Convention center notebook: What’s the deal with the food and beverage tax advisory commission?

With an announcement on Friday from the mayor’s office, Bloomington appears to be charting its own course, independent of any deal with Monroe County government, to “to expand the space available for conventions and other large gatherings in Bloomington.”

Key to the city’s effort—just as it would have been if a deal had been reached with Monroe County government—will be the use of food and beverage tax revenues.

Key to the city’s effort—just as it would have been if a deal had been reached with Monroe County government—will be the use of food and beverage tax revenues.

Expenditures of food and beverage tax revenue, by either Bloomington or Monroe County, have to be approved by a seven-member local commission called the food and beverage advisory commission (FABTAC). There’s currently a vacancy for a “community representative” on the FABTAC.

Under state law, the appointment to “community representative” seats on the FABTAC is made “by the city and county executive.”

That means whatever path forward is taken on the question of adding convention center space, the mayor of Bloomington and the three-member board of county commissioners will have to agree on the appointment to the vacant FABTAC seat.

It’s also conceivable that the city and the mayor and the county commissioners won’t agree, and that any votes in the near future by the FABTAC to approve expenditures of food and beverage tax revenue will have to succeed based on the votes of six members.

Key to any FABTAC consideration of a request to expend funds are the legally allowable uses of the tax. Under the state law that enables the collection of a 1-percent food and beverage tax in Monroe County, revenues from the tax have to be spent “to finance, refinance, construct, operate, or maintain a convention center, a conference center, or related tourism or economic development projects.”

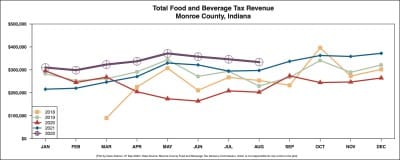

The revenue from the tax is divided between Bloomington and Monroe County government based on the location of the business that collects the tax. If a business is located inside the city, tax revenue collected by the business (from its patrons) goes to Bloomington. Revenue collected by businesses not inside Bloomington goes to Monroe County government. In round numbers, that works out to around 90 percent of the tax that goes to Bloomington.

For this year through August, the city of Bloomington has seen about $2.4 million in revenue from the countywide tax on food and beverage sales. When this year’s total is added to a $9 million fund balance, which Bloomington recorded at the end of 2021, that works out to a current food and beverage tax fund balance of around $11.4 million.

Under state law, a local food and beverage tax advisory commission (FABTAC) had to be formed, in order to approve the expenditures made with revenues from the tax.

The FABTAC is a seven-member group. The other four seats, besides the three community representatives, are split between county and city government: the president of county commissioners (Julie Thomas); a county councilor (Cheryl Munson); the Bloomington mayor (John Hamilton); a member of the city council (Dave Rollo). The FABTAC web page has not yet been updated to reflect Rollo’s appointment, after city councilmember Ron Smith’s service the previous year.

The community representatives have to be owners of retail facilities that sell food or beverages subject to the county food and beverage tax. The two community representative seats with serving members are currently filled by Lennie Busch (Lennie’s) and Susan Bright (Nick’s). The third seat is vacant after the retirement of Tony Sutille (Fourwinds Lakeside Inn & Marina).

The FABTAC has not met since February of 2020 2021, because there have not been any requests from the city or county to expend tax funds.

Last Friday, the county council representative to the FABTAC, Cheryl Munson, told The B Square the FABTAC would be meeting sometime soon. The reason for meeting, Munson said, is not to evaluate any proposal to expend funds.

Instead, the point of the upcoming meeting, which has not yet been scheduled, is to approve an annual report that was supposed to be submitted to the county council in February of this year.

The report is supposed to describe “all projects on which the food and beverage tax has been spent or is planned to be spent.” There were no projects in 2020 2021 on which tax revenue was spent. But Munson said the report will include a breakdown of revenues for the period of the report.

Comments ()