Wednesday’s city council committee meeting could mark the start of local income tax negotiations

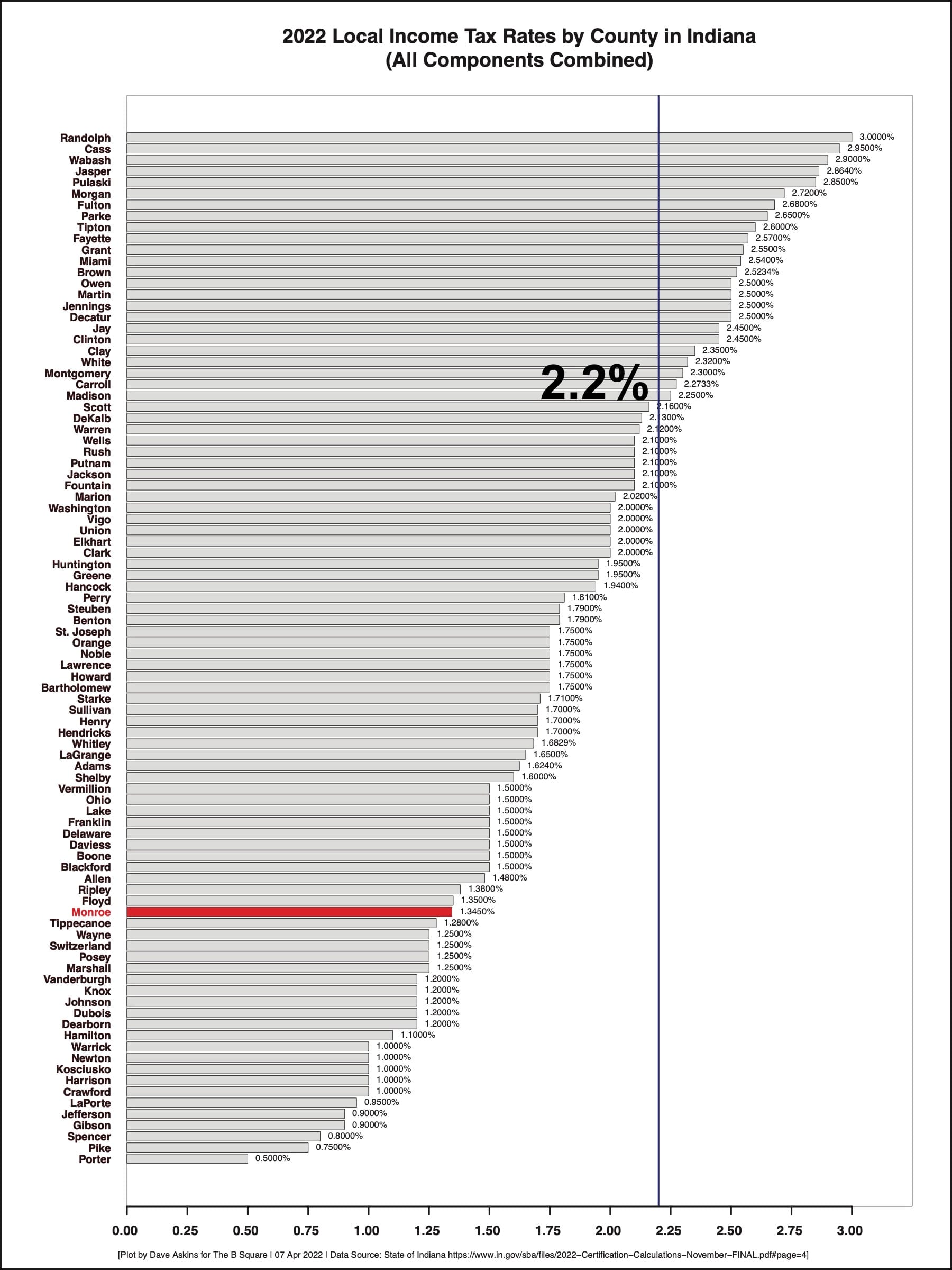

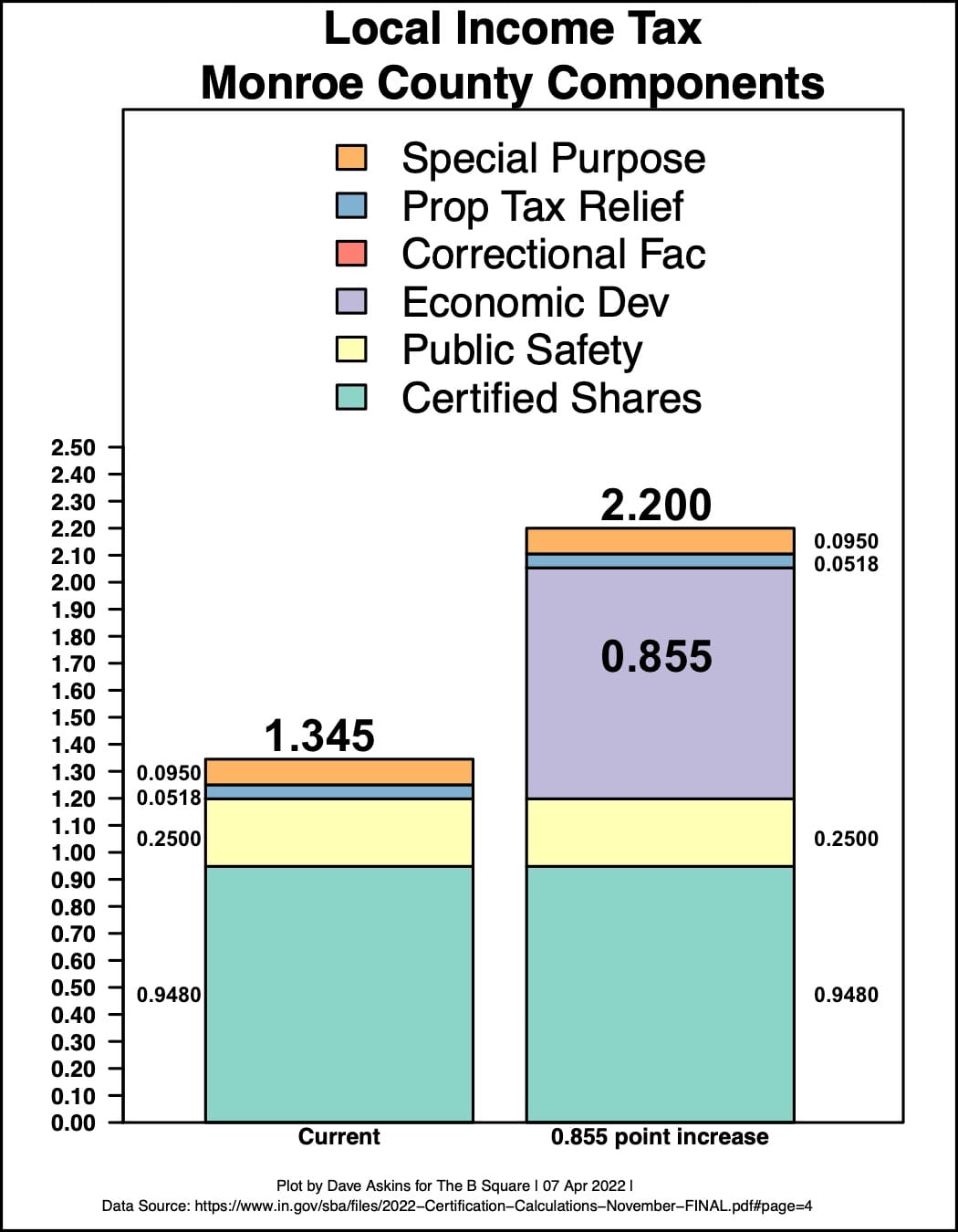

Bloomington mayor John Hamilton’s proposal to increase the countywide local income tax (LIT) by 0.855 points, to a total of 2.2 percent, appears on the agenda for the city council’s Wednesday night committee-of-the-whole meeting.

Other revenue items on the agenda include two $5-million bond proposals—one for parks bonds and the other for public works bonds. [Updated at 4:34 on April 13, 2022: Two amendments to the list of projects to be funded by the bonds were posted by the city council office. Here’s a link: 2022-04-13 meeting packet addendum.]

