New Bloomington commission floated, would oversee funds from higher local income tax rate

On Wednesday night at a special meeting, Bloomington’s city council started its deliberations on a proposal to increase the countywide local income tax by a quarter point. The debate will continue on Sept. 16.

That amount would take the rate from 1.345 percent to 1.595 percent. The higher rate would generate about $4 million annually for Bloomington. A little more than $4 million would be generated each year for Monroe County government and the town of Ellettsville.

A public hearing and a vote is scheduled for Sept. 16.

Under a proposed ordinance released to the public a few hours before the city council’s special meeting, a new city commission would have some control over expenditures from the extra revenue.

Under the ordinance, a new non-reverting fund would be created, called the Sustainable Development Fund.

Future ordinances and resolutions requiring expenditures from the fund would be subject to approval of a new seven-member commission, called the Sustainable Development Fund Advisory Commission (SDFAC).

Under the new ordinance, without a majority recommendation from the seven-member commission, the city council could not adopt an ordinance requiring an expenditure from the new fund.

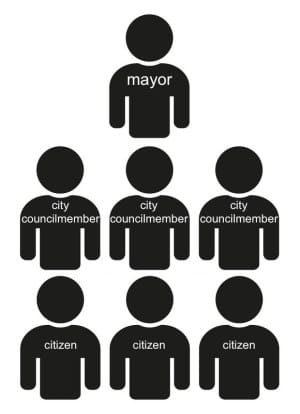

Membership on the new commission would consist of: the mayor, three councilmembers and three citizens. That means an ordinance requiring expenditures from the new fund could be blocked by a coalition consisting of a single councilmember and three citizens.

The ordinance creating the new commission got a first reading on Wednesday, but no discussion, because under local code no debate or amendments are allowed at a first reading. It will be considered at a second reading on Sept. 16.

Wednesday marked the first public deliberations by the city council on the possible income tax increase. A city council work session held last Friday was limited to asking questions of the administration.

On Wednesday, four councilmembers indicated some level of support. The other five can be analyzed as undecided.

On Wednesday, the one councilmember who indicated support for the proposal, without hedging it with “leaning towards” was Dave Rollo. He stated, “I’ll indicate I’ll support it this evening.”

Saying they’re leaning towards it were Kate Rosenbarger, Matt Flaherty, and Steve Volan.

Rosenbarger and Flaherty both cited transparency and accountability as a concern, and the proposed ordinance creating the new commission appears to be one way they’ll address that concern.

Rosenbarger said, “I’m leaning in support of this tax, just as I did in the beginning of the year, when we started it as a climate tax. I would say my major concern, as it was then, is the transparency and the accountability and the focus on how we’re going to spend the fund.”

Flaherty said “I lean towards supporting this, but I think the issues raised in [the ordinance creating the new commission] are really important to me and I would like to see them be part of our approach here.”

Three councilmembers said they’d abstain.

Sue Sgambelluri said, “If we were to vote tonight, I would likely abstain, because I do want to think about this more.”

Ron Smith said, “And if I was voting tonight, I would abstain as well so that I could do more research and gather more information.”

For her part, Susan Sandberg said “If we were to vote tonight I would be a definite abstention.”

Isabel Piedmont-Smith did not characterize her hypothetical vote as an abstention, but didn’t give an indication either way. “Yeah, I don’t have a lot to say at this point, because I’m undecided,” she said.

Jim Sims did not take a final speaking turn but could probably be characterized as not yet decided. His questions on Wednesday focused on the planned water rate increase in the first half of 2021, and the increased property tax that residents in incorporated areas of the county are paying to fund fire protection through the Monroe Fire Protection District.

Procedurally, what happened Wednesday was a unanimous postponement of the vote until Sept. 16.

On Wednesday, city council president Steve Volan shared a different perspective about the urgency of the date.

