Bloomington bus ridership down 6% so far in 2025, as 2 teams bidding for ops center merge

Fixed route ridership on Bloomington’s public buses continues to lag about 6% behind last year’s numbers. Along with the ridership numbers, the board received an update on the process for selecting the builder and designer of the new operations center, to replace the one on Grimes Lane.

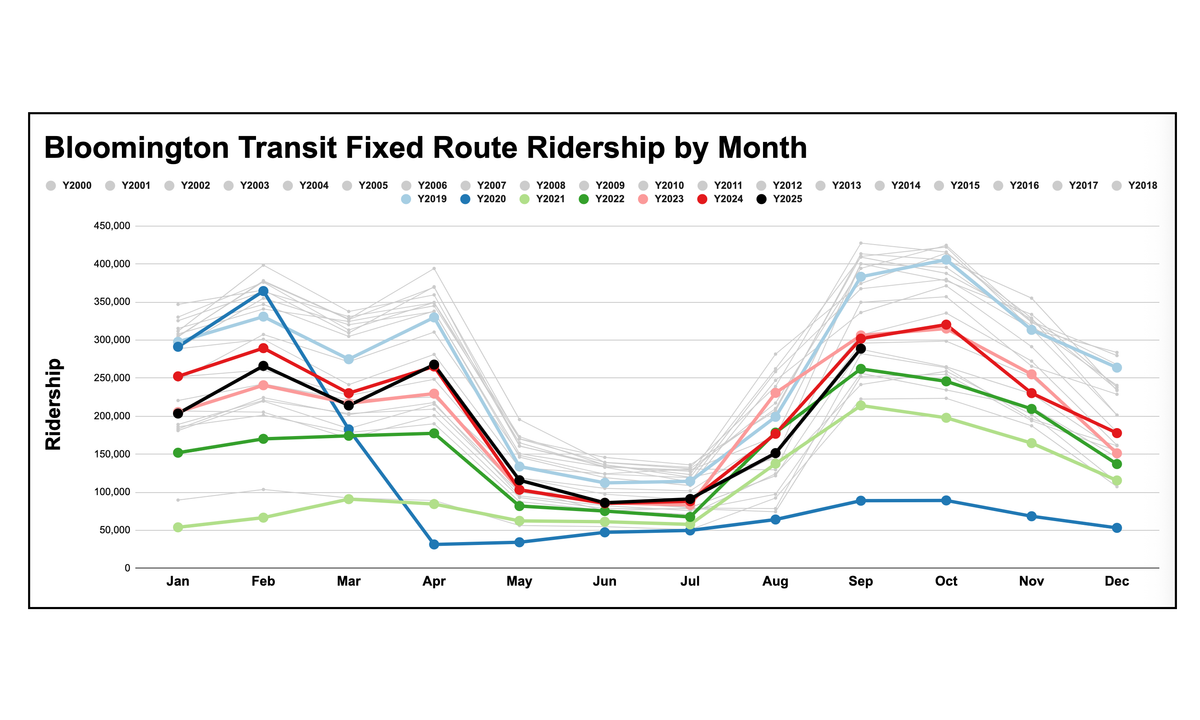

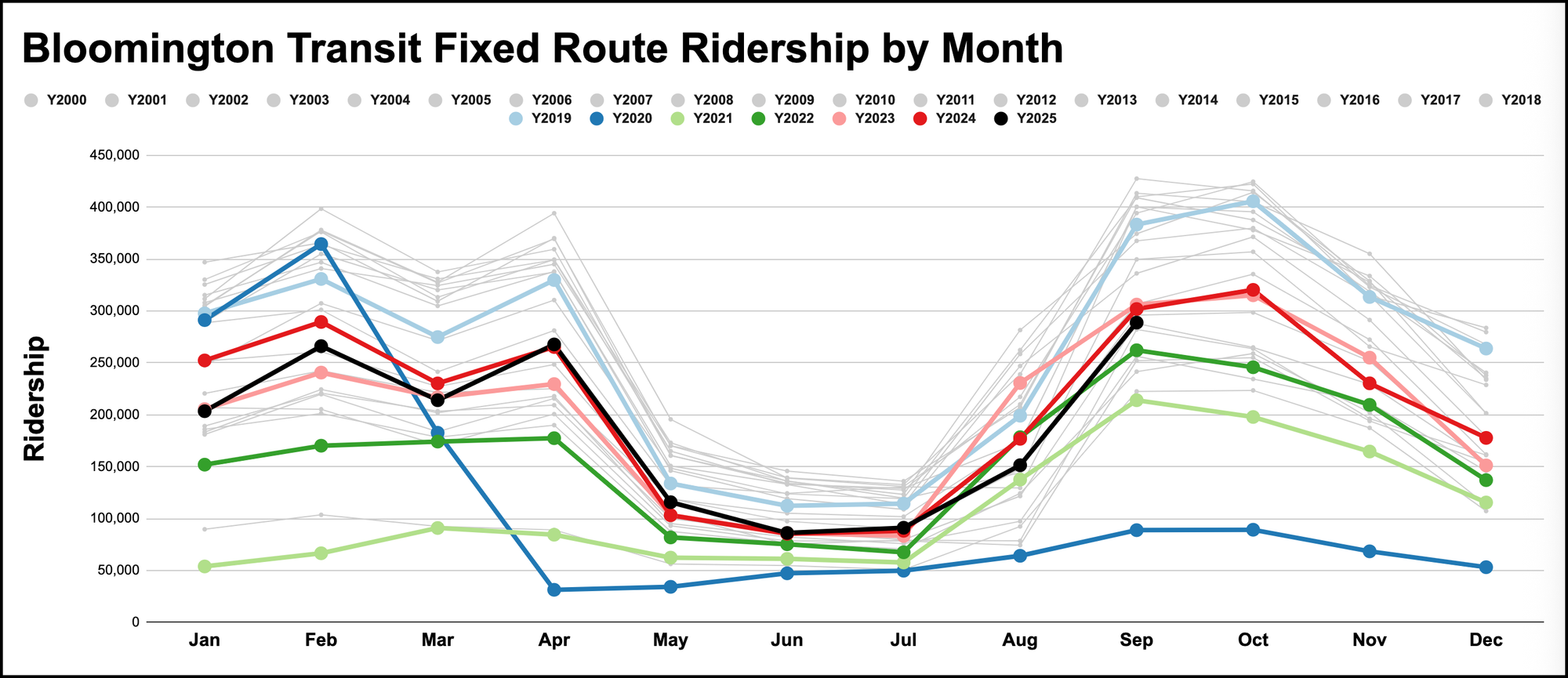

Fixed route ridership on Bloomington’s public buses continues to lag about 6% behind last year’s numbers. That’s one takeaway from the quarterly review of the transit agency’s key performance indicators given to Bloomington Transit board at its regular meeting on Tuesday.

Along with the quarterly review of system performance, the board received an update on the process that’s being used to select the builder and designer of the new maintenance, operations, and administration facility, to replace the one on Grimes Lane.

Responding to the request for qualifications for the project were three development teams, two of which were selected as finalists—523 Development and GM Development. The project is being pursued under a part of Indiana state code on public-private partnerships that is covered under state law, called a BOT (build operate transfer) process.

The newsy bit came on Tuesday when BT’s general manager John Connell told the board that GM Development had unexpectedly announced its acquisition of 523 Development. That was ultimately analyzed as a positive outcome by Connell and BT members of the board who served on the committee doing the selection process.

Ridership and other performance indicators

Data collected for the performance indicators was presented to the board by Bryan Fyalkowski, who is BT’s manager of marketing and development.

Fyalkowski reported that total ridership for 2025’s third quarter continued a downward trend that started earlier in the year.

