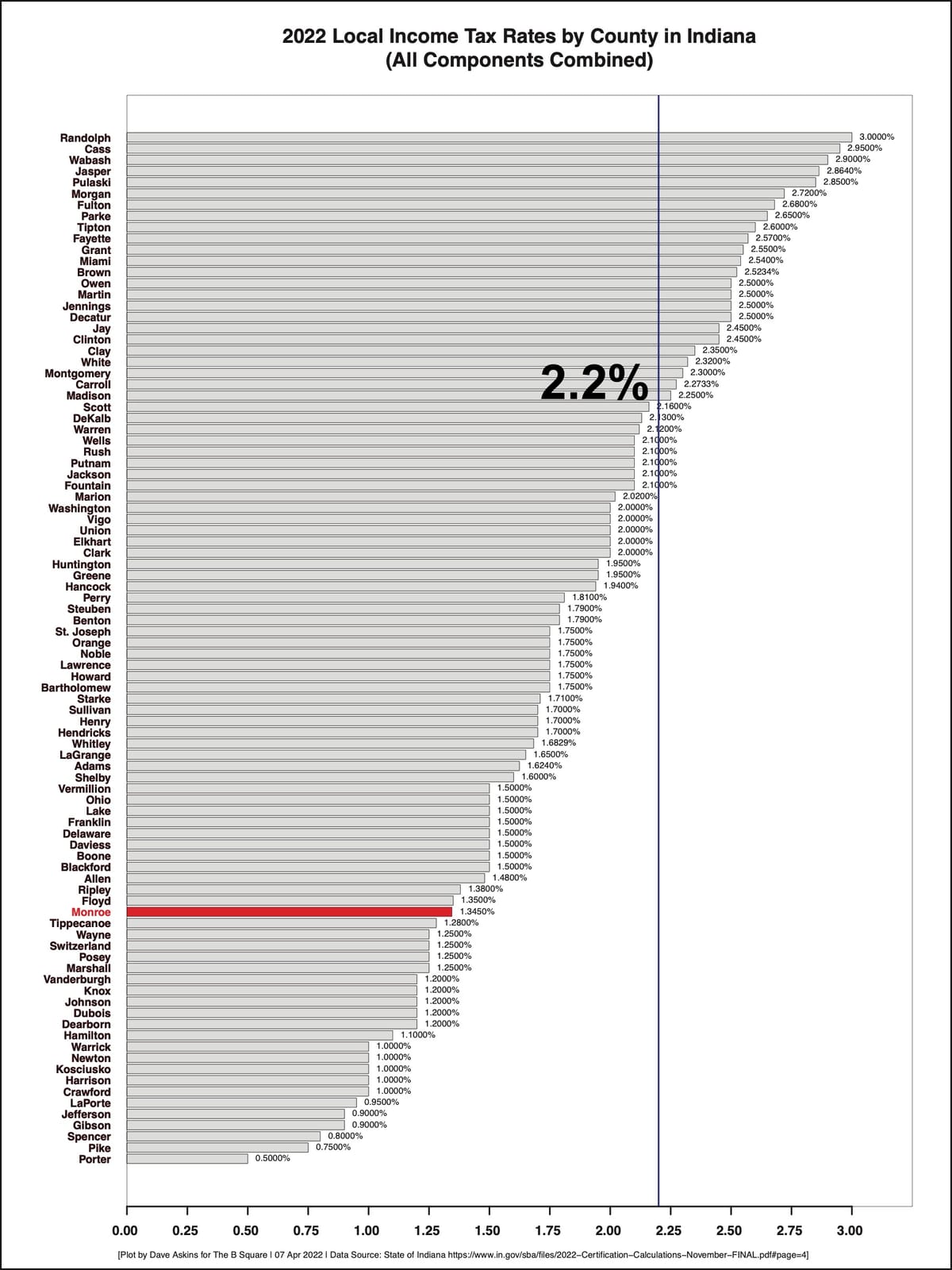

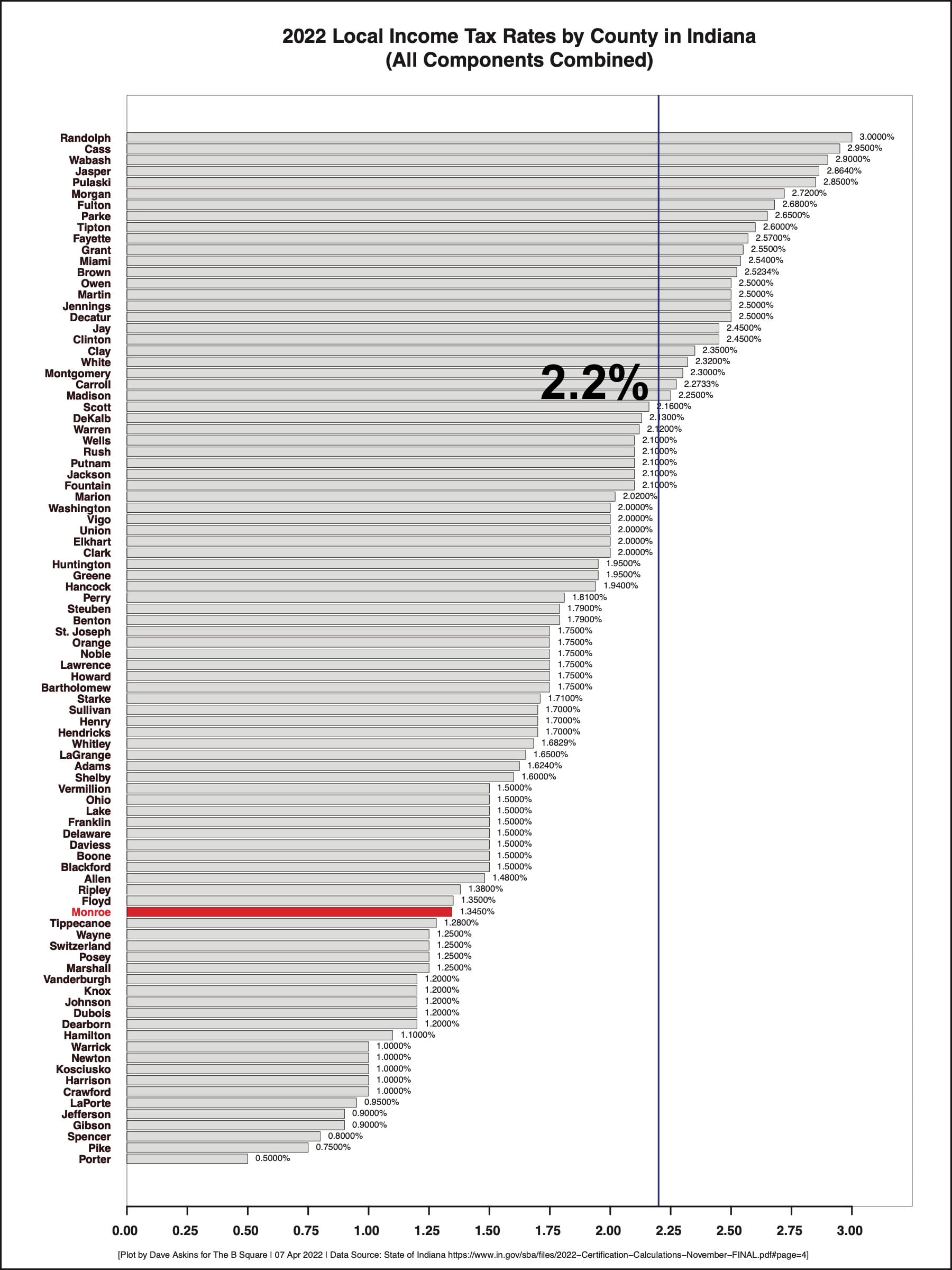

Bloomington mayor pitches 64% increase in Monroe County’s local income tax

In a news release issued Wednesday afternoon ahead of the city council’s evening meeting, Bloomington mayor John Hamilton put a specific number on the local income tax (LIT) rate increase he has been talking about for the last several weeks.

