First Monroe County, now Bloomington, to consider food and beverage tax money as economic relief funds in COVID-19 response

On Monday, Indiana governor Eric Holcomb’s gave a noon address announcing a stay-at-home order as a way to help curb the spread of the COVID-19 pandemic virus.

A couple of hours later, elected and appointed officials from Bloomington, Monroe County, Indiana University, and IU Health, held a virtual press conference.

During his turn, Bloomington’s mayor, John Hamilton, referred to the necessary response to the COVID-19 pandemic as a “marathon, not a sprint.” He quickly revised that description: “We’re in a marathon that starts with a sprint.”

Part of the sprint is a resolution approved last Wednesday by Monroe County commissioners, to make a request of the food and beverage tax advisory commission (FABTAC). If the FABTAC gives its approval, the county would be able to use $200,000 of already-collected food and beverage tax revenues for economic relief of local businesses impacted by COVID-19.

Bloomington now looks like it could make a similar request of the FABTAC. It will likely be for a larger amount, because Bloomington receives 90 percent of the food and beverage tax revenues. The county receives the other 10 percent.

Bloomington’s request could be made at the city council’s upcoming Wednesday meeting. A revised meeting agenda now includes a resolution that would make a request of FABTAC for the use of food and beverage tax revenues.

The meeting agenda item does not specify a purpose for the use of food and beverage tax money. But city councilmember Dave Rollo confirmed to The Square Beacon that the point would be to use the funds to provide relief to local businesses impacted by COVID-19. The amount has not yet been determined, Rollo said.

The city council’s Wednesday meeting was originally put on the calendar to approve the re-funding of some waterworks bonds so that the city can save around $2.3 million in interest. The bond re-funding ordinance is expected to be approved with a first and a second reading coming on the same day, at the same council meeting, an unusual step that requires a unanimous vote. The urgency comes from a desire to take advantage of favorable interest rates that might not remain so favorable.

A special meeting of the FABTAC is scheduled for today (Tuesday, March 24) to consider the county’s $200,000 request. The seven-member FABTAC, consists of two city electeds, two county electeds, and three business owners.

The meeting will be held in conformance with laws on public meetings that have been relaxed under an order from the governor. The relaxed requirements allow for members of a governmental agency to participate remotely in meetings, as long as at least one member is physically present as an onsite anchor. Anchoring duties for Tuesday’s meeting appear that they’ll fall to Monroe County councilor Cheryl Munson.

[Note: The Square Beacon might be able to provide live text streaming of the meeting, which starts at 2 p.m.]

The need for an initial sprint to respond to the pandemic is driven by the expected dramatic increase to COVID-19 cases locally and statewide. As Ben Hunter, Indiana University’s associate vice president for public safety put it during the conference call: “We know a surge is coming here in Indiana.”

The number of confirmed COVID-19 cases in Indiana has not quite doubled in two days, from 201 on March 22 to 365 on March 24 (today). The number of tests has about doubled during that period, from 1,494 to 2,931. COVID-19 has killed at least 12 people so far in the state of Indiana.

Highlights of Hamilton’s remarks included the city’s focus on two non-health-system areas, that the mayor said is intended to allow the health system to do its job.

One area is social services—special needs for housing during the pandemic, special food security challenges, child and youth care needs. Because public schools have been closed, child care needs are acute for essential health and public safety workers, as well as those with manufacturing jobs.

The other area, Hamilton said, is economic survival—helping families meet immediate income needs, and helping at-risk businesses meet immediate cash flow needs.

The effort to support social services is being led by the Community Foundation, United Way, the Bloomington Health Foundation, IU Foundation and the IU Health Foundation, Hamilton said during Monday’s press conference.

A press release from the United Way issued on Monday announced that applications can now be made for funding from the COVID-19 Emergency Relief Fund, which was launched last week by the United way of Monroe County.

According to the United Way’s press release, the effort has generated $295,508 in community donations so far from individuals, businesses, local government, and foundations. Individual donations have reached $41,508, according to the release, which easily maxes out the Bloomington Health Foundation matching contribution for the first $25,000 in donations.

Possible initial concerns among some city officials about the use of food and beverage tax revenues for economic relief look like they’ve been assuaged. County attorney Jeff Cockerill told The Square Beacon this past Thursday he believes providing relief to businesses is a legal use of the tax money. Cockerill said he’d made an initial inquiry with Indiana Department of Revenue and was expecting to hear back from a follow-up by early this week.

The 1-percent food and beverage tax was enacted by the county council in late 2017 to pay for the convention center expansion. The expansion’s current cost estimate is around $44 million. But the tax has uses specified in the state statute and local ordinance that are somewhat broader: “…to finance, refinance, construct, operate, or maintain a convention center, a conference center, or related tourism or economic development projects.”

The convention center got a mention during Monday’s virtual press conference, but not in connection with the food and beverage tax. According to county commissioner Julie Thomas, the convention center could be used as the location for an upcoming major blood drive, but that’s not yet settled.

The center has seen all of its conventions canceled through early May. So the building has been offered for use as needed during the COVID-19 pandemic, Thomas said. The size of the rooms would allow for significant distance between blood donors so that they don’t infect each other.

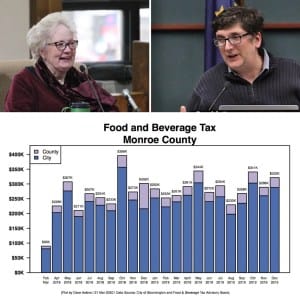

How much food and beverage tax money has already accumulated in the two years since it was enacted?

Based on the recently approved annual report of the food and beverage advisory commission (FABTAC), the unexpended portion of the city and county portions of the tax total around $5.7 million. Most of that is the city’s share. Bloomington receives 90 percent of the revenue. About 330 establishments collect the food and beverage tax countywide.

Bloomington currently has about $5 million of unexpended funds in its share of the food and beverage tax. Monroe County has about $700,000 in unexpended food and beverage tax money.

But Bloomington’s city council has already appropriated $6,250,000 of the food and beverage tax money. That appropriation would go mostly for architectural fees, if the current negotiations between city and council officials ever put the chosen architect under contract for the final design work.

The FABTAC’s Tuesday meeting is a special meeting, called just to consider Monroe County’s request. The group would likely meet again in a special session, if Bloomington’s city council were to act on Wednesday to make its own request.

Of the $700,000 in tax revenue accumulated by the county, $500,000 has been approved by the FABTAC for the county’s planned limestone heritage designation site.

The convention center expansion, which has stalled since May last year, has not been a priority for city and county officials during the initial “sprint” phase of the COVID-19 marathon.

Comments ()