Bloomington area budget prep: Income tax revenues for 2023 projected up 13%, property tax levy up 5%

Indiana’s state budget agency has released its estimated county-by-county local income tax (LIT) distributions for 2023, which are numbers local governmental units will use for 2023 budget planning.

For the certified shares category, Monroe County (across all government units) is projected to see about a 13-percent increase—from $34,232,607 in 2022 to $38,815,238 in 2023.

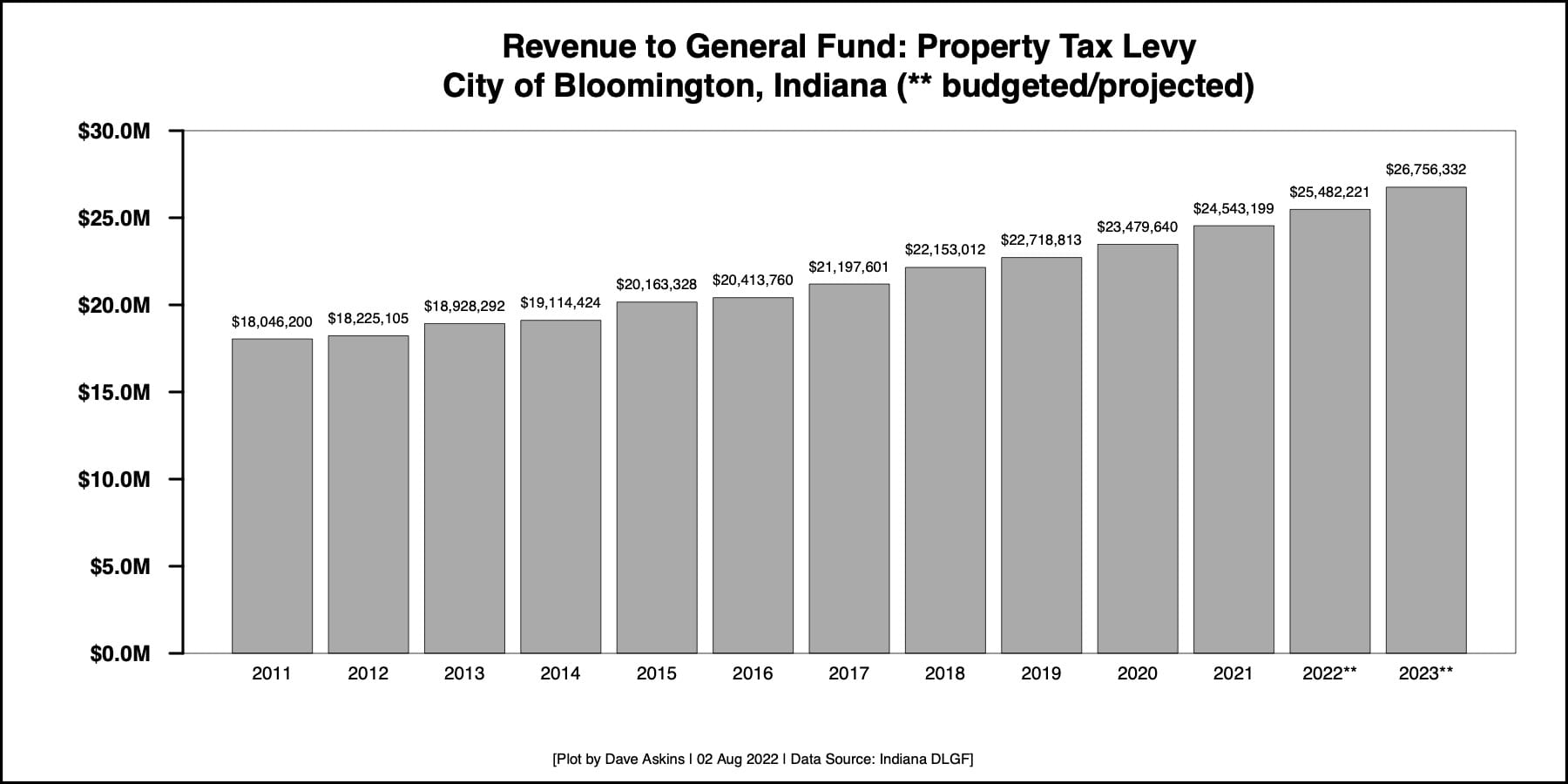

That news comes shortly after the maximum levy growth quotient for property tax revenue was announced for the 2023 budget year: 5 percent. That’s the biggest percentage increase since at least as far back as 2003.

