Bloomington mayor proposes $147M budget for 2026, would tap $11.2M in reserves

Last Friday, Bloomington mayor Kerry Thomson released her proposed budget for 2026—which includes a total of about $147 million in spending. That compares to about $143 million for 2025, according to the city’s budget book.

Last Friday, Bloomington mayor Kerry Thomson released her proposed budget for 2026—which includes a total of about $147 million in spending. That compares to about $143 million for 2025, according to the city’s budget book.

The news release that came with the budget release stressed the reduced revenues that all local governments will see because of SEA 1, a bill enacted by the Indiana state legislature this spring. The headline to the news release mentions a “tighter fiscal climate” and talks about the need for “the City to reassess which services it delivers …”

SEA 1 gives property owners a tax break, which for 2026 translates into about $1.4 million less revenue for the city government than it would have received without the impact of the new legislation. In future years, the impact will be more, and the city will have to negotiate with the Monroe County council for some of its local income tax revenue.

For the general fund, Thomson is proposing to tap $11.2 million in reserves to balance the 2026 budget. That compares to $12.1 million in reserves that were tapped to balance the proposed 2025 budget.

The 2026 budget includes enough spending for a 2% COLA (cost of living allowance) as an increase to compensation for non-union positions. AFSCME (American Federation of State, County and Municipal Employee) workers in Bloomington city government are currently in contract negotiations for an increase in 2026. Police officers and firefighters will receive a 3% increase in 2026 under the terms of their collective bargaining agreements reached last year.

The proposed 2026 budget calls for the elimination of two special projects coordinators—in parks and in CFRD (Community and Family Resource Department). According to the mayor’s office, both positions are currently vacant.

Proposed to be added are two jobs in planning and two in engineering, which are intended to take the place of outside consultants, for a net cost of zero. In addition to the four jobs that are replacing consultants, two jobs are proposed to be added to public works, one of them a deputy director.

The net effect of the job eliminations and additions, factoring in the saved cost of consultants, is supposed to be an increase in spending of around $40,000.

One of the themes of the budget book is the idea of a “deficit.” The memo from Bloomington mayor Kerry Thomson says, “My administration is focused on reducing a pattern of deficit spending...” City controller Jessica McClellan’s controller’s memo reinforces the idea of deficits: “[A]ll adopted/proposed budgets [from 2022 to 2026] show a deficit except 2023 …”

The idea of a deficit has been a recent talking point for Thomson, saying in a July episode of Indiana Public Media’s Ask the Mayor: “When my administration took over, we inherited a budget with a $16 million deficit, and I’ve been committed to reducing that deficit…”

The kind of deficit that Thomson means is the difference between budgeted revenues and budgeted expenditures—not a shortfall of revenue in a given year compared to actual costs for that year.

The 2024 budget was the spending plan for Thomson’s first year in office, which was proposed by her predecessor John Hamilton and approved by the city council in 2023. The 2024 budget called for $66.5 million in spending against just about $51 million in revenues—the apparent source of Thomson’s reference to a $16 million deficit.

