Approaching $750K: Monroe County reimbursement grants to businesses using CARES Act money

Monroe County’s total allocation of awards to local businesses, nonprofits and other governmental entities using federal COVID-19 pandemic relief money is now approaching three quarters of a million dollars.

At their regular Wednesday meeting, county commissioners approved a total $64,724 in the latest round of allocations to local businesses to reimburse COVID-19 expenses. The grand total amount that’s been awarded so far now stands at $743,654.

Wednesday’s grantees included: Dimension Mill; Hive; Jerry G. Miller; Katherine James Designs; Monroe County Public Library; Nick’s English Hut, Inc; One World Catering; Pizza Express, Inc; Rainbow (Hopscotch) Bakery; The Wonderlab Museum; Upland Brewing Company, Inc;VTG Enterprises; Landlocked Enterprises, Inc; Innovative Financial Solutions; Laughlin Financial LLC; Litwin Enterprises; and BloomingPaws LLC.

On Wednesday, after Monroe County’s financial director, Brianne Gregory, presented the item, commissioners approved the allocations without a lot of extra discussion.

Board of commissioners president Julie Thomas noted that the application deadline for the grants is April 30. That means only a couple more weeks are left for businesses, nonprofits, and other governmental entities to apply for the reimbursements.

The county has set up a web page with a form for applicants to fill out.

The basic purpose of the funds is to reimburse non-payroll pandemic-related expenses that haven’t been covered by some other program.

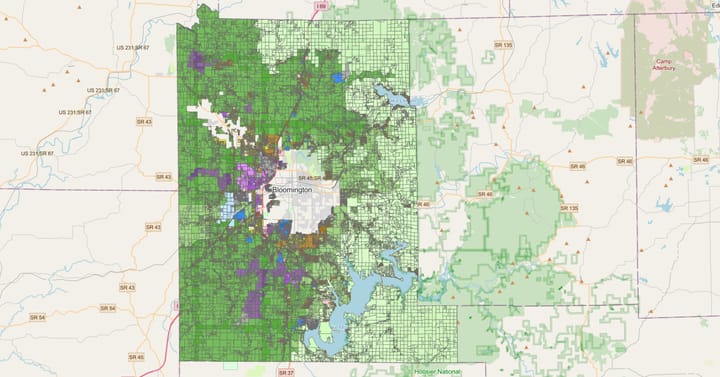

The money that Monroe County has been distributing to businesses and government entities comes from a total $4.7 million CARES (Coronavirus Aid, Relief, and Economic Security) Act allocation to the county.

The county’s federal relief program started with the county government acting as a clearinghouse of sorts, by passing through to the state the claims submitted by local businesses and governmental units—like the library and townships—for non-payroll expenses related to COVID-19.

The state eventually asked the county to submit the county’s own expenses for public safety, which were enough to get reimbursement to the county for the whole $4.7 million.

With the money now sitting in the county’s general fund, it’s now up to the county government to reimburse local businesses and governmental units.

The federal CARES Act funding pre-dates the more recent American Rescue Plan money.

The Bloomington and Monroe County estimated shares of the American Rescue Plan Act of 2021 (ARPA) are $22 million and $29 million, respectively.

The county commissioners are due to join the county council at the council’s April 27 work session to kick off discussion of how the ARPA money should be spent. The text of the bill outlines how cities and counties can use the money.

[Added April 14 at 9:17 p.m.] President of the board of commissioners, Julie Thomas, told The Square Beacon a lot of details on possible use of the funds are still missing. She thinks the first priority will be to recover any lost tax revenue. The first step will be to approve an ordinance that establishes a fund to receive the money, Thomas said.

In the text of the ARPA, one broad category of possible uses includes efforts to respond to the COVID-19 health emergency or its “negative economic impacts.” Specific examples mentioned in the text of the bill include: “assistance to households, small businesses, and nonprofits, or aid to impacted industries such as tourism, travel, and hospitality.”

Another category of possible use is to provide premium pay for government employees doing essential work. A third category involves making up for revenue shortfalls due to the pandemic so that government services can be provided.

Finally, the bill allows the funds to be spent on water, sewer, or broadband infrastructure.

ARPA Text: Possible uses of American Rescue Plan funding

(1) USE OF FUNDS.—Subject to paragraph (2), and except as provided in paragraphs (3) and (4), a metropolitan city, nonentitlement unit of local government, or county shall only use the funds provided under a payment made under this section to cover costs incurred by the metropolitan city, nonentitlement unit of local government, or county, by December 31, 2024—

(A) to respond to the public health emergency with respect to the Coronavirus Disease 2019 (COVID–19) or its negative economic impacts, including assistance to households, small businesses, and nonprofits, or aid to impacted industries such as tourism, travel, and hospitality; H. R. 1319—229

(B) to respond to workers performing essential work during the COVID–19 public health emergency by providing premium pay to eligible workers of the metropolitan city, nonentitlement unit of local government, or county that are performing such essential work, or by providing grants to eligible employers that have eligible workers who perform essential work;

(C) for the provision of government services to the extent of the reduction in revenue of such metropolitan city, nonentitlement unit of local government, or county due to the COVID–19 public health emergency relative to revenues collected in the most recent full fiscal year of the metropolitan city, nonentitlement unit of local government, or county prior to the emergency; or

(D) to make necessary investments in water, sewer, or broadband infrastructure.

