Monroe County councilor on possible local income tax increase: “This was not anything proposed by the county.”

Bloomington’s mayor, John Hamilton, made a New Year’s Day announcement that he wanted to see an additional 0.5 percent in local income tax collected countywide. Hamilton wants to spend the extra portion of tax money allocated to Bloomington on climate action.

Under the current state statute, Bloomington’s city council has a 58-percent voting share on the county’s local income tax council. So a five-vote majority on Bloomington’s nine-member city council could enact the extra 0.5 percent of local income tax on all county residents. The voting shares are allocated based on population.

The mayor’s proposal hasn’t received air time at two regular meetings and two work sessions held by the Bloomington city council so far this year.

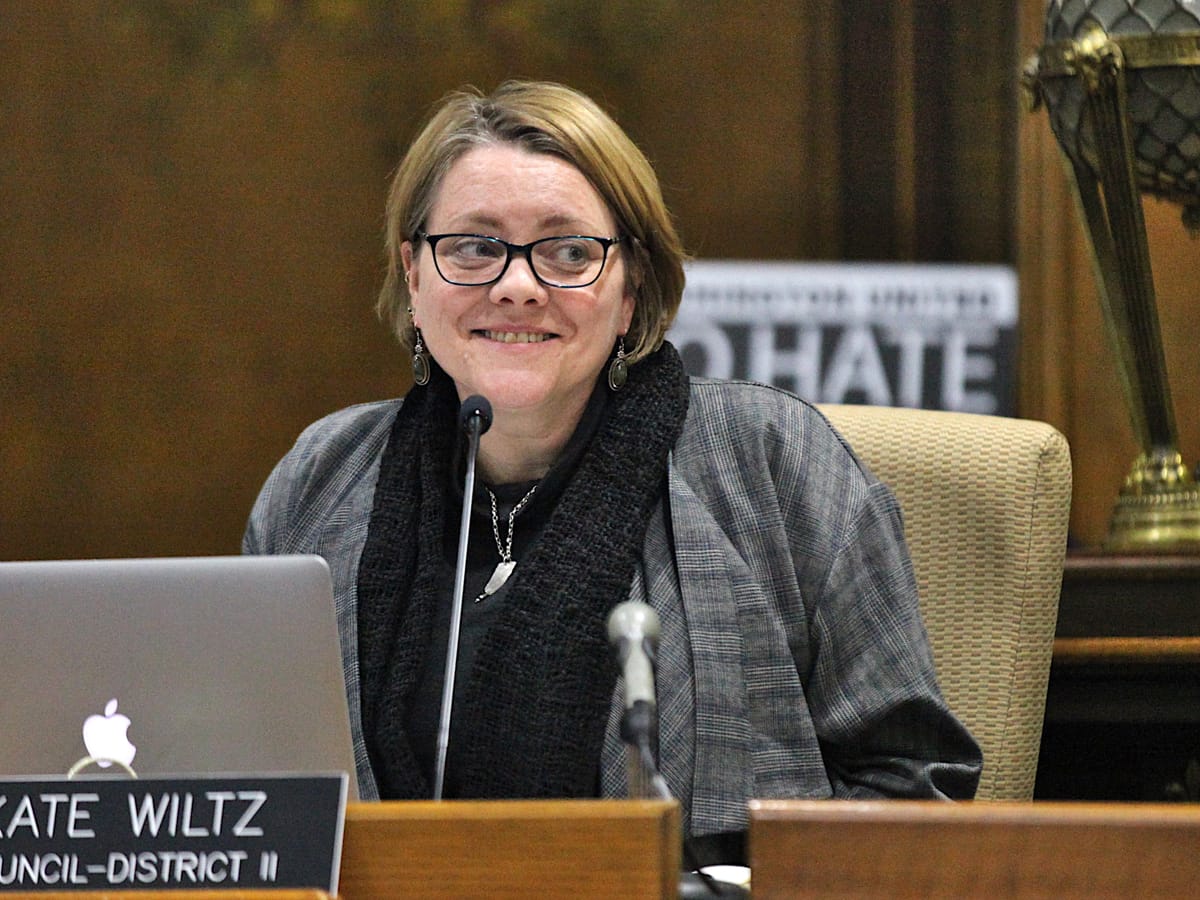

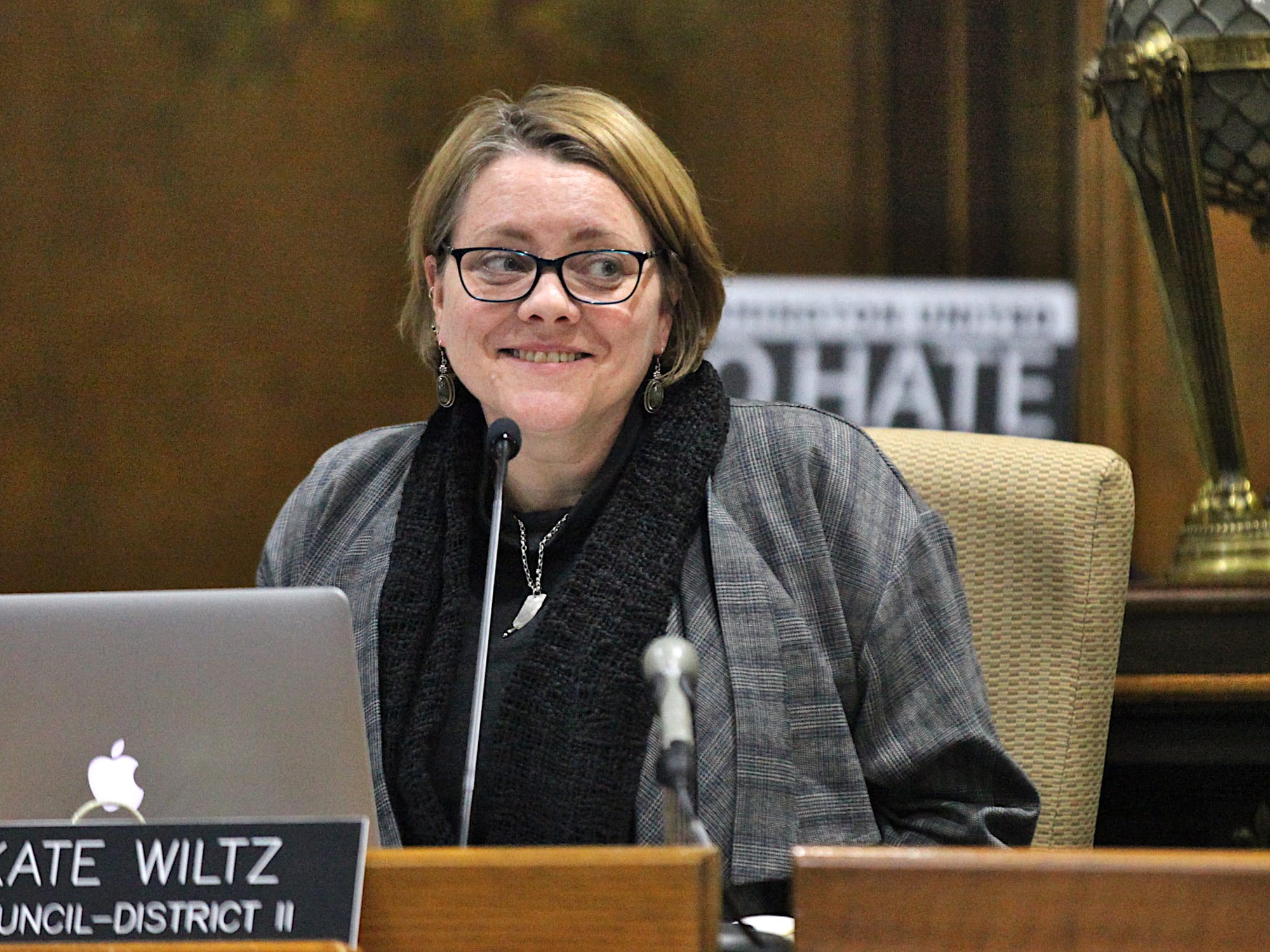

In contrast, county officials had a lot to say about the local income tax proposal at Tuesday’s first county council meeting of the year. They didn’t take any formal action.

