Bloomington mulls GO bonds as way to keep tax rate constant, but increase amount paid by 14.5%

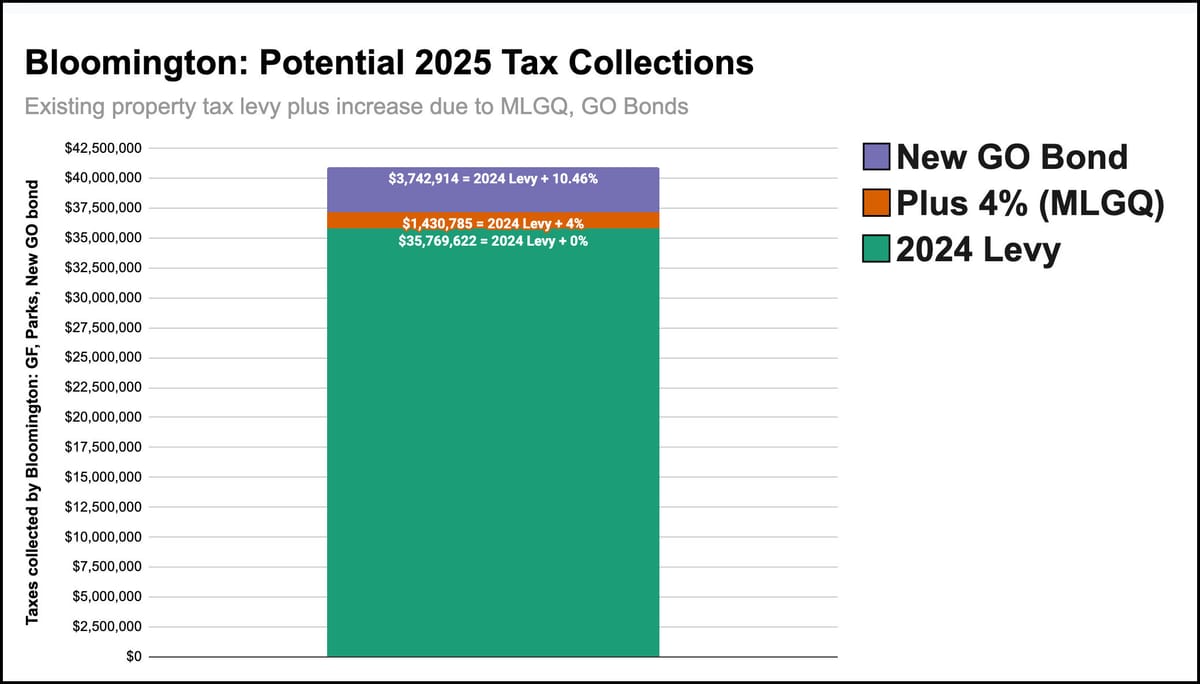

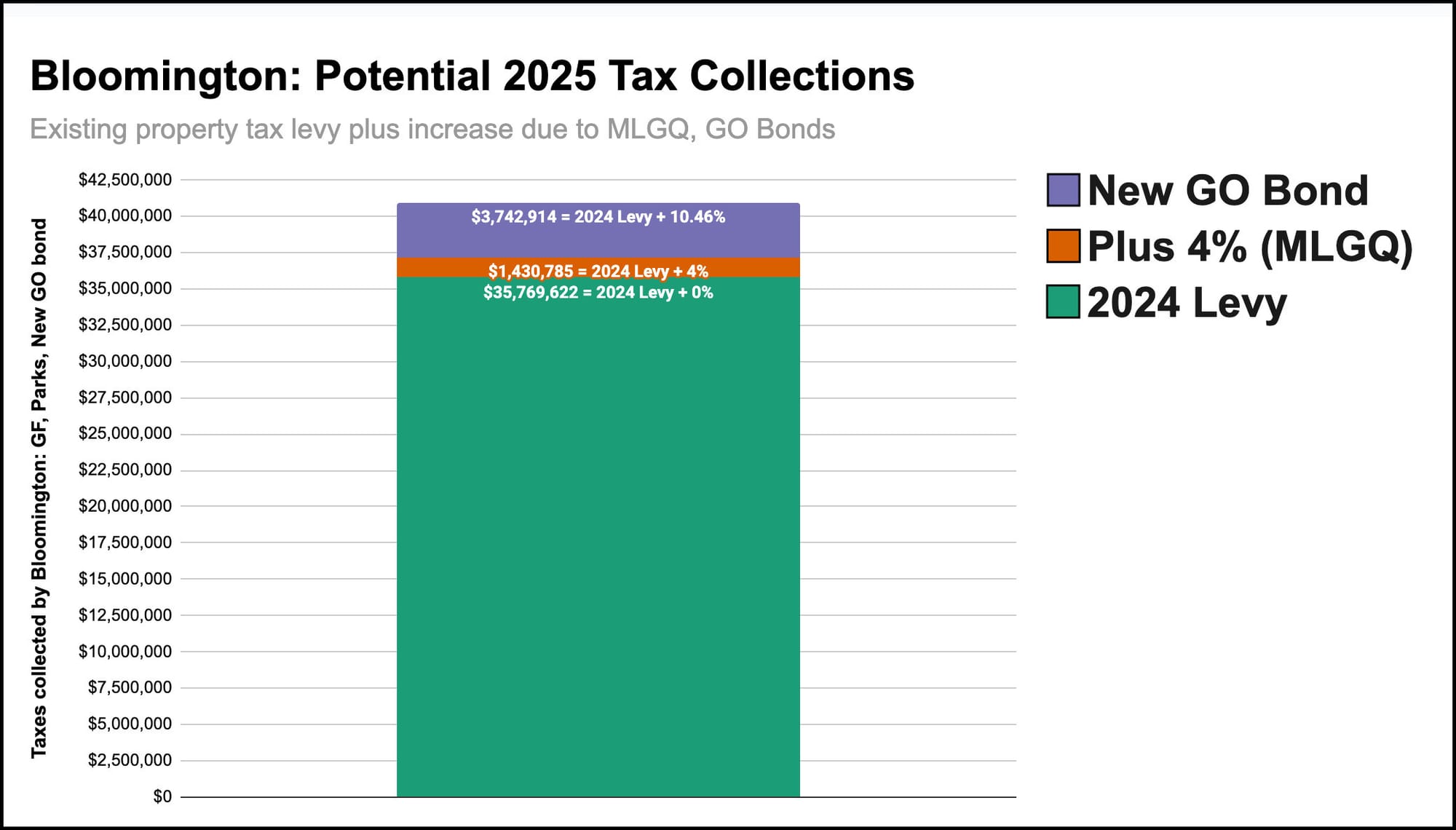

The biggest part of the tax bills for Bloomington property owners could be increasing on average by about 14.5 percent in 2025.

That’s because Bloomington mayor Kerry Thomson and city councilmembers are considering issuing a general obligation bond that would require an additional $3.743 million in property tax revenue to pay back, beyond the $1.43 million in additional property taxes that are built into the proposed 2025 budget.

The $1.43 million of increased revenues (to the general fund and the parks fund) is the amount that comes from Bloomington’s decision to increase the amount of the levy for 2025 by the maximum allowed by Indiana state law this year—which is 4 percent.

With the issuance of the GO bond, Bloomington’s electeds are looking to increase property taxes by another 10.5 percent, beyond the basic 4 percent.

Raising the amount of taxes paid without raising the rate

In the state of Indiana, what elected officials choose is the amount of revenue, not the tax rate. The needed rate is calculated based on the amount of revenue chosen and the amount the total assessed value.