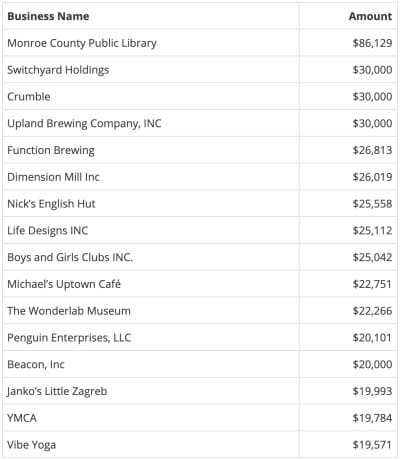

Table: CARES Act grants as of April 14, 2021

| Business Name | Amount |

| Monroe County Public Library | $86,129 |

| Switchyard Holdings | $30,000 |

| Crumble | $30,000 |

| Upland Brewing Company, INC | $30,000 |

| Function Brewing | $26,813 |

| Dimension Mill Inc | $26,019 |

| Nick’s English Hut | $25,558 |

| Life Designs INC | $25,112 |

| Boys and Girls Clubs INC. | $25,042 |

| Michael’s Uptown Café | $22,751 |

| The Wonderlab Museum | $22,266 |

| Penguin Enterprises, LLC | $20,101 |

| Beacon, Inc | $20,000 |

| Janko’s Little Zagreb | $19,993 |

| YMCA | $19,784 |

| Vibe Yoga | $19,571 |

| RVC Holdings/C3 Bar | $18,415 |

| Convention Center Mgmt Co | $18,292 |

| One World Catering, LLC | $18,119 |

| HealthNet, Inc | $16,644 |

| Cave Group, INC/Malibu Grill | $15,232 |

| The Village Deli | $13,964 |

| Bluebird Live Inc | $13,637 |

| Soma | $9,534 |

| Curry Auto Center | $8,632 |

| The Farm Restaurant | $7,926 |

| BloomingPaws LLC | $7,829 |

| Acacia Building Corporation | $7,725 |

| WonderLab | $7,721 |

| Campus Tutoring, LLC | $7,192 |

| The Greater Bloomington Chamber of Commerce | $7,049 |

| Lennie’s | $6,671 |

| Hive | $6,302 |

| Alibi LLC | $5,602 |

| The Laughing Planet Café | $5,237 |

| Far | $5,150 |

| High and Fine | $5,016 |

| Cinema Pub Inc | $4,828 |

| Richland Township | $4,356 |

| The Convention and Visitor’s Bureau of Monroe County | $4,352 |

| VTG Enterprises/Popkorn Kernels | $4,321 |

| Carmichael Center LP | $3,905 |

| The Cocuun | $3,881 |

| Loren Wood Builders | $3,724 |

| Disque/Mardon Salon | $3,617 |

| BUGS | $3,364 |

| Landlocked Enterprises Inc. | $3,277 |

| Trendin Vendin | $3,250 |

| Katherine James Designs | $3,201 |

| Cajun House/DATS | $3,156 |

| Bloomington Real Estate/RE/MAX | $2,983 |

| Litwin Enterprises LLC | $2,920 |

| Benton Township | $2,460 |

| BCT Management/Buskirk-Chumley | $2,275 |

| Royale Hair Parlor | $2,248 |

| Rainbow (Hopscotch) Bakery | $1,904 |

| Monroe County Humane Association | $1,830 |

| Innovative Financial Solutions | $1,800 |

| Bunger & Robertson | $1,487 |

| Jerry G. Miller | $1,318 |

| ProNails | $1,213 |

| Laughlin Financial LLC | $1,170 |

| Gather | $937 |

| Patient PT LLC | $821 |

| Pizza X | $735 |

| Move and Bloom | $679 |

| Ally Barber | $675 |

| Deborah Zera | $660 |

| Oak Native | $650 |

| Gallagher Properties, INC | $650 |

| Fine Craft/By Hand | $644 |

| MC Humane Society | $568 |

| Santo Family Insurance | $548 |

| Four Walls LLC | $520 |

| Cup & Kettle | $514 |

| Farrell’s eXtreme Bodyshaping/Pamela Green/Purple Band Fitness | $425 |

| Bloomington Salt Cave | $323 |

| Hoosier Films Inc. | $224 |

| Yoga Mala | $215 |

| Grand Total | $743,654 |

Comments ()