Analysis: Bloomington city council to take up local income tax increase again this Wednesday

The sole item on this Wednesday’s special meeting of the Bloomington city council is a proposal to increase the countywide income tax by 0.855 points, which would bring Monroe County’s total rate to 2.2 percent.

Bloomington mayor John Hamilton re-floated the idea of a local income tax increase at his “state of the city” address this February. It was an idea he had unsuccessfully pitched in 2020. The mayor gave details of this year’s proposal in early April.

If the city council approves a LIT rate increase by a vote of at least 8–1, that will increase the tax for all residents of Monroe County. If the approval gets fewer than eight votes from the Bloomington city council, then the proposal would need to pick up some support from county councilors and/or members of the Ellettsville town council.

The stage for this Wednesday’s special meeting (April 27) was set at last week’s meeting (April 20), when councilmembers could have voted on the resolution to increase the local income tax—but chose instead to postpone consideration until the following week.

The hour had grown late by the time the council reached the item on its agenda, and after councilmembers had asked a few rounds of questions of the administration, and entertained public commentary on the question.

Councilmembers put much of their time last week into getting clarification on the transportation proposals, and the available alternatives under Indiana’s local income tax law for funding public safety needs.

This week’s meeting could end in a final vote. But in terms of statutory deadlines, as long as the council acts by August, the increased rate could start collection on Oct. 1 of this year. [IC 6-3.6-3-3]

This Wednesday, if councilmembers focus on negotiations for an increase in the rate that at least eight or nine councilmembers can live with, deliberations are more likely to end in a vote by the end of the night, instead of another postponement.

That approach would leave the basic assumptions of Hamilton’s proposal intact. Those assumptions include the idea that the increased tax rate would be imposed in the economic development category and that a population-based method would be used for distribution of revenue to the four eligible governmental units: city of Bloomington, Monroe County, Ellettsville, and Stinesville.

Hamilton’s approach would yield the most revenue for the city of Bloomington—around $18 million. And for any fixed amount of revenue that Bloomington would like to generate, it’s also the approach that makes for the lowest LIT rate increase.

This Wednesday, if councilmembers want to revisit the basic assumptions—like the category of LIT to be used, it’s probably somewhat less likely they’ll wind up taking a final vote by the end of the night.

Besides the economic development category, other possible LIT categories include regular certified shares and public safety (PS LIT).

In the certified shares category, Monroe County currently imposes a LIT rate of 0.9482. And in the PS LIT category, Monroe County currently imposes a LIT rate of 0.25. Using the certified shares category would distribute revenue to other units of government, like the townships, the public library, the public bus company and the Monroe Fire Protection District.

During public commentary last Wednesday, Monroe County councilor Geoff McKim pointed out that imposing the tax increase in the PS LIT category would assure the public that the additional revenue will, in fact, be spent on public safety.

The economic development category of LIT requires the inclusion of a capital improvement plan for some of the expenditures, but it’s flexible in the way funds can be spent. A catch-all clause in the state law lets economic development LIT revenue be spend for any lawful purpose.

The PS LIT category had apparently not been contemplated as a legal possibility until the day before last Wednesday’s city council meeting. That’s when the city’s own FAQ page was edited to correct the inaccurate claim by Bloomington that 0.25 was the maximum rate that could be imposed in that category. [April 13, 2022 FAQ] [April 19, 2022]

A further delay, in order to consider the basic architecture of a LIT increase, could fit into the several-months lead-in to the annual end-of-August 2023 budget proposals from the administration to the council.

The annual “budget advance” city council meeting set for April 26 was canceled. But still on the council’s calendar for June 14 is a “budget discussion.”

Possibly mitigating against further postponement, to consider the basic assumptions, is the new police labor contract, with its substantial (13 percent) pay increase. The contract, which will be effective starting in 2023, was ratified by a vote of the police union membership in early March.

That contract has not yet been signed, because the Hamilton administration has made its support of the contract contingent on having additional revenue to pay for it. The new police contract is supposed to help with recruitment and retention of sworn officers. But that intended effect, as long as the contract is not signed, could be limited.

Paul Post, who’s president of the Fraternal Order of Police, Don Owens Memorial Lodge 88, told the council last Wednesday during public commentary that by the end of the month, BPD will lose its seventh officer so far this year. That departure puts the number of sworn officers in Bloomington’s police department 20 officers short of the 105 officers that are authorized in the 2022 budget.

Said Post about that difference, “It’s the first time in my almost 20 years I can remember being at that point.”

Post told city councilmembers last Wednesday: “My members expect that the proposed contract will be honored by the city.” Post added, “That single narrow item is dwarfed by all the other items put into this tax increase. On those, the FOP will remain silent.”

The annual cost of the new contract in the first year is estimated at $1.5 million. The total amount of additional revenue the Hamilton administration says it wants, in order to cover essential services and address some climate change mitigation initiatives, is around $18 million.

