Bloomington’s e-scooter ridership down, Lime still leads, but cedes ground to Veo

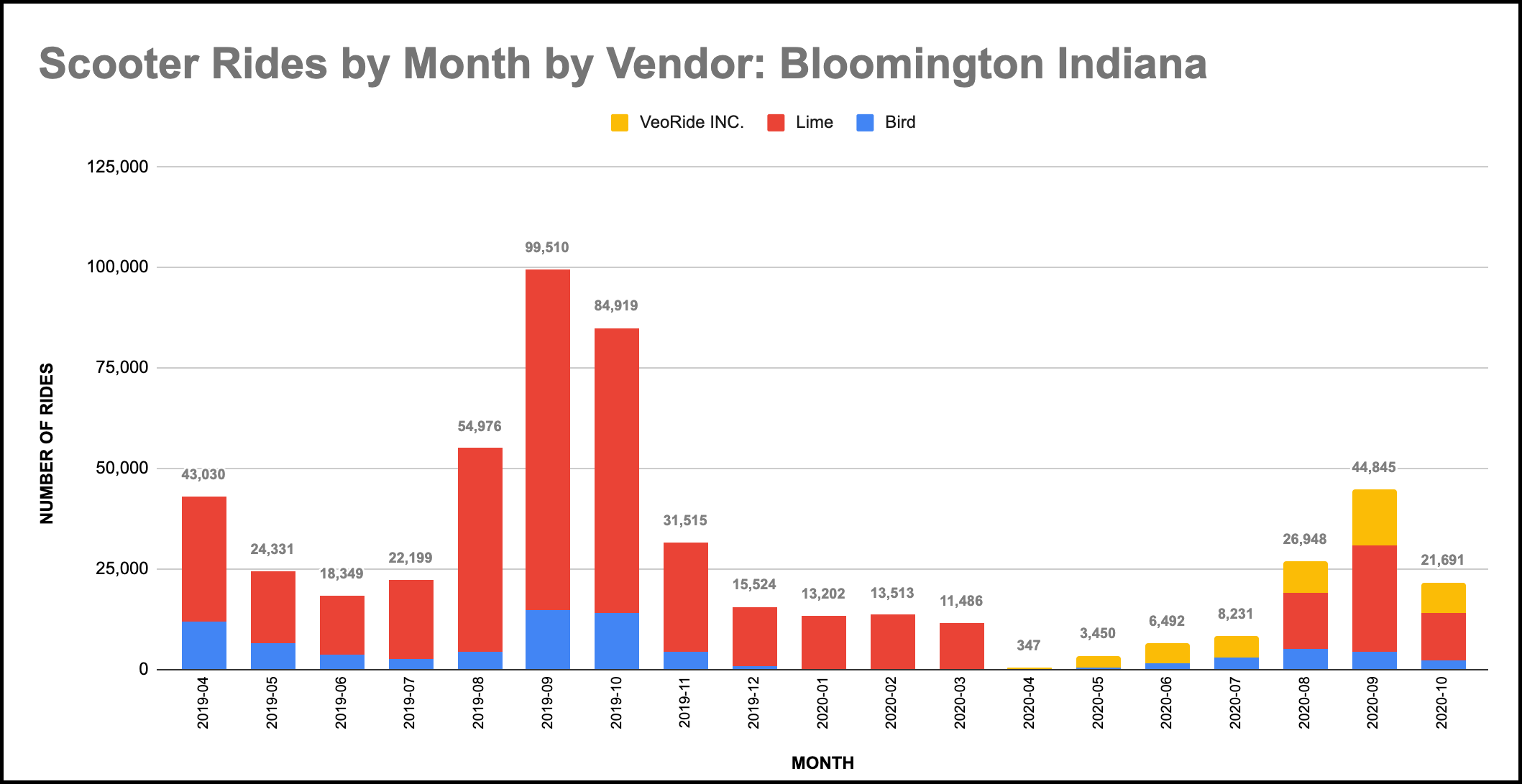

In August and September this year, a total of about 71,800 rides were taken in Bloomington on e-scooters, which are available for short-term rental from three different companies.

That’s only about 46 percent of the ridership seen for the same two months in 2019—an impact of the COVID-19 pandemic. Even though Indiana University students have returned to campus, many of them have vastly reduced local travel requirements, because some of their classes are offered online.

University affiliates make up the majority of ridership for public buses and private e-scooters alike. After e-scooter ridership dipped to nearly nothing over the summer, it has rebounded a little bit this fall, somewhat better than public bus ridership.

Ridership on Bloomington Transit’s fixed route buses in August this year was around just 32 percent of August ridership in 2019.

In Bloomington the competition for riders is a three-way fight between Bird, Lime and a newcomer, Veo. The last to arrive on the scene, Veo can now claim around 32 percent of Bloomington ridership, better than twice as much as Bird’s 12 percent, but still trailing Lime’s 56 percent.

The initial two-way competition between Bird and Lime, starting in fall of 2018, was dominated by Lime. In the second half of 2019, about 85 percent of rides were taken on Lime scooters.

For the first three months of the 2020, Bird did not offer any scooters, so the market belonged to Lime as a sole competitor. When the COVID-19 pandemic hit in March, Limes also disappeared from the landscape.

For a couple of weeks, no e-scooters were available at all.

Then Veo scooters started showing up in Bloomington. It was already known in January that Veo was planning to enter the Bloomington market, because the company had already paid the $10,000 licensing fee to the city.

For the month of April, Veo was the only scooter game in town. In May, Bird returned. From May through July, Veo and Bird split the ridership about 3:1, in favor of Veo.

When Lime returned in August, the company named after a green fruit resumed its position as the dominant force in Bloomington’s market. Bird’s market share from August through mid-October this year is close to what it was last year—around 12 percent. But Lime’s market share has dropped from 85 percent to around 56 percent. The other 32 percent of scooter rides were taken on machines made by Veo.

Responding to questions from The Square Beacon, Ben Thomas, midwest regional general manager for Veo said, “Veo has been very happy with the current ridership in Bloomington. We knew going in that this market has a lot of opportunity for us to provide users with a better riding experience than our competitors and the numbers are showing that people are preferring our vehicles to others.”

Thomas added, “Operating in a competitive landscape like Bloomington, we knew ridership would be fought over between the three companies there, but we have been more than happy with the numbers we have seen since we launched.”

The licensing arrangement for scooter companies requires that they provide to the city of Bloomington a certain amount of data related to their operations. The city hosts a scooter ride dataset on its website in a framework that it calls the B Clear Portal.

The licensing agreement also requires scooter companies to pay the city 15 cents a ride. The total of 150,613 e-scooter rides taken so far in 2020 work out to about $22,500.

Comments ()