Bloomington park commissioners give final OK to $5.8 million in GO bonds

On Monday afternoon, Bloomington’s board of park commissioners convened a special meeting to approve $5.8 million in parks general obligation bonds, to pay for some multi-use trail and protected bicycle lane projects.

The bonds were a part of Bloomington mayor John Hamilton’s new revenue package, which was recently approved by the city council. The whole package included another $5.8 million in public works bonds, and a 0.69-point increase in the countywide local income tax, which is expected to generate about $14.5 million annually for the city of Bloomington.

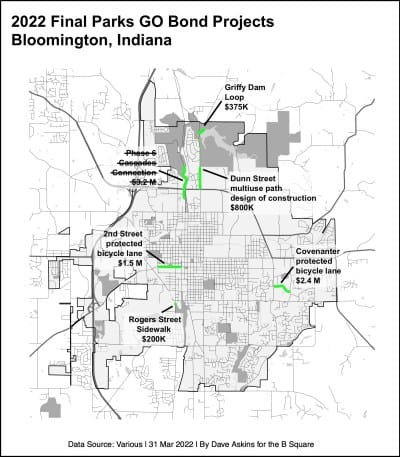

The bond projects approved by the board of park commissioners on Monday included: replacement of missing sidewalk on Rogers St. by Switchyard Park; addition of protected bicycle lanes along Covenanter Drive (from College Mall to Clarizz Blvd); construction design for a North Dunn Street multi-use path (from the SR 45/46 Bypass to Old SR 37); the Griffy Loop Trail dam crossing and community access\ improvements; and modernization of West 2nd Street modernization, including protected bicycle lanes (from Walker Street to BLine trail).

No one spoke during the public commentary period at Monday’s meeting.

Given initial approval by park commissioners in April were two bond projects that the city council later struck from the list: replacement of gas-powered equipment with electric equipment; and a non-motorized connection from Lower Cascades Park to Miller-Showers Park.

So those two projects were not among those approved on Monday by the board of park commissioners.

The final approval of the bonds was previously on the agenda for a late-April meeting of the park commissioners. But they could not take a vote on the item. That’s because under Indiana’s Open Door Law, all members who are voting on a tax increase have to be physically present—not participating through electronic communication. Only two of the four park commissioners were physically present at the late April meeting.

That’s why a special meeting of the park commissioners had to be called.

While a vote on the issuance of a general obligation bond is not explicitly a vote on a tax property tax increase, it has the same impact.

The increased property tax rate to pay the debt service on one of the $5.8 million bonds is estimated at 3.3 cents. Bloomington’s current general fund property tax rate is about 61 cents.

For a property with an assessed value of $250,000, subtracting the $45,000 homestead deduction leaves $205,000. The supplemental deduction of 35-percent on that remainder leaves $133,250 as the net assessed value.

So an extra 3.3 cents of tax on that net assessed value ($133,250*.00033) would work out to $43.97 more in property taxes per year. For the parks and public works bonds together, on a property with $250,000 in gross assessed value, the additional property tax would work out to about $88 more a year.

The $5.8 million for each of the bonds is at the limit for a “controlled project” under state law. In 2017 the threshold for controlled projects was raised from $2 million to $5 million plus a growth quotient each year. The amount above $5 million reflects the growth quotient.

They’re called “controlled projects” because any greater general obligation bond issuance would be under the control of potential remonstrators, who could push the issue to a referendum.

At least part of the reason Hamilton’s administration wanted to issue some of the bonds through the board of park commissioners is that they don’t count towards statutory debt limits.

The city generally has a debt limit equal to 2 percent of the adjusted value of taxable property in the city. [IC 36-1-15-6] But the park bonds don’t count toward that limit. [IC 36-10-4-35]

| Bond Type | Item | Min Estimate | Max Estimate |

| Parks GO Bond | |||

| Covenanter Drive Protected Bicycle Lanes (College Mall to Clarizz Blvd) [4] | $2,400,000 | $2,880,000 | |

| W. 2nd Street Modernization, Protected Bike Lanes (Walker St to B-Line) [2] | $1,500,000 | $1,500,000 | |

| N Dunn St Multiuse Path (45/46 Bypass to Old SR 37) [3] | $800,000 | $960,000 | |

| Griffy Loop Trail dam crossing and community access [5] | $375,000 | $375,000 | |

| Replace missing sidewalk on Rogers St. by Switchyard Park [1] | $200,000 | $200,000 | |

| Parks GO Bond Total | $5,275,000 | $5,915,000 | |

Comments ()