On Wednesday Volan said, “I just don’t believe that the 16th is necessarily the deadline for this proposal. I believe that it would be much less reliable to attempt to adopt such a tax between the [Sept. 16] and Oct. 31, but it is not out of the question. So over the next week, one of the things I’m going to try to pin down is, you know, to what extent that’s a political question to what extent that’s a technical or bureaucratic question.”

That mean’s it’s conceivable the council might postpone its vote again, when it meets on Sept. 16.

Under the state statute, if Bloomington’s city council votes with an 8–1 or 9–0 majority, the other governmental units that are members of the tax council—the county council and the two town councils—would not need to vote on the new tax.

Absentions

If a vote on the proposal is taken on Sept. 16, an abstention would count the same as a “no” vote.

Under Bloomington’s local code councilmembers are not supposed to abstain from voting, unless they have a conflict of interest or have some other “good cause.” It’s not defined in the local code what a good cause is.

If a councilmember does abstain, the local code says they can be challenged to vote or explain why they’re not voting:

Members shall vote on all questions before the council except in situations where there is a conflict of interest or for other good cause. If a member fails to vote upon any matter, any other member may raise the question and insist that the member either vote or state the reason for not voting and be excused.

Most recently, councilmember Susan Sandberg abstained from a vote at the council’s Sept. 2 meeting that was otherwise unanimous. The vote extended some special authority to the council president on scheduling matters, which had been assigned earlier in the year when meetings started taking place online, instead of in-person. No one asked Sandberg to state a reason why she was not voting.

Council authority?

An ordinance that was given a first reading on Wednesday would create the Sustainable Development Fund Advisory Commission (SDFAC). The ordinance gives the SDFAC control over expenditures from the fund into which the revenue from the higher rate of local income tax will be deposited.

SECTION 4. Expenditures from Fund. All expenditures from this fund shall be subject to appropriation by the city’s fiscal body. The city’s fiscal body may not adopt any ordinance or resolution requiring the expenditure of EDIT revenue without first receiving a recommendation, in writing, of a majority of the members of the Sustainable Development Fund Advisory Commission on the proposed expenditure.

The wording of the second sentence of Section 4 mirrors the wording of the state statute on the food and beverage tax [IC 6-9-41], which gives some oversight of expenditures to the food and beverage tax advisory commission (FABTAC).

The county or city legislative body may not adopt any ordinance or resolution requiring the expenditure of food and beverage tax collected under this chapter without the approval, in writing, of a majority of the members of the advisory commission.

The FABTAC is composed of the mayor, a county councilor, a county commissioner and a city councilmember and three merchants who collect the food and beverage tax from their patrons. The four electeds and three citizens on the FABTAC make for a membership that’s parallel to that of the proposed SDFAC.

For the SDFAC, the following scenario could unfold. The mayor and eight councilmembers—six non-members of SDFAC and two SDFAC members—could support approval of an ordinance requiring expenditure of funds, so that a contractor could be paid to construct a solar array. But if one councilmember on SDFAC and all three citizens on SDFAC were against it, that ordinance couldn’t be adopted by the city council.

With respect to the FABTAC, it’s the state legislature that has constrained the authority of the city council. But for the proposed SDFAC, it’s the city council itself that could be analyzed as delegating its own authority to a different entity.

Could the solar panel contractor argue that the assignment of the described powers to SDFAC through an ordinance would violate the due process clause of the Constitution?

At Wednesday’s meeting, The Square Beacon asked during public comment if the proposed SDFAC had been reviewed with an eye towards the constitutional question. No answer was given.

The city of Bloomington has a legal case currently pending that turns on that kind of question. In City of Bloomington Board of Zoning Appeals vs UJ-Eighty Corporation, the lower court and the court of appeals found that Bloomington had made an unconstitutional delegation of its authority to Indiana University, with respect to the definition of a sorority or fraternity.

Oral arguments are scheduled in front of the Indiana Supreme Court on Sept. 24.

The part of Bloomington’s zoning code which prompted the lawsuit, has since been revised—as a part of the new unified development ordinance (UDO).

Comments ()