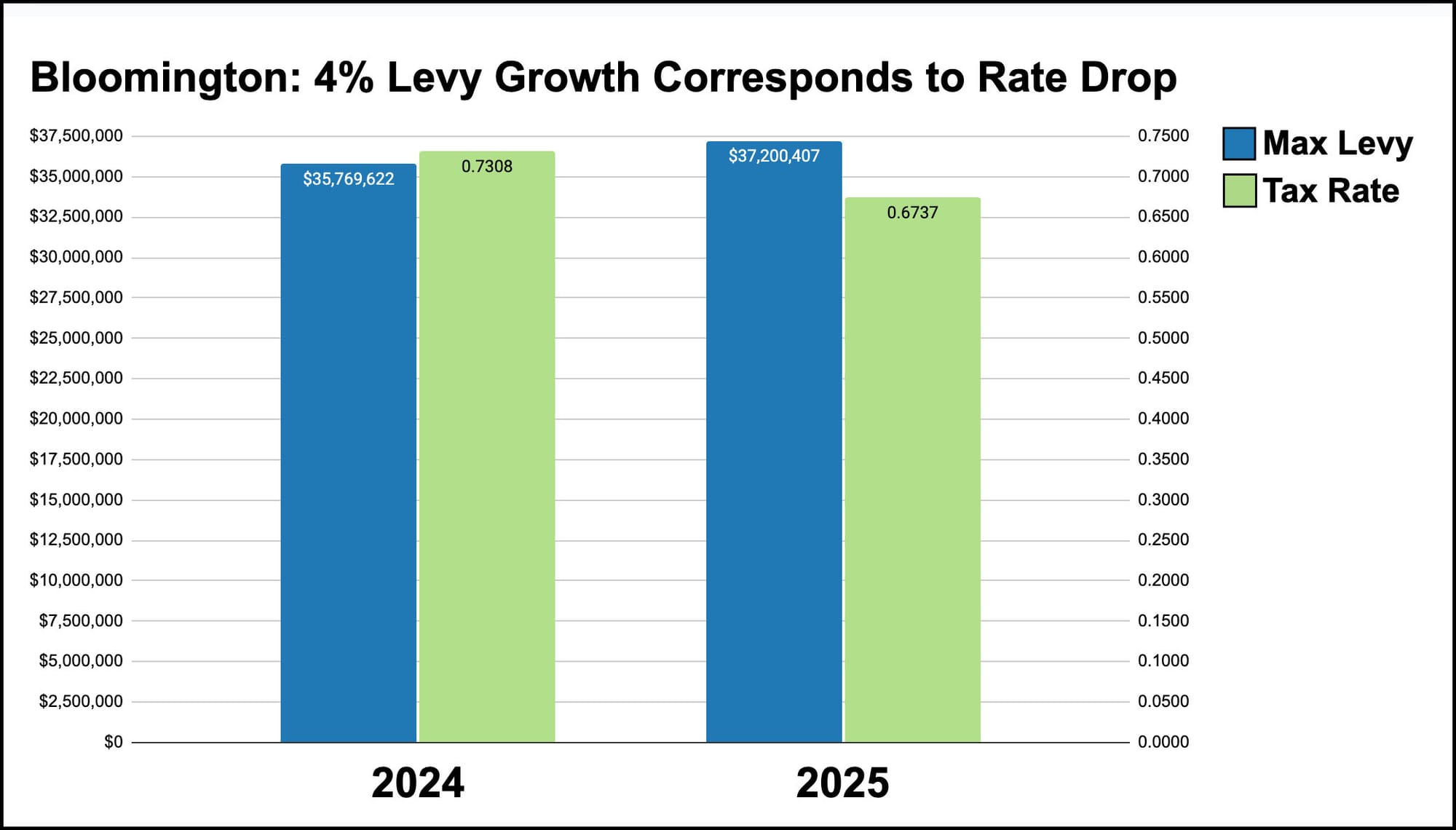

The idea of increasing tax revenues by another 10.5 percent is to take advantage of the fact that the overall net assessed value for Bloomington property has increased this year by about 12.8 percent.

That means the tax rate that is required in order to generate just 4 percent more revenue in 2025, is not as high as the 2024 rate. (A smaller percentage applied to a bigger amount, can still yield a bigger amount.)