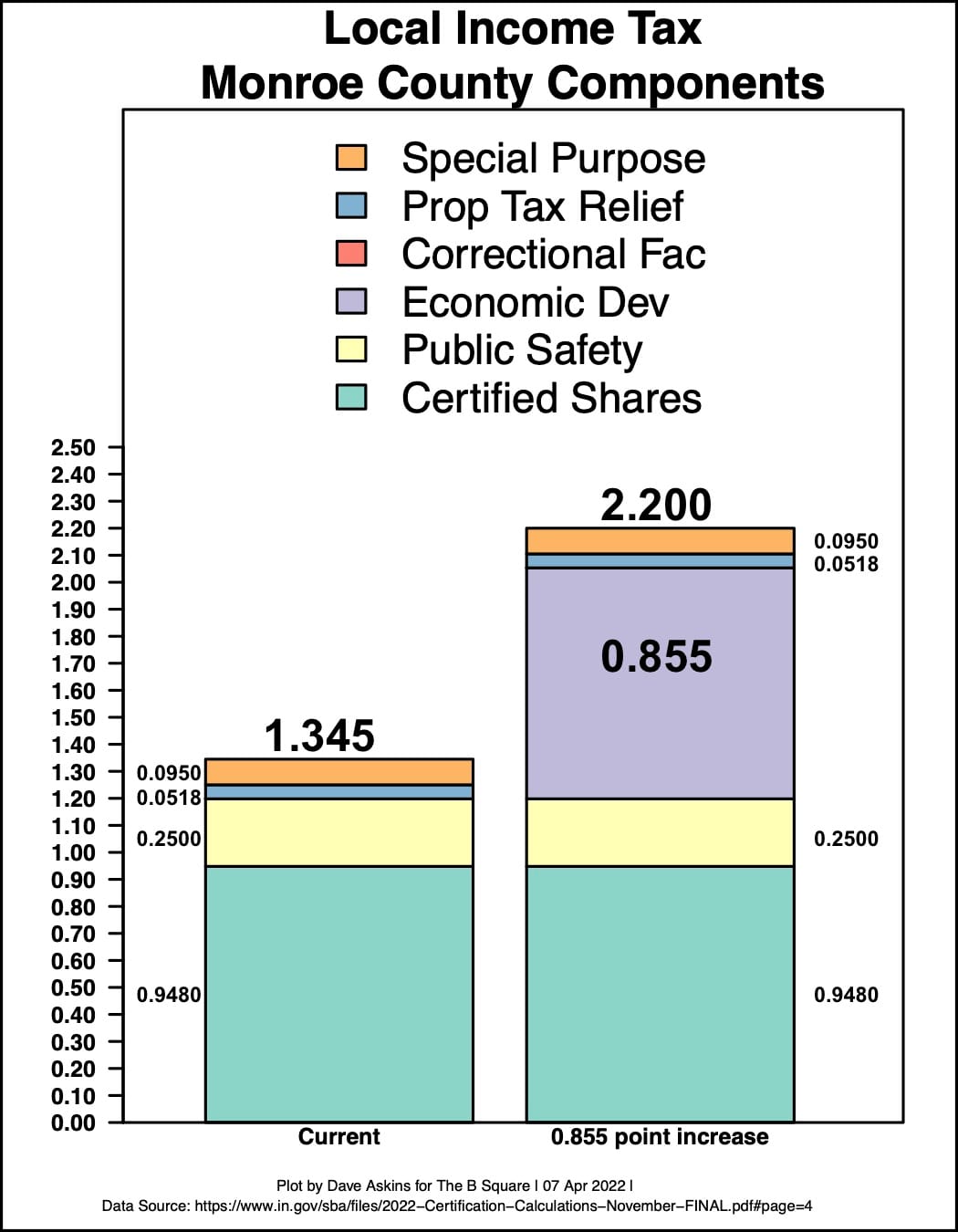

What Hamilton is proposing is an increase from 1.345 percent to 2.200 percent. That’s 0.855 points, or about a 64-percent increase to the current rate.

