Bloomington 2022 budget revenues: Property tax levy up, local income tax down

Last Friday, Bloomington mayor John Hamilton released his proposed 2022 budget.

Compared to the 2021 budget, the combination of local income tax distributions and the general fund property tax levy nets out to about zero change for 2022 revenues.

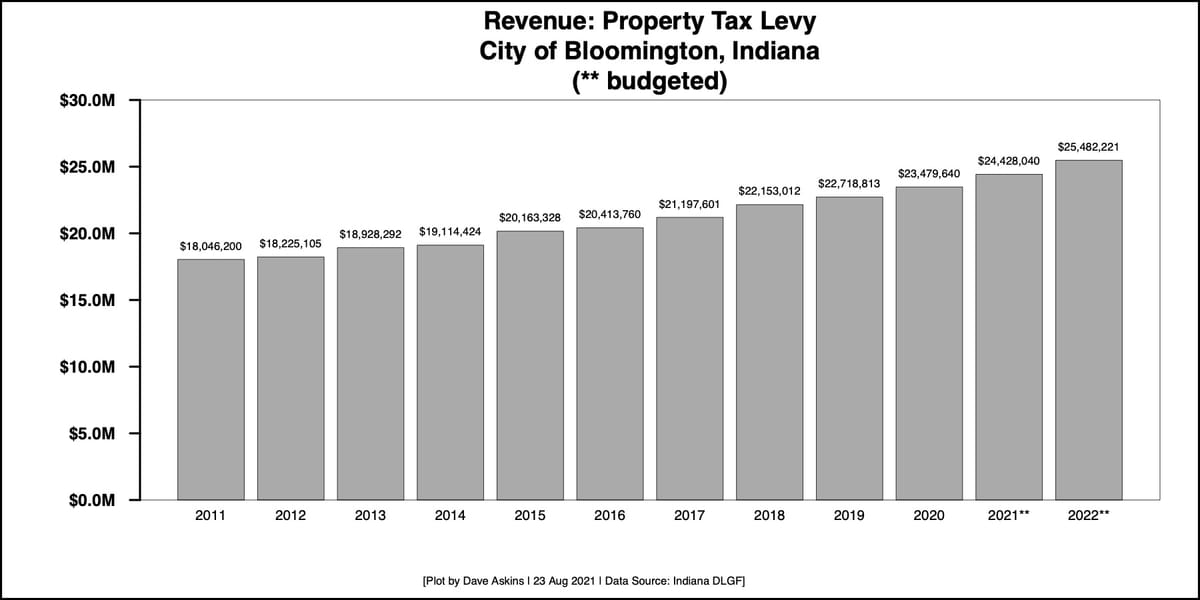

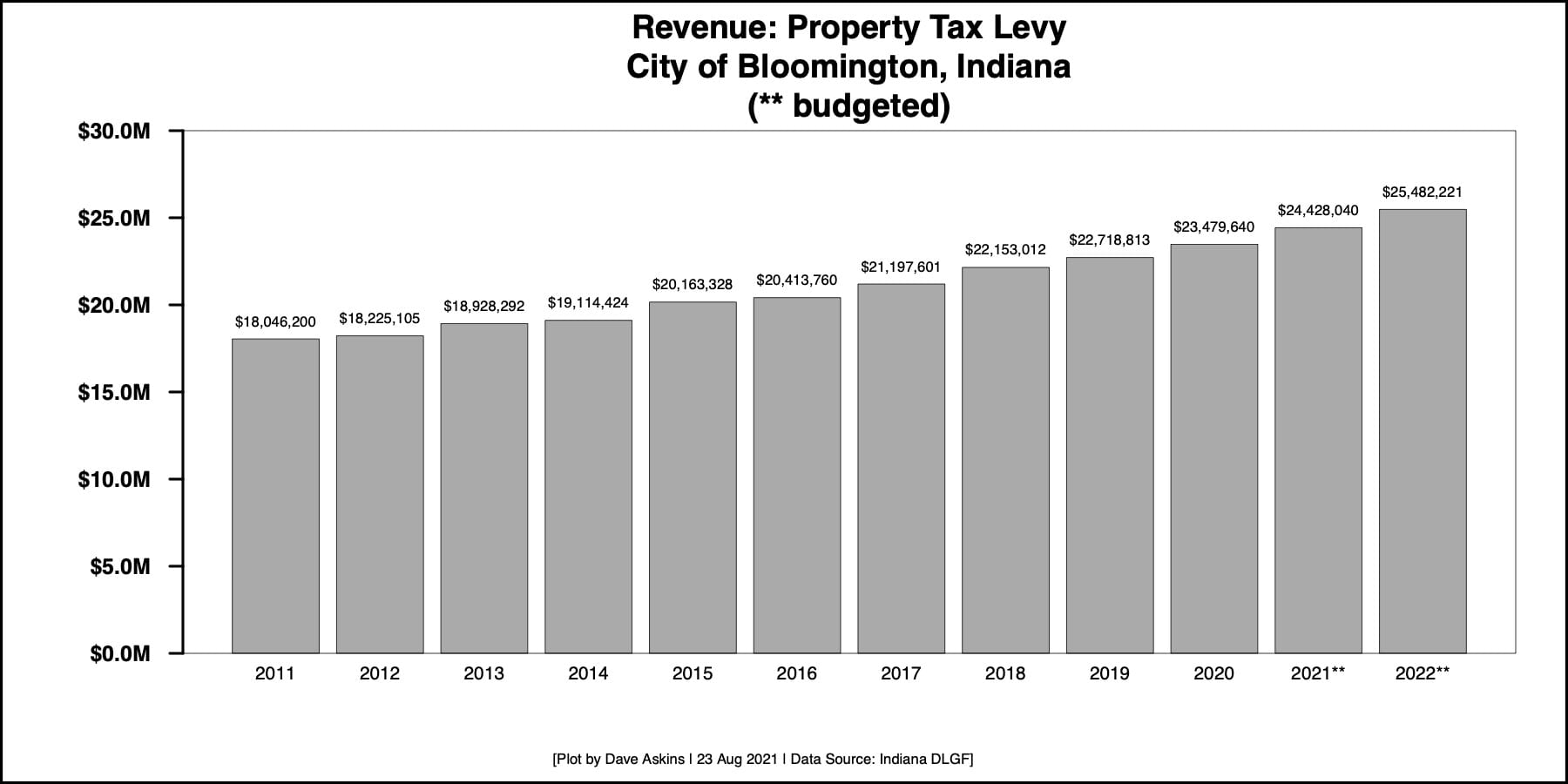

There’s an increase in the general fund property tax levy (based on a 4.3-percent growth quotient)—from $24.43 million to $25.48 million, or an increase of $1.05 million.

