Consultant scrutinizes Bloomington’s annexation fiscal plan: $866K bigger blow to Monroe County local income tax revenue

A two-person team from the Baker Tilly accounting firm, hired by Monroe County’s board of commissioners to review Bloomington’s annexation fiscal plan, presented its report to the county council on Tuesday night.

Baker Tilly found that in Year 2, the impact on local income tax (LIT) revenue to Monroe County government would be negative $1.4 million. That’s a $866,000 bigger impact than Reedy Financial Group reported in Bloomington’s annexation fiscal plan. Reedy analyzed the impact as negative $534,694.

Paige Sansone and Deen Rogers, the accountants from Baker Tilly who did the work for the county, noted a handful of other issues with Bloomington’s fiscal plan, none of which had a significant financial impact.

Among the issues were the outdated assessed value information in the fiscal plan, a decimal place error for cigarette tax calculations, and the inaccurate way the impact of growth was analyzed.

The Baker Tilly pair also pointed to an additional step the city of Bloomington will need to take to ensure that all the additional property taxes it is assuming in its fiscal plan can be collected.

Under state law, Bloomington is guaranteed the ability to collect additional property taxes, as long as the additional tax collections don’t increase the total by more than 15 percent. Any more than 15 percent will require an appeal for an “excess levy,” which is not automatically granted, according to Sansone.

Bloomington’s annexation would mean an $8 million increase in property taxes for the city, but the portion of that corresponding to a 15-percent increase would be about $5.5 million, Sansone said. To get the additional $2.5 million would require an appeal.

Even the relatively large discrepancy in the LIT impact analysis seemed to be viewed by county councilors as small in the context of the county’s overall budget.

Councilor Geoff McKim penciled out the negative impact on the general fund at about $1.8 million for that fund’s $50 million annual budget. “So essentially, that boils down to about a 3.6 impact on our general fund revenues. … It’s just the way I see it.”

Sansone and Rogers, the Baker Tilly accountants, reprised their report on Wednesday night in a presentation at Bloomington Township’s fire station on Old SR 37. The presentation, which was accessible by Zoom video conference, was attended in person by a dozen and a half people.

A contingent from a group called County Residents Against Annexation (CRAA) attended Wednesday’s meeting encouraging people to sign pre-remonstrance petitions, before the Bloomington city council takes its votes in September on individual ordinances for each annexation area.

Formal remonstrance petitions can be signed only after the city council’s enactment of annexation ordinances. But CRAA wants to show the council what the sentiment of residents is, in the hope of discouraging a vote in favor of the ordinances.

Bloomington’s annexation proposal would add more than 9,000 acres to Bloomington’s land area and about 14,000 new residents to its population.

Local Income Tax Impact (LIT)

Year 2 is the right year to focus on for LIT, Baker Tilly’s Paige Sansone told county councilors, because there’s a one-year lag after annexation for the impact on LIT revenues.

Sansone reviewed the basics of how LIT revenue is distributed to different units of government in the county.