Also on Wednesday’s agenda is a nominal decrease to the drinking water rate, driven by the General Assembly’s repeal of the 1.4-percent utility receipts tax. It was a pass-through tax, which means it was collected by utilities and forwarded to the state. For the residential rate, the decrease is 5 cents—from $4.03 to $3.98 per 1,000 gallons. That works out to 1.2 percent less.

No final votes will be taken on Wednesday night at the committee meeting. But it is the city council’s custom to take straw polls. That should give some indication of how councilmembers are leaning toward the proposed income tax increase. Abstentions are generally used as a mechanism to show moderate disapproval.

A final vote on a local income tax (LIT) increase by the city council could be taken as soon as next Wednesday (April 20).

The additional 0.855 points translates into an extra $85 to be paid on every $10,000 of taxable income for all Monroe County residents, on top of the $135 in LIT that is currently paid on each $10,000 of taxable income.

At the April 6 city council meeting, Hamilton formally presented the council with the new revenue package.

The impact of the flat tax on those with lower incomes is one source of concern that councilmembers have expressed. Councilmember Ron Smith asked Hamilton on April 6 about the impact of the additional tax on people with fixed incomes, the elderly, and people with disabilities.

Hamilton responded by pointing to the “economic equity” fund that is supposed to be created to help address any negative impacts of the increased LIT. The amount allocated in the fund has been increased from $750,000 in the initial proposal to $1 million, Hamilton said.

The economic equity fund is supposed to give direct support to low-income working residents, possibly working through South Central Community Action Program or Monroe County United Ministries, among other non-profits.

Generally, all the new revenue to be generated for Bloomington from the increased LIT rate is supposed to be received in a newly created fund, so that expenditures using the increased revenue can be tracked.

The other units of government that stand to see additional revenue from the kind of tax that Bloomington’s city council is proposing are: Monroe County, Ellettsville, and Stinesville.

Those are the four governmental units that would benefit from the “economic development” category of LIT, which currently is not used at all by Monroe County.

One point of contention for any LIT proposal is how the money, which is collected by the state from all residents of Monroe County, is distributed to the different governmental units.

It’s not the case that each dollar of LIT revenue can be traced to the specific geographic location within Monroe County where the person who paid it lives. That means the total amount collected has to be distributed based on some agreed-upon method.

For the economic development category, there are two possible methods. One is based on relative amounts of total property tax paid by residents of a unit. The other is based on population. The method yielding the most revenue for Bloomington is the population method.

In a recent memo to the city council from Hamilton, the population method is characterized like this: “As taxes are collected based on population, the most equitable allocation of the funds collected is also by population.”

At Tuesday’s Monroe County council meeting, Hamilton’s claim in the memo that taxes are collected based on population got a critical reception from councilor Marty Hawk, who said: “That just simply is not true. How could it be true?” Councilor Geoff McKim agreed: “No, of course that’s not true.”

The taxes are paid by people, which is in some sense the “population,” but they are collected from all residents of the county and piled together.

At Tuesday’s meeting, councilor Trent Deckard lamented the fact that the state legislature had not set up a system that allows different units to decide their own local income taxes. He said, “It would be probably wise for the state to clarify this entire process…” Deckard added, “I sometimes think that they like it better when we’re fighting each other. And I think that’s ridiculous.”

The population method would yield around $17.5 million annually for Bloomington and about $11.9 million for Monroe County government, with the remainder to Ellettsville and Stinesville.

The levy or “property tax footprint” method would generate about $16 million for Bloomington and about $14 million for Monroe County government, with the remainder to Ellettsville and Stinesville.

On Tuesday, McKim pointed out that Bloomington’s idea was to start with the amount of revenue it wants, then use the method that generates the greatest share for Bloomington—so that the rate could be as low as possible.

That’s why it’s unlikely to see the Bloomington city council amend the proposal to a completely different category of LIT—certified shares. Bloomington would see a lot less for the same 0.855 rate increase.

