Tax abatement gets final OK from Monroe County, could mean NHanced production of chips by fall 2024

Winning unanimous approval from the seven-member Monroe County council on Tuesday night was the approval of a request from NHanced Semiconductors for a 10-year tax abatement.

Based on remarks from NHanced CEO Bob Patti made at Tuesday’s meeting, the company could start semiconductor production in Bloomington by fall of 2024.

The request was for 100 percent of personal property taxes each year, in exchange for a planned $152-million investment by NHanced.

NHanced did not ask for any abatement of real property taxes. Its investment will be almost exclusively in personal property.

Personal property refers to movable assets like equipment, while real property means immovable assets, like land and buildings.

The county council’s approval on Tuesday followed the previous week’s approval by county commissioners. Tuesday’s county council vote was the final action needed.

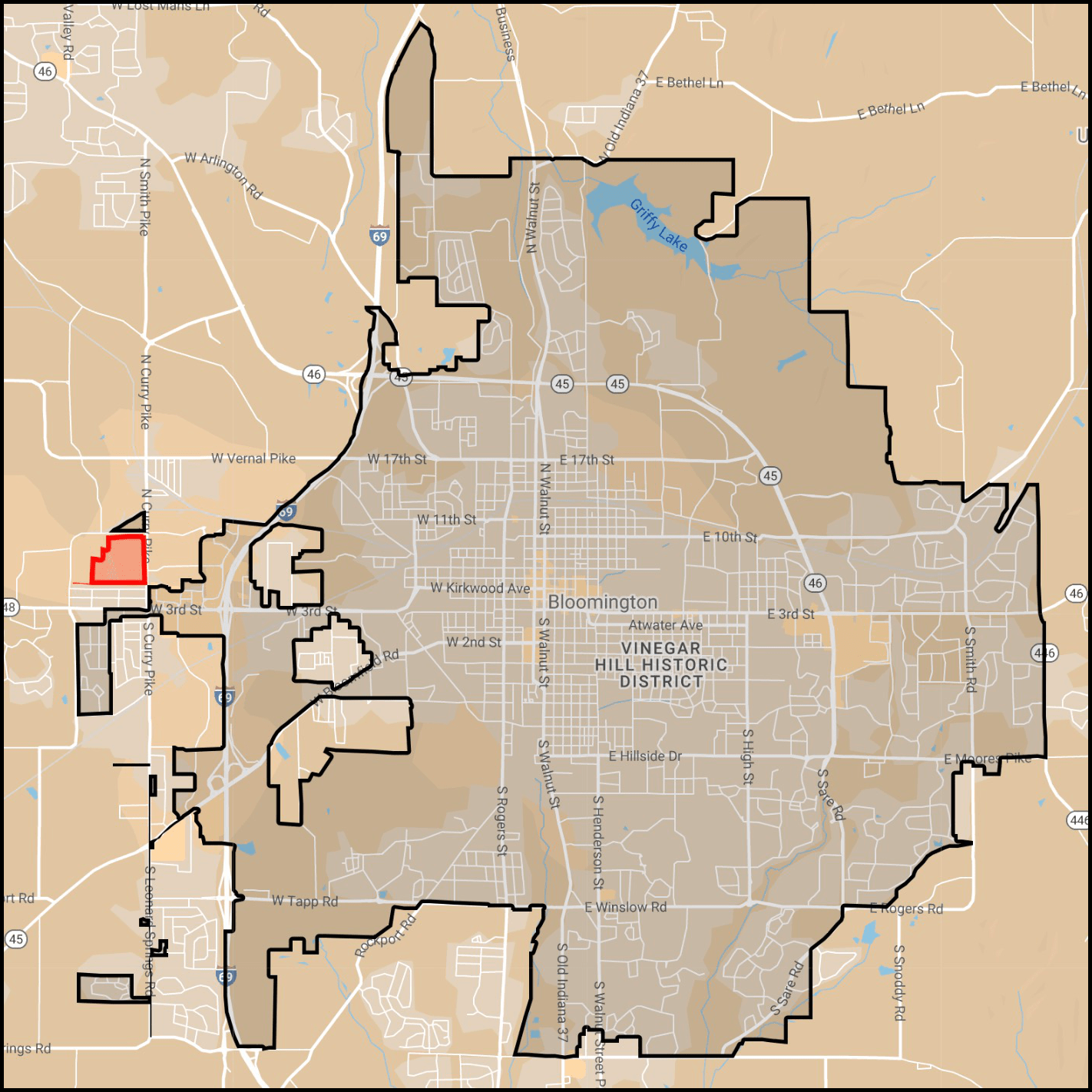

Appearing in person at Tuesday’s meeting was NHanced CEO Bob Patti, who described to county councilors the impact of his company’s planned new facility, to be located in a former General Electric building west of Bloomington, now owned by Cook Medical. NHanced plans to lease the building from Cook Medical.

