utilities

THURSDAY, AUGUST 29

Office of the City Clerk

Common Council

Office of the Mayor

Information & Technology Services (ITS)

Human Resources

Legal

Office of the Controller (including CIB)

Comments ()