Monroe County gets GO bonds OK’d before expected pre-election news of rebounding economy

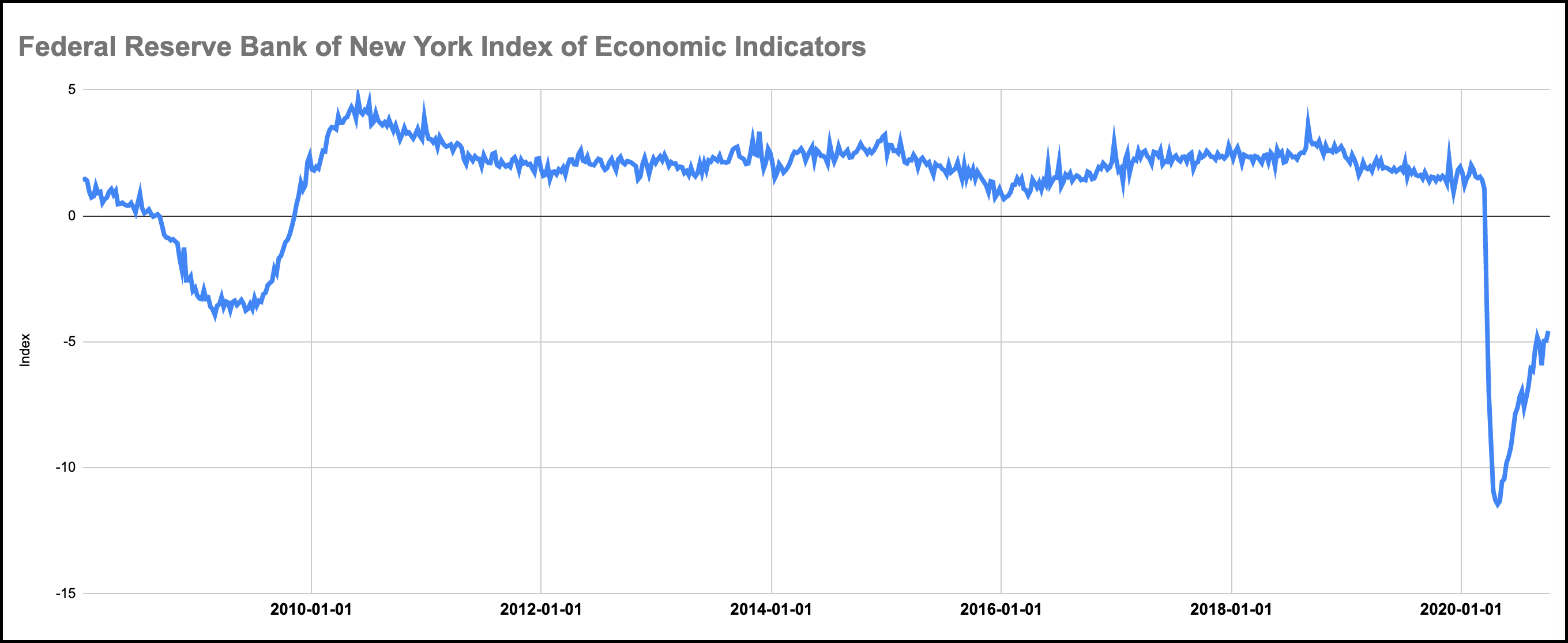

At its meeting last Tuesday, the Monroe County council handled two $3-million items.

One was a transfer of $3 million to its rainy day fund. The other was a final approval on issuance of $3.1 million in general obligation bonds. The amount includes $3 million worth of capital projects and another $100,000 to cover transaction costs.

Those items will now provide some of the background for the county council’s first reading of the 2021 budget, on Monday starting at 5:30 p.m.

The rainy day fund transfers came in the context of a negative impact to local income tax revenue that’s expected in 2022. In that year, revenue will be based on individual earnings in 2020, the year of the COVID-19 pandemic.

The timing of the bond issuance came before the general election in a presidential year and before Thanksgiving—two events that can affect bond ratings, according to county attorney Jeff Cockerill.

Cockerill said, “I think this year, [the presidential election] most definitely will have a greater likelihood than not to affect the bond rates as opposed to some of the more historical presidential races.”

The other factor is Thanksgiving. “Every year after Thanksgiving, the bond rate markets fluctuate,” Cockerill said. He added, “And there is less predictability on the rates.”