The 13-percent increase in certified share LIT distributions does not include an additional estimated $28.2 million in economic development LIT to be divided between Bloomington, Monroe County government, Ellettsville, and Stinesville. That $28.2 million comes from the additional 0.69 points of economic development LIT that the Bloomington city council enacted in early May. The $28 million is about $2.5 million more than the amount that was estimated when the council approved the tax increase.

When the council enacted that tax increase, the estimated amount to be generated countywide by the extra 0.69 points of economic development LIT was around $25.5 million. Of that amount, Bloomington’s share was estimated to be around $14.5 million. That figure looks like it can now be bumped up by at least $1 million. [Updated Aug. 4, 2022 at 2:55 p.m. The SBA has released the unit-by-unit breakdowns, which peg Bloomington’s share of the economic development LIT at $16 million.]

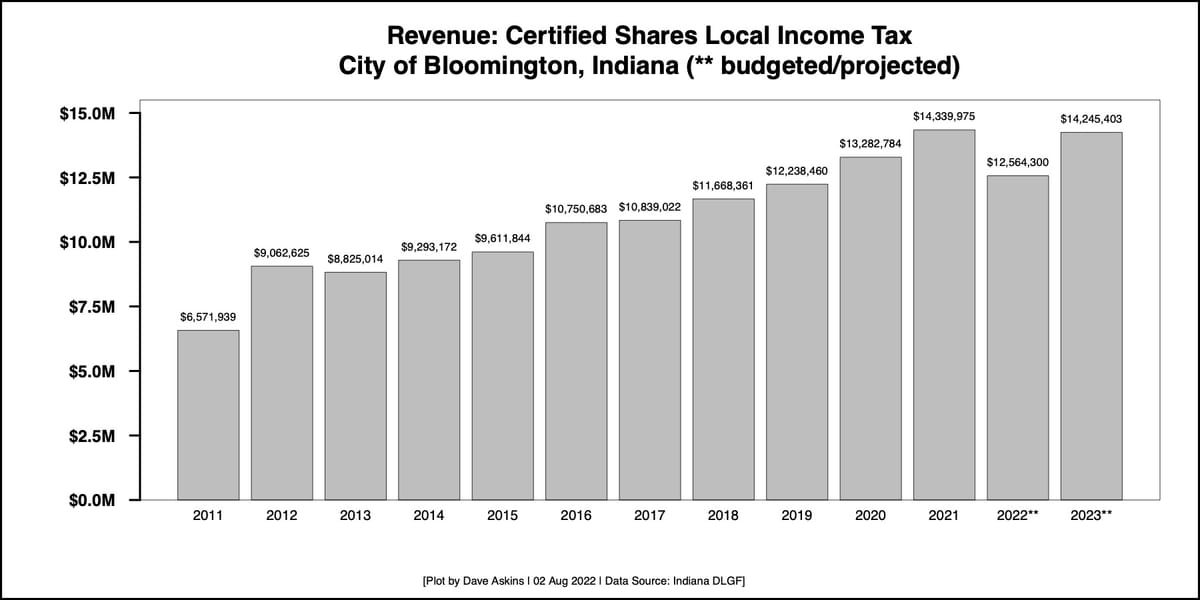

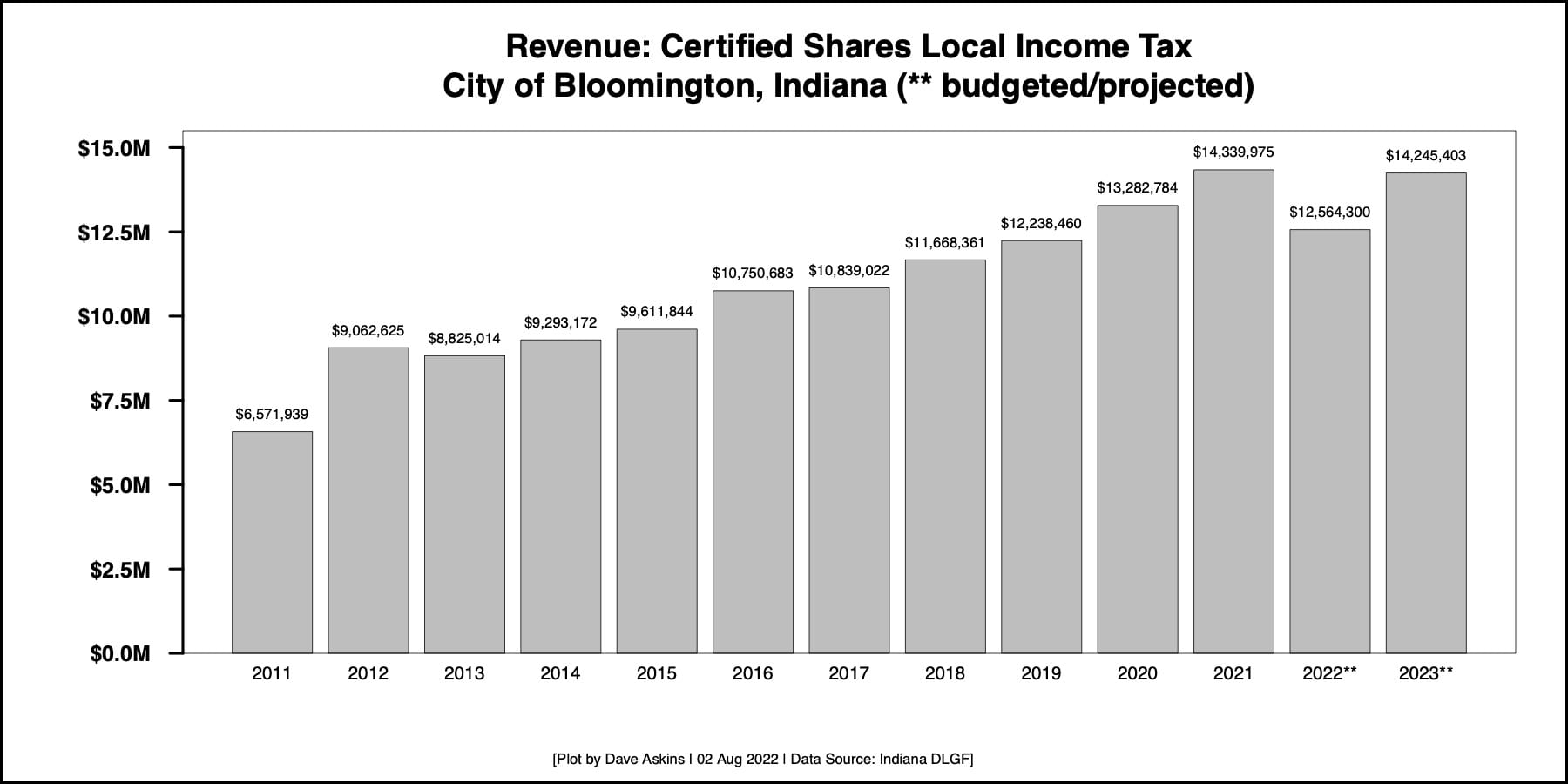

The state budget agency will sometime in the coming days release a unit-by-unit breakdown for the 2023 LIT distributions. For now that can be estimated. Bloomington’s LIT certified shares distribution in 2022 was $12,564,300. Applying a 13-percent increase gives $14,245,403—which is a reasonable estimate for certified share LIT revenue for Bloomington, as the 2023 budget gets prepared. [Updated Aug. 4, 2022 at 2:55 p.m. The SBA has released the unit-by-unit breakdowns, which peg Bloomington’s certified shares at $14.3 million.]

