Monroe County asks food and beverage tax group to recommend use of tax proceeds for convention center debt

At their Wednesday meeting, Monroe County commissioners decided to send a request to the local food and beverage tax advisory commission (FABTAC) that they be able to use “any and all” of the county’s share of food and beverage tax proceeds for existing convention center debt and management expenses.

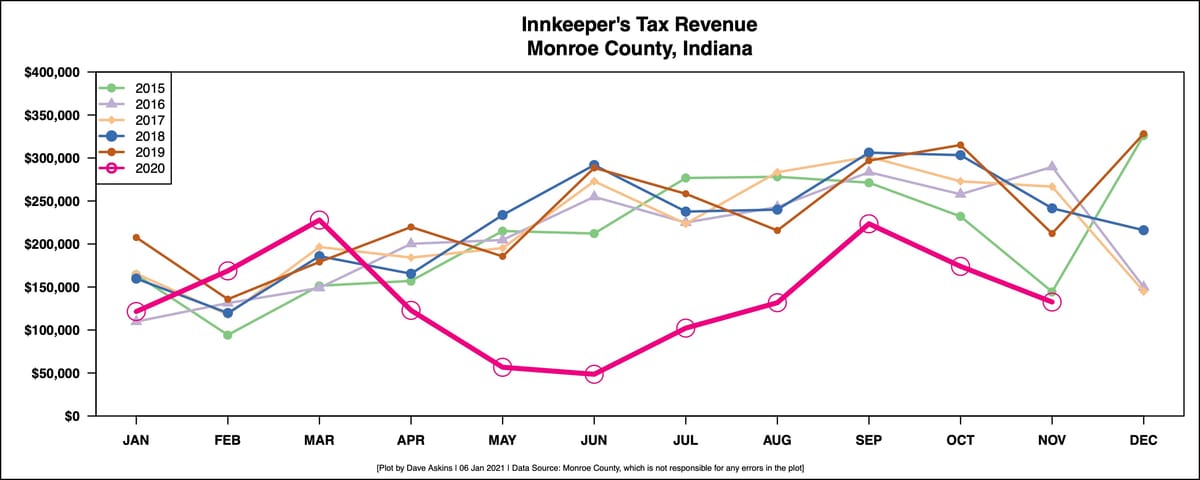

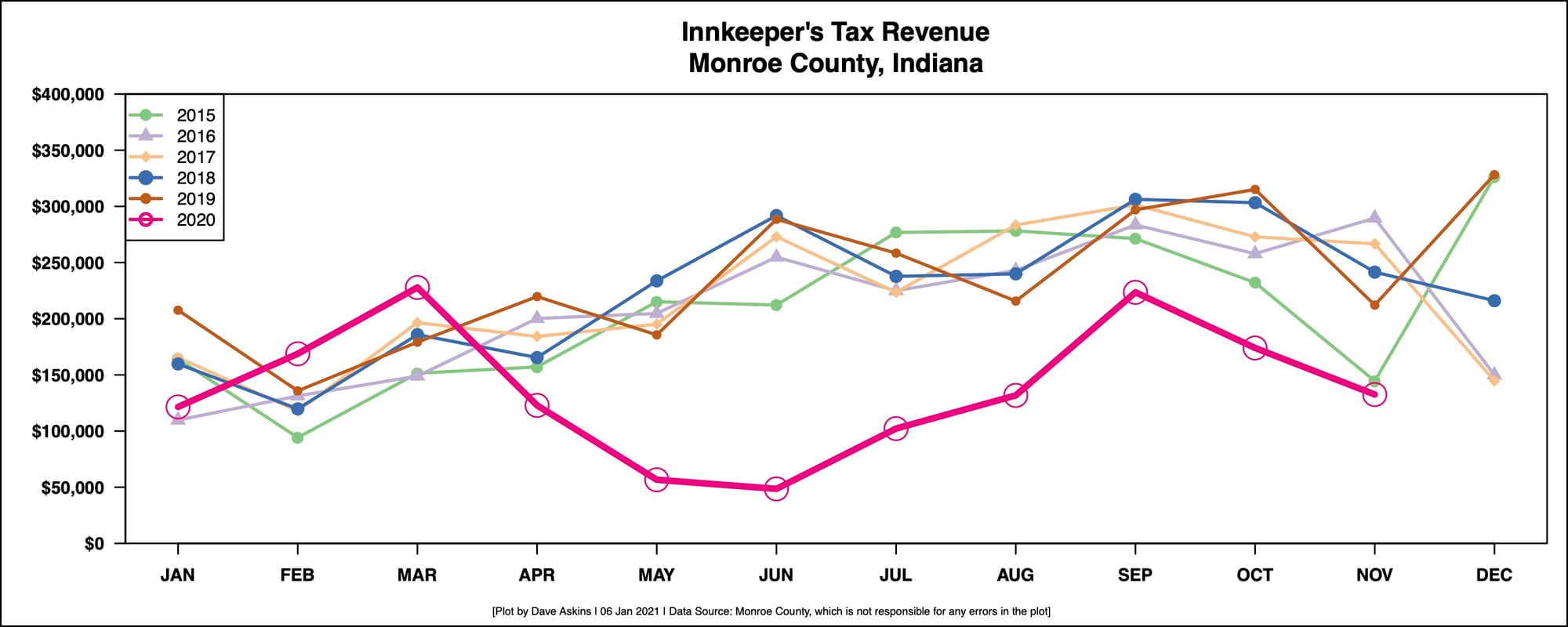

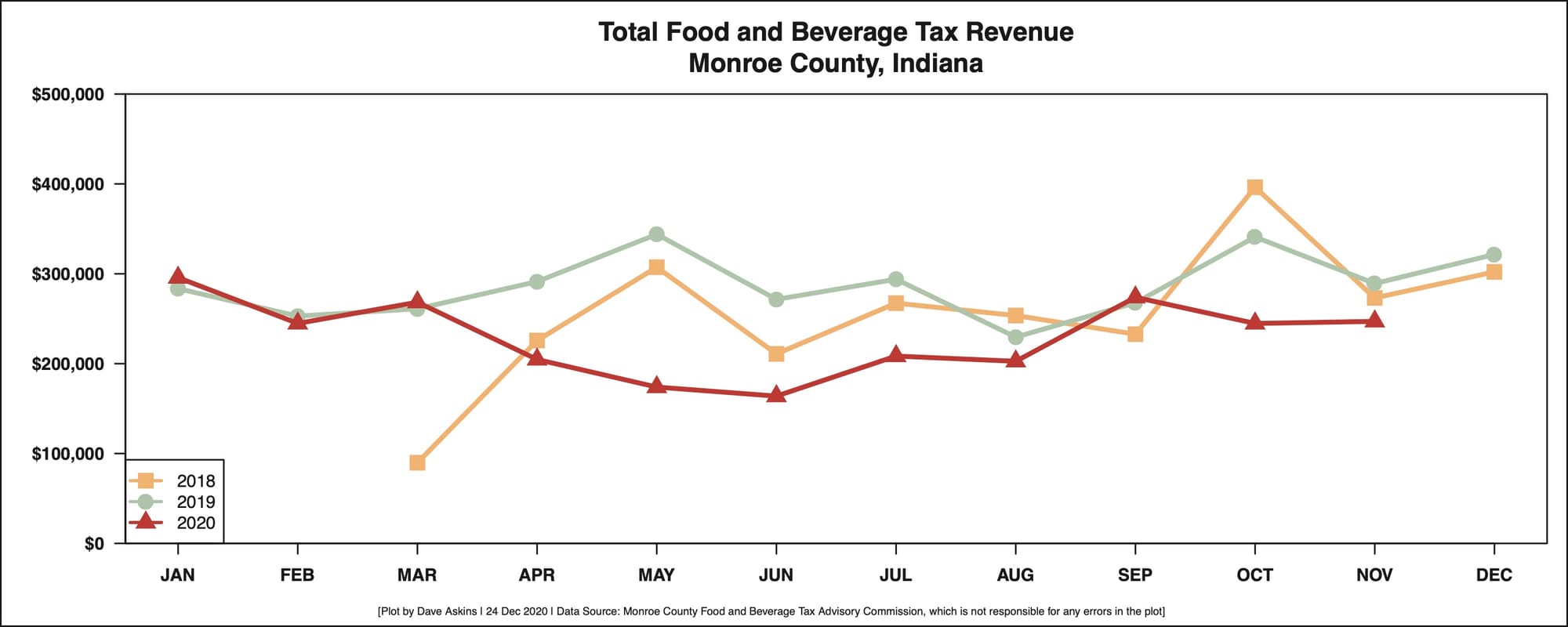

Historically it has been innkeeper’s tax revenues that have been used to pay the convention center debt service. But innkeeper’s tax revenues have have been hit hard by the COVID-19 pandemic. Food and beverage revenues are also down due to the pandemic, but not by as much.

Under the state statute on food and beverage taxes, the request needs to go before the seven-member FABTAC and get a favorable recommendation, before the tax revenue can be used the way the commissioners are requesting.

By April next year, the convention center will have about $2.8 million in principal left on debt that was incurred for acquisition of land around the center and renovations to the existing building. The annual debt service of $636,000 was planned to be paid by the innkeeper’s tax, a 5-percent charge on lodging in the county.