Last Wednesday, city council president Susan Sandberg wanted to know if it would be possible to cover the cost of the new police contract without an increase in the LIT rate. Hamilton’s answer: “I do not feel it would be responsible to sign such a contract, if we did not have sources of revenue identified.” Hamilton added, “The need to reduce other expenses in the city would be very, very dramatic.”

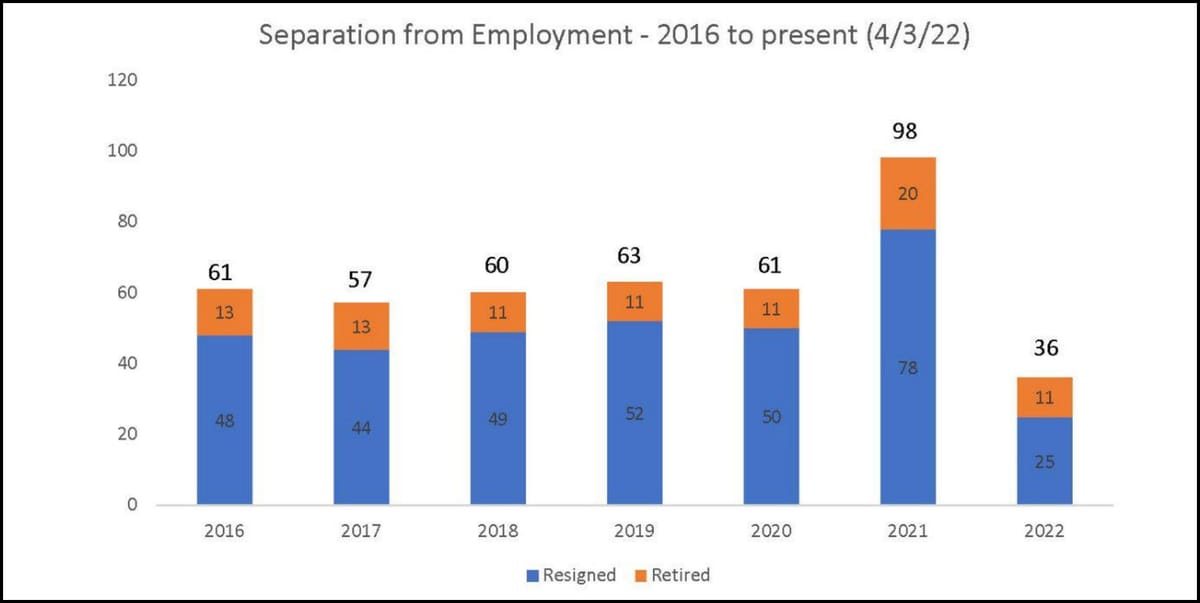

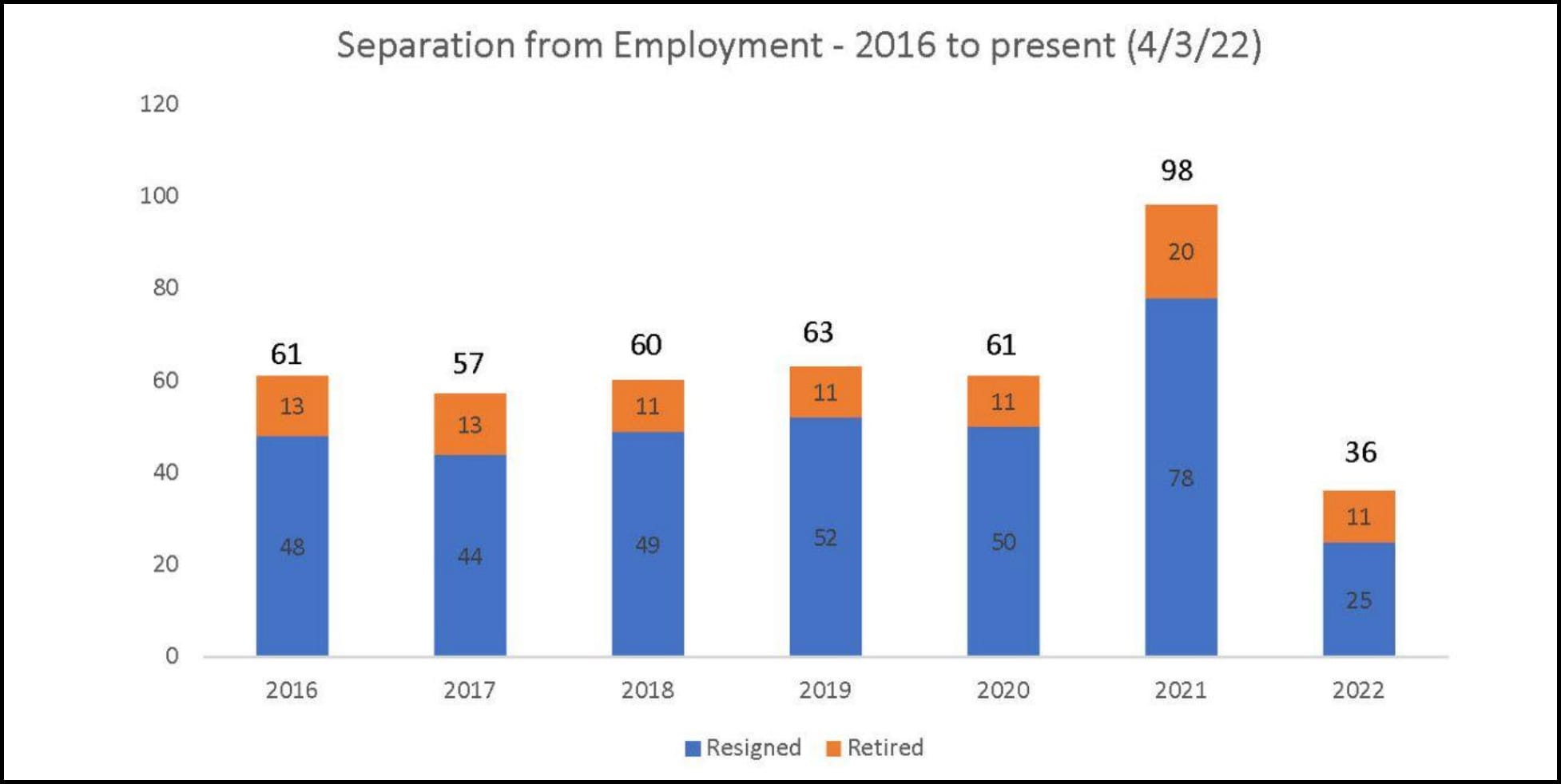

The departure of the seventh sworn officer from employment this year is part of a general trend for loss of city employees. Counting retirement and non-retirement separations, 98 city employees left their city employment in 2021. That’s two-thirds more than the roughly 60 total departures in each of the previous five years.

Some of the additional revenue that would be generated from an increased LIT rate would be put towards better employee compensation. Part of the mayor’s proposal for the LIT rate increase includes $1 million, to offer incentives to attract and retain talented city employees. Those incentives could include: pay adjustments; hiring bonuses; creation of new positions; tuition reimbursement; relocation allowance; longevity bonuses; and/or housing assistance.

Some councilmembers could be looking to ratchet down the increase in LIT rate to some bare bones level, out of concern for the impact of the flat tax on lower-income residents. One place to look for a “floor” on a rate increase would be a bar chart presented by Bloomington mayor John Hamilton at the council’s committee-of-the-whole meeting on April 13.

The bar chart showed a shortfall of about $5 million in each of the next four years—if no additional revenue is added. The assumptions that went into that bar chart include the additional $1.5 million in expenditures for the police contract and an average growth of expenditures of 3.5 percent.