Based on the current public safety local income tax rate, which is 0.25 percent, and the state’s certified local income tax distributions for 2022, just a quarter-point LIT increase would generate a total of $9,025,682 a year countywide.

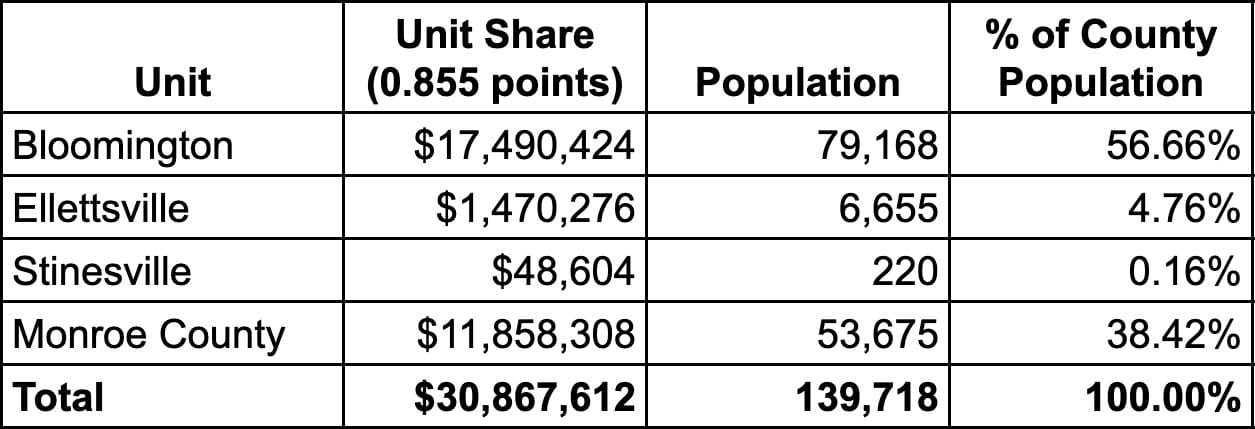

For a full point increase, that translates into $36.1 million in revenue countywide. That figure, multiplied by Hamilton’s proposed 0.855 increase, means about $30.87 million.

Based on the proportional population distribution method proposed by Hamilton, Bloomington’s share would be about $17.5 million. Monroe County government’s share would be about $11.9 million, with the remainder going to Ellettsville and Stinesville.

The levy or “property tax footprint” method would generate about $16 million for Bloomington and about $14 million for Monroe County government, with the remainder to Ellettsville and Stinesville.

If a 0.855 point increase were not enacted in the economic development category, but instead in the certified shares category, it would mean about $11 million for Bloomington and $12 million for Monroe County government, with the remainder distributed across other local units. An increase to the certified shares rate would be split out not just to Bloomington, Monroe County, Ellettsville and Stinesville, but also to all the individual townships, Bloomington Transit, the Monroe Fire Protection District, and the Monroe County Public Library.

The mayor’s proposed increase would come in a category for which Monroe County does not currently impose any tax: economic development. The economic development category is pretty flexible in the way revenue can be used. There’s a catch-all category in the statute that says a local unit of government can use economic development LIT for “any lawful purpose for which money in any of its other funds may be used.” But there’s a statutory requirement that a capital improvement plan accompany LIT that is collected in the economic development category.

Hamilton started his pitch to the city council on Wednesday night by quoting former mayor Tomilea Allison, writing to the city council in a 1984 memo on the occasion of Bloomington’s enactment of its first income tax at a rate of 0.5 percent: “No government official wants to raise taxes which are unnecessary. But our first obligation is to provide basic services to our citizens. We must maintain the high quality of our police and fire services. We must maintain our streets, curbs sidewalks, our equipment inventory, and our city facilities.”

The city council raised the tax again in 1989, to a full point. In 2016, the council again increased the LIT rate, in the category of public safety, by quarter point. In the city’s Wednesday afternoon news release, Hamilton is quoted saying, “We haven’t had a general increase in our LIT for 30 years, during which time our needs have grown substantially and our challenges have mounted.”

