Bloomington city council declines mayor’s request for tax increase on 4-5 vote, proposal now dead

On Monday Wednesday night, Bloomington’s city council voted 4–5 on a request from mayor John Hamilton for a quarter-point increase to the countywide local income tax. That kills the proposal and it will not be considered by other governing bodies in Monroe County.

A press release from Bloomington mayor John Hamilton, issued 15 minutes before midnight on Wednesday and shortly after the city council’s meeting concluded, announced the news.

The headline of the press release leaves the defeat of the proposal to a calculation by readers: “City Council Renders Four Votes for 0.25% Local Income Tax Increase.”

The press release confirmed that the proposed ordinance considered by Bloomington’s city council will not be forwarded for consideration to the other members of Monroe County’s income tax council, which includes the county council and the two town councils. [IC-6-3.6-3-8]

The four votes in favor of the tax increase came from Dave Rollo, Matt Flaherty, Kate Rosenbarger and Steve Volan.

Voting against the proposal were Ron Smith, Isabel Piedmont-Smith, Susan Sandberg, Sue Sgambelluri, and Jim Sims.

The press release quotes Hamilton saying, “I am disappointed that a majority of our city council did not affirm the need for government to step up in this time of multiple crises to take care of our residents, and protect and advance the community for subsequent generations with additional revenue.”

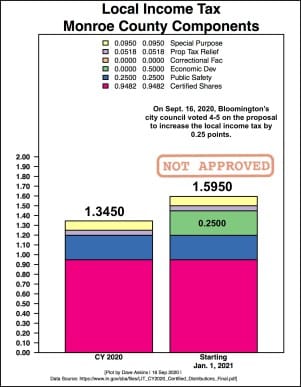

The extra 0.25 points of local income tax would have brought the total rate paid by Monroe County residents to 1.5950 percent. The higher rate would have generated around $4 million for the city of Bloomington and around $4 million for Monroe County government and the two towns of Ellettsville and Stinesville.

The arithmetic on 0.25 points of additional income tax for someone with a taxable income of $30,000 would translate to an extra $75 a year.

For some councilmembers and public commenters, a proposed new seven-member Sustainable Development Fund Advisory Commission (SDFAC), which would make recommendations on expenditures from the additional tax revenue, could have provided an assurance that the additional tax revenue would not wind up as what one public commenter described as “the mayor’s slush fund.”

Wednesday’s meeting agenda put the separate ordinance establishing the fund and the commission ahead of the income tax proposal. The fund and commission were approved on a 7–2 vote, with dissent from Sims and Sandberg.

After the 4–5 vote on the tax proposal, the council reconsidered the establishment of the fund and the commission, because their existence had become moot. The second vote to establish the fund and the commission was 0–9.

A motion by Dave Rollo to delay consideration of the new fund and commission, until after the vote on the tax proposal, died for lack of a second.

Membership on the new commission would have consisted of: the mayor, three councilmembers and three citizens.

During the initial deliberations leading up to a vote on the commission and the fund, a couple of amendments were made. One of the amendments added wording so that the ordinance did not delegate to the commission the city council’s authority to enact appropriation ordinances. Another one struck a clause that would have made the enactment of the ordinance contingent on the action of a third party.

Councilmembers Sims and Sandberg foreshadowed their votes against the ordinance by abstaining from votes on the amendments. And their votes against the ordinance served to foreshadow their votes against the tax proposal.

The idea to increase the local income tax under the economic development category was first floated publicly by Bloomington’s mayor, John Hamilton, on New Year’s Day. At that time it was pitched as a half-point increase.

In the couple of years before that, the idea had been discussed among some advocacy groups to enact a tax under the economic development category, targeting expansion of public transit.

Funding for public transit was no longer a part of the mix in the draft of the capital improvement plan put forward by Hamilton just before Labor Day. Funding for the public bus system had been been a major part of the original proposal—about half of it. For many, it was a compelling reason to support an increased tax.

Instead of focusing just on sustainability initiatives like transit, affordable housing, energy, and local food—which Hamilton described in his February State of the City address—the draft proposal that the city council defeated on Wednesday included a range of other projects.

