Monroe County to Bloomington: “We respectfully write to implore you to postpone any vote on the tax increase.”

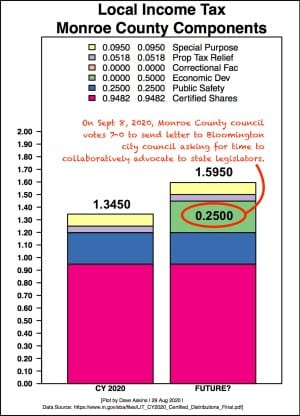

Responding to a proposal to increase Monroe County’s local income tax by a quarter point, from 1.345 percent to 1.595 percent, the county council voted unanimously on Tuesday to approve a letter to the Bloomington city council that questions the timing of the move.

The county council’s letter asks Bloomington’s legislative branch “to devote substantially more time to collaborating with the mayor and the full local income tax council membership to most effectively plan and consider this proposed income tax rate increase.”

The city council has scheduled its vote on the proposal for Sept. 16, after an initial city council discussion that is set for Sept. 9. The county council wanted city councilmembers to receive the letter in time for their Sept. 9 deliberations.

The city council is responding to a request by Bloomington mayor John Hamilton to consider increasing the income tax by a quarter point, after proposing a half-point increase on New Year’s Day.

The impact of the COVID-19 pandemic is a reason given by Hamilton for reducing the amount of the increase. Hamilton has also refocussed the intended expenditures for the additional revenue to eliminate additional funding for public transit, among other changes.

The impact of the COVID-19 pandemic is one reason that the county council’s letter gives for not considering a tax increase of any amount at this time: “Monroe County residents are experiencing a global pandemic with no end in sight. The negative impacts of COVID-19 are real and continue to weigh heavily on all residents in recent weeks and months.”

The letter continues, “Some of Monroe County’s largest employers have announced plans for personnel furloughs, and wage cuts due to the ongoing COVID-19 crisis. In addition, many small local businesses have had to make the difficult choice to close permanently, or lay off staff indefinitely, causing a loss of income to a significant number of Monroe County residents and families.”

The letter wraps up the point about the COVID-19 impact by saying, “During such uncertain times, when evidence of stress and depression are all around us, and hitting us too close to home, it would be unwise to add to the stress our residents face by increasing their tax burden without a manifest and widely supported plan for its use.”

A city council vote on Sept. 16 could enact the tax increase on all Monroe County residents, if it achieves either a 9–0 or 8–1 majority. That’s based on the voting weights assigned to individual representative to members of the tax council.

If the tax increase doesn’t achieve the required majority, it would have to be considered by other members of the tax council. The tax council includes Bloomington’s city council, Monroe County’s county council, Ellettsville’s town council, and Stinesville’s town council.

If enacted before Oct. 31, the extra tax would be collected from Monroe County residents starting Jan. 1, 2021. It would generate about $4 million for Bloomington and a bit more than $4 million for the other units of government in Monroe County.

What does the letter say?

The letter from the county council makes two requests of Bloomington’s city council.

First, the county’s seven-member fiscal body wants the city council to slow down the process: “With the health and welfare of our residents in mind, we respectfully ask the [Bloomington city council] to … slow the process down. Let us please take time to plan and take seriously the fiscal obligations we owe to all Monroe County residents.”

The letter adds, “There may be a time in the future when a tax increase is needed, and is the right action to take. But now is not that time. There is no need to fast-track this legislation.”

The second point of the request is that the city council “jointly advocate with the county for legislative reform that allows both units to raise revenue, with appropriate input from residents in a way that recognizes the difference in needs and representation among the units.”

That call for joint advocacy was highlighted by county councilor Geoff McKim to councilor Marty Hawk, after she said she’d wanted the letter to go further than it did. “The city council should not have the authority to raise taxes on the people who cannot vote for the city council,” Hawk said. McKim said the letter touches on that idea, because as McKim summarized it, the letter “advocates for a system where county representatives can determine county taxes and city representatives will determine city tax.”

Who makes local income tax decisions?

Except for the county council, the units of government are assigned voting weights on the tax council based on the percentage of the county’s population they represent. County councilors are assigned voting weights based on the leftover population that is not represented by the other units, not the entire county.

Bloomington officials don’t like the idea of the county council deciding tax issues for the whole county, even though they’re elected by all county residents, including Bloomington residents. Monroe County government officials don’t like the idea of Bloomington electeds having the ability unilaterally to impose a tax on all county residents, which they can because 58-percent of Monroe County’s population lives in Bloomington.

Summing up both perspectives recently was former Bloomington mayor John Fernandez (1995-2003): “I don’t believe cities should be controlled by county officials any more than I think the city should be able to impose taxes on county residents simply because they have the majority vote on the income tax council.”

