Bloomington plan commission OKs $1M payment instead of onsite ‘affordable’ units at Relato, still needs council nod

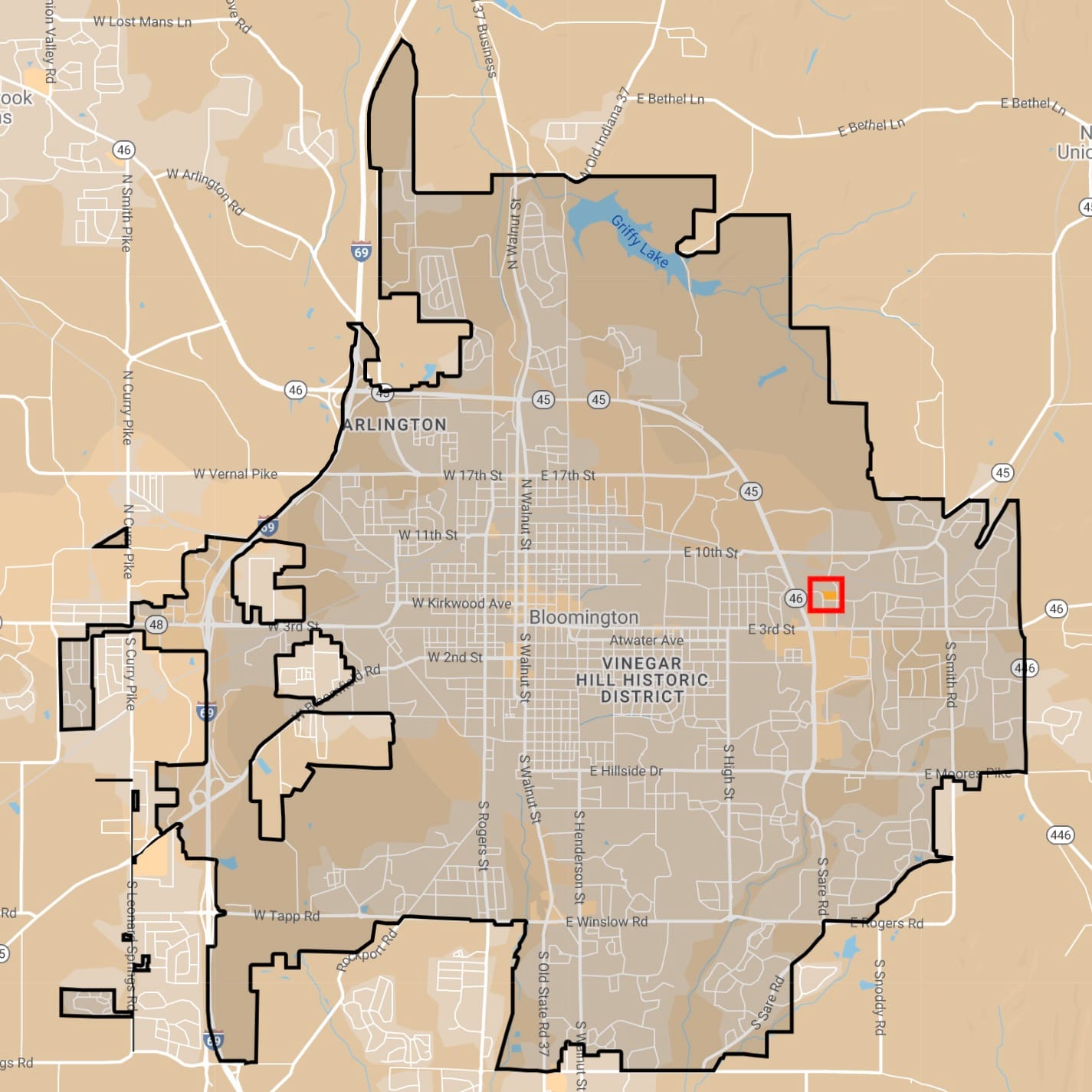

When its zoning was approved by the Bloomington city council almost five years ago, The Relato Bloomington apartment building on the east side of town was supposed to include several “affordable” units—15 percent of its total bedrooms.

Now the owner wants to alter the PUD (planned unit development) zoning, and pay about $1 million into the city’s housing development fund, instead of signing a portion of its leases with income-restricted tenants.

The request to swap a $1-million payment for provision of onsite affordable units cleared one hurdle on Monday night, winning a 6–1 recommendation from the city’s plan commission at its regular Monday meeting.

Dissenting was Hopi Stosberg, who is the city council’s representative on the commission.

Because it’s a change to the zoning, the request will have to win approval from the city council as well. That will be one of the first orders of business for the city council in 2025.

The proposal from project owner SPCW JV, LLC is modeled on a payment-in-lieu option for achieving affordable housing incentives in Bloomington’s new UDO (unified development ordinance). But the payment-in-lieu option does not exactly apply to the Relato building, because its zoning was approved before the new UDO was passed.