Providing a counterpoint to the idea that a rate of tax collection should increase over time was Jeff Mease, who delivered remarks during public commentary at Wednesday’s meeting. Mease operates One World Enterprises with Helen “Lennie” Busch. Among the iconic local businesses under the One World umbrella is Pizza X.

Mease described how the financial arrangement that pays his and Busch’s salaries entails a “management fee” that is applied to individual businesses operating under One World. It has remained the same 6.75 percent since it was implemented 30 years ago, Mease said.

In Mease’s own words:

We recognize that if we were to raise that 6.75-percent management fee that we take from them—it’s like a tax—that their income goes down. And so today, 30 some years later, our management fee is still six and three quarters percent. Now our sales have grown dramatically, just like the payrolls in Bloomington. And so to say Bloomington needs more revenue, well, it’s got more revenue. But when we raise that rate, that’s a bigger slice of the pie. And what I want to know from the council and from the mayor is: Why does the city need a bigger slice of the pie? Because there’s only 100 percent There’s only one pie. And when we take more pie, somebody doesn’t get their pie.

The needs that Hamilton has identified to be funded by the LIT increase include climate change; essential services; public safety; and quality of life.

Hamilton said that the revenue from the economic development LIT would be received by a special fund that would be established, so that spending of the additional money could be tracked.

Other than Hamilton’s report, the LIT increase did not have an agenda item at Wednesday’s meeting. An LIT increase will appear on the city council’s April 20 agenda.

A council vote on April 20 could result in the enactment of the proposed LIT increase for all of Monroe County—if there are at least eight votes in favor. On that scenario, neither the Monroe County council nor the Ellettsville town council would need to weigh in. But if the LIT increase gets seven votes or fewer from the nine Bloomington city council members, it would have to pick up some votes from the county council.

Getting introduced, but no discussion on Wednesday were two $5 million bond proposals that are a part of Hamilton’s revenue package. The $10 million worth of bonds were a part of last year’s tussle between the city council and the mayor over passage of the 2022 budget. The bonds are set for a vote at the city council’s April 20 meeting.

The bond package is split between public works bonds and parks bonds. The parks bonds are in the bailiwick of the board of park commissioners. Park commissioners have given the bonds an initial green light and will take a vote on their issuance, assuming city council approval, and after a public hearing already set for April 26.

Controller Jeff Underwood told the park commissioners at their meeting a week ago that he estimates the increased property tax rate to pay the debt service on the bonds at 3.3 cents. Bloomington’s current general fund property tax rate is about 61 cents.

For a property with an assessed value of $250,000, subtracting the $45,000 homestead deduction leaves $205,000. The supplemental deduction of 35-percent on that remainder leaves $133,250 as the net assessed value.

So an extra 3.3 cents of tax on that net assessed value ($133,250*.00033) would work out to $43.97 more in property taxes per year. The total for both of the bonds would work out to around $88 more in property taxes per year.

Reaction from Bloomington city councilmembers to the mayor’s LIT proposal on Wednesday night, was not clearly indicative of support or opposition.

When it comes to enacting a countywide LIT increase, members of the Bloomington city council and Ellettsville town council have votes that are weighted based on the percentage of the population they represent. Monroe County councilors get the leftover percentage.

If just seven (or fewer) Bloomington city councilmembers support a LIT rate increase, it would need to pick up two county councilor votes to pass.

Details like the rate and the method of distribution to different government units could change, based on what city councilmembers might be willing to support.

In thanking Hamilton for his presentation, city council president Susan Sandberg seemed to indicate that the mayor’s proposal would be subjected to significant scrutiny. Sandberg said, “We are looking forward to the democracy to come.”

Table: Voting shares for LIT in Monroe County

| Unit | Population | % of county | Share per member |

| Bloomington | 79,168 | 56.66% | 6.30% |

| Ellettsville | 6,655 | 4.76% | 0.95% |

| Stinesville | 220 | 0.16% | 0.05% |

| Monroe County | 53,675 | 38.42% | 5.49% |

Comments ()