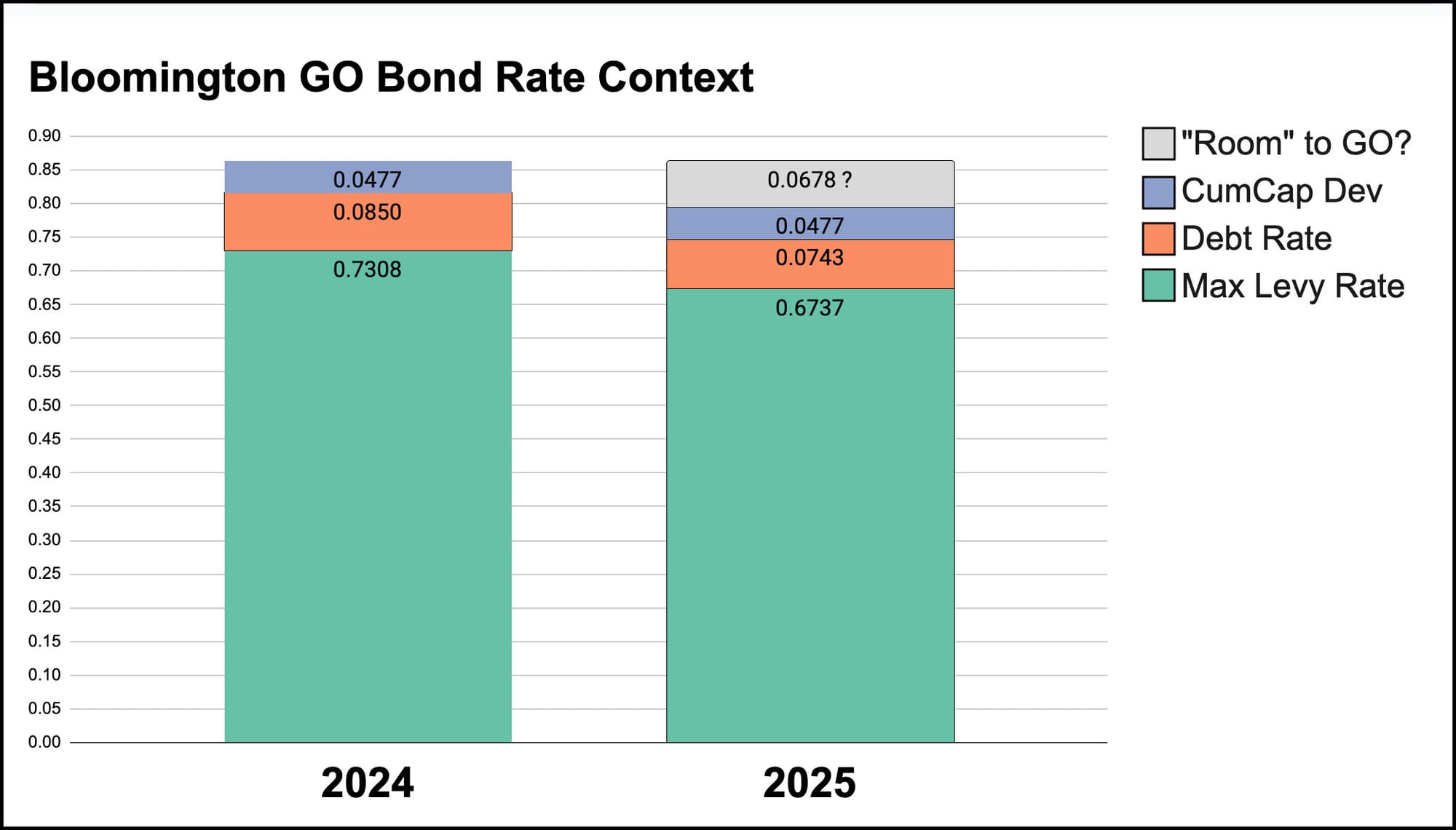

So there is “room” between the lower tax rate that property owners will see in 2025, if no GO bond is issued, and the 2024 rate. In detail, the 2024 basic rate of $0.7308 is made up of a $0.5686 general fund rate and a $0.1622 parks rate. That basic rate will drop from $0.7308 to $0.6737, due to the increased assessed value, but still generate 4 percent more revenue.

Even at the lower rate, the combined general fund and parks property tax revenue will rise from $35.77 million to $37.20 million.

Factoring in the other bits that make up the total rate, property owners would see an overall city tax rate drop from $0.8635 to $0.7957.

That difference of $0.0678 in rates is where some financial advisors see an opportunity—to generate additional revenue, while maintaining the same rate.

An additional $3.743 million in property tax revenue could be generated by adding a rate of $0.0678, which would mean the same overall tax rate for Bloomington taxpayers in 2025 as they pay now.

Despite maintaining the same rate, the amount of tax revenue the city would collect from property tax payers would increase by about 14.5 percent—from $35.77 million to $40.94 million.

Tuesday (Sept. 24) city council work session

Gary Smith, from Reedy Financial Group, and Josh Janak from Baird, which among other things underwrites municipal bonds, attended a work session this past Tuesday, to brief councilmembers on the nuts and bolts of the GO bond proposal.

