$3.8M less for Monroe County govt in 2025 due to its own mistake, unintentional tax break for property owners

Monroe County government will collect about $3.8 million less in property taxes in 2025 than would have been allowed under state law.

That’s due to what has been described to The B Square as a data entry error for the budget numbers that were approved by the seven-member Monroe County council last year. Councilor Marty Hawk cast a vote of dissent.

The 2025 budget calls for $122.5 million in spending.

The mistake means that property owners will collectively pay $3.8 million less in taxes this year than they would have, if the intended budget numbers had been enacted.

The budget numbers are prepared by the county auditor, Brianna Gregory, and approved by the county council, the county’s fiscal body.

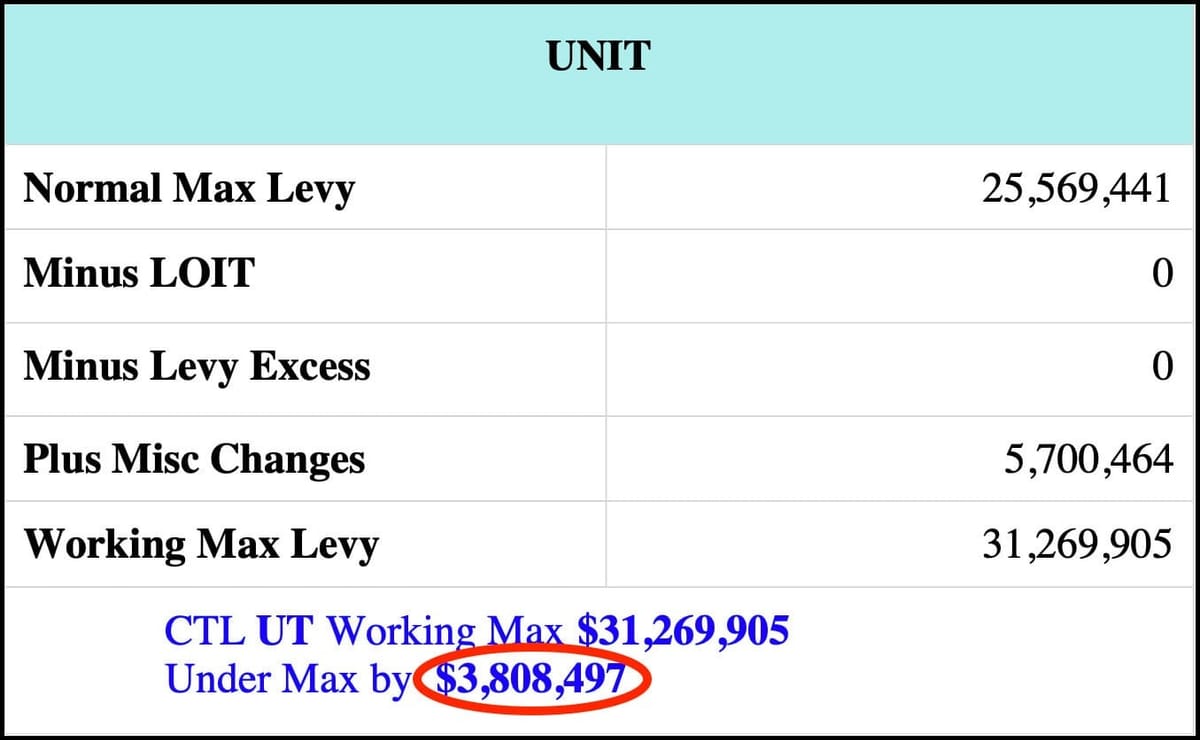

The diminished property tax levy, compared to what county officials intended to collect this year, is apparent in the 1782 notice for 2025 issued by Indiana’s Department of Local Government Finance (DLGF) to Monroe County. On page 7 of the 1782 notice, the indication is: “Under Max by $3,808,497.”

The 1782 budget order is issued by DLGF to counties, cities, towns, and other taxing units, detailing their certified budgets, tax rates, and levies for the upcoming year. It serves as the final step in the budget approval process, which allows local governments to review and request corrections before final certification.

Indicated in the 1782 notice is a deadline for a response from Monroe County government: Dec. 26, 2024.

In a statement made at Tuesday night’s county council meeting (Feb. 25), county council president Jennifer Crossley raised the possibility of trying to file an appeal.

Crossley said, “It is my hope that this county council will evaluate the county's government budget needs, impacts of pending legislation and current available funding to decide what options are available in addressing the lower rate, which includes whether to appeal the approved levy rate.”

By “pending legislation” Crossley meant this year’s biennial budget bill, which is currently under consideration by the state legislature. If enacted as it’s currently drafted, the bill would not allow any increase to local unit levies in 2026, compared to 2025 levels.

Regardless of what increases the state legislature allows for 2026, the question hanging over county government officials is whether the baseline for the 2026 comparison will be the amount of the 2025 actual levy, which is $3.8 million shy of the intended number, or the amount that the county could have enacted for its levy—that is, the actual amount plus $3.8 million.

Speaking to the county council’s long-term finance committee on Friday morning (Feb. 21) was Greg Guerrettaz, with FSG, which is the county's financial planning consultant. Guerretaz compared certified budget numbers for the county’s general fund in 2024 ($21,166,097) to the numbers for 2025 ($17,819,153).

Given the 4.0-percent maximum levy growth quotient (MLGQ) for 2025, the general fund could have been expected to be certified at a little more than $22 million, if the county council had enacted the maximum levy as it intended.

Guerretaz called the question of the new baseline the “300-pound gorilla that's in the room.” He said, “Now we're assuming then that they will allow us to go and reclaim what was lost this year. … That's a big assumption…”

On the question of whether the county will have to live with the $3.8-million lost revenue this year and in future years, or will be allowed to reclaim the $3.8 million for a new baseline, Guerretaz said on Friday: “That jury is still out…”

The news that county officials will have $3.8 million less to work with this year comes in the context of uncertain property tax revenues in the future—which depends on how the state legislature handles the biennial budget bill. The end of the legislative session this year is set for April 29.

Also a part of the context is a request from deputy sheriffs for a significant salary increase, which was already floated last year. The requested salary increase for sheriff's deputies is estimated to require an additional $732,891 year.

The potential looming financial crunch prompted county auditor Brianne Gregory in late January to send an email message to county councilors and county commissioners that suggested some “areas to ponder”:

Some areas to ponder are noted below.

- Non-essential training and travel

- New hires

- Classification changes

- New positions

- Capital purchases

- Overtime

- Reversion trends

- County provided local assistance

Comments ()