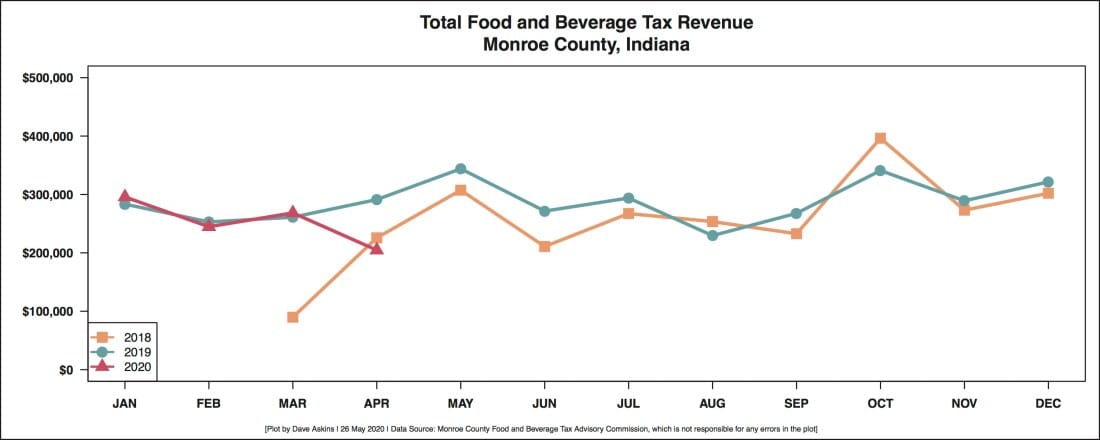

Food and beverage tax revenues start to show COVID-19 impact

The impact of Indiana governor Eric Holcomb’s initial stay-at-home order, which was effective starting March 25, is starting to show up in food and beverage tax revenue reports for Monroe County.

In the April report delivered to food and beverage tax advisory commission (FABTAC) members at their regular meeting on Tuesday, revenues from the 1-percent tax were $204,681.

That’s down about 30 percent from the $291,297 reported for April in 2019.

An April report of food and beverage tax revenues will reflect collections made in March, based on discussion as the meeting.

At the meeting, Susan Bright (Nick’s English Hut) a merchant representative on the FABTAC, said that even though the governor’s stay-at-home order didn’t take effect until the end of March, her revenues started showing a decline already in the first two weeks of March.

This year’s April drop comes after the first three months of the year tracked within 3 percentage points of last year’s totals.

The number of merchants collecting the tax for this April’s report was 275, deputy auditor Chris Muench reported at the FABTAC meeting, compared to 333 last year.

This year’s numbers were closer to the year before last’s numbers. The number of payers in 2018 was 282, based on the last annual report of the FABTAC, and the total revenues in 2018 were $225,752, about 9 percent better than this year.

Next month’s (May) report of food and beverage tax revenue is likely to be down a lot more than April’s.

Annual revenue for the first two years the food and beverage tax has been implemented in Monroe County has worked about to about $3 million a year. An April 9, 2020 Ball State study on the estimated tax revenue impacts of COVID-19 pegged food and beverage tax revenues for Monroe County to be down as much as 50 percent for 2020.

Comments ()