Based on BT data just for fixed-route service, which accounts for the vast majority of BT’s ridership, the most recent year-over-year monthly numbers saw a drop in September ridership from 301,909 in 2024, to 288,823 in this year. That’s about a 4.3% drop. Over all, through the first nine months of the year, fixed route ridership saw a decrease from 1,792,986 to 1,684,858 rides, for about a 6% decrease.

Certain routes, such as 1, 7, 9, 11, and 14, saw drops in particular, Fyalkowski said. Board members asked about factors likely contributing to these declines—which included severe winter weather early in the and recent changes in route alignments. In particular, alterations to Route 9, which no longer includes Indiana University’s Tulip Tree Apartments, might have influenced overall patterns, Fyalkowski said. At the same time, Indiana University’s campus bus system has seen ridership gains, which appear to correspond with some of the decreases seen on overlapping city routes.

Routes 11 and 14, connecting to The Atlas on 17th Street and Mueller Park respectively, have also reported declines. The new Ivy Tech route (Route 13) has plateaued or possibly dipped, though its overall impact on trends for total ridership remains limited given the route’s small total ridership. In September, Route 13 carried just 1,003 passengers.

That underperforming route does have an impact on a different statistic, which is the number of passengers per revenue mile—because the route covers a big swath territory, but carries few riders. Despite that negative impact, the system overall is still meeting its goal of two passengers per revenue mile.

The inclusion of the payments to BT by Indiana University and several big apartment complexes as a part of BT fare revenue got some scrutiny from board members. But they were persuaded that it makes sense to analyze those payments as fare revenue, because they are tied directly to allowing passengers from affiliates of those organizations to get on the bus.

Shelley Strimaitis, who is BT’s planning and special projects manager, pointed out that because BT has contractual arrangements with IU and apartment complexes, its farebox recovery ratio ranks high nationally.

The farebox ratio is the percentage of the operating cost that is actually covered by passenger fares. In 2023, according to National Transit Database statistics, BT’s farebox recovery ratio for its fixed route buses was 22% and has averaged about 20% for the six years from 2018 to 2023, even factoring in three years impacted by the COVID-19 pandemic.

In 2023, BT’s fixed-route fare recovery ratio was double the national average of 11%, based on numbers in the Federal Transit Administration’s “2023 National Transit Summaries and Trends” report.

New operations center

The location of the property that Bloomington Transit has its eye on for its new operations center, to replace the facility at Grimes Lane, still hasn’t been publicly disclosed. But the board held another executive session just before its regular monthly meeting on Tuesday to discuss real estate acquisition.

The last publicly released news about the location was that PCBs were detected in one of the 10 borings that had been done in connection with soil samples, which had prompted additional testing work.

The news that was publicly discussed at the board’s meeting related to the two development teams—523 Development and GM Development—who were the finalists in BT’s process to develop a new maintenance, operations, and administration facility under a build-operate-transfer process. The committee that is handling the selection is made up of BT general manager John Connell, board chair James Mclary, board member Doug Horn, BT grants and procurement specialist Zac Huneck, and Bloomington city engineer Andrew Cibor.

Connell reported that GM Development unexpectedly announced its acquisition of 523 Development. BT Board member Don Griffin was somewhat taken aback because it meant that there was just a single company left in the running. In the end, though, Griffin appeared persuaded that it was not a bad outcome, because it allows BT to choose those members from each of the firm’s project teams that they wanted to work with, in a kind of ala carte choice of civil engineers and architects. Connell called it a chance to assemble a “Dream Team” saying, “I think it was advantageous to Bloomington Transit.”

As of last year, the total estimated cost for BT’s new facility was $54.4 million, which included $10 million for land acquisition, and $600,000 for architectural and engineering work. BT was hoping to get $35 million from the FTA (Federal Transit Authority), through Section 5339(b) of Title 49 of the United States Code. But that application did not come through.

To help pay for the project, BT is now looking at about $13.6 million of Section 5307 funding that it has been awarded but is still uncommitted. In February, Connell told the BT board that his “greatest concern at this point is that uncommitted funding could evaporate.”

Comments ()