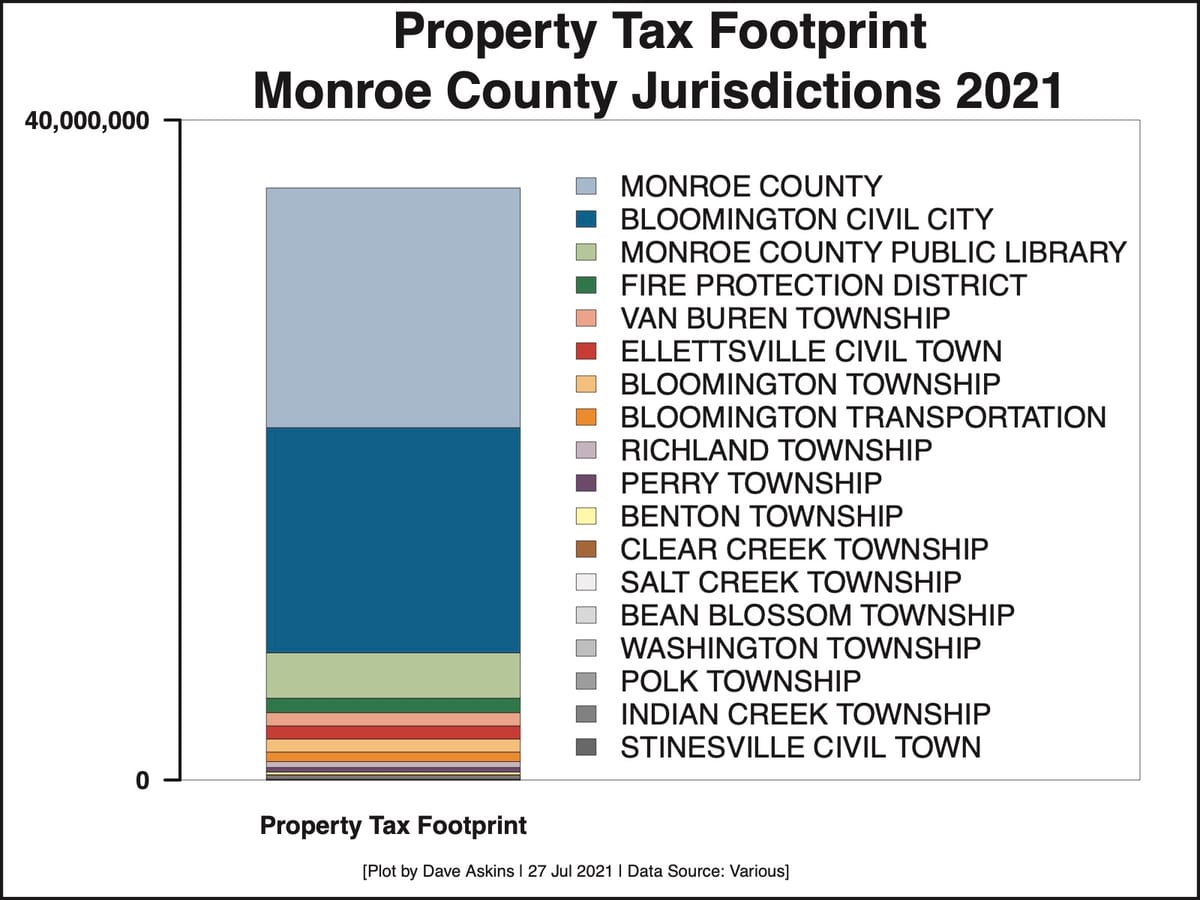

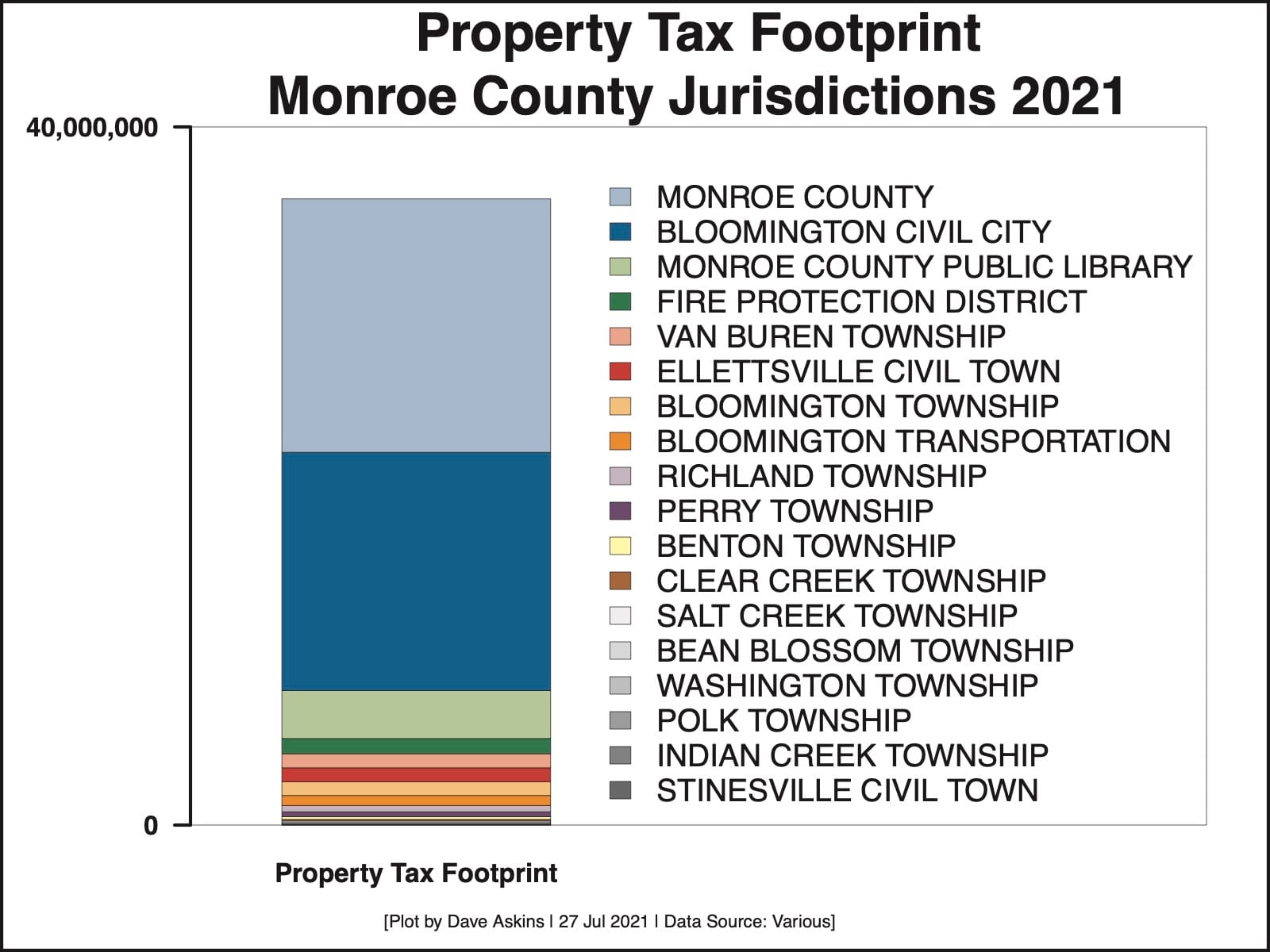

The distribution is based on the relative proportion of that taxing authority’s property tax collections. That relative proportion is sometimes called the taxing authority’s property tax “footprint,” even though it’s not based on a geographic footprint. So Bloomington’s property tax footprint will increase, because of the additional taxes collected due to annexation. That means the property tax footprint of every other jurisdiction will decrease.

But Sansone said it’s not as simple as just applying the proportional calculation—there are other statutory requirements and various adjustments that have to be made. The tool used by Baker Tilly is based on the considerations that Indiana’s department of local government finance (DLGF) uses, according to Sansone.

But Sansone said it’s not as simple as just applying the proportional calculation—there are other statutory requirements and various adjustments that have to be made. The tool used by Baker Tilly is based on the considerations that Indiana’s department of local government finance (DLGF) uses, according to Sansone.

Sansone indicated the other considerations could account for the $866,000 difference between Baker Tilly’s number and the number in Bloomington’s fiscal plan.

Other than the impact on Monroe County’s LIT revenue, Baker Tilly came up with numbers that were pretty close to those analyzed by Reedy Financial Group. In Year 2, the other negative impacts to county government revenue—circuit breaker tax credits, vehicle excise taxes, gasoline and wheel tax, storm water fees, and TIF revenue—added up to about $1.92 million for both accounting firms.