On Tuesday, councilors Marty Hawk and Cheryl Munson were keen to have county auditor Cathy Smith help provide some clarity on the components of the tax.

Councilor Eric Spoonmore, who was chosen on Tuesday by his colleagues to continue as president of the council in 2020, made a statement to the public about the local income tax proposal. Spoonmore said he’s been hearing from constituents who are “kind of alarmed” about the size of the proposed increase.

The point emphasized by Spoonmore was: It’s not the county council that is pushing to enact a local income tax increase. Spoonmore said: “We know that the city has proposed this. This was not anything proposed by the county.”

State representatives in the General Assembly have also heard from the county’s non-city residents, who oppose paying a higher income tax, especially one that can be enacted unilaterally by a jurisdiction where they don’t live. Councilor Marty Hawk said on Tuesday, “There can be no other word for it than taxation without representation.”

A bill that’s been introduced in the House (HB 1065) by Rep. Jeff Thompson (R) would try to address the issue of representation on the local income tax council. The bill would change the way the votes on the tax council are tallied.

Now, each fiscal body that’s a member of the tax council casts its weighted percentage vote as a block of votes. The bill would change the voting to a weighted percentage for each person who’s a member of a fiscal body that is a part of the tax council.

LIT Components

At Tuesday’s county council meeting, Monroe County’s auditor, Cathy Smith, spoke up during the meeting to confirm that county councilors had received the information she’d sent them about the local income tax.

Smith told councilors that she worried about the impact of an income tax on county employees, who were generally given just cost of living increases, as well as residents across the county.

Among the points Smith lays out in her email are the components of the local income tax in Monroe County. There are six components. It’s the economic development component that Mayor Hamilton is calling on the Bloomington city council to start using. Monroe County does not currently levy any local income tax in this category.

Councilor Munson asked that the information that Smith had provided in her emailed message be placed on the county council’s web page.

For calendar year 2020, the 1.345-percent total local income tax in Monroe County corresponds to $46,562,175 in certified distributions.

The extra 0.5 percent, if it were added, would pencil out to $17.31 million. The ballpark number that Hamilton floated in his New Year’s Day announcement was about $8 million each for Bloomington and Monroe County governments to spend at they think best.

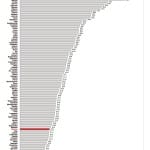

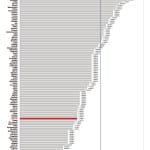

How does the current total LIT in Monroe County stack up against the LIT in other Indiana counties? Any answer to that question should come a caveat, according to county councilor Marty Hawk. That’s because some counties enacted a part of their local income tax in order to reduce their property tax levy.

In the bar chart below, only the “expenditure rate” components of the LIT were used for the ranking—leaving out the property tax relief component and special purpose component. Ranked from high to low, Monroe County has the 70th highest total local income tax rate out of 92 counties. In the bar chart, the vertical line shows where the additional 0.5 percent of income tax would put Monroe County’s total.

How does Monroe County stack up on its general fund levy compared to other counties? Starting with the certified general fund levy for each county, and dividing by population for each county, gives the per capita number of dollars levied in property tax. Ranked high to low, Monroe County is 76th highest on the list.

How Economic Development Local Income Tax Can be Spent

In his statement to the public at Tuesday’s county council meeting, councilor Eric Spoonmore first established that it was not the county council that was thinking of pushing for an increase to the local income tax.

Based on the mayor’s New Year’s Day announcement, Spoonmore said it revenue would be used for a climate change purpose. “Aside from that, I know we are eagerly anticipating what those details would be from the city.”

After the meeting, Spoonmore clarified to The Square Beacon that he wanted to know how the Bloomington city council was planning to initiate the ordinance with the local income tax council. In principle, the county council could bring forward such an ordinance, but Spoonmore stressed that he was not interested in seeing the county council initiate it.