The 2022 LIT distributions were generally down compared to 2021. Distributions to local units in 2022 are based on earnings in 2020, which were depressed due to the COVID-19 pandemic.

The 2023 distributions are based on earnings in 2021, which got a boost from federal subsidies.

Another factor that decreased Bloomington’s relative LIT revenue for 2022 was the geographic expansion of the Monroe Fire Protection District (MFPD)—which increased the fire district’s property tax footprint. LIT distributions are based on property tax footprint, which meant that the MFPD’s relative share of the countywide LIT increased. In raw numbers the MFPD’s LIT distribution increased from $871,121 in 2021 to $2.71 million in 2022.

The 5-percent increase in property tax revenues is based on a calculation called the maximum levy growth quotient.

The maximum levy growth quotient for Indiana property tax levies is defined in terms of income tax. That is, broadly described, Indiana’s state law is set up so that property taxes aren’t supposed to increase much faster than incomes.

The fact that the maximum levy growth quotient includes a kind of six-year rolling average buffers the amount against a decrease due to a recession year or an increase due to a year of extraordinary growth.

These latest numbers from the state will no doubt be fed into the preparations for Bloomington’s 2023 budget.

Departmental presentations to the city council on the 2023 budget are just four weeks away. They’re scheduled for the four evenings from Aug. 29 through Sept. 1.

Comments ()