After netting out the reduction in costs for services that county government would no longer have to provide as a result of annexation, it makes for a $2.74 million hit to county government revenue in Year 2, according to Baker Tilly. That compares to the $1.86 million hit analyzed by Reedy Financial Group, which prepared Bloomington’s fiscal plan.

Circuit Breakers

Baker Tilly’s circuit breaker analysis for the county and for other units came out close to the same as the analysis that Reedy Financial Group gave in Bloomington’s annexation fiscal plan.

It is circuit breakers that help explain why annexation has a negative impact on school district revenue, even though school district local income tax revenue does not decrease. That’s because school districts don’t receive local income taxes in the first place.

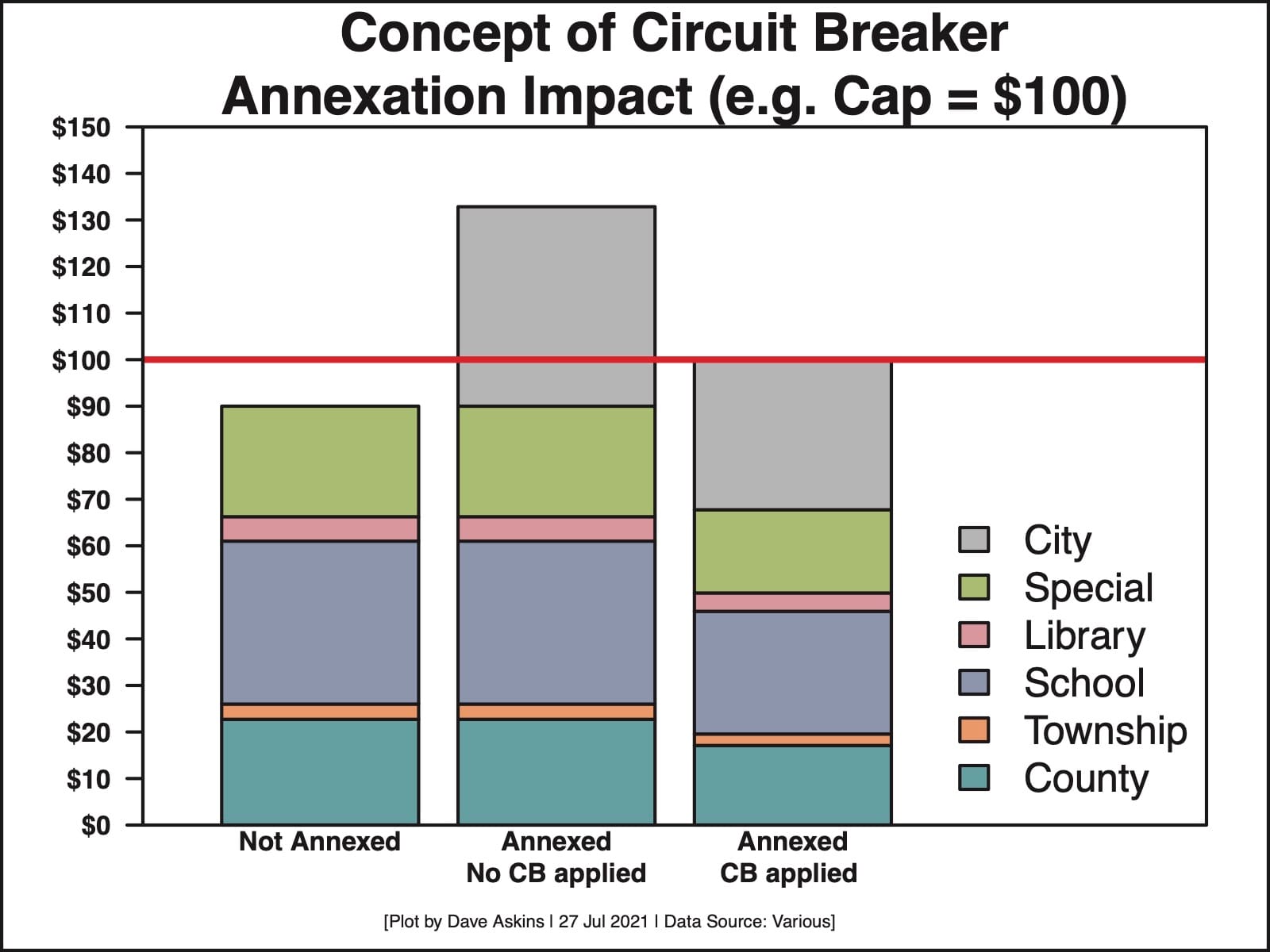

Indiana’s tax caps limit the property tax burden to a fixed percentage of the property’s gross assessed value. The circuit breaker limit is different for three classes of property: 1 percent for residential homestead), 2 percent for non-homestead residential and farmland, and 3 percent for commercial and industrial.

For properties that are not close to their circuit breaker limit, the increased tax burden from city of Bloomington taxes due to annexation will not push the property past the limit, and there is no impact to county government, schools, township, library, or fire protection districts.

But for properties that are close to the limit, the additional city tax can push past it. To fit under the cap, all the tax levies from each jurisdiction get squished down in a proportionate way to fit inside the cap.

Both accounting firms put annexation’s negative impact on Monroe County Community School Corporation annexation at about a half million dollars a year.

Out-of-date parcel assessed value?

Rogers pointed out on Tuesday night that under Indiana law, the parcel list in the annexation fiscal plan is supposed to include the most recent assessed value of the parcels to be annexed.

According to Rogers, Bloomington’s fiscal plan is based on 2019 assessments, which are now outdated. A tax calculator tool, created by Baker Tilly, relies on the more recent 2020 assessments.

The city of Bloomington did not respond on Wednesday to a question from The B Square about the possibility that a revised fiscal plan would need to be produced with updated parcel-by-parcel assessed value information.