On Tuesday, the fact that it’s the amount of taxes that impacts property owners, not the rate per se, did not seem to be completely lost on the elected officials in the room. Bloomington city councilmember Hopi Stosberg said, “I felt like when I was knocking [doors], I heard way more people upset about the bottom-line number, and they just went: You’re raising my taxes.”

But Stosberg continued, “And I had to go, Well, actually, the percentage actually went down in the last year.” She added, “But people don’t necessarily see that difference in percentage versus a full dollar amount. As a former math teacher…that was kind of fun for me to talk about afterwards, but it’s not necessarily something that—I don’t think people see very much of.”

Bloomington mayor Kerry Thomson said, “I would say that most people don’t differentiate between their assessed value and the city tax rate, the county tax rate.” Thomson said, “They just know how much they’re paying.”

Thomson continued, saying “We are at a point, especially with low- and fixed-income…residents, where they’re having a hard time affording keeping up. Assessed values have gone up quite significantly.”

Thomson added, “So I just am very aware of that, and I am talking to residents that are concerned.”

Impact on property owners

To calculate the impact of the potential GO bond on someone who owns a house with an assessed value of $200,000, the first step is to calculate the net assessed value—which is equal to the assessed value minus the homestead deduction and minus the supplemental deduction.

The homestead deduction is either 60 percent of the property’s assessed value or a maximum of $45,000, whichever is less. For a $200,000 house, 60 percent works out to $120,000, which means the standard homestead deduction is $45,000.

A supplemental deduction of 35 percent is applied to the remaining assessment, after the standard homestead deduction is subtracted. Here’s the math:

Supplemental deduction = 0.35*($200,000 – $45,000) = $54,250

Subtracting both the standard homestead deduction and the supplemental deduction gives the net assessed value:

Net assessed value = $200,000 – $45,000 – $54,250 = $100,750

To apply a $0.0678 tax to $100,750 means crunching this:

$0.0678/100 * $100,750 = $68.31

For the owner of a house with an assessed value of $200,000, issuance of the proposed GO bond would mean an extra $68.31 in property tax owed,

Next steps

For Thomson’s administration, it sounds like a GO bond will definitely be in the mix for the 2025 budget year, even if the term is not yet determined.

If the term is three years, the projects that might go into the bond could amount to $6 million—that’s based on materials provided by Baird on Tuesday.

In a memo released on Wednesday (Sept. 25) together with the formal presentation of the 2025 budget, Thomson wrote that “a bond is key to meeting our shared objectives.” Thomson’s memo continued, “Our bonding capacity is dependent on many factors yet to be decided, such as bond size and term length. The controller intends to recommend a $5-million, 2-year bond.”

Possible projects to be funded by the GO bond are, in part, reflected in the budget, while others would be added.

In Thomson’s memo, some of the projects to be included in the bond are listed as: $1.4 million for 2025 Safe Streets 4 All (prioritized projects would be added to the bond, possibly including the Indiana Avenue project); $1.35 million for three engineering projects (curb ramps and signal modernization); $100,000 in transportation plan projects; and $50,000 for neighborhood traffic calming.

The 2025 budget adoption meeting is set for Oct. 8.

About the timing for a council vote on the GO bond, city controller Jessica McClellan told councilmembers on Wednesday: “We’ve got until the middle of October to kind of get our ducks in a row to write a bond ordinance.”

McClellan told councilmembers the administration wants input from the council about the amount of the bond, the term, and the projects to be funded.

A draft list of potential projects has already been sent to councilmembers. It’s anticipated that they will send the administration their ideas, about what to include and exclude in the project list.

| 2024 | 2025 | |

| NAV | $4,894,584,325 | $5,521,688,674 |

| Max Levy | $35,769,622 | $37,200,407 |

| Max Levy Rate | $0.7308 | $0.6737 |

| CCD Rate | $0.0477 | $0.0477 |

| Current Debt Rate | $0.085 | $0.0743 |

| Total City Tax Rate | $0.8365 | $0.7957 |

| New GO Debt Rate | $0.0678 | |

| New GO Debt Levy | $3,742,914 | |

| new City Tax Rate | $0.8635 |

Comments ()