Stosberg called it a “cop out” if a developer used the payment-in-lieu approach to satisfy an affordable housing option, but does not accept housing vouchers. Housing vouchers are a form of public assistance that helps low-income people afford rent in the private market.

Tom Jasin, who represented SPCW at Monday’s plan commission meeting, had responded to a question from Stosberg by saying that The Relato does not accept housing vouchers.

The connection between a developer’s use of a payment-in-lieu approach and a requirement that the development accept vouchers is not yet a part of Bloomington’s UDO. But it could soon be added, based on a resolution put forward by Stosberg and adopted by the city council in the third week of November.

The resolution in part directs the plan commission to prepare a proposal to amend the UDO to require housing developments that use the payment-in-lieu option to accept housing vouchers.

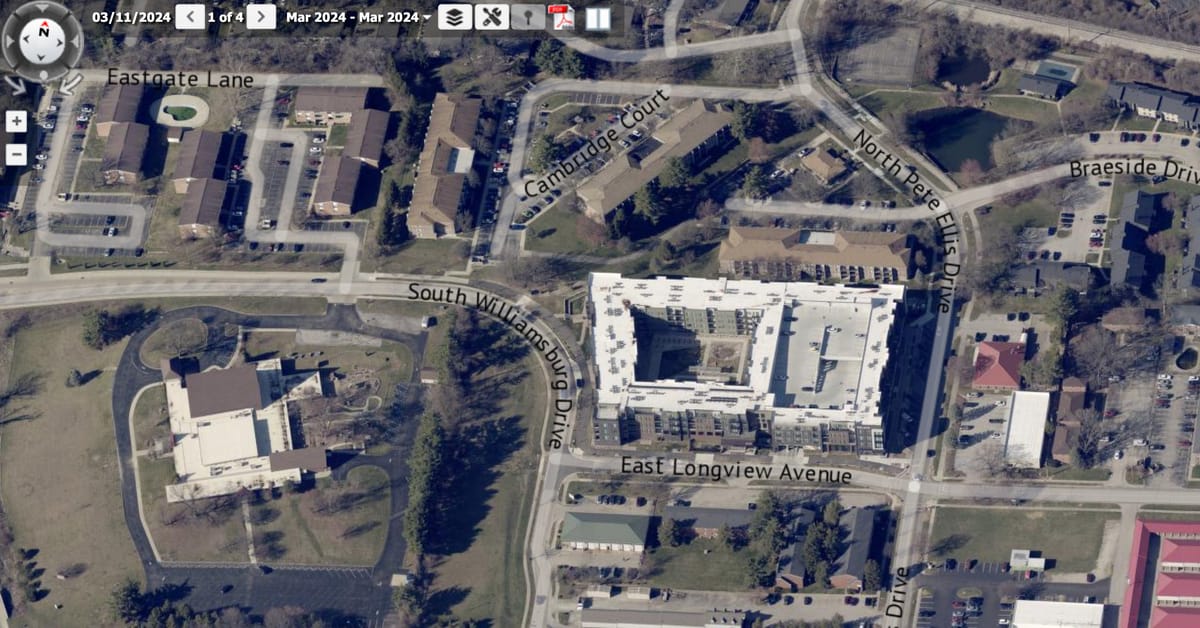

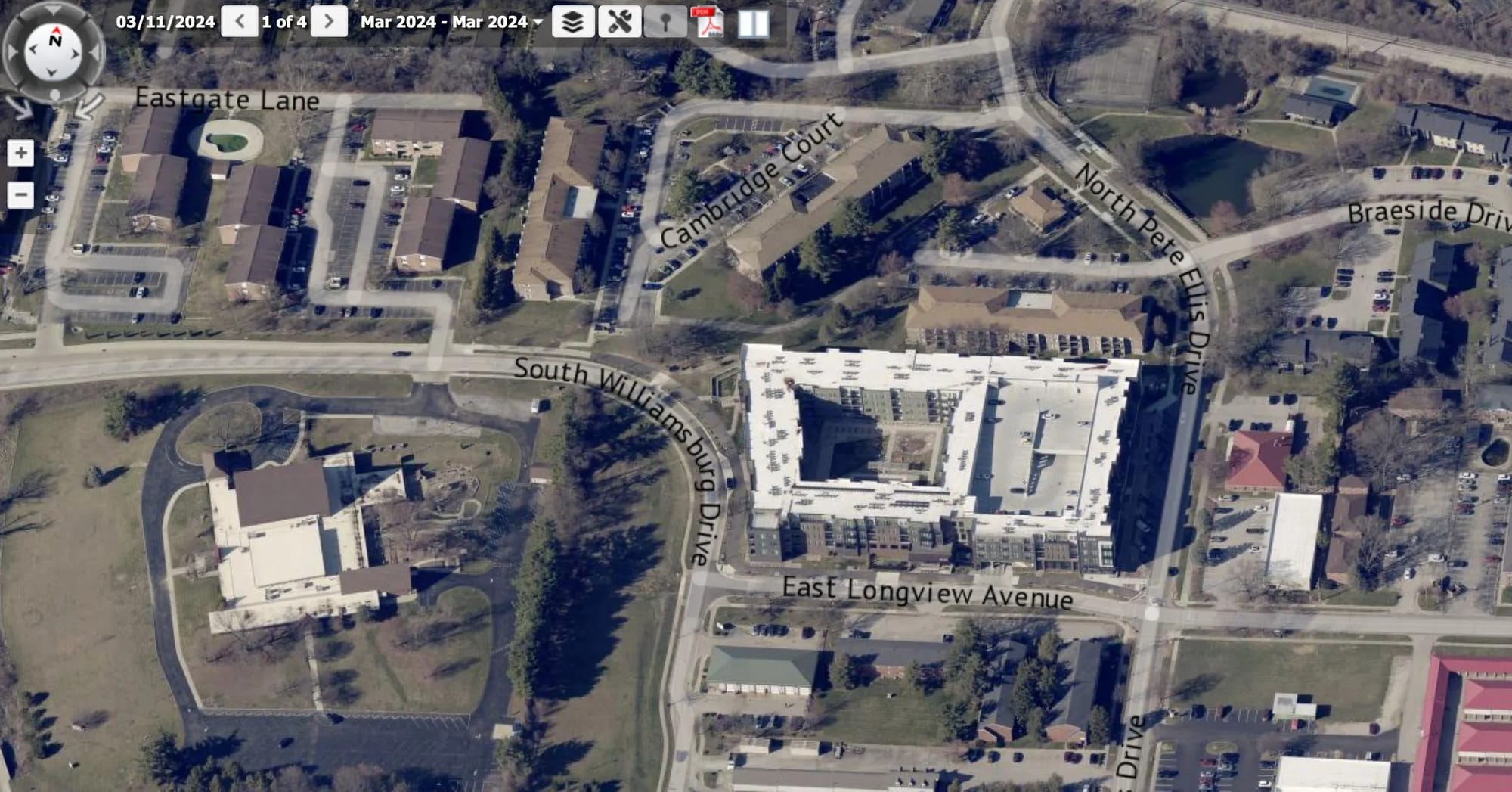

The Relato building, which stands four stories tall on 3.2 acres at the intersection of Longview Avenue and Pete Ellis Drive, includes 233 apartments with a total of 341 bedrooms. There’s also 14,000 square feet of commercial space and a 254-space parking garage building inside the building.

Under the terms of the zoning commitment—an agreement between the city of Bloomington and Bloomington SPCW JV, LLC—the project was supposed to make 15 percent of the units available to tenants who meet certain maximum income requirements. The 15-percent figure works out to 52 of the 341bedrooms.

Under the agreement, 10 percent of the bedrooms have to be available to tenants earning 100 percent of AMI (area median income) and 5 percent of the bedrooms for tenants with income no more than 120 percent of AMI. Apartments keyed to this level of AMI are commonly called “workforce” housing. The first zoning commitment, which was recorded three years after the city council approved the zoning, runs for 99 years.

But according to the memo submitted by the developer, it has proven difficult to find tenants who meet the income requirements: “Since opening, and despite its best efforts, SPCW has had difficulty in securing qualifying tenants for the designated units and sees a payment in lieu as an effective way to assist the City’s efforts concerning workforce housing.”

