Nov. 7 election: School district voters will decide on 8.5-cent tax increase

On Nov. 7, voters who live in the Monroe County Community School Corporation will decide whether to increase their property tax rate by 8.5 cents.

The resolution to put the question on the ballot was approved by the MCCSC board on Tuesday night at its regular monthly meeting.

The vote was unanimous among the seven board members, who were all present at the meeting.

According to the wording of the ballot question, the money to be raised by the additional tax has to be used for the purpose of “expanding and funding free and affordable early childhood education (including preschool) and eliminating student and family fees for K-12 education, funding career education program costs and technology and funding supply and instructional materials for all students.”

According to district superintendent Jeff Hauswald, the effect of the proposed tax increase, combined with some reductions in other tax rates, would mean about $50 more dollars a year for someone who owns a $250,000 home.

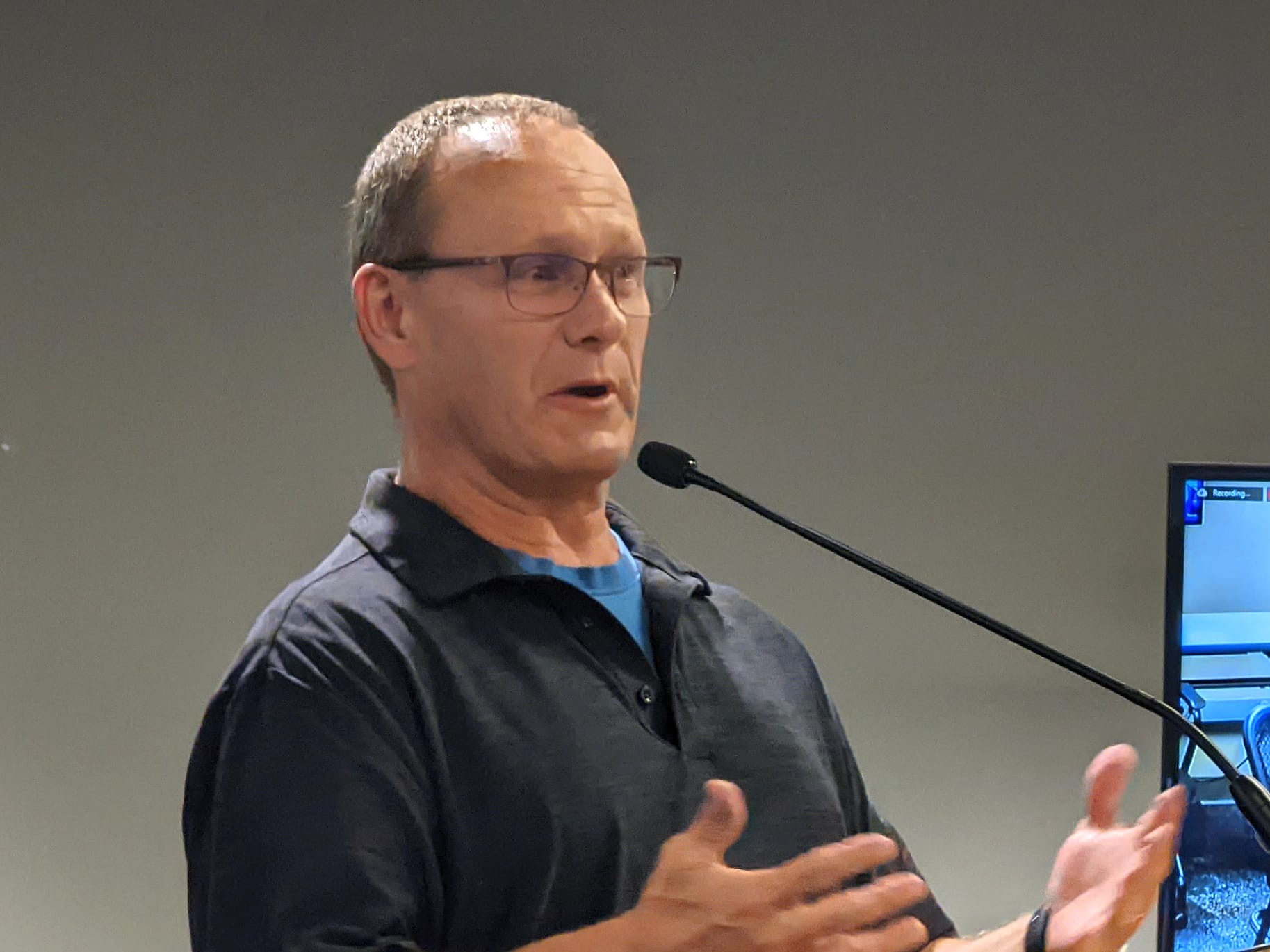

Tuesday’s meeting was lightly attended, but one person did take a turn at the public mic, in support of the referendum.

Paul Farmer, president of Monroe County Education Association, spoke on his own behalf, because the teachers union has not yet voted on the question. But Farmer said he thinks the MCEA will vote in support of the increased tax.

Farmer told the board that funding pre-K is something that has been a topic of conversation in Monroe County for more than a decade. In 2010, at a meeting held at University Elementary School to talk about the referendum that year, Farmer said he had stood up to say, “We need to do pre-K.”