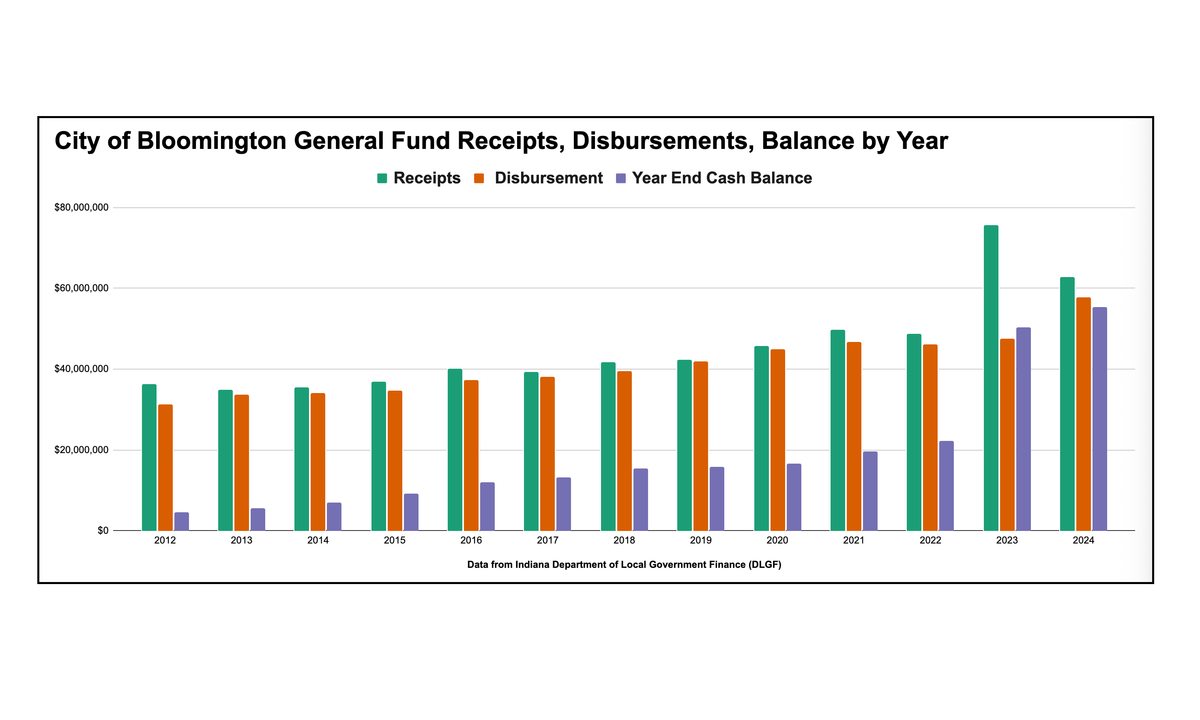

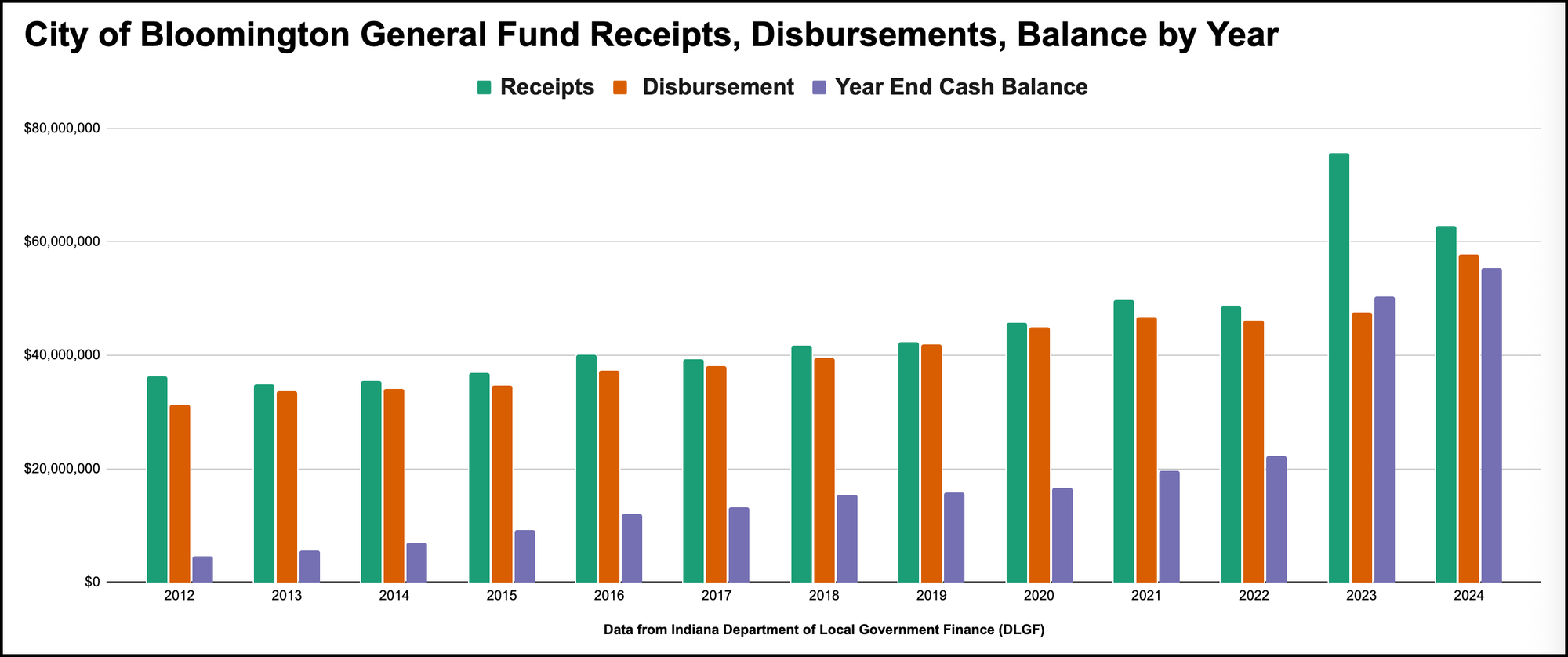

The actual numbers from Indiana’s DLGF (Department of Local Government Finance) show an increasing fund balance every year for Bloomington’s general fund, starting in 2012. That includes 2024, which on paper showed the nearly $16 million difference in revenues and expenditures that Thomson mentioned.

The actual spending for 2024 was just $57.7 million compared to $62.7 million in revenues.The difference came from several revenue items that the Hamilton administration had significantly under budgeted. In 2024, revenue from supplemental local income tax was greater by $3.7 million and interest income was greater by $5.6 million than the budgeted numbers, according to the 2026 budget book.

At the end of last year (2024), Bloomington’s general fund balance stood at $55.3 million.

Even though the 2025 budget—Thomson’s first as mayor—called for using $12.1 million in reserves, that much might not be needed to balance out the spending. Based on the memo from human resources director Sharr Pechac in the 2026 budget book, the amount that was needed to implement the city’s new salary grades, and credits for prior experience, was about $4.33 million. For that project, $6 million had been appropriated. That leaves a surplus of $1.67 million.

No explicit financing plan is included in the 2026 proposed budget to convert the now vacant 714 S. Rogers building to a police headquarters. That’s the prefered alternative for the Thomson administration for addressing the police department’s need for more space. The building is the former home of the Bloomington Convalescent Center, and is undergoing mold remediation, funded by Bloomington’s redevelopment commission (RDC).

Bloomington’s RDC is also mentioned in 2026 budget book as providing $50,000 for preliminary due diligence and design for the rehabbing of 714 S. Rogers. Such projects are not separated out as programs for the purposes of the budget book. But the building gets a mention in the budget book the context of large capital projects “that would likely be funded by bonds.”

SEA 1 has a negative impact on the ability of local units to issue bonds. For general obligation (GO) bonds, local units have to wait a year after existing general obligation bonds expire before issuing new bonds. Bloomington’s city council approved the issuance of two-year GO bonds last year.

Another impact on the ability of local units to bond is that they cannot pledge more than 25 % of their local income tax (LIT) distributions to pay the debt on a bond issuance. The city has estimated the cost of renovating the 714 S. Rogers building into a new police headquarters at around $23 million.

Comments ()