Monroe County jail update: Proposed LIT rate cut to 0.175%, North Park purchase on Sept. 25 agenda

The proposed jail LIT (local income tax) rate, which is meant to help pay for a new jail and co-located justice center, has been reduced from 0.2 percent to 0.175 percent.

That was the outcome of a 6–1 vote by the county council on Tuesday night. Dissenting was Peter Iversen, who wanted to enact the previously advertised 0.2-percent rate as “a clear message to the community that we are dedicated to fixing this problem and fixing it tonight.”

An earlier vote, to lower the proposed rate to 0.150 percent, failed by a 3–4 tally. Voting for the 0.150-percent rate were Kate Wiltz, Jennifer Crossley, and Marty Hawk. Voting against the 0.150 percent rate were Geoff McKim, Trent Deckard, Peter Iversen, and Cheryl Munson.

[A 2023 memo from Indiana’s Department of Local Finance (DLGF) indicates that rates should be in increments of hundredths of a percent, which would mean that 0.175 percent is not allowed. The county council has a meeting already scheduled for Thursday (Sept. 19), which could be an occasion to revise the rate to be advertised to either 0.17 percent or to 0.18 percent. ]

About the 0.150 rate, McKim said, “I can’t support that rate. I don’t think it’s enough to accomplish what we need to accomplish here.” It was Munson who proposed the 0.175 rate as a way of meeting in the middle.

A public hearing was held Monday, the previous day, on the 0.2-percent rate.

The lowering of the rate means public notice of another public hearing, which was to be set for Oct. 7.

The other big news about the planned new jail that came out of the county council’s Tuesday meeting was about a possible location for a new facility. The news was delivered by president of the board of county commissioners, Julie Thomas.

During departmental updates at the start of the meeting, Thomas told the county council that commissioners would be considering a purchase agreement for the North Park property next week at its Wednesday Sept. 25 meeting.

Under state law, the county council also has to approve the purchase of any new significant property, regardless of how it is funded.

Why Monroe County is planning a new jail

The point of raising the jail LIT rate is to pay for a new jail, and possibly a co-located justice center complex, with a total construction budget of as much as $200 million.

The backdrop to current efforts to plan a new jail facility includes a lawsuit filed by the ACLU in 2008 against Monroe County on behalf of jail prisoners, about overcrowded conditions at the jail. The Monroe County jail operates under a settlement agreement that has been extended several times.

Under the terms of the settlement agreement, when a cap of 248 inmates is hit, certain “reasonable steps” have to be taken, to lower the population. In January of this year, the Monroe County jail population hit a peak of 275, when there were only 239 secure beds available.

The current effort towards constructing a new jail, stems from two reports from consultants hired to study the local criminal justice system. The reports were delivered three years ago, in July 2021.

The reports from the two consultants—RJS Justice Services and Inclusivity Strategic Consulting—highlighted a number of challenges in Monroe County’s criminal justice system.

The key conclusion from the RJS study, which prompted the start to the recent effort was: “The jail facility is failing and cannot ensure consistent and sustainable provision of constitutional rights of incarcerated persons.”

Points of tension: Pace of response

During Tuesday’s meeting, an exchange between jail transition director Cory Grass and councilor Kate Wiltz illustrated the frustration on the side of some county councilors that they are being portrayed as slowfooting their response to the situation at the jail.

In Grass’s remarks to the council, one highlight was the estimate that every month of delay results in around $500,000 of additional cost, due to inflation in the construction marketplace.

Grass also told the council that in the context of a correctional facility, “every second feels like a lifetime.” He added that since the county council had started their recent discussion of the jail LIT rate, 30 days had elapsed, which he calculated at 2,592,000 seconds.

Wiltz responded by saying no one appreciates the “intensity and the long-term anxiety” that the conversation about the situation at the jail is causing, more than county councilors. Wiltz added, “I am just a little troubled that there’s a narrative out there and the council is dragging its feet on this.”

