Bloomington city council completes routine maintenance on public safety income tax rate, total still 0.25 percent

At its meeting on Wednesday, Bloomington’s city council completed its annual adjustment to the public safety local income tax (PS-LIT) rate.

The total rate that residents of Monroe County pay on their income for public safety stays the same, which is 0.25 percent.

But the way the rate is split—between funding for the countywide dispatch center and general public safety—was tweaked to fit the 2021 budget request by the dispatch center.

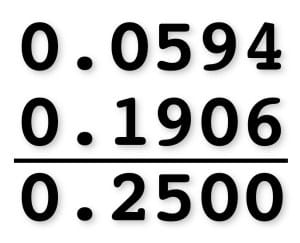

The dispatch center—known as a public safety answering point, or PSAP—needed $2,247,490 in PS-LIT revenue for its 2021 budget. The rate corresponding to that amount, based on estimates released in September by the state’s department of revenue, is 0.0594 percent.

The remaining revenue, generated by the other 0.1906 of the 0.25 total rate gets divided by city, county and town governments for general public safety purposes.

That’s a smidgen higher rate for general public safety purposes than last year’s 0.1846 percent, due to a slight decrease in the dispatch center’s overall budget.

Also bumping the general purpose PS-LIT revenue seen by governmental units in Monroe County was a decision made by the PS-LIT committee of the tax council in early August. The tax council consists of: Bloomington’s city council; Monroe County’s county council; Ellettsville’s town council; and Stinesville’s town council.

On a split vote, the committee decided to recommend that rural fire departments—qualified services providers, or QSPs—would not receive any allocations this year. One reason for non-allocation, cited by Bloomington representatives to the PS-LIT committee, was based on a look ahead to 2022, when LIT revenues are expected to be down, due to the COVID-19 pandemic. They wanted to protect the fiscal interests of Bloomington.

The state statute on PS-LIT requires that the tax council review applications from rural fire departments, but does not require that any funding be allocated.

This year, four rural fire departments made requests which were pared down by the county council to a total of $353,700. That amounted to about 4.5 percent of the estimate for total PS-LIT revenue that the committee was using at the time. The estimate was $7,789,211, which was—out of caution due to the potential impact from COVID-19—just 90 percent of last year’s number.

The estimates from the state department of revenue, which were eventually provided in mid-September, turned out to show a 9.3 percent increase compared to last year. Monroe County’s PS-LIT mid-September estimate was $9,459,193.

If the PS-LIT committee had recommended funding of the requests from the rural fire departments, the $353,700 they would have been allocated would have worked out to 3.74 percent of the total PS-LIT revenue.

That would have been 0.75 points less than the 4.5 percent that rural fire departments have been allocated in the last few years. It’s a point that was made by county councilor Geoff McKim during PS-LIT committee deliberations. Namely, pegging the 4.5 percent to a conservative estimate of revenue (90 percent of last year’s number) would mean a lower percentage than in the past, if the final numbers from the state came back higher.

McKim pointed to that possibly-lower percentage as a reason to fund the requests from the rural departments, because it would be consistent with the idea of belt-tightening. That was an argument that proved to be unpersuasive.

That means $353,700 more in general purpose public safety LIT revenue that will be divided among Bloomington, Monroe County, Ellettsville and Stinesville.

Analysis: PS-LIT distribution

Distribution of PS-LIT revenue is based on a statutory prescription, which is the same for the economic development category of LIT. The economic development category is the kind of LIT that the Bloomington city council considered imposing, but in the end rejected in a vote taken on Sept. 16.

The statutory prescription is commonly described as “based on the assessed value” of property in each governmental unit’s jurisdiction. At the Sept. 16 city council meeting, Bloomington’s mayor, John Hamilton, described the distribution of economic development LIT this way: “It’s based primarily on assessed value. I think there’s a formula but it’s the same formula that’s used for the public safety LIT.”

In fact, the distribution is based not on the assessed value of property, but on the amount of property tax actually levied in a jurisdiction.

In concept, the distribution of PS-LIT revenue is akin to the idea of matching funds that many federal programs use. Taxpayer dollars from across the country are allocated to local governments for a specific purpose, but only to the extent a local jurisdiction is willing to reach into its own pocket.

The state of Michigan applies that principle in making fire protection grants to jurisdictions where state-owned facilities are located. The theoretical assessed value of the state-owned facilities is part of the mix, but the key ingredient is how much in local funding the jurisdiction has decided to spend on fire protection.

In the state of Indiana, the prescribed method of PS-LIT distribution is based on the amount of property tax revenue a local unit has decided to collect and spend on services. So the statute describes a method of supplementing a jurisdiction’s revenues in a way that it is proportionate to the unit’s own investment through its property tax levy.

What does a city get to count as an investment in public safety with property tax? The statute doesn’t aim for precision, but does rule out some property taxes that don’t have an obvious public safety connection, like libraries and public transit corporations.

Left out of the statutory distribution formula are the investments that townships make through their property tax levies, some of which goes specifically to fire protection. Monroe County does not get to count the property tax levy by townships as part of its share in the formula. The property tax levy by the Monroe County Fire Protection District also does not count as a part of Monroe County government’s levy in the distribution formula.

Why is there a statutory provision that rural fire departments can apply for PS-LIT allocations? And why do their applications have to be reviewed by the tax council, even if the tax council is not required to honor those requests? It provides a chance for the tax council to allocate some PS-LIT revenue to match the property tax investments that are being made to support rural fire departments.

Comments ()