Advisory group OKs food and beverage tax money for convention center debt

On Thursday, Monroe County commissioners cleared a key hurdle for using part of the county government’s share of the 1-percent food and beverage tax, to pay for debt on the convention center and the center’s management expenses.

By the end of its hour-long meeting, the seven-member food and beverage tax advisory commission (FABTAC) had recommended that up to $300,000 of the county’s food and beverage fund balance could be spent on convention center debt and management.

Historically, it has been innkeeper’s tax revenues that have been used to pay the convention center debt service. The innkeeper’s tax is 5-percent charge on lodging in the county.

But innkeeper’s tax revenues have been hit hard by the COVID-19 pandemic.

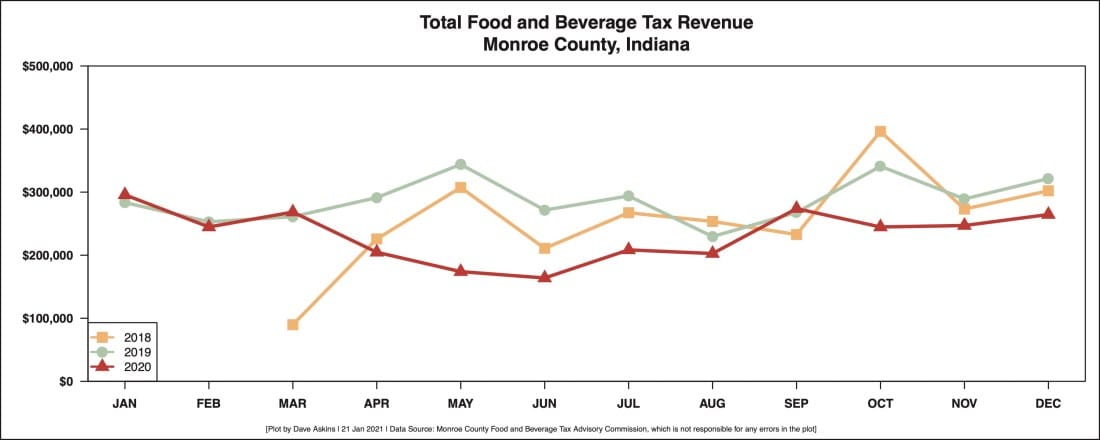

Food and beverage revenues are also a bit down due to the pandemic, but not by as much. That’s why commissioners wanted the flexibility to use some of the more than $600,000 in the food and beverage fund balance to pay towards the annual debt service on the convention center. The annual debt service is $636,000.

The specific mention of the $300,000 in FABTAC’s approval was different from the original wording of the request made to the FABTAC by county commissioners. Commissioners had voted in the first week of the year to ask for consideration from the FABTAC.

In their request, the three-member board of commissioners had asked to use “any and all funds” in the county’s food and beverage tax fund.

Except for wrangling over the difference in wording, the meeting probably could have been wrapped up in under a half hour.

In the opening minutes of Thursday’s meeting, president of the board of commissioners Julie Thomas, who serves as the board’s representative to the FABTAC, moved to amend the request to be more specific. Her amendment set $300,000 as the amount instead of “any and all funds.”

The stage for the tedious back-and-forth was set by a question from Bloomington’s mayor, John Hamilton.

Hamilton began by heading off a possible topic of discussion raised by Susan Bright (Nick’s English Hut), a merchant representative on the FABTAC. Bright wondered what state or federal resources could be tapped, instead of food and beverage tax money.

Hamilton said he doesn’t think it is the role of the FABTAC to “second-guess” the requests of the entities that make them, but rather to “ensure that the requests that come up to us are appropriate uses of the food and beverage tax.”

In addition to the county, the city of Bloomington can make requests for recommendations from the FABTAC. The split in food and beverage tax revenue between the city and the county governments is 90-10.

Hamilton thought the county’s intended use—to support the convention center—was appropriate.

The question from Hamilton that set the stage for the legal wrangling was: Can the FABTAC, on its own, amend the request that was made by the requesting entity? In this case the amendment would be to insert a specific dollar amount.

That generated extended back-and-forth between two lawyers on the county’s side, Jeff Cockerill and Margie Rice, and city’s corporation counsel, Philippa Guthrie.

About the resolution that the commissioners had adopted by a vote at their own public meeting, Rice said, “Now, if the resolution wasn’t specific, I don’t think that that’s necessarily reflective of the commissioners’ intent. I think it’s just the way it was drafted.”

In his remarks Hamilton alluded to an episode from late 2019, when a request from the city to the FABTAC had not been accompanied by a resolution from the city council that named a specific dollar amount. The solution on that occasion was for the FABTAC to postpone its vote on a recommendation, until the city council could approve a resolution with a specific dollar amount.

At Thursday’s meeting, the county council’s representative to FABTAC, Cheryl Munson, hinted at using the same solution this time around. Postponing a vote would mean just a month’s delay, given that the FABTAC would be meeting again in February to review its annual report, Munson said.

For his part, Hamilton said he would be content to support the request with its original wording of “any and all funds,” reasoning that there is a natural cap, which is the current fund balance. If the dollar figure for that fund balance were incorporated into the record of the meeting, Hamilton felt that would be sufficient.

Councilor Munson was reluctant to approve wording that says “any and all funds.” Munson said, “I don’t think it’s good business to have an open-ended check.”

Rice told the group that the record of the discussion in the meeting minutes would capture the intent that the amount should be limited to $300,000. Rice said, “There’s case law in Indiana that says boards and commissions speak through their minutes.”

Rice felt the minutes of the meeting would reflect that the commissioners wanted to narrow the request to $300,000. She also floated the possibility that the county commissioners could pass a resolution at their next meeting to clarify the request was for $300,000.

Guthrie, the city’s corporation counsel, said that it’s good that the idea is to reduce and not increase the amount requested. Using meeting minutes to document the change is fine, Guthrie said. But she added, “It’s just not ideal.”

During public commentary, two other county councilors weighed in—Eric Spoonmore and Geoff McKim—both supporting a FABTAC recommendation of approval for the county commissioners’ request.

McKim thought the amount should be $318,000, because that corresponds to exactly two quarterly debt payments.

McKim also thought the allowable expenditures should be confined just to debt service, not including management expenses. But McKim said that issue could be handled when the question of the appropriation comes in front of the county council, which is the fiscal body for the county.

The statement on which the FABTAC voted included a specific reference to $300,000 as the dollar amount.

For the county to spend the money, as county councilor Geoff McKim said, the next step would be for the county council to approve the appropriation.

Comments ()