Bloomington econ dev commission to ‘re-Zoom’ meeting efforts in time for review of tax abatements

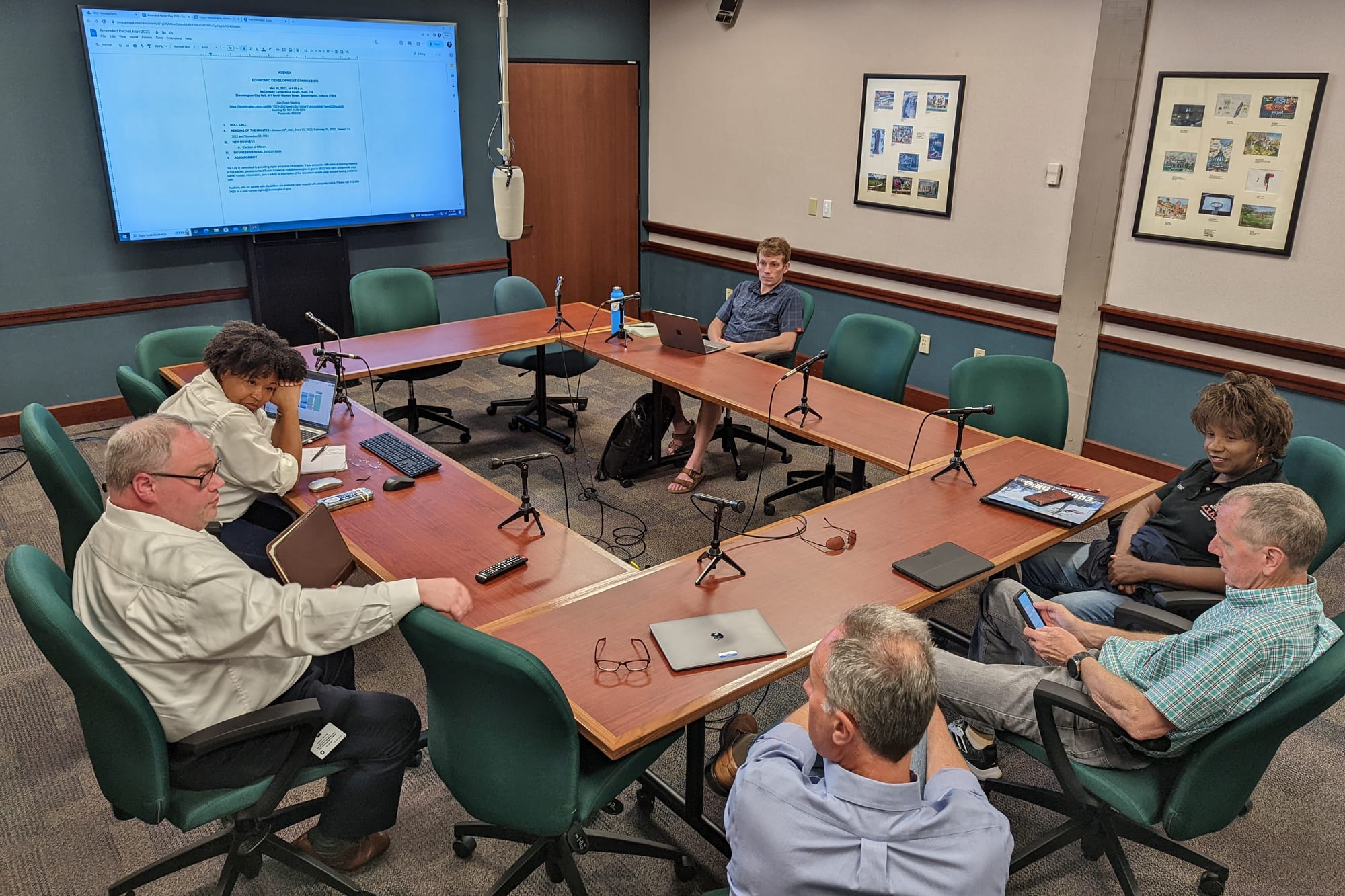

On Tuesday, Bloomington’s five-member economic development commission (BEDC) tried to meet for the first time since October of last year.