If councilmembers are looking to cover just those projected shortfalls, which max out at $5.4 million in 2023, and add in some amount of buffer, then $6 million is probably a reasonable amount of additional revenue for them to consider as a bare minimum.

If the proposed 0.855 point LIT rate increase is projected to generate around $18 million annually for Bloomington, to calculate a rate that generates $6 million would mean dividing 0.855 by 3, which equals 0.285 points.

At the city council’s April 13 committee-of-the-whole meeting, councilmember Matt Flaherty said he would support the full 0.855-point increase requested by the mayor. But he added, “In working to meet my colleagues somewhere in the middle, at the very least, I think I can come down to 0.65, and find a balance of what I think is most essential.”

That means the negotiations among city councilmembers over a LIT rate increase could land somewhere in the span between 0.285 and 0.65 points.

If just five Bloomington city councilmembers voted for LIT rate increase, it could still be enacted, if at least four members of the Monroe County council were to support it. That’s based on the allocation of weights of votes, which for Bloomington city councilmembers and Ellettsville town councilors proportionate to the population of the city and the town compared to all of Monroe County.

The weight of votes for county councilors is calculated based on the amount of population that is left over after subtracting the populations of Bloomington and Ellettsville and Stinesville.

Table: Voting shares for LIT in Monroe County

| Unit | Population | % of county | Share per member |

| Bloomington | 79,168 | 56.66% | 6.30% |

| Ellettsville | 6,655 | 4.76% | 0.95% |

| Stinesville | 220 | 0.16% | 0.05% |

| Monroe County (left over) | 53,675 | 38.42% | 5.49% |

The Bloomington city council’s special meeting starts at 6:30 p.m. on Wednesday, April 27.

Comments ()