On Monday night, Jasin told the plan commission that in 2023, just 17 of the 52 workforce units were leased out. In 2024 the building saw a marginal increase and currently has 25 of the 52 affordable units leased.

Even though Stosberg voted against the recommendation, she was successful in getting her plan commission colleagues to add a requirement that Relato has to allow those tenants currently leasing the workforce units to renew their leases as long as they continue to meet the income requirements.

Under the terms of the zoning commitment, it is only studios and one-bedroom units that are made available as workforce units.

Jasin told plan commissioners on Monday that the 80-percent AMI rate for studios is $817, and for one-bedroom units is $957.

Bloomington’s housing and neighborhood development (HAND) director, Anna Killion-Hanson, noted that even at the 80-percent AMI rate, a tenant has to be earning $50,000 a year. Killion Hanson said she believes part of the reason some Relato workforce units are sitting vacant is that the AMI percentages are “far too high.”

Reached by phone, local developer Mark Figg told The B Square that designating a small number of affordable units inside an otherwise market-rate building “just doesn’t work very well.” Figg said he has avoided doing that, by making a whole building subject to AMI requirements.

As one example of the whole-building approach, Figg gave the Patterson Pointe, towards Bloomington’s west side, which he developed in 2018, as an affordable senior housing project. Figg described Patterson Pointe as “a home run.” He added, “I mean, it’s absolutely full!”

The formula used by the city to calculate appropriate payment-in-lieu amounts is $20,000 per bedroom, for each of the 52 bedrooms, which works out to $1,040,000 to be paid to the city’s housing development fund.

Established in 2016, at the end of 2023, the city’s housing development fund had a fund balance of $2,634,269.86. Based on figures from Bloomington’s online financial system, the fund has seen revenues of $119,209 in 2024, due to interest and repayment of principal on loans.

Since 2018 about $1.8 million has been spent from the housing development fund.

Comments ()