All the pieces for a meeting appeared to be in place. Three of the five BEDC members were physically present in the McCloskey Room at city hall.

The majority attendance meant the group had the required minimum number to meet—a quorum. That number also satisfied Indiana’s Open Door Law which has a 50-percent in-person requirement for electronic meetings—in case any BEDC members had wished to attend by using the Zoom video conferencing platform.

But the Zoom link that had been provided in the official public notice of the meeting did not work. When an attempt was made to launch the Zoom interface for the meeting, an error message was delivered, which read: “This meeting ID is not valid.”

Assistant city attorney Larry Allen told those who had assembled for the meeting that because Zoom access had been advertised to the public under a specific link, but could not, in fact, be made available, his advice was to not hold the meeting.

The inoperative link was apparently created by a former city employee, whose account no longer exists.

The five-member BEDC consists of: Matt Flaherty (city council selection); Geoff McKim (county council selection); and Vanessa McClary, Kurt Zorn, and Malcolm Webb (mayoral selections). The quorum present for Tuesday’s attempted meeting consisted of Flaherty, McClary, and Zorn.

The BEDC was created under state law to use “a variety of tools to stimulate redevelopment and increased employment, including tax abatements and economic development revenue bonds.”

Tuesday’s BEDC agenda did not include matters that looked particularly pressing—election of officers and the approval of meeting minutes, which in one case dated back to 2021. So the impact of Tuesday’s meeting cancellation was light—not much different from the last six months’ worth of meetings that have been canceled.

But at its next meeting, the BEDC will take up what could be considered to be the main business for the commission in any given year—a review of performance for those companies that have been given tax abatements. One common kind of performance metric is a specific number of jobs that the company will add to its workforce.

After the BEDC reviews the material against the benchmarks that companies were supposed to achieve, Bloomington’s city council reviews the submitted material. The council has the option of revoking a tax abatement.

Companies that receive a tax abatement are required every year to submit information demonstrating compliance with the terms of their abatements. According to the state statute on tax abatements [IC 6-1.1-12.1-5.9], the annual deadline to submit that information is May 15.

During this year’s review, a tax abatement that will likely generate some interest among city councilmembers is the one that was granted to Catalent last year on a split city council vote.

The city council has a 45-day window to initiate action to revoke a tax abatement based on non-compliance. Based on the wording of the state statute, the window does not start when the deadline falls, but rather when the “designating body,” which is the city council, receives the required information from the company.

At the Bloomington city council’s April 19 meeting, Bloomington’s director of economic and sustainable development, Alex Crowley, notified the council that Hoosier Energy Rural Electric Cooperative had submitted the required information about its tax abatement, and that Hoosier Energy had exceeded the requirements.

About Hoosier Energy’s submission of its compliance material this year Crowley said, “But unfortunately, they did it early. So we have to come to you a little bit out of process in order to give you the opportunity to react to this, in advance of the termination of the 45-day period.”

The city of Bloomington appears to treat the May 15 deadline for submission as the start of the 45-day window, and asks that companies submit their material to the economic and sustainability department (ESD), instead of the city council.

The ESD then forwards the material to the city council as one batch for consideration.

The statute describes the 45-day window keyed not to the due date, but rather to the date that the documents are received: “Not later than forty-five (45) days after receipt of the information described in section 5.1, 5.3(j), or 5.6 of this chapter, the designating body may determine whether the property owner has substantially complied with the statement of benefits approved under section…” [IC 6-1.1-12.1-5.9]

Hoosier Energy’s submission was apparently made directly to the city council, which meant the 45-day clock on council action had already started when Crowley addressed the council in April. The council did not initiate any action to revoke the tax abatement for Hoosier Energy.

The next Bloomington economic development commission meeting is set for June 13. But that date could change, due to quorum issues.

Comments ()