Wiltz said that in the time frame during which the council has been discussing raising the jail LIT, dating back to the spring, as long as the council acted by the end of October, the start to collection would have been the same—Jan. 1, 2025.

(If the council had acted before Aug. 31 to approve the rate change, the start to collection at the new rate would have been Oct. 1, 2024.)

Wiltz told Grass that she does not believe the councilors who were sitting there that night were responsible for any delays. Grass responded by saying he meant to be alluding to the several years that it had taken for Monroe County government to get to the current state of the conversation.

Wiltz added that even one more year would be a “drop in the bucket,” compared to how long the issue had previously been “kicked down the road.”

The two then went back and forth for a bit:

Grass: You’re the one that mentioned previously that it “hurts your heart” to talk about a tax increase—

Wiltz: —yeah—

Grass: —But what about the hearts of our inmates and their families? What about the hearts of our staff and their families? Their hearts hurt every day.

Wiltz: That’s why my heart is hurting—

Grass: —I know, ours, too—

Wiltz: —and because I recognize how badly change is needed.

Grass: But you said a year is a drop in the bucket, that’s another year—

Wiltz: —I know!—

Grass: —on top of the five we already have—

Wiltz: —and all of that is sad, and all of that is stressing me out beyond belief. I’m not trying to say that is a problem. I ran for office, believe me, it is my responsibility to get stressed out about these issues. But when I say it hurts my heart…to think about raising taxes on people in our community, it is more complicated than that. And that was an oversimplification. It hurts my heart to think about the conditions in that jail for every person who walks in and out of that building. And, and it hurts my heart that we haven’t been able to come to any sort of action that makes us feel good as we move forward on this. I’m not going to feel good tomorrow…I can just tell you I’m going to feel like at the very least I’ve made some compromises and that’s OK. But there is no bone in my body, and I would bet my fellow councilors agree, that wants this to be delayed any more.

Points of tension: Size of the new jail

A conceptual shift in the conversation about the number of beds needed for a new jail came in July, when Monroe County sheriff Ruben Marté gave a presentation that stressed “functional capacity” as the key notion to apply to the size of a new jail. The accepted metric is that the functional capacity of a jail is 80 percent of the number of beds in the facility.

On Tuesday, weighing in on the size of the new jail facility, on a remote electronic connection, Marté said that “I am not advocating for a 500-bed jail so we could fill it.” Marté said he was advocating for a 500-bed jail because that yields a functional capacity of 400, which gives the jail a chance to classify people into separate parts of the jail—for their own safety and to help people so they don’t return to the system.

Wiltz also used the concept of functional capacity, but gave 350 as a possible target for functional capacity, which she pointed out is “well over 100 more than our current jail population.”

A functional capacity of 350 would equate to a facility with 438 beds.

Early in the discussion on Tuesday, councilor Geoff McKim asked Grass what he thinks of the phrase: “If you build it, they’ll fill it.”

Grass responded to McKim by saying the point to be stressed is that the new jail needs to be big enough to classify, separate, rehabilitate, and educate the inmates.

Later during Tuesday’s meeting, Monroe County circuit court judge, and presiding judge for Monroe County’s board of judges, Mary Ellen Diekhoff, addressed the council. Diekhoff said she could not talk about her “sentencing philosophy” because she’s prohibited ethically from doing that. “If you come in front of me, the idea is that I am listening to your case, on your facts, on your person, on that particular time, and I listen to everyone, and make a decision,” Diekhoff said.

Diekhoff said she could not take into account the number of people who are in the jail, when she makes a decision: “That isn’t justice.”

Diekhoff continued, “Justice is looking at the facts and circumstances of a case and a particular person’s circumstances, and then making a decision.”

Points of tension: Preventive services versus jail construction

In her remarks, Diekhoff also picked up on a point made by one of the public speakers on Tuesday evening.