If a 0.855-point increase were enacted in the certified shares category, it would mean about $11 million for Bloomington and $12 million for Monroe County government, with the remainder distributed across other local units. An increase to the certified shares rate would be split out not just to Bloomington, Monroe County, Ellettsville and Stinesville, but also to all the individual townships, Bloomington Transit, the Monroe Fire Protection District, and the Monroe County Public Library.

Any changes that the Bloomington city council makes to the proposal would likely come in the form adjusting the amount of the increase—almost certainly downward. City councilmembers seem generally on board with the idea that some additional revenue is needed. But it’s not clear that the 0.855 amount would have the support of at least eight of nine councilmembers.

Eight is the key number, because if eight or more city councilmembers vote for the tax increase, it passes automatically. The Monroe County council and the Ellettsville town council would not even have to take a vote.

But if seven or fewer city councilmembers vote for the proposal, it would need to pick up additional support from the council council and possibly the town council. Here’s how voting weights are calculated:

Table: Voting shares for LIT in Monroe County

| Unit | Population | % of county | Share per member |

| Bloomington | 79,168 | 56.66% | 6.30% |

| Ellettsville | 6,655 | 4.76% | 0.95% |

| Stinesville | 220 | 0.16% | 0.05% |

| Monroe County | 53,675 | 38.42% | 5.49% |

The political math probably works like this: If the rate is so high that it doesn’t get at least eight votes on the city council, that is probably too high a rate to get any support on the county council. That is, if the LIT passes, it will likely be because the Bloomington city council is able, on its own, to vote it through for the rest of the county.

What could unfold starting this Wednesday are negotiations towards a kind of ratcheting downward of the rate by councilmembers. The notice of the public hearing for April 20 has already been given with the amount of increase set for 0.855 points.

But that could be amended and adopted next Wednesday—as long as the amended rate is lower. That’s the word from city council administrator/attorney Stephen Lucas and Bloomington corporation counsel Beth Cate, who responded to emailed questions from The B Square.

At the April 6 city council meeting Jim Sims said he thinks more revenue is needed: “Speaking for myself, I think it’s pretty clear that we’re going to need a new revenue source.” The question of how much is not clear, he added.

Sims said he also wanted to factor into the equation that every few years, the city routinely enacts increases to sewer and water rates.

In fall of 2020, Sims joined the majority in voting against the quarter-point increase to the LIT. The four votes in favor of the tax increase that year came from Dave Rollo, Matt Flaherty, Kate Rosenbarger and Steve Volan.

It will be Sims who chairs Wednesday’s committee-of-the-whole meeting.

Rollo, who voted for the quarter-point increase in 2020, has expressed some reservations this time around about the size of the proposed increase. At the March 25 work session, Rollo said, “I’m looking at this entire package in terms of discerning between immediate needs and desires.”

Rollo later noted that “I think we’re going into uncertain economic times. And clearly people are being affected. They’re having to tighten their belts. And I think that we need to be very judicious about this.”

Later in the work session, Rollo commented on the proposed timeframe set forth by Hamilton for the decisions, which could come as soon as the city council’s April 20 meeting. Rollo said the time window is “quite circumscribed” and suggested it might be more appropriate to consider the LIT increase and the issuance of the GO bonds in the context of the 2023 budget deliberations, which will start sometime at the end of August.

The timing of a city council decision to increase the LIT rate has implications for the start of collection at the increased rate. If a LIT increase is approved before Sept. 1 this year, the residents of Monroe County will start paying the additional amount on Oct. 1.

From IC 6-3.6-3-3: “An ordinance adopted after December 31 of the immediately preceding year and before September 1 of the current year takes effect on October 1 of the current year.” If it is adopted later than Sept. 1 but before Oct. 31, this year, then the increase would go into effect on Jan. 1, 2023.

If Rollo’s “immediate needs” are analyzed as public safety ($4.5 million) and essential services ($3 million) that works out to about $7.5 million out of the $18 million in additional annual spending that Hamilton is proposing. That would work out to around an 0.356-point increase.

The city council’s committee-of-the-whole meeting starts at 6:30 p.m. on Wednesday in city council chambers. A Zoom video conference connection will also be available.

Here’s a link: Bloomington city council committee-of-the-whole meeting information packet

The live stream will be available on CATS.

Comments ()