The main immediate impact will include 250 new jobs, Patti said. Even though that’s the number of jobs spelled out in the abatement paperwork, Patti said he imagines it will be closer to 400 new jobs.

The jobs of engineers will pay between $150,000 and $200,000, Patti said. NHanced hopes to recruit those jobs from Purdue, Indiana University, Notre Dame, and Rose-Hulman. Patti earned an undergraduate degree in computer science from Rose-Hulman Institute of Technology.

The bunny-suited blue-collar jobs that are associated with a semiconductor cleanroom production facility will be paid between $70,000 and $120,000 a year according to the tax abatement paperwork. Patti said NHanced expects to recruit those workers from Ivy Tech and Vincennes University among other places.

Patti described a 3,000-square foot training facility that NHanced is building at its Odon, Indiana campus. The training facility will feed into the Bloomington operation’s staffing, to help meet a target of a production start in Bloomington by the third quarter of 2024. Patti called the schedule “very aggressive,” adding, “I’m sure we will not make it, but you have to drive to a goal.”

The best-case scenario, Patti said, is to start moving equipment into the building by April 1, 2024.

When county attorney Jeff Cockerill presented the county’s case for a tax abatement to county councilors, he highlighted three points: reutilization of the former GE building; economic diversification; and creation of high-wage jobs.

Patti described the way NHanced approaches semiconductor production by drawing an analogy to constructing a house. Patti said that any chip includes a part where all the wiring is—the “important stuff,” which can be likened to a house. But the house in the semiconductor analogy has a 400-foot foundation, which is only there to hold it all together, Patti said.

What NHanced is good at, Patti said, is taking the “house” part of the semiconductor and stacking many of them on top of each other. Patti put it like this: “We build chips, like building multi-story buildings.” He added, “Instead of having 10 of them with 400-foot foundations, we only have one.”

Because the wire distance is shorter, that means the chip runs faster. But it also uses less power, Patti said. The decreased power requirement could be the key to avoiding a scenario that might unfold 20 years from now, where data centers take up 25-percent of the world’s electric power production, he said.

Councilor Marty Hawk told Patti that he reminded her of Bill Cook, who founded Cook Group. When he was talking about chip production, Hawk told him, “What I saw was your passion for what you’re doing.” Hawk continued, “You remind me so much of Bill Cook— he had so much passion for what he brought, and what he was providing to the world to make a change.”

Councilor Trent Deckard said he is excited about seeing a facility come alive again that he remembered as a kid having a lot of life in it. He also pointed to the importance of diversifying the area’s economy. “I love the idea that we’re diversifying this economy in a glorious way,” he said.

Councilor Cheryl Munson echoed support for the idea that NHanced would be reusing an existing facility. Munson told Patti, “You are going to occupy an area that has been essentially unused and abandoned.” Munson called it “a very wise conservation of resources.” Munson told Patti: “Thank you for picking a place that doesn’t require investment in additional energy put into building.

As a benefit, councilor Peter Iversen pointed to the attraction of other vendors, who will want to locate near NHanced’s facility.

Speaking from the public mic in support of the tax abatement were: Jennifer Pearl, who is president of the Bloomington Economic Development Corporation; and Eric Spoonmore, who is president and CEO of the Greater Bloomington Chamber of Commerce.

Responding to a B Square question, county attorney Jeff Cockerill provided estimates from the Hoosier Energy tax abatement calculator that peg the total value of the NHanced tax abatement, over 10 years, at nearly $9 million.

The 250 jobs to be created by NHanced have been described as paying an average of $100,000 a piece. If all 250 jobs are filled by people who live in Monroe County, then at the local income tax rate of 2.035 percent, that would work out to a total of about $500,000 a year in additional income for government units in Monroe County.

| Abatement Percentage | Estimated Property Taxes | Estimated Tax Abatement Savings | |

| Year 1 | 100% | $1,011,060 | $1,011,060 |

| Year 2 | 100% | $1,415,484 | $1,415,484 |

| Year 3 | 100% | $1,061,613 | $1,061,613 |

| Year 4 | 100% | $808,848 | $808,848 |

| Year 5 | 100% | $758,295 | $758,295 |

| Year 6 | 100% | $758,295 | $758,295 |

| Year 7 | 100% | $758,295 | $758,295 |

| Year 8 | 100% | $758,295 | $758,295 |

| Year 9 | 100% | $758,295 | $758,295 |

| Year 10 | 100% | $758,295 | $758,295 |

| Totals | $8,846,775 | $8,846,775 |

Comments ()