Cigarette Tax

Another apparent mistake in Bloomington’s fiscal plan is the calculation of the impact of annexation on cigarette tax revenue.

A decimal place error means that Bloomington’s fiscal plan shows an extra $82,000 in revenue, instead of the $8,200 that Baker Tilly calculated.

Remonstrance

At Wednesday’s meeting, held at the Bloomington Township fire station on Old SR 37, Van Buren Township trustee Rita Barrow asked about formal remonstrance petitions, and how they would be made available.

County attorney Jeff Cockerill said he was still inquiring with state officials about the legal ways that petitions could be made available to residents—he’s not sure if they can be distributed through the county’s website.

Margaret Clements, who is president of Monroe County’s plan commission but acting in her individual capacity as a resident to oppose annexation, encouraged people to sign a petition now, before the Aug. 4 public hearing in front of Bloomington’s city council. The idea is to show the city council what sentiment is like, before councilmembers vote on the annexation ordinances.

She has petitions at 1010 South Walnut, the Perry Township office, and she’s there from 3 p.m. to 6 p.m., on Monday, Wednesday, and Friday, Clements said. Clements reported that of the people she’s canvassed, she’s seen 98-percent opposition to annexation.

Cockerill stressed that whatever petition people sign now, before any ordinance is enacted, is not a legal remonstrance petition. Those can only be issued by the county auditor’s office after Bloomington’s city council enacts an ordinance. About any petitions signed now, Cockerill said, “That is not a petition to remonstrate, which cannot occur until after the city council has made a determination.”

Clements returned to the mic to respond to Cockerill: “This may be true, and it is true. But we want to give city council an idea of how many people are opposed to annexation.”

Colby Wicker, a co-founder of the group called County Residents Against Annexation, asked for the community to come together to oppose annexation.

Standing with Barrow and Clements near the mic, Wicker said, “The three of us standing here can’t do it [by ourselves].” Wicker added, “The only way that we can operate is if we come together as a community. And I wholeheartedly believe that we can stop this, but only if we come together.”

Click to view slideshow.

Comments ()