Seth Mutchler, with the group Care Not Cages, advocated for spending the money that could be generated through a jail LIT, on funding for local nonprofits like: Beacon, Inc.; New Leaf New Life; Courage to Change; Mother Hubbard’s Cupboard, Middle Way House; Indiana Recovery Alliance; and New Hope Family Shelter.

By Muchler’s math, the operating expenses for those nonprofits could be funded for about 11 and a half years, with the money that would be generated by a 0.2-percent jail LIT.

About the list of nonprofits that Mutchler listed out, Diekhoff said, “I am very familiar with all of them— because we utilize them.” Diekhoff added, “We will always use alternatives when we can as best as we can, because to incarcerate people is not always the answer.”

In his remarks, councilor Geoff McKim also took up Mutchler’s point. McKim noted that even if the revenues from the jail LIT cannot be spent on funding those nonprofits, the 0.69-percent economic development local income tax (ED LIT) which was already imposed countywide by Bloomington’s city council in 2022, could be spent on such initiatives. The total amount of ED LIT revenue expected to be collected by Monroe County government for 2025 is around $11.7 million.

On McKim’s line of thinking, besides the ED LIT revenues that are needed to cover the debt on bonds that are issued to construct the new jail, there will be a significant portion of ED LIT revenues that remain.

McKim said that if the county council and the county commissioners wanted to support an anti-recidivism initiative sponsored by one the nonprofits mentioned by Mutchler, then ED LIT money would be available to do that.

Points of tension: City versus County

A big chafing point at Tuesday’s meeting came in the form of reaction from county elected officials to recent and past suggestions from their city of Bloomington counterparts about relative amounts of money to spend on jail construction compared to services to people to prevent incarceration. The B Square hopes to report on that topic separately.

Rates: Jail LIT, special purpose LIT

The point of raising the jail LIT rate is to pay for a new jail, and possibly a co-located justice center complex, with a total construction budget of as much as $200 million.

In late August, county councilors voted to hold the Sept. 16 public hearing with an advertised rate of 0.2 percent for the jail LIT.

Also in late August, the county council voted to advertise a new, lower rate of 0.03 percent for the “special purpose” category of local income tax, which currently funds the operation and maintenance of a facility to provide juvenile services.

At its Tuesday meeting, the council did not alter the lowering of that “special purpose” rate.

The combined effect of the increase in the jail LIT to 0.175 percent and a decrease in the special purpose LIT would be an increase of 0.110 points in the total amount of local income tax paid by Monroe County residents. The resulting total would be 2.145 percent.

County councilors are not looking to maintain the special purpose tax at just 0.03 for the longer term, because that would not be enough to fund juvenile services over the long haul.

But it would allow for the current high fund balance for the special purpose LIT to be drawn down. And the lower special purpose rate would provide a relatively lower overall rate for taxpayers, at least for a while, compared to an increase in the jail LIT rate, with no adjustment to the special purpose LIT.

It’s the same logic the council council used last year, when it established a jail LIT rate for the first time, at 0.01 percent, while reducing the special purpose LIT rate to 0.085 percent. The net effect of that move was no change to the overall income tax paid by Monroe County residents.

The rate for the special purpose LIT won’t increase in the future, unless a future council acts to increase it.

A 0.2-percent rate applied to a taxable income of $20,000 per year works out to $40 a year. The difference between a 0.175-percent rate and a 0.2-percent rate for someone earning $20,000 works out to $5.

