UDO Update: How payment-in-lieu of building affordable housing could still be in the mix

The first two days of the Bloomington city council’s work on amendments to the unified development ordinance update were dominated by two contentious questions.

Should duplexes and triplexes should be allowed in core neighborhoods? Should accessory dwelling units should be subject to the conditional use public process?

Both questions related at least indirectly to the issue of the availability and affordability of housing. The council chambers were packed each night.

The following week, the council’s docket started off with another amendment related to the affordability of housing.

Sponsored by councilmember Isabel Piedmont-Smith, Amendment 08 changed the planned unit development (PUD) qualifying standards, by eliminating the option for a developer to donate a sum to the city’s housing development fund, instead of building income-restricted affordable units on site as a part of the project.

PUDs are projects that depart significantly enough from existing zoning standards that they require their own custom zoning, which means that unlike by-right projects, they have to win approval from the city council.

The UDO update builds a 15-percent affordable housing requirement into the qualifying standards for a PUD. So elimination of the payment-in-lieu option means that the only way a PUD could be approved without including affordable units as a part of the project is through waiver of the PUD qualifying standard.

Judged by the smattering of attendees at the following week’s meeting, and the council’s 8–0 vote, the amendment on payment-in-lieu (PIL) for PUDs was not controversial.

But the council’s decision was disappointing to the city’s administration. Responding to a query from The Beacon, Bloomington’s communication director, Yaël Ksander, said, “The City plans to work with Council to suggest they reconsider PIL as a viable option…”

Ksander added, “Competition for federal and state dollars for affordable housing is steadily increasingly as these funds continue to shrink, so payment-in-lieu (PIL) to the Housing Development Fund is an essential tool in Bloomington’s limited toolbox for developing affordable housing.” A housing development fund is also a best practice recommended by the American Planning Institute, Ksander said.

Even if the council can’t be persuaded to revisit the PIL for PUDs, the successful amendment leaves intact the part of the UDO update that describes by-right incentives for inclusion of affordable housing components. Among other incentives, a project is allowed an extra floor of height compared to the prevailing zoning standard, if 15 percent of its units are restricted to renters making 120 percent or less than the annual median income.

The standards for those incentives can be met by payment-in-lieu, if the city’s plan commission makes at least one of three possible determinations.

One possible determination is that creation of affordable housing as part of the project would result in too high a concentration of low-income housing in one area of the city. Another determination making payment-in-lieu possible is if the income-restricted units would be more than a 10-minute walk from public services or public transit. The third way a project might qualify for payment-in-lieu is if the small size of the project would require the creation of less than three affordable dwelling units.

The Beacon took a look at PIL question, starting with one recent PUD and then turned to the history of the city’s housing development fund.

City: Don’t call it “pay-to-play”

The most recent example of a PUD project that included a payment-in-lieu component was the proposal from Collegiate Development Group to build a 750-bed student-oriented housing project on North Walnut, where the current Motel 6 sits.

When the project came in front of the city council in late summer, it was the payment-in-lieu component, among other things, that proved objectionable to some councilmembers, as well as some members of the public. Some councilmembers wished for the income-restricted affordable units to be built as part of the project, thereby integrating the project with a bigger demographic range of residents.

The policy question was whether to demand an income range for residents within every project as opposed to allowing a developer to contribute to economic inclusion in a bigger geography. Layered on top of that policy question was a perception— amplified by use of the expression “pay to play”—that the developer was somehow paying a kind of “bribe” to win approval for the project.

As deployed in the debate, “pay-to-play” was objectionable enough to city staff, that planning and transportation department director Terri Porter on one occasion took the podium in council chambers just to lodge her objection to the phrase as an insult to the professional integrity of planning staff.

The project was originally proposed with 820 beds. Based on the per-bed calculation for in the agreed-upon arrangement, the amount that Collegiate Development Group will wind up donating to the city’s housing development fund for the 750-bed project will be around $2.25 million.

The first 25 percent of the donation is supposed to be paid by CDG when the building permits are issued. The remaining amount is due when occupancy permits have been issued. That means the city’s housing development fund should get its infusion of another $2.25 million by August 2022.

How much money is in the fund?

The housing development fund is known casually as the affordable housing fund. That’s because the ordinance that established the fund in late 2016 requires that be used to support housing for people making no more than 130 percent of the annual median income. That support can come in the form of direct financial assistance to individuals, land acquisition, grants and loans for development of housing, among other things.

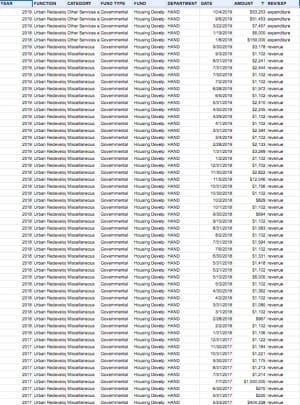

Because the fund is relatively new, its complete transactional history is available through the city’s public-facing online financial portal.

The two major contributions to the fund so far came from a $1 million payment-in-lieu made by the Evolve student-oriented housing development and a $404,228 contribution which was transferred from the Community Foundation of Bloomington and Monroe County. The money was as part of housing trust fund that was maintained at the foundation. Investment income accounts for several other periodic revenues to the fund in the single-digit thousands.

Expenditures include $159,000 to support re-financing of Bloomington Cooperative Living’s co-housing facility at at 404 West Kirkwood. In 2019 so far, expenditures of $53,253 and $51,453 are payment draws for Union at Crescent, a 146-unit multifamily affordable housing development, which received a $250,000 loan and a $250,000 grant from the fund, according to Ksander.