Among the additional programs that Hamilton wanted to fund with the extra LIT revenue were social services, jobs programs, bicycle-pedestrian infrastructure, curbside composting, health care, and parks capital development projects.

Several elements in the LIT draft spending plan released on the Friday before Labor Day turned out to be continuations of initiatives that are included in the recently proposed 2021 budget, or programs that won the council’s approval in early August as part of a roughly $2 million appropriation ordinance.

If the tax increase had been enacted, it would have been collected in the economic development category of Indiana’s local income tax. Taxes collected under the economic development category in Monroe County would be distributed to just four units of government—Bloomington, Monroe County, and the two town councils. The quarter point in the proposal defeated by the city council would have been the first time any rate was imposed in Monroe County under the economic development category.

In contrast to the economic development category, a tax increase enacted under the regular certified shared category would get distributed to all the township governments, the public transit agency, the public library, the fire protection district and the solid waste management district. That distribution is based on a property tax footprint.

Using the property tax footprint is also the default for distribution under the economic development category. For the economic development category, it’s also possible in any given year for the tax council to enact an ordinance to distribute the money based on population. That has to be done by Aug. 2 in a given year. The ballpark numbers for property tax footprint versus population for Bloomington would mean a 12-point swing—46 percent on the property-tax footprint approach, compared to 58 percent if the percentage of population were used.

During Wednesday’s meeting, Hamilton said that the question of allocating based on population had not been looked at much, in part because he thinks that option could be changed by the state legislature in the upcoming session.

In the words of councilmembers

I think that this is very important vote, it’s an important thing to pass. I don’t think we have the luxury of time. And I think that’s why we need to act with this level of urgency. I think it’s exceedingly risky to delay, actually. I hope I’m proven wrong if this fails, but that’s my read. And I won’t expound, but we all know the risk. Although this is a flat tax, as has been mentioned, that’s the hand we’ve been dealt. And we can mitigate that by applying it to social service spending, which we intend to do. Can it be used for other things than what is in the capital draft capital plan? Yes, of course. The mayor has made it clear that the capital plan is yet to be determined. And what was offered was…not definitive but illustrative of what it could be used for. In any case, it will be used for our climate emergency, which we are committed to addressing. Regardless of what our economic situation is going to portend, we need to keep working. … So I think that we need to do this. I think we need to move ahead. And I think it’s a bold thing to do, but it’s necessary. I think it’s looking forward, it’s looking ahead, and I urge my colleagues to support it.

—Dave Rollo

You know, regarding some of the process concerns, again, it’s the hand we’re dealt to some extent, and I think there are valid concerns about how that may change in the future and not ones that we should easily dismiss. You know, the public safety LIT was passed with actually what one might consider a less equitable process a number of years ago, without anyone really raising any problems with it at that time. So it’s really not a problem of process, or at least, it seems everybody was OK with the process when there was a consensus agreement about the direction of things. But there’s not always going to be agreement, you know. …This kind of gets to city-county issues. We’ve done a lot of work and a lot of planning over the last five years. We’re in the Global Covenant of Mayors for Climate and Energy. … We’ve tracked our greenhouse gas emissions…We have developed detailed specific plans to address this crisis that is unfolding, in the most equitable way possible, in the way that addresses vulnerable populations, in a way that helps people here now today, with their energy burden, with their food burden with their transportation burden. And we are doing our best to implement those things, because it’s needed and we’ve committed to doing so. And our community plans and adopted goals say we should. And the county, frankly, while I think they’re sympathetic to these issues, they haven’t done the planing that we have. They don’t have a commitment on greenhouse gas emissions reductions. They don’t have targets, they don’t have a climate plan and that’s something they do need to come along with us on. And the fact that we can’t agree fully on that at this time is really a reflection of…we are differently situated with response to the climate crisis, even though we all care about it.

