Bloomington city council enacts 0.69-point tax increase for Monroe County residents on 9–0 vote

On Wednesday night, Bloomington’s mayor John Hamilton did not get the full 0.855-point local income tax (LIT) increase he had asked Bloomington’s city council to approve.

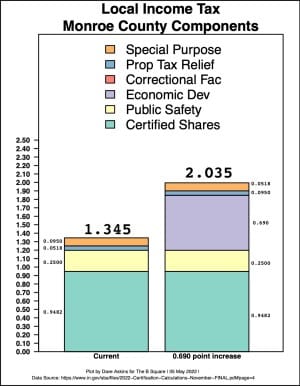

But the council did approve a 0.69-point increase, which will generate around $14.5 million annually in new revenue for the city of Bloomington. The additional 0.69 points brings the countywide income tax rate to 2.035 percent.

The new rate will take effect on Oct. 1.

Based on the category of income tax used for the increase (economic development) and the method used for distribution (population-based), the additional 0.69 points will also mean additional annual revenue of around $10 million for Monroe County, around $1 million for Ellettsville, and around $40,000 for Stinesville.

Those are the only four units of government that receive a distribution under the economic development category of local income tax.

The original proposal from Hamilton would have generated about $18 million in annual revenue for Bloomington. The intended expenditures fall into four categories: climate change preparedness and mitigation; essential city services; public safety; and quality of life.

Held as a political bargaining chip since it was ratified in early March was the new labor contract with police officers, which is set to take effect in 2023. The new contract includes a 13-percent raise in the first year, which is estimated to cost around $1.5 million annually.

Hamilton’s administration considered the contract to be contingent on approval of a substantial local income tax increase. That meant it had been left unsigned. Now that the LIT increase has been approved, that contract will be signed and put in front of the city council for approval.

After the council’s meeting Hamilton approached Paul Post, who’s president of the police union, and was seated in the audience. Their brief exchange was focused on the fact that now they could move ahead with signing the new labor contract.

In the list of projects that Hamilton had proposed, the $1.5 million to cover the new police contract was one of the few that was not reduced at least somewhat in the course of the behind-the-scenes political horse-trading that led to the 0.69-point increase.

From councilmember Kate Rosenbarger’s perspective, it had been only seven of the nine councilmembers who had worked on compromises over the last few weeks. At Wednesday’s meeting, Rosenbarger said, “I think the administration and—I would say—seven of us, have been working really hard over the last few weeks to come up with a good-faith compromise on this.” Rosenbarger added, “It’s been difficult for me to have some colleagues absent from our conversations and our compromises.”

Rosenbarger’s remarks came in the context of a motion to postpone the final vote, after the amendment had been approved, which reduced the increase under consideration from 0.855 points to 0.69 points.

The proposal had already been postponed twice before. It was Dave Rollo, who wanted on Wednesday to postpone again, because he wanted to try to ratchet down the increase a bit more.

The way Rollo wanted to try to lower the rate involved using more of the $16 million in two expiring CRED (community redevelopment district) funds, towards down payments for a combined new police/fire headquarters. Because they are expiring, the amounts can be transferred to the general fund and be used for any purpose in any location, according to controller Jeff Underwood at the city council’s meeting a week ago.

In negotiations between the mayor and councilmembers, which apparently took place outside of public meetings, Hamilton committed to using $3 million of the $16 million towards a new police/fire facility. Rollo wanted to use more than $3 million.

Rollo’s bid to postpone the vote failed on a 3–6 tally. Joining him in support of postponement were only Ron Smith and Susan Sandberg.

With the 0.69-point increase set up for a final vote, and after the other eight councilmembers had already indicated they’d support it, Rollo began his final remarks in a way that sounded like he could vote against it.

Rollo said, “I think that I agree with Eric Spoonmore, that this comes at a terrible time.” Spoonmore, who is a former county councilor who is now president and CEO of the Greater Bloomington Chamber of Commerce had weighed in during public commentary against the timing of the LIT increase.

Rollo continued, “And I would just say that a good time or a better time would be a time when people’s salaries were keeping pace with inflation and that they had discretionary spending that could absorb this kind of tax. But the opposite is true right now. So it is a bad time.”

But the new police contract was the deciding factor for Rollo: “I will support it, because the [police union] contract must be honored.”

Even if Rollo had voted against the increase, the other eight votes in favor would have been enough to enact the tax for the whole county based on the way individual votes are weighted for the city council, the county council, and Ellettsville’s town council.

Based on the amendment included in an addendum to the city council’s meeting information packet, here’s the breakdown on the changes to the spending proposal that allowed the reduction of the increased rate from 0.855 to 0.69 points. [Direct link to shared Goog Sheet]

Comments ()