The innkeeper’s tax revenue is starting to recover from a monthly low of about $49,000, reported in June this year. That was just 17 percent of the total for June in 2019, which was about $289,000.

Less severe was the impact on the food and beverage tax, which saw a year-over-year low in the May 2020 report, when $174,000 collected. That was about half of the May 2019 revenue total ($344,000).

The current fund balance for the county’s portion of the food and beverage tax now sits at $616,071, a bit less than the annual debt service on the convention center.

Based on discussion at a late November meeting of the county council, the convention and visitors commission has cash reserves that could cover two of the quarterly payments.

The 1-percent tax is paid by purchasers of all prepared food and beverages in the county. The county government’s share of the tax proceeds is 10 percent. The other 90 percent goes to the city of Bloomington.

The food and beverage tax was enacted specifically to fund the planned expansion of the convention center and for other related tourism or economic development projects.

But the COVID-19 pandemic led city and county leaders to consider using the funds for business and nonprofit relief. It’s a move that was green-lighted by Indiana’s State Board of Accounts (SBOA).

After getting a favorable recommendation from the FABTAC, Bloomington city government and Monroe County government have both used food and beverage tax proceeds to provide relief to businesses and nonprofit organizations that have been impacted by the COVID-19 pandemic.

The county nearly maxed out its $400,000 worth of approved COVID-19 business relief grant funding. Bloomington has distributed as loans about $1.47 million of the $2 million that was recommended by the FABTAC.

The $44-million convention center expansion is planned to be funded by the city of Bloomington, out of its share of the food and beverage tax proceeds. That expansion has been on hold since early March, before the pandemic arrived. That’s when city and county elected officials had hit another rough patch in their effort to sort out the governance structure of the expanded convention center.

Monroe County plans to use its share of the food and beverage tax proceeds to fund a limestone heritage tourist destination site and has approved $500,000 for the project. That’s been on hold since the pandemic started.

Serving on the seven-member FABTAC that will consider the request from the county commissioners to use food and beverage tax money to pay existing debt on the convention center are: John Hamilton (Bloomington’s mayor), Julie Thomas (president of the county board of commissioners), Steve Volan (Bloomington city council), Cheryl Munson (Monroe County councilor), Lennie Busch (Lennie’s), Susan Bright (Nick’s English Hut) and Tony Suttile (Fourwinds Marina).

Comments ()