| Allocation Rate Category | Existing LIT Rate | Proposed Rate |

| Certified Shares (IC § 6-3.6-6) | 0.9482% | 0.9482% |

| Public Safety (IC § 6-3.6-6) | 0.25% | 0.25% |

| Economic Development (IC § 6-3.6-6) | 0.69% | 0.69% |

| Property Tax Relief Rate (IC § 6-3.6-5) | 0.0518% | 0.0518% |

| Special Purpose Rate (IC § 6-3.6-7) | 0.085% | 0.03% |

| Correctional or Rehabilitation Facilities (IC § 6-3.6-6-2.7) | 0.01% | 0.175% |

| Emergency Medical Service3 (IC § 6-3.6-6-2.8) | 0.00% | 0.00% |

| Staff Expenses for State Judicial System (IC § 6-3.6-6-2.9) | 0.00% | 0.00% |

| Total Tax Rate | 2.035% | 2.145% |

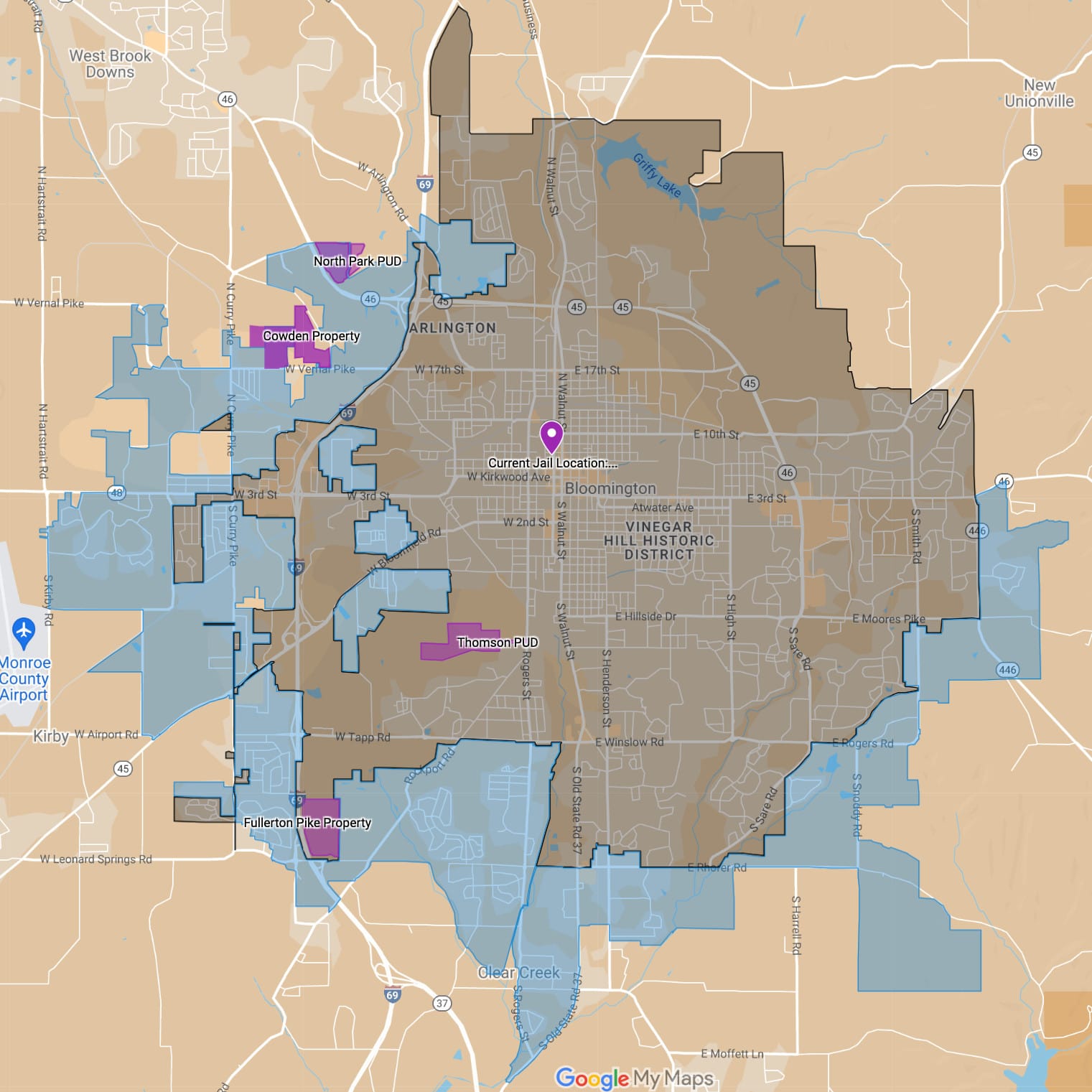

Location for the new jail

The location of a new jail looks like it could be decided soon.

