Monroe County commissioners: Equal county-city representation is “only way” to move convention center expansion forward

Set for Thursday night in Bloomington’s city council chambers is the third in a series of meetings between city and county elected officials about the planned expansion of the county convention center.

A short letter from the three Monroe County commissioners, sent Wednesday to Bloomington’s mayor, John Hamilton, will help now set the mood for Thursday’s meeting.

A short letter from the three Monroe County commissioners, sent Wednesday to Bloomington’s mayor, John Hamilton, will help now set the mood for Thursday’s meeting.

The single sentence in the letter, which dispenses with salutation and closing, runs 27 words:

The only way we will consider moving forward with the Convention Center Project is with the County having an equal representation of membership on the oversight board.

The project is an expanded 30,000-square-foot exhibit space with a 550-space parking garage. It’s estimated to cost $59 million, of which about $15 million is for a parking garage.

In previous written and oral exchanges, it has been evident that representation in the governing entity—whether it’s a building corporation, a capital improvement board, or a 501(c)(3)—is a point of acute disagreement between county commissioners and Mayor Hamilton.

For a seven-member capital improvement board, commissioners have proposed either a 4–3 or a 3-4 split. Hamilton has countered by saying that he thinks 6–1 or 5-2 in the city’s favor would reflect better the city’s financial contribution to the project.

Based on Wednesday’s one-sentence letter, commissioners are not willing to negotiate the point.

The county council’s president, Eric Spoonmore, told The Beacon late Wednesday after seeing the letter, “It provides some clarity for where the commissioners are,” adding “I take them at their word.” Spoonmore said the letter puts the ball in the city’s court.

The food and beverage tax is defined in state statue as confined to funding the convention center expansion. Given that the food and beverage tax is being collected, Spoonmore said, “We need to make sure we move this forward.” The 1-percent food and beverage tax, which has been collected since February 2018, had generated about $4.5 million through July of 2019.

Having seen the one-sentence letter, Bloomington’s city council president, Dave Rollo, told The Beacon after the council’s meeting on Wednesday, “Clearly, we have something to discuss tomorrow evening.”

Rollo zeroed in on the word “equal” in the letter, saying he thinks the right representation should be “fair” not necessarily “equal.”

Based on the city’s financial contribution, from the food and beverage tax, for the new construction, Rollo said he has some sympathy for the mayor’s position.

The food and beverage tax, which has been collected since February 2018, is split 90-10 between a city share and a county share. The construction of the expanded facility is planned to be funded solely from the city share of the food and beverage tax. The split is based on where the establishments are located that pay the 1-percent tax.

The parking garage is planned to be financed with revenue from the city’s tax increment finance TIF district.

County officials consider the funding mix for the eventual governance to be more than just the financing for the construction of exhibit space and the parking garage. The exhibit space is expected to be financed by bonds with a possible term of 25 years, the parking garage maybe 20 years.

Factors considered by the county include its innkeeper’s tax, starting from 1999 and projected 25 years into the future. That totals around $111 million, based on a county spreadsheet reviewed by The Beacon. One chunk of the innkeeper’s tax (40 percent) is used to pay the maintenance and debt on the existing facility. Another chunk of the innkeeper’s tax (60 percent) is allocated to Visit Bloomington for tourism promotion.

The county analyzes the city’s contribution over the 25-year bond period as totaling $81 million for the expanded facility, paid out of the food and beverage tax, and $20.6 million for the parking garage paid out of city TIF revenues.

Based on those totals—$111 million for the county and $101.5 million for the city—the county concludes that the financial contributions to the expansion project are tilted 4–3 in favor of the county.

The ledger balances different if tourism promotion is not counted as a part of the mix. Lopping 60 percent off the innkeeper’s tax would put the county-city split for governance representation at closer to 2–5.

At the most recent meeting of the county council a draft resolution was circulated, which called for a 3–3 split between county and city, with the remaining seat on a CIB to be decided by those six appointees.

Rollo told The Beacon that if a discussion of the relative county-city representation on the governing body is not on Thursday’s meeting agenda, it needs to be added.