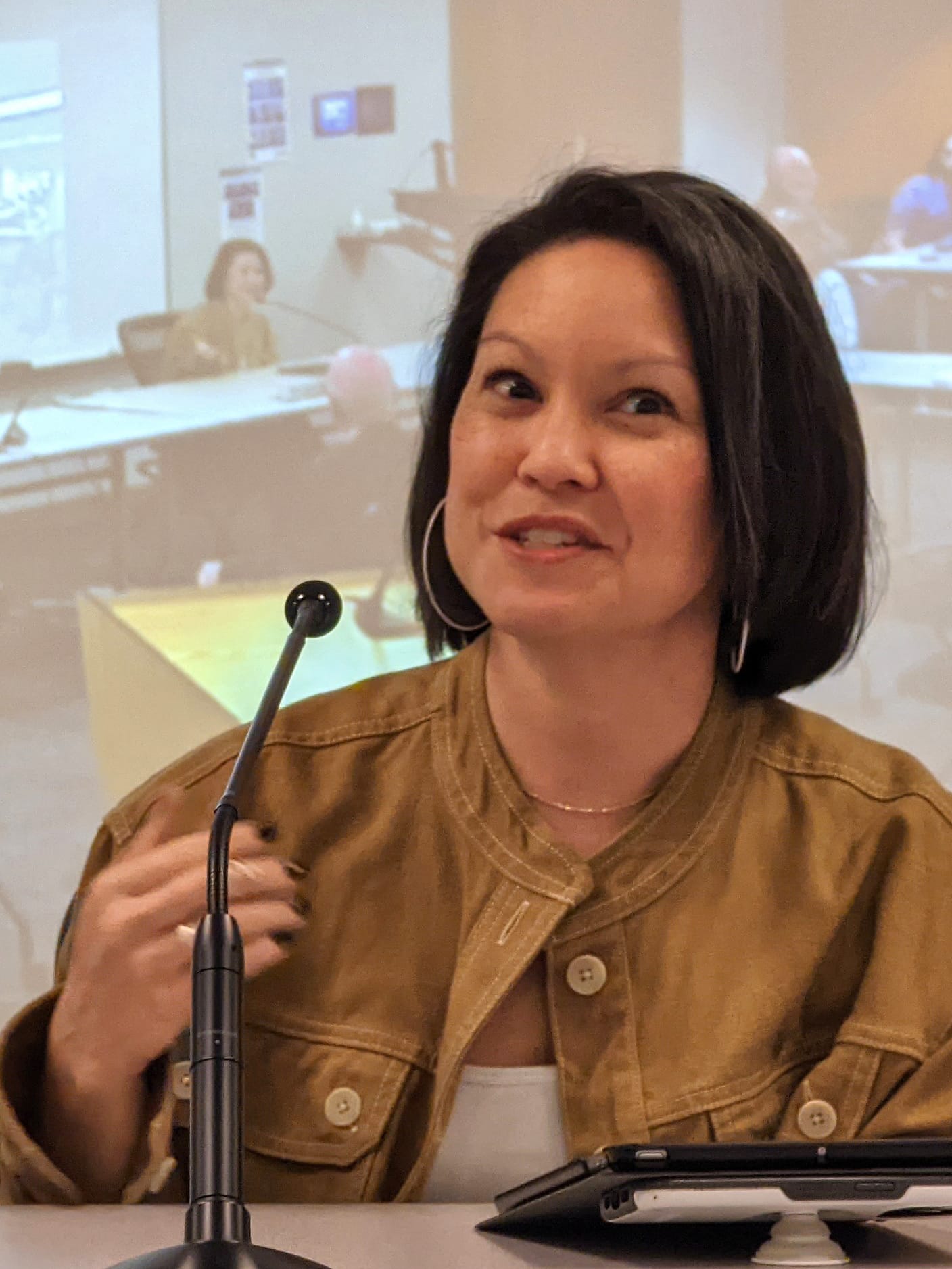

Although she was not in attendance at the University Elementary meeting that Farmer described, board member Cathy Fuentes-Rohwer said, “I had all four kids in school in 2010.” She added, “If we wait for the legislature to fund early childhood, it’ll never happen.”

Board vice president April Hennessey, who made the motion to adopt the resolution to put the tax increase on the ballot, said her first reaction to hearing of the proposal was to say, “There’s no way!”

That was not based on any lack of support for the purpose of the tax, she said. “It was just that I was worried, on the heels of our last referendum, about asking this community for more money again.”

Hennessey continued, “I just want to say to our community that I recognize and acknowledge that this is another ask.” She added, “I think that is a really important one, or we wouldn’t be bringing it to you.”

The 2022 referendum that Hennessey mentioned was a successful 18.5-cent proposal that MCCSC—which passed with 68.6 percent support.

One of the points made by MCCSC superintendent Jeff Hauswald at Tuesday’s meeting was that the 8.5-cent tax increase would be balanced out by a reduction in the rates for other parts of the district’s taxes.

The 18.5-cent rate approved by voters in 2022 will be ratcheted down as an effect of HB 1499, which was passed by the General Assembly during this year’s legislative session. HB 1499 says that the levy amount from referendums cannot increase more than 3 percent over the previous year. That means the 18.5 percent rate approved by MCCSC voters in 2022 will effectively be reduced to about 16.75 cents in 2024, Hauswald previously told The B Square.

Added to reductions in other parts of the district’s tax rates—for debt service and operations—will mean that the overall rate increase will be closer to 4 cents than 8.5 cents, Hauswald said at Tuesday’s meeting.

Hauswald said that the effect of a 4-cent increase on a $250,000 home would work out to about $50 a year.