—Matt Flaherty

So, part of my thinking on this is you know, first we kind of started with 0.5, we were on transportation and, of course, the pandemic hit. And now we’re at 0.25. And now…is this a climate response ordinance? Is that what this is now? …I feel like it sounds like that now. And maybe that’s part of my problem, is that it’s been an amorphous ordinance to begin with. It’s kind of had too many things and it has had no focus. And that initially bothered me, right away. There’s too many things, and too many different little things. There was climate, great—you know, I’m happy to support taking care of the planet, environmental causes. There’s recreational things in it, recreational initiatives. There’s social services—of course, I’m for that, Jack Hopkins. But it’s this amorphous plan, that it’s like: Let’s raise some money and we’ll figure out what to spend it on. And that initially gave me great pause.

—Ron Smith

I want to point out that there’s more than one way to address climate change. And the 0.25 percent tax is not going to make enough money to make all the changes we need to make. That said, I hear Daniel Bingham, I hear you! We need to do everything we can do. Yes. But I feel like sometimes you can get more done with collaboration and with listening and with getting people on your side than with imposing something upon people. So unfortunately, I have to say, I cannot vote for this tax. …I’ve talked to a lot of people, people whose judgment I value greatly, and who recognize climate change is a crisis. I have also not heard a lot of support for this tax. I feel like we need to work with people on climate change, we need to bring people into realizing how urgent the situation is—so that they can make changes in their own lives and with their own businesses and with their own employees and their own investments. And I feel like raising a tax, when so many people are hurting, is not going to win us friends. You know, it’s not going to increase my ability to talk to somebody and, and let them know that we need to change the way we live because of climate change.

—Isabel Piedmont-Smith

I’m not going to be coy. I’m going to say upfront that my vote is a no. …But I will assure the public that in order to recover forward, we are going to need resources. So make it very clear: I am not going along with the individuals, the many folks who have contacted us who are, you know, frankly, you could consider them “anti-tax.” There would be nothing that we could propose tonight, or in the future, that they would feel that they wanted to pay taxes to support. We are in hard times. We are going to be facing harder times. And in order for us all, to keep this community the way we want to see it—healthy, prosperous, equitable—we are going to have to do everything in our power over the next several budget cycles in order to be on top of this. With respect to basic city services, which is what we’re all going to be called upon to provide, as well as all the wonderful amenities that have been discussed in this proposal. And I agree with many of my colleagues: It’s all over the map. There is not a clear focus to it. And that’s problem number one. Problem number two, which Councilmember Piedmont-Smith alluded to, is cooperation, coalition building, alliance building. And it is my personal opinion that that was not done adequately in order for us to get a place that we would have a proposal that would have a broad enough consensus. This is not just the city of Bloomington acting alone. We’re not in a vacuum here, we must consider our county colleagues.

—Susan Sandberg

First things first, I wholeheartedly support the goals mentioned by the mayor. And I appreciate his keeping front and center the core values of economic justice and racial justice and climate justice. Those should indeed be the lenses through which we look at every piece of legislation that comes to us, not just this one. I also agree that these are extraordinary times. The pandemic and the economic downturn and climate change are presenting extraordinary challenges. We have to respond now. And we have to think ahead and think two or three years down the road. That’s why earlier this year, when the mayor introduced an earlier phase of the Recover Forward plan, I was pleased to support it and I voted with a lot of people colleagues to take our reverted funds…to redeploy it, to find ways in which to use it to help us recover forward… Looking at this legislation, the proposal before us, it isn’t talking about reversions and just redeploying…unspent funds. It’s asking us to impose a new tax, with no sunset date, on our residents. And that’s a qualitatively different decision, in my mind. And while it does point to the three broad themes we talked about, it isn’t talking about a clear coherent set of priorities. It’s talking about an eclectic set of initiatives ranging from downpayment assistance on housing, to undefined “support” for life sciences jobs, to planting and pruning urban trees. And it isn’t based on…substantial public engagement, or truly collaborative discussions with our colleagues and county government. We already have a strained relationship in many ways. So when I looked at this legislation, I asked myself, is there a clear coherent plan in place? Are we close to one for spending these funds?