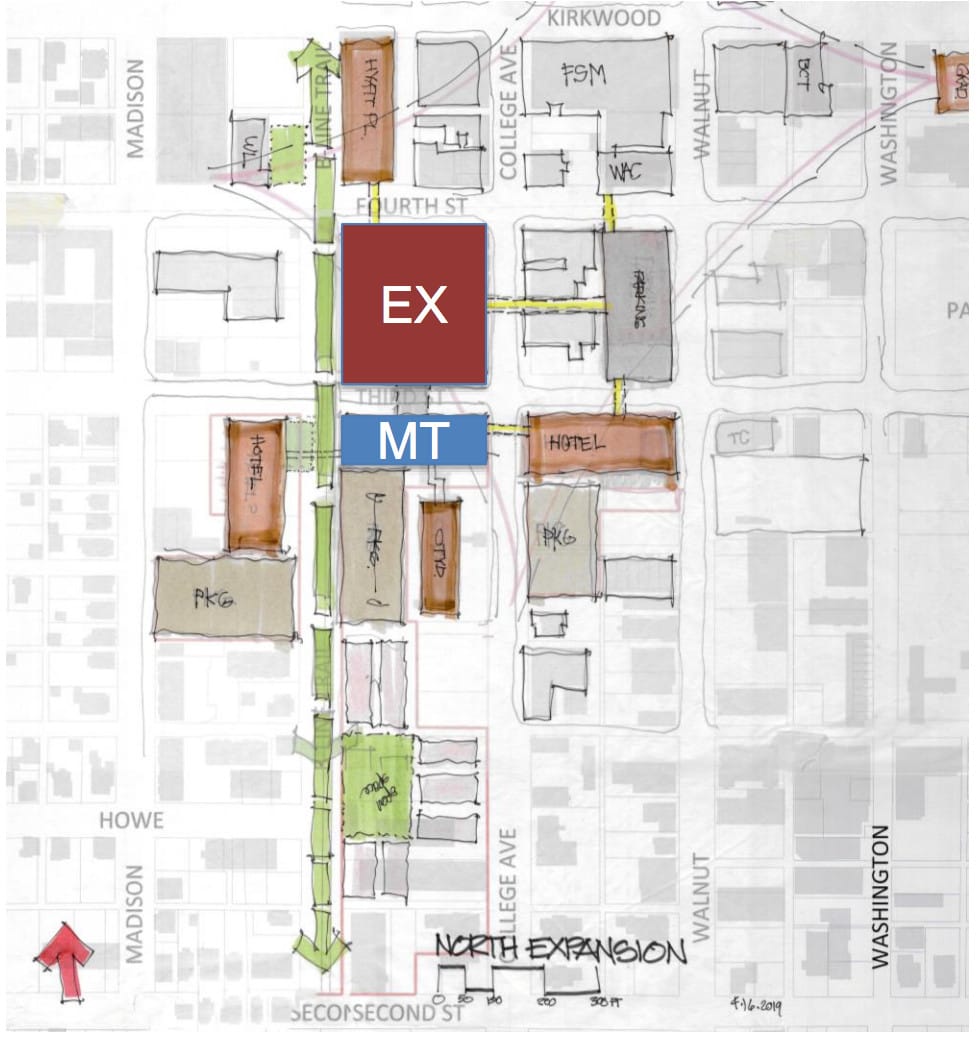

The current agenda has three main points: governance options (capital improvement board, 501(c)(3), building corporation); site plan options; and discussion of next steps.

The two site plans on agenda are a northward expansion and an eastward expansion. A nine-member steering committee voted in late May to recommend a preliminary site plan that calls for a northward expansion of the existing convention center facility. But the county commissioners favor an eastward expansion.

Another topic that could easily arise at Thursday’s county-city meeting: The idea of revising the memorandum of understanding (MOU) that established the nine-member steering committee. The steering committee selected the architect and shepherded the public engagement process that concluded in May. The MOU revision would allow the steering committee to move the project to the design and construction phase.

The city’s draft revision of the MOU from earlier this year reflects the disagreement between the county and the city about which partner is contributing more to the project. The county’s proposed phrase “true and equal partnership” has been struck through by the city.

County commissioners want to form a capital improvement board and turn the project over to the CIB. It’s the commissioners who have the statutory power to form the CIB. Mayor Hamilton wants to revise the MOU and have the steering committee continue to work, at the same time work on governance issues.

Rescind tax? No, says Spoonmore

The passage of the food and beverage tax was one of the most contentious issues he’d ever seen, Spoonmore told The Beacon Wednesday. He compared it to the kind of debate the city council was currently having on its unified development ordinance.

Spoonmore voted with the minority back in 2017, when the county council approved the tax.

Just four of the current seven county councilors were serving when the food and beverage tax was approved in December 2017, on a 4–3 vote. Voting yes were Ryan Cobine, Shelli Yoder, Cheryl Munson, and Geoff McKim. Voting no were Lee Jones, Eric Spoonmore and Marty Hawk.

The tally among the four councilors who are still serving—Spoonmore, Hawk, Munson and McKim—was 2–2. Jones, who voted no, is now a county commissioner.

The Beacon asked Spoonmore if the lack of progress on the convention center expansion, because of the lack of agreement between the mayor and the commissioners, might cause the county council to consider rescinding the tax.

Spoonmore responded, “I have no desire to revisit that. The easiest thing to do is to deliver the product that we promised, the convention center expansion.”

Comments ()