Near the start of Tuesday’s county council meeting, president of the board of county commissioners Julie Thomas told councilors that she and her colleagues would be considering a purchase agreement for the North Park property next week at its Wednesday Sept. 25 meeting.

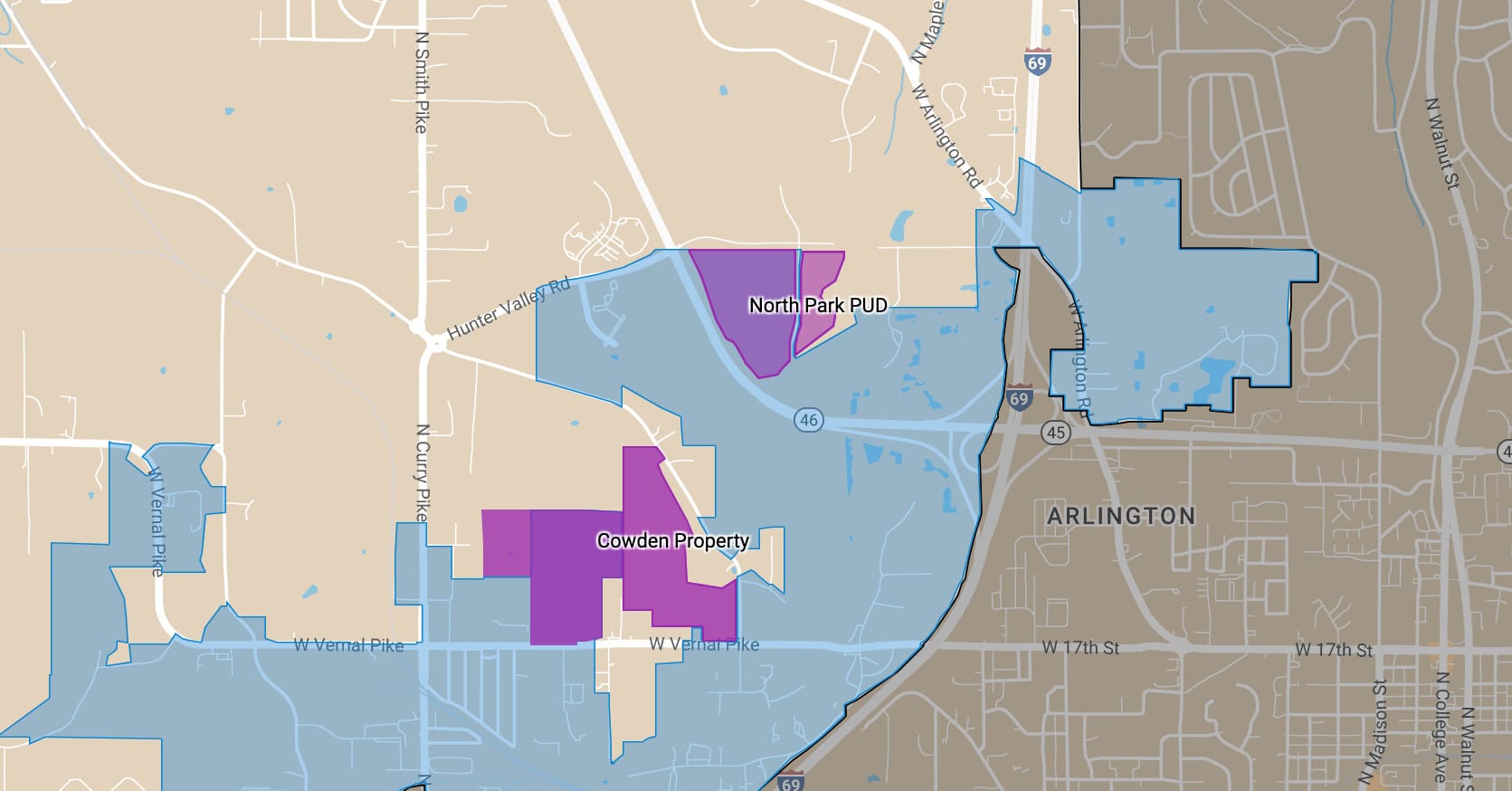

The North Park property has been the leading contender as a jail location for county commissioners since March of this year.

The North Park location has received a lot of opposition from Ellettsville officials and residents.

In mid-August , an alternative site on Vernal Pike was put forward, supported by the Greater Bloomington Chamber of Commerce and the Ellettsville Chamber of Commerce.

In her remarks on Tuesday, Thomas said that commissioners had done due diligence on the Vernal Pike land, but determined that there are significant barriers to using that site as a jail location.

Among the barriers: To extend sewer service from the city of Bloomington utilities to the Vernal Pike location would require annexation into Bloomington, which would hinge on the voluntary annexation of properties between the Vernal Pike land and the Bloomington boundary. If the land were annexed into the city, that would make the site plan subject to decisions by Bloomington’s plan commission and city council.

Under state law, the county council also has to approve the purchase of any new significant property, regardless of how it is funded.

More than once during Tuesday’s deliberations, councilor Marty Hawk stated that she would not be supporting the North Park location.

Thomas circulated a printout of a table that lists out the properties considered so far by commissioners:

| Site | Fullerton Pike | Thomson | North Park | Vernal Pike/Woodyard |

| Purchase Cost | $10,010,000 | $1,000,000 (to purchase small additional property) | $11,375,000 |

Approximately $6,000,000 (Not appraised yet)

|