—Sue Sgambelluri

It’s difficult here in Indiana, right? I mean, we wanted to ban plastic bags and then were banned from banning bags. We can’t have true inclusive affordable housing, we can’t do these progressive taxes. So I think, especially in times like this, we have to do our best to move forward and…to get pretty creative to support our community members, especially when there’s just such a great need and people are having such a hard time. So I think with this tax, and with an outline of how it would be spent, and now with the the ordinance to create a commission to really make sure this is going toward the purposes that we’re here for—I think this was our way to work around the system in front of us and make something as similar to progressive taxes we could here in this state…We will be taxing all income, but we would use those funds to help people in the most need and we would use those funds to take steps to adapt and mitigate our changing climate.

—Kate Rosenbarger

I was one of those folks, before I ever came to Bloomington 45 years ago, that grew up with very, very little means. Meager, you might even say. I value the dollar. I am one of those people who happen to be a very liberal, yet financially conservative. I’ve been going back and forth, back and forth. Yes, we could use some extra revenue to do certain things. Or maybe we ought not, maybe we ought to just tighten our belts and withstand all of this. …I was prepared to support this several hours ago, even though I talked with many, many people,…what many of us would consider heavy hitters in this town, very influential people, very knowledgeable people. It was difficult. Corporations, organizations, people that I have worked with hard, in order to better this community. …This is difficult. …As we listen this evening, I get to thinking: Is this really the “greater good” as I had thought a couple hours earlier? What about the process? I’ve heard from community folks, many of you have, but did we get extensive community input? And when I say extensive, I mean meaningful input. Did we really get that? I was a little shocked—and I hope no one views this as non-supportive of some of our climate change issues—but part of the ordinance we talked about it, and how it kind of changed from the overall good to a more specific part of the agenda. That, in my mind, does not reciprocate well, through a lot of the other pegs of social justice. Now, I know there is some interconnectivity, as I’ve talked with several folks. But there’s still, in my mind, not an equitable distribution across the board, that is going to uplift everyone.

—Jim Sims

The entitlement that non-city residents demonstrate in giving their opinion about how the city should behave astonishes me. To those who say that the tax is regressive and unrepresentative of non-city residents, first, I say that is an argument to cut taxes in the name of poverty relief—which sounds like a talking point that Republicans have been making for the past 40 years. That argument has validity only as much as the use of those tax dollars doesn’t help those most in need. Second, I say emphatically, that your quarrels, ladies and gentlemen, are not with this city council but with the State House. The LIT used to be the LOIT, the local option income tax, and there used to be a county option income tax. The state has literally removed the option and all other options from us. The General Assembly and previous governors administrations the past decade have threatened the very sovereignty of the city of Bloomington. Do not underestimate the anti-city sentiments of those who are also anti-tax. The mayor was right. If he doesn’t present a proposal, he is criticized for no detail, but if he presents a specific plan, he’s criticized for the details. … Nevertheless, the panoply of initiatives the mayor proposed, only serves to glaze people’s eyes over and open his proposals up to criticism that it was unfocused and not directly related to either climate or racial justice. He could have mitigated this by simplifying the ask. Had the mayor sold the tax solely as a bulwark against the greater recession created by the pandemic—because we know that fiscal year 2022 and later budgets are going to be grimmer than the Great Recession a decade ago—it might have found favor tonight. But I think more likely that had the mayor proposed a 25-cent tax that would go entirely to public transit, I would have been surprised if it didn’t pass with the votes from across the LIT council. Public transit now is like dispatch was four years ago, a service that has been consistently underfunded, but serves everyone and is something most everyone can agree on, particularly our county colleagues. A year ago, not only was I enthusiastic about a 50-cent LIT, half of which would go to transit, I’ve been actively asking the question: Why wouldn’t we devote the entirety of a 50-cent tax to transit? The only hesitation I have about proposing that right now is that it might be a while, thanks to COVID, before the new transit service that these dollars would fund would benefit anyone. These are reasons why I support this tax now. But if it is true that we are not actually voting on spending tonight but merely the raising of revenue, it may not be too late to call for such a tax instead to be used for transit, maybe even to convert this proposal to a transit LIT. I welcome everyone to consider that idea as we consider this problem in the days, weeks, months and years to come.

—Steve Volan

Comments ()