Property tax rates in the Hoosier state are expressed as a number of cents of tax per $100 of assessed value. To calculate the impact of a 4-cent tax increase on the owner of a house with an assessed value of $250,000, the first step is to calculate the net assessed value of the house—which involves subtracting the standard homestead deduction and a supplemental deduction. Subtracting those amounts leaves just $133,250 to which the 4-cent rate would apply.

The referendum itself will be administered by the Monroe County clerk’s office as a special election on Nov. 7. Also taking place that day are municipal elections—in Bloomington for mayor, city clerk and councilmembers, and in Ellettsville for town councilors and clerk/treasurer.

Deputy county clerk Tressia Martin wrote in response to emailed B Square questions that for Bloomington voters, the MCCSC referendum question will appear on the same ballot as for city races. That will reduce the cost of the special election compared to printing separate ballots. Under state statute, MCCSC has to pay for the special election.

Martin estimated that the cost of the municipal elections, without the special election, would be $250,000 to $300,000.

Additional costs would come from adding polling sites to accommodate voters who live outside of Bloomington but inside of the MCCSC district, which covers all but the northwest corner of the county.

Martin indicated 18 polling sites were used in the recent May 2 primary election. The election board could decide to use a full set of polling locations, which would be 26.

Monroe County’s election board meets next on Thursday, July 6. Some of the decisions about how the Nov. 7 referendum will be conducted could get some discussion at that meeting.

The early July meeting of the three-member board will likely have a new member in attendance. The Republican Party’s appointee to the board, Donovan Garletts, has resigned. According to Democratic Party Chair David Henry, who serves on the election board, the new appointee is former Monroe County circuit judge Judith Benckart.

Comments ()