That’s why Cockerill asked the council to consider approving the bonds in mid-October, well ahead of the election and Thanksgiving. Cockerill cautioned, “Clearly, if the council wants to take the additional time, you’re just running the risk that one of those two factors could affect the bond rate.”

It’s not just the outcome of the election that might affect bond rates. The impact on bond rates could start to be felt a few days before the election.

That’s when third quarter GDP growth rates will be released. Larry DeBoer, a professor in Purdue University’s Department of Agricultural Economics, wrote about the timing of the news on GDP rates in his mid-September Capital Comments column.

DeBoer writes, “Will the third quarter real GDP growth rate really be released in the last week of October? Yes, on Thursday, Oct. 29, at 8:30 a.m.” DeBoer adds: “ And yes, that’s the Thursday before election Tuesday. It will be a large positive growth rate, and I would guess that both parties are working on their spin right now.”

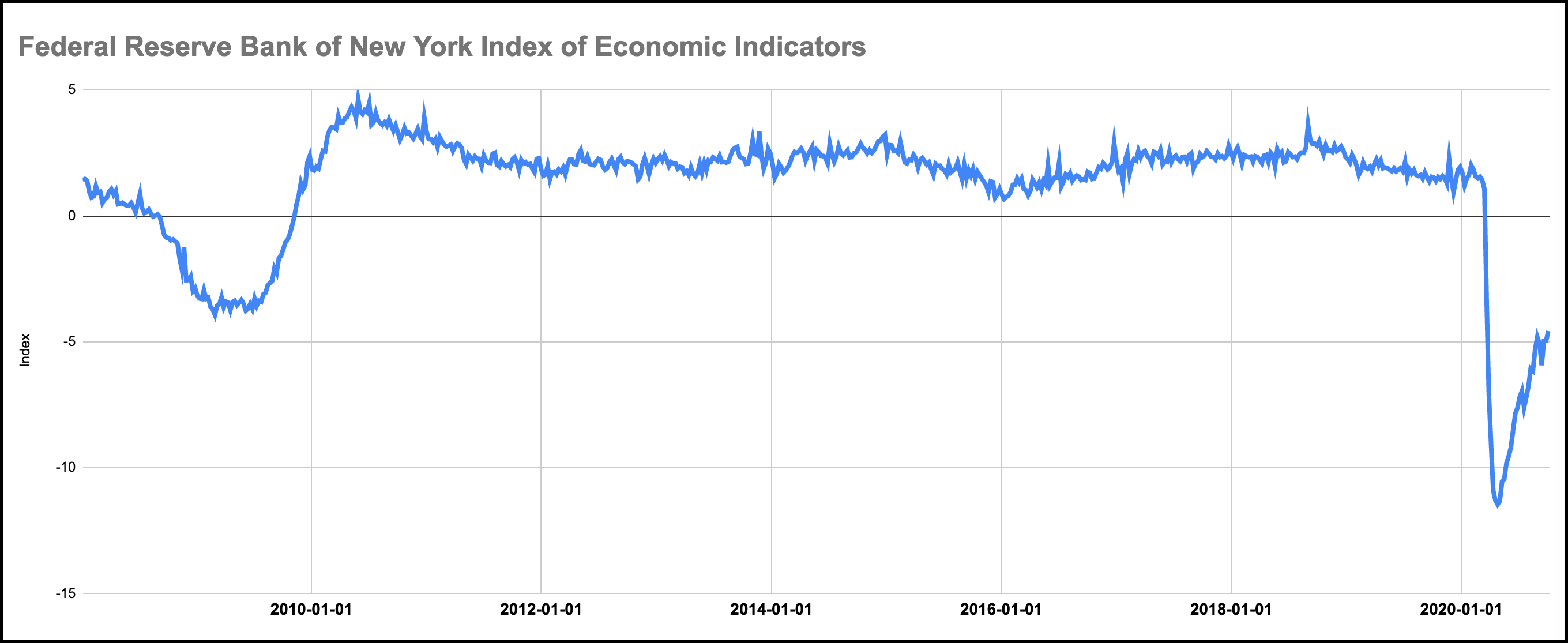

The index that DeBoer looks to for an indication of what’s happening “right now” in the economy is the Federal Reserve Bank of New York’s index of 10 different indicators.

And that index shows the economy in recovery. DeBoer writes, “The economy is growing fast. But we’re still way below where we want to be.”