Independently of what the Bloomington city council might say about the intended use of the extra revenue, which would come from increasing the economic development component of the LIT, Monroe County and Ellettsville can decide how they want to spend the funds. The statute (IC 6-3.6-10-2) that outlines how economic development LIT can be spent includes on the list “any lawful purpose for which money in any of [a fiscal body’s] other funds may be used.”

After the county council’s meeting, county attorney Margie Rice confirmed to The Square Beacon that the phrase “any lawful purpose” appears to be the wording that’s relevant.

During the meeting, councilor Marty Hawk discouraged discussion about how to spend the money: “I will not consider what it will be used for because that’s not what this debate is. This debate is simply that we have one elected body putting in place a tax on many of us who cannot vote for that body.”

HB 1065

At Tuesday’s county council meeting, councilor Marty Hawk said she’d contacted state legislators about the issue of Bloomington’s voting share. She called on collective action to get the legislation amended:

If we as an elected body will join together with our county commissioners and perhaps even our city colleagues, to ask the state to correct this legislation, it’s something that all of us should be able to support…

Have Republican state legislators heard any complaints so far?

Yes.

Wade Coggeshall, press secretary for the House Republicans, told The Square Beacon that Rep. Peggy Mayfield (R) has heard from many people in Monroe County with concerns about the proposed increase to the local income tax.

In a phone interview, Rep. Jeff Ellington (R) said he’d been asked, not only by Republicans but also Democrats, to address the way local income taxes are administered.

About the population-based representation on local income tax councils, Ellington said, “It’s just not fair for any municipality or any unit of government to have that much authority over someone who does not get the opportunity to have a voice at the ballot box.”

Ellington said the legislation on local income taxes probably should have been fine-tuned years ago. Is there anything in the works this year? “There might be,” Ellington said. He pointed out that it’s an off budget year, so it’s a short legislative session. Committees are backed up already with a lot of legislation, Ellington said.

If anything is done, Ellington said, it will be done in a “fair and equitable, reasonable manner.”

Mayfield’s message, relayed by Coggeshall, pointed to a specific piece of legislation already in the queue for this session (HB 1065).

It would change the way votes are tallied on the local income tax council. Now, each fiscal body that’s a member of Monroe County’s local income tax council is allocated some number of votes out of 100. For Bloomington, Ellettsville and Stinesville, the number corresponds to the percentage of county population in the fiscal body’s jurisdiction. For Monroe County it corresponds to the percentage of population that is not in any of the other jurisdictions.

For the members of the local income tax council, here’s the current allocation of votes after getting tweaked last year—one of Bloomington’s votes went to Monroe County.

37 votes: Monroe County

58 votes: Bloomington

5 votes: Ellettsville

0 votes: Stinesville

Under the current statute, blocks of votes don’t get broken down based on the votes of people serving on each of the fiscal bodies, even if the vote is split. For example, if the vote on the Bloomington city council is 5–4 in favor of a proposal, all 58 votes still count in favor.

HB 1065 would dose each fiscal body’s allocation of votes of across each member of that fiscal body. Here’s the wording in the bill:

Each individual who sits on the fiscal body of a county, city, or town that is a member of the local income tax council is allocated for a year the number of votes equal to the total number of votes allocated to the particular county, city, or town under subsection (d) divided by the number of members on the fiscal body of the county, city, or town.

That means each member of the nine-member Bloomington city council would have 6.44 votes (58/9) on the local income tax council. Members of the seven-member county council would each have 5.29 votes.

As a practical matter, a unanimous vote on the Bloomington city council in favor of a tax increase would still be enough to put it through. Even a 8–1 split vote on the Bloomington city council would still be enough to enact a local income tax increase. That’s because an 8–1 split would still translate into 51.5 votes on the the local income tax council.

But a 7–2 vote on Bloomington’s city council would leave a proposal short of a majority. That means it’d need a least one person from another fiscal body to vote in support, in order to pass.

HB 1065 is supposed to be heard by the ways and means committee next Tuesday.

[Please consider supporting The B Square Beacon with a monthly pledge.]

Comments ()