Advocating changes to the state tax legislation

Fernandez’s advice for Bloomington electeds was consistent with Tuesday’s call by the county council for collaboration on advocating for a legislative solution: “I think the smartest, most effective policy is to enable taxing jurisdictions (whether a city, town or county) to establish rates for their jurisdiction. [Hamilton should] get out in front of this and demand that the legislature enact this legislative fix. He could get county officials on his side for once!”

A possible legislative solution would provide cities with the ability to impose an income tax just on city residents. One barrier to a city-only income tax in the past has been technological, according to state officials. The software used by the state’s department of revenue could not give an analysis finer-grained than just the county where an income tax payer lives, as opposed to the municipality within the county. Recent software upgrades might provide the technical means to enact such an approach.

Whether there’s legislative interest in pursuing such an approach is not clear. Based on recent Square Beacon interviews with area Republican state house representatives Peggy Mayfield and Jeff Ellington, basic economic survival will be a primary focus for the 2021 legislative session. Neither representative thinks it’s likely that complete control for all local income taxation would be handed over to the county council—cities would still have a say.

Bloomington mayor John Hamilton has raised the specter that the state legislature would act against cities in the next session, writing in a Herald-Time op-ed: “The state legislature may well reduce or eliminate our ability to accomplish new revenues by next spring (they already changed the voting requirements earlier this year).”

At a city council work session last Friday, deputy mayor Mick Renneisen described Republican state representative Jeff Thompson as interested in considering an approach that might allow cities to enact an income tax just on city residents, but added, “There’s no guarantee that that will happen.”

Counting votes

The county council’s Tuesday vote on its letter to the Bloomington council, which was taken at the first of four budget work session scheduled for this week, was not a vote on a formal ordinance of the tax council, of which the Monroe County council is a member. And the votes cast by county councilors on Tuesday in support of the letter would not be binding on them—if such an ordinance were eventually to come before the county council sometime in the next several weeks.

But the formal statement from all seven members of the county council on Tuesday underscored the press release issued by six of them in the second part of July: There does not appear to be any support on the county council for raising the local income tax at this time.

The question of how county councilors might vote on the question is important for the timing of the Bloomington city council’s vote, which is currently planned for Sept. 16, after some discussion at a Sept. 9 meeting. The need for the timing has been portrayed by city officials as based on a statutory deadline of Oct. 31. Enactment before Oct. 31 means Monroe County residents would start paying the higher rate on Jan. 1, 2021.

A vote by the city council earlier than Oct. 31 looks like it would be needed only if the Bloomington city council failed by itself to achieve the required majority on the tax council, and time were needed to pick up additional votes from the county council and the two other town councils in the county.

Under the state law, after the other members are notified by the auditor that the Bloomington city council has achieved the required majority, the other members of the tax council “need not vote on the proposed ordinance.” [IC 6-3.6-3-8] That’s in part why the county council’s letter calls the Sept. 16 date a “self-imposed timeline” adding that it is “not required by law.”

A vote of 9-0 or 8–1 by the Bloomington city council alone would be enough to enact the tax increase for all Monroe County residents.

That’s based on a precise allocation of 100 votes on the tax council as follows: 6.48 votes for each of 9 Bloomington city councilmembers; 5.28 votes for each of 7 Monroe County county councilors; .0.92 votes for each of 5 Ellettsville town councilors; and 0.05 votes for each of 3 Stinesville town councilors.

Even if the county council’s Tuesday’s vote predicted with perfect accuracy the outcome of an official vote on the tax increase, there’s still a mathematical chance chance for enactment, on a 7–2 vote by the Bloomington city council. That’s a scenario that could unfold if all Ellettsville town councilors voted in favor, and at least one Stinesville town council did as well. (7*6.48 + 5*0.92 + 1*.05 = 50.01).

One of the members of the Ellettsville town council is William Ellis, who’s also chair of the Monroe County Republican Party. The proposed tax increase comes from Bloomington’s mayor, Democrat John Hamilton, and could be approved by with a sufficient majority on the all-Democrat city council.

Ellis told The Square Beacon on Tuesday morning, that if the vote came to the Ellettsville town council, “I would be a firm ‘no.’ There is no way anything could be added on the proposal that would even make me begin to consider a ‘yes’ vote for a tax increase on people that have already been hit hard by the COVID shut down!”

Based on public statements, it looks like the only way the tax increase would be enacted is on a vote by the Bloomington city council by a majority of at least 8–1. That would mean the scheduling of the city council vote would not need to depend on the timing of votes by other members of the tax council.

Previous coverage from The Square Beacon on the LIT proposal:

Comments ()