| Additional associated cost | None known | ~$5,000,000 to remove large debris mound; ~$1,400,000 to reroute high voltage lines | Unknown (see below) | $ 875,000 (estimated – see below) |

| Potential delays / costs | 2nd attempt at rezone, up to 1 year delay; no guarantee rezone will be approved | Min 2 years to reroute high voltage lines, including “plan” approval by Duke; 6 months to remove debris mound | No delay/Unknown Cost The package plant at North Park may need to be expanded. |

6 months/$ 125.000 (est): conduct Phase 1 & II environmental and geological studies, survey, two appraisals.

|

| Potential delays / costs |

Unknown / $750,000 (est) Sewer connection ONLY available if the properties are annexed into the City. In addition, ALL properties between the city limits and the property need to ‘voluntarily annex’ to the City.

|

|||

| Potential delays / costs |

Unknown Delay / Unknown Cost All planning approval will need to go through the City of Bloomington -Plan Commission and Council

|

|||

| Estimated cost of delay, calculated at $10,000,000/year (5% of $200,000,000)* | $10,000,000 | $25,000,000 | $0 | $10,000,000 |

| Other considerations | Need to find a new location if rezone denied; free parking | Need to work out road access; need rezone from City; need plan approval from Duke; potential traffic delays at drop-off and pickup times for Summit Elementary | Planned Unit Development will need to be revised (County Planning). Free parking that could be used for a Park-and-Ride |

Property owners may not want to be annexed into the City of Bloomington; unknown if there is sufficient sewer capacity

|

| Restrictions | None known | None known | Seller wants construction of justice campus to begin within one year of the start of the jail construction** |

Part of the property has slopes exceeding 25% limiting buildable area. We have not received input from residents on this site yet.

|

| TOTAL POTENTIAL COST* | $20,010,000 | $32,400,000 | $11,375,000 | $16,875,000 |

Comments ()