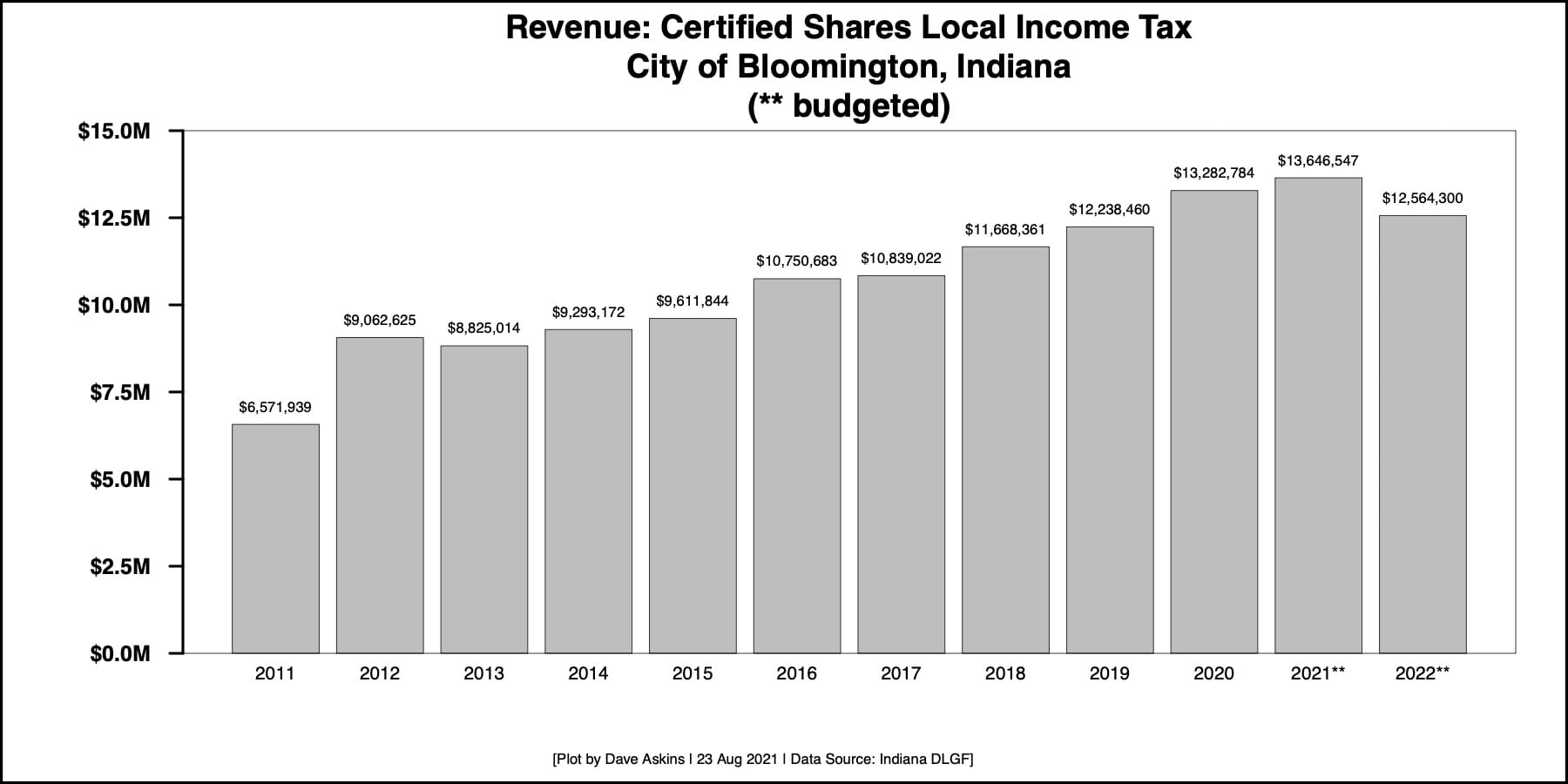

But Bloomington’s certified share of local income taxes is expected to drop 7.8 percent, from $13.65 million in 2021 to $12.56 million in 2022, for a difference of $1.09 million.

So the $1.05 million gain in property tax levy is erased by the $1.09 million loss in local income tax revenues.

Still, the overall proposed budget for the city of Bloomington in 2022—not including Bloomington Transit, Bloomington Utilities, and the Bloomington Housing Authority—will increase by about $11.5 million compared to 2021, making the total for 2022 about $106.6 million.

The revenue to cover the $11.5-million increase is coming from the two federal pandemic relief packages—the Coronavirus Aid, Relief, and Economic Security (CARES) Act and American Rescue Plan Act (ARPA).

According to Bloomington’s 2022 proposed budget document, the $106.6 million budget will tap Bloomington’s CARES Act funding for $1 million and the ARPA for $9.735 million.

Unlike the 2021 budget, which relied on a $2-million transfer from the rainy day fund, the 2022 budget does not make any transfers out of the rainy day fund.

The hit to local income tax revenue is the effect of the COVID-19 pandemic.

That’s because the certified distributions of local income tax received by Bloomington from the state are based on tax collections from July 2020 to June 2021—most of which were from the spring 2021 income tax payments. Those spring 2021 payments were based on income earned in 2020, the first year of the pandemic.

Some of the reduction in local income tax distributions could be made up in the form of a “supplemental distribution” in spring 2022. Supplemental distributions are drawn from each county’s trust fund maintained by the state. Under state law, if the amount in the trust fund exceeds 15 percent of the distribution in a given year, the state has to make a supplemental distribution.

In spring 2021, there was a supplemental distribution of local income tax made to Monroe County, of which Bloomington received about $1 million.

The maximum levy growth quotient for Indiana property tax levies is defined in terms of income tax. That is, broadly described, Indiana’s state law is set up so that property taxes aren’t supposed to increase much faster than incomes.

The fact that the maximum levy growth quotient includes a kind of six-year rolling average, buffers the property tax levy against a sharp decrease due to a recession year or a sharp increase due to a year of extraordinary growth.

This year the maximum levy growth quotient was calculated at 4.3 percent.

In Bloomington’s proposed 2022 budget, the total reserves—rainy day fund plus general fund balances—are projected to amount to 23.6 percent of annual operating expenses by the end of that year.

As a part of the Hamilton administration’s four-day series of meetings this week, the impacts of the pandemic on specific city funds are likely to get at least some mention.

Here are some examples of city funds that saw pandemic impacts.

Sample Charts: Bloomington funds with pandemic impacts

Comments ()