The fund played a crucial role in a 16-unit South Central Indiana Housing Opportunities project, starting construction near Switchyard Park, according to Ksander.

Ksander said the fund is one of the tools used by the city’s Affordable Housing Team, which consists of: Amber Skoby at the Bloomington Housing Authority; Alex Crowley, director of economic and sustainable development; Terri Porter, director planning and development; and Doris Sims; director of housing and neighborhood development.

Next steps

The exact amount that a developer has to pay under a payment-in-lieu option is not spelled out in the UDO. The section for PUDs that was eliminated through the city council’s amendment says it should be “an amount estimated to offset the cost to the city of providing an equivalent amount of income-restricted housing.”

For the section on affordability incentives to be effective, the city administration is required under the UDO update to establish some administrative procedures:

The provisions of this Section 20.04.0110(c)(7) shall not become effective until the City adopts administrative procedures for calculating, collecting, accounting for, and spending payments-in-lieu in compliance with all applicable law.

Housing Development Fund Transactions

| FUND | DATE | AMOUNT | REV/EXP |

| HDF (Ord 16-41) | 11/27/2019 | $94,331 | expenditure |

| HDF (Ord 16-41) | 10/4/2019 | $53,253 | expenditure |

| HDF (Ord 16-41) | 9/6/2019 | $51,453 | expenditure |

| HDF (Ord 16-41) | 3/22/2019 | $7,457 | expenditure |

| HDF (Ord 16-41) | 1/19/2018 | $6,000 | expenditure |

| HDF (Ord 16-41) | 1/8/2018 | $159,000 | expenditure |

| HDF (Ord 16-41) | 9/30/2019 | $3,178 | revenue |

| HDF (Ord 16-41) | 9/3/2019 | $1,102 | revenue |

| HDF (Ord 16-41) | 8/31/2019 | $2,241 | revenue |

| HDF (Ord 16-41) | 7/31/2019 | $2,444 | revenue |

| HDF (Ord 16-41) | 7/30/2019 | $1,102 | revenue |

| HDF (Ord 16-41) | 7/2/2019 | $1,102 | revenue |

| HDF (Ord 16-41) | 6/28/2019 | $1,972 | revenue |

| HDF (Ord 16-41) | 6/5/2019 | $1,102 | revenue |

| HDF (Ord 16-41) | 5/31/2019 | $2,410 | revenue |

| HDF (Ord 16-41) | 4/30/2019 | $2,245 | revenue |

| HDF (Ord 16-41) | 4/29/2019 | $1,102 | revenue |

| HDF (Ord 16-41) | 4/1/2019 | $1,102 | revenue |

| HDF (Ord 16-41) | 3/31/2019 | $2,394 | revenue |

| HDF (Ord 16-41) | 3/4/2019 | $1,102 | revenue |

| HDF (Ord 16-41) | 2/28/2019 | $2,133 | revenue |

| HDF (Ord 16-41) | 1/31/2019 | $3,269 | revenue |

| HDF (Ord 16-41) | 1/2/2019 | $1,102 | revenue |

| HDF (Ord 16-41) | 12/31/2018 | $1,702 | revenue |

| HDF (Ord 16-41) | 11/30/2018 | $2,822 | revenue |

| HDF (Ord 16-41) | 11/5/2018 | $12,046 | revenue |

| HDF (Ord 16-41) | 10/31/2018 | $1,756 | revenue |

| HDF (Ord 16-41) | 10/30/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 10/2/2018 | $829 | revenue |

| HDF (Ord 16-41) | 10/1/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 9/30/2018 | $694 | revenue |

| HDF (Ord 16-41) | 9/10/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 8/31/2018 | $1,583 | revenue |

| HDF (Ord 16-41) | 8/2/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 7/31/2018 | $1,594 | revenue |

| HDF (Ord 16-41) | 7/6/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 6/30/2018 | $1,331 | revenue |

| HDF (Ord 16-41) | 5/31/2018 | $1,418 | revenue |

| HDF (Ord 16-41) | 5/21/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 5/10/2018 | $6,000 | revenue |

| HDF (Ord 16-41) | 5/3/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 4/30/2018 | $1,362 | revenue |

| HDF (Ord 16-41) | 4/2/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 3/31/2018 | $1,080 | revenue |

| HDF (Ord 16-41) | 3/1/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 2/28/2018 | $967 | revenue |

| HDF (Ord 16-41) | 2/2/2018 | $1,102 | revenue |

| HDF (Ord 16-41) | 1/31/2018 | $1,106 | revenue |

| HDF (Ord 16-41) | 12/31/2017 | $1,122 | revenue |

| HDF (Ord 16-41) | 11/30/2017 | $1,184 | revenue |

| HDF (Ord 16-41) | 10/31/2017 | $1,221 | revenue |

| HDF (Ord 16-41) | 9/30/2017 | $1,175 | revenue |

| HDF (Ord 16-41) | 8/31/2017 | $1,213 | revenue |

| HDF (Ord 16-41) | 7/31/2017 | $1,214 | revenue |

| HDF (Ord 16-41) | 7/7/2017 | $1,000,000 | revenue |

| HDF (Ord 16-41) | 6/30/2017 | $270 | revenue |

| HDF (Ord 16-41) | 5/31/2017 | $220 | revenue |

| HDF (Ord 16-41) | 5/23/2017 | $404,228 | revenue |

Comments ()