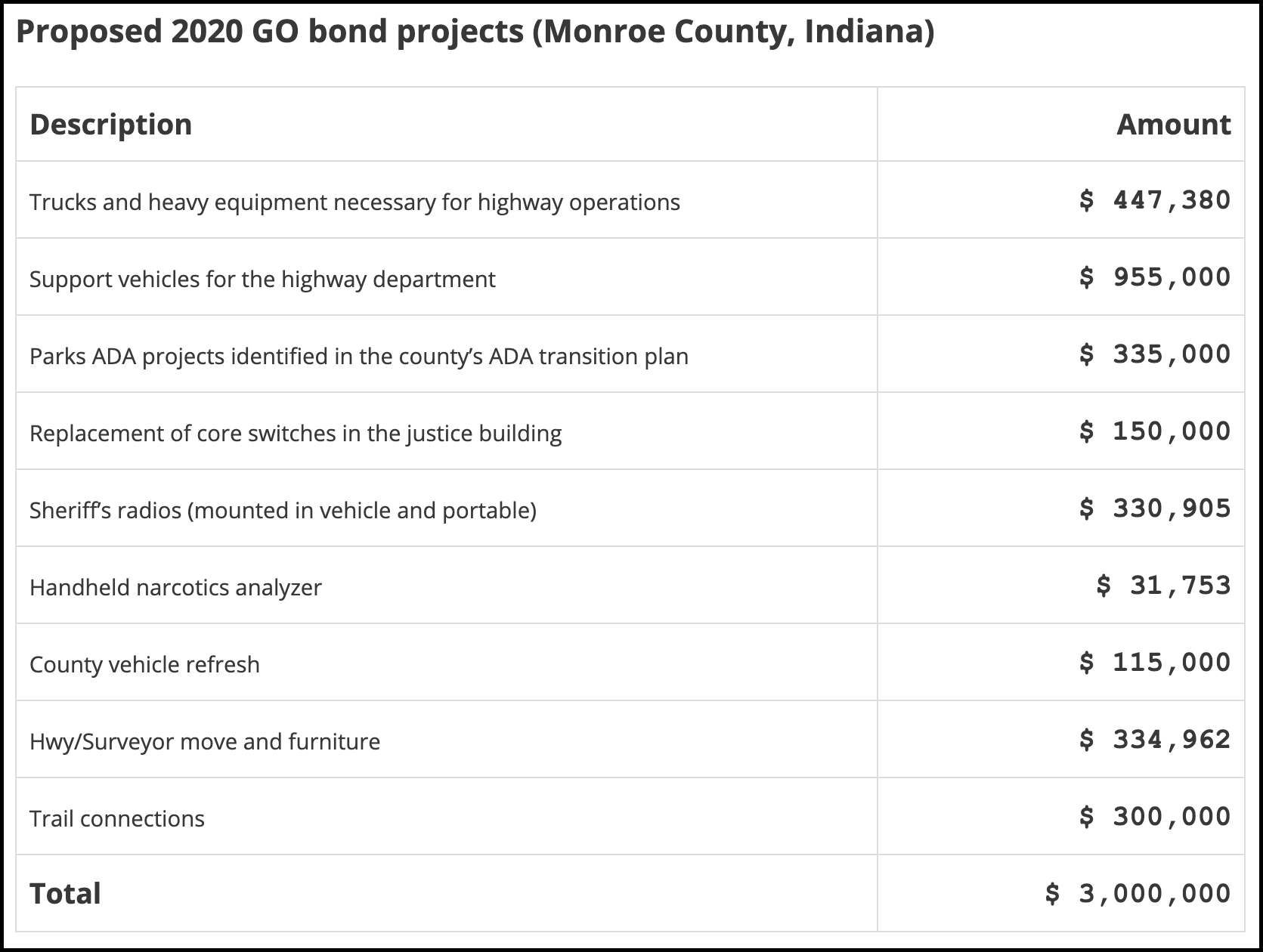

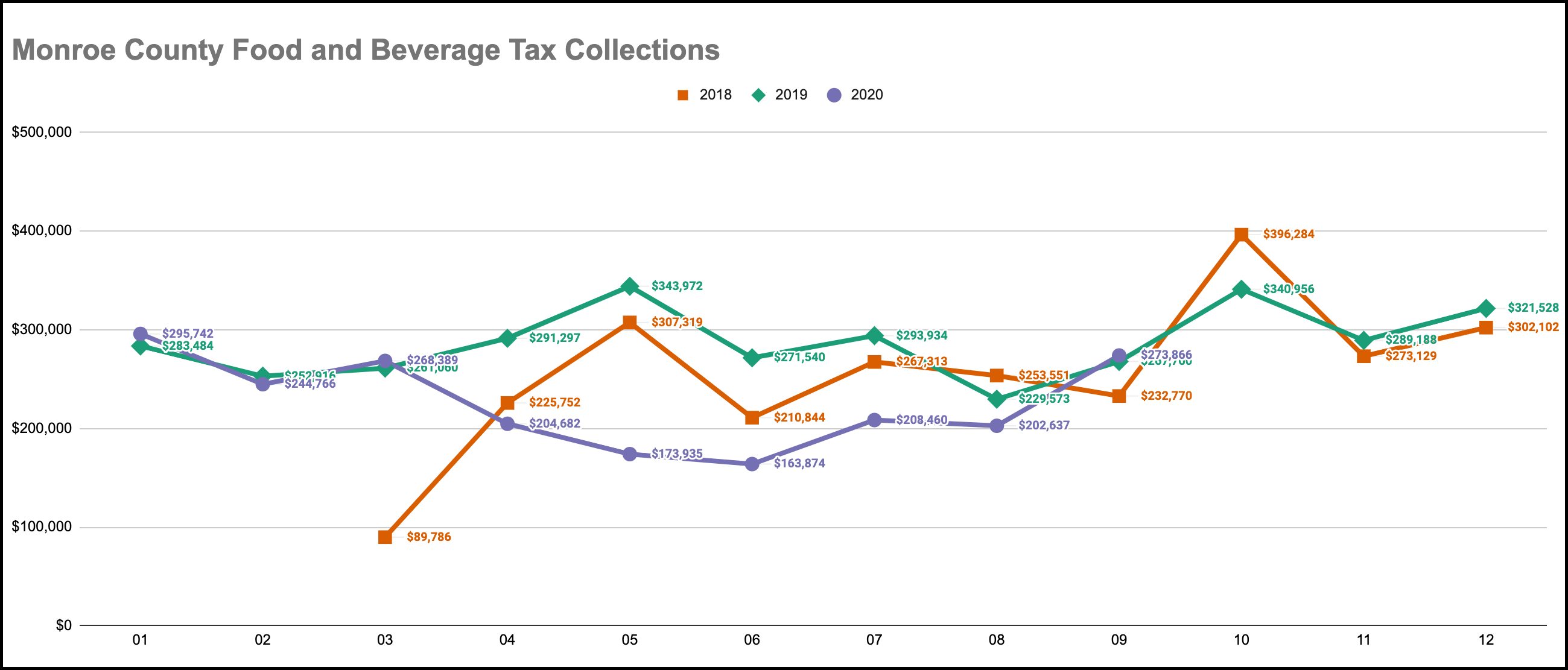

One sign that Monroe County’s local economy is starting to recover is the food and beverage tax collection numbers. The September report shows $273,866 turned in by merchants who collect the 1-percent tax from customers who buy prepared food and beverages. That’s actually about 2 percent better than the $267,760 reported in September 2019.

Even if the economy shows signs that it’s recovering, the impact from COVID-19 on local government revenues is not expected to be felt next year, but rather the following year, in 2022. That’s when local income tax revenue will be pegged to the amount of tax paid by individuals in 2020. Those numbers are certain to be down. The only question is by how much.

So last week the county council was keen to sock away some extra cash in the county’s rainy day fund.

The $3 million rainy day fund transfer was twice the minimum that auditor Cathy Smith had recommended, and she did not object to the higher number. As she put it, “I would rather give a number that I’m most comfortable with, that’s conservative. So $1.5 million is that, and that I believe that should be a minimum. And if you guys double that, I think that’s very prudent.”

County councilors were persuaded by their colleague Geoff McKim’s argument that it is better to maintain reserves in the rainy day fund as opposed to letting fund balances accumulate in several separate funds.

“We really want to have one savings account. And that’s the rainy day fund, right? We’ve been moving in the last couple of years to not having lots of little pockets of money in different funds, where there might be almost a view that that money is there to be spent,” McKim said.

McKim added, “If we slowly move to a process where we’ve got one savings account, then I think there’s a lot more, I would say, budgetary transparency. The public knows much more clearly what our reserves are.”

Comments ()