Food and beverage tax group OKs expansion of eligibility for COVID-19 relief

Even though it’s physically located inside the Bloomington city limits, the Monroe County History Center is now eligible for a grant through an already established county government program that’s designed to support businesses and nonprofits impacted by the COVID-19 pandemic.

That’s the specific effect of a decision made at a Tuesday afternoon meeting of the food and beverage tax advisory commission (FABTAC). But the FABTAC’s decision applies to any entity “whose purpose and mission is to support the entire county in tourism related endeavors.”

What’s new for the county’s grant program is the suspension of a rigid geographic requirement that a grantee be located outside the Bloomington city limits.

The FABTAC is a seven-member group made up of city and county electeds, and three owners of businesses that collect the 1-percent food and beverage tax from their patrons.

The FABTAC had previously given its OK for separate Bloomington and Monroe County COVID-19 relief programs, using proceeds from the countywide food and beverage tax.

Bloomington’s $2-million loan program was restricted to businesses and nonprofits physically located inside the the city limits. Monroe County’s $400,0000 grant program was restricted to businesses physically located outside the Bloomington city limits, but inside Monroe County.

Both relief programs were restricted to entities that have a tourism-related purpose, which stems from the statutory purpose of the food and beverage tax. The primary statutory purpose is to pay for the convention center expansion, but secondarily to promote tourism-related purposes.

The FABTAC dispatched with the policy change without controversy, after an initial concern was raised by Steve Volan, who serves on the FABTAC as a Bloomington city councilmember. Volan wondered what it meant for an entity to have “countywide coverage.” He asked, “Doesn’t every… business in Bloomington serve people in and outside of Bloomington?”

County attorney Jeff Cockerill replied to Volan by saying, “I would say that it’s not their mission and purpose to do that. I think they do that as part of their routine business, but it’s not necessarily their mission and purpose to have a countywide footprint.”

Given that Bloomington has a program for support of pandemic-impacted businesses located inside the city limits, using food and beverage tax proceeds, Volan asked if the history center was discouraged from applying to the city’s program.

Julie Thomas, who serves on the FABTAC as a county commissioner, told Volan she did not know, but observed that there is a difference between a grant and a loan. The city’s program awards loans. The county’s program awards grants.

Volan’s initial apprehension was about an organization inside the city limits, which is eligible to apply for the city’s loan program, instead applying for a grant from the county’s program. Volan asked city controller Jeff Underwood, who was on the Zoom video conferenced call, if he had any concerns about that point.

Underwood said his main concern would be if an entity were trying to apply for both Bloomington’s and Monroe County’s program. The history center is not applying to both programs.

Underwood’s comment put to rest any unease that Volan had. The FABTAC voted unanimously with a couple of absences and one abstention, to approve the policy change.

Abstaining from the Tuesday FABTAC vote was county councilor Cheryl Munson, who told the group she wouldn’t participate in the vote, because she serves on the board of the history center.

The board of county commissioners has so far granted more than a quarter million dollars in funds for pandemic-impacted businesses. Assuming a request for $5,000 from The Black Sheep Boutique is approved Wednesday morning (June 17), that would bring the total awards to $271,442 for more than 30 businesses.

County commissioner Julie Thomas told The Square Beacon that she thinks a proposal for a grant to the Monroe County History Center could be on the board’s June 24 meeting agenda.

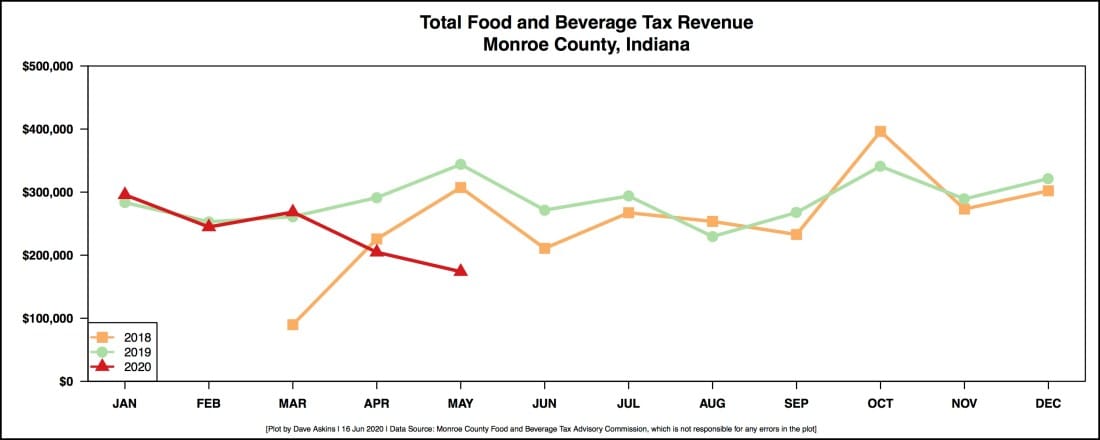

Also at its Tuesday meeting, the FABTAC got a preliminary update on the latest revenue figures from the food and beverage tax, in the monthly report provided by the state. Deputy county auditor Chris Muench told the FABTAC that he had not completed his audit of all the figures but reported the state’s May figures at $173,935 —that’s the total of city and county shares.

That’s about half the revenue reported for May 2020, May 2019 which was $343,971, but still more than some FABTAC members were expecting. Their expectation was based on the anticipated impact of statewide health orders that closed down restaurants for dine-in service, starting towards the end of March. The emergency orders closing down restaurants were meant to help reduce the spread of the COVID-19 virus.

There’s a delay between the food and beverage sales transactions and state’s monthly report. That’s because businesses are not required to send the taxes they collect to the state until 30 days after the end of the month in which the transactions occur. Businesses that average more than $1,000 a month in collections have to file the collections sooner—by the 20th of the month after the transactions take place.

That means for March food and beverage sales, businesses had until April 30 to send in the money, as long as they don’t average more than $1,000 a month. Businesses that average more than $1,000 had just until April 20 to send it the taxes they collected.

At a previous FABTAC meeting, city controller Jeff Underwood said he thinks based on the reporting deadlines, for a given monthly report from the state, it reflects business activity from two months earlier. That would mean the May figures presented on Tuesday reflect sales from March.

There’s still not a uniform consensus on that point among FABTAC members and the county auditor’s office. On Tuesday, Volan ventured that the May report reflects business activity in March. Munson said it was April.

The topic didn’t get any debate. Volan wrapped up by saying, “But next month’s numbers are going to be even more dramatically low, I think.”

Comments ()