Bloomington: $550K in COVID-19 small business relief loans awarded so far using food and beverage tax proceeds, about $250K already distributed

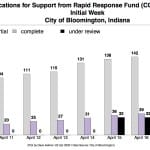

In a press release issued Wednesday afternoon, the city of Bloomington announced that a total of $550,700 has now been approved in loans to 22 businesses that applied for COVID-19 relief funds.

The city currently has a pool of $2.5 million to draw on for loans to local businesses that have been impacted by the COVID-19 pandemic.

That pool was created through a series of actions by Bloomington’s city council, the food and beverage tax advisory commission and the Bloomington Urban Enterprise Association over the last couple of weeks.

Making up $2 million worth of the pool are proceeds of the 1-percent food and beverage tax. The food and beverage money is restricted to loans for tourism-related businesses. Tourism is a secondary purpose specified in the state statute that allows the levy of the food and beverage tax. The primary purpose of the tax is to pay for an expansion of the existing convention center.

The other $500,000 in the pool comes from the Bloomington Urban Enterprise Association (BUEA). The BUEA funds are not restricted to tourism-related businesses but do have a geographic requirement. BUEA funds are restricted to support businesses that are located in a specific area of downtown Bloomington.

Distributions to the first seven applicants have been made, according to the press release, which total $240,600. All of that is being drawn from the food and beverage portion of the pool.

Another 15 additional applicants have been selected for loan awards totaling $310,170 for a total of $550,700 in approved funding.

Of the $310,170 that’s been approved but not yet distributed, $101,170 is coming from BUEA funds. That’s based on a slide presented to the Bloomington city council on Wednesday by Alex Crowley, director of economic and sustainable development for Bloomington.

A couple dozen more applications are at some stage of review. The application process is still open.

Crowley has previously described publicly the nuts and bolts of the city’s loan program requirements. An eligible business has to have a physical address inside the city limits or be a nonprofit that resides in or serves Bloomington.

Businesses outside the city limits are eligible for a similar COVID-19 relief program, also funded by food and beverage tax money, administered by Monroe County’s board of commissioners. Earlier on Wednesday, commissioners announced their first round of awards, which are grants, not loans, totaling about $68,000.

For Bloomington’s loan program, the business has to have at least one employee, but no more than 250 employees.

To qualify for a loan, a business has to show there’s been a negative impact in revenue due to the COVID-19 pandemic, and has to have been open before Feb. 29. Applicants also have to be making good faith efforts to pursue other funding sources. As Crowley puts it: “We don’t have local resources to maintain the whole economy.”

The money will be lent at a rate of 2 percent with a 3-year repayment period. Payments could be deferred for the initial six months. If the loan is repaid within a year, then no interest would be owed.

Crowley has said that a small subset of the loans, for certain nonprofits, might be forgivable.

The process used for reviewing applications includes an initial review by a representative of a lending institution. That review involves a scoring metric. After that review, the application is passed along to a five-member committee of the Rapid Response Fund advisory commission, consisting of lenders and financial professionals. The five-member committee does a more subjective impact review.

The committee’s summary sheet is passed along to the city in summary form and then either approved or denied by the city.

At Wednesday’s meeting, Crowley said the economic stabilization and recovery (ESR) working group, which put together loan program, is trying to sort out some issues that have arisen about the number of applicants who’ve expressed an interest so far.

Crowley said they’d done a better job at reaching women-owned businesses than minority-owned businesses. The group is looking at ways to try to amplify the message that loans are available he said. They’d received some applications form minority-owned businesses, he said, but added, “It’s not to the extent we’d like to see.”

First Round of Distributions

| Loan Awardee | Amount |

| Nick’s English Hut INC | $50,000 |

| Back Door Bloomington LLC DBA The Back Door | $50,000 |

| The Atlas Ballroom | $50,000 |

| Penguin Enterprises LLC dba The Chocolate Moose | $40,000 |

| MJSB LLC. DBA: B-Town Diner | $32,000 |

| The Ritz Hair Studio | $15,000 |

| A.E.A Design & Apparel | $3,600 |

| Total | $240,600 |

Members of the Rapid Response Fund Advisory Commission

| Name | Organization |

| Steve Bryant | SBDC |

| Lynn Coyne | BEDC (ret.) |

| Doug Dahoff | Upland (ret.) |

| Amy Doan | IUCU |

| John Fernandez | Former Mayor |

| Jerry Hays | OCS |

| David Hays | CFS |

| Cindy Kinnarney | FFB |

| Vanessa McClary | Kiwanis |

| Troy Phelps | SBDC |

| Tony Rastall | IUCU |

| Karen Reid Renner | Rejuv Aesthetics |

| Scott Shishman | Old National |

| Karin St. John | BHF |

| Lon Stevens | PS |

| Jason Whitney | IU Ventures |

| Kurt Zorn | IU/EDC |

Comments ()