Bloomington RDC OKs payment of property taxes connected to real estate deal for convention center expansion

On Monday night, Bloomington’s redevelopment commission (RDC) approved the payment of some property taxes, on land it does not (yet) own.

The uncommon circumstance arose from the fact that when the RDC purchased the Bunger & Robertson property on College Avenue last year for $4,995,000, the deal did not include two parcels making up the north part of the parking lot that serves the building.

That portion of the parking lot has different owners. Based on a count using aerial images from the Monroe County GIS database, the two parcels include around 45 parking spaces.

The RDC is still looking to buy the parking lot parcels, so they can be used for the Monroe County convention center expansion project. That’s why the RDC bought the Bunger & Roberston real estate.

The convention center expansion is currently paused due to the impact of the COVID-19 pandemic.

For now, the RDC is leasing the two parking lot parcels from the owners. The deal approved by the RDC in May includes a contractual agreement that the RDC pay $3,500 a month, for an annual total of $42,000.

But the contract also includes a requirement that the RDC pay the property taxes on the parcels.

It was payment of the property taxes that the RDC approved at its regular Monday night meeting.

The tax bill they agreed to pay was $11,853.07, which covered the last half of 2019 and all of the property taxes in 2020. The tax bill included a delinquency payment of $360.37, which drew some questions from RDC members.

Assistant city attorney Larry Allen said that the city had not received an invoice from the land owner, and the lease agreement was silent about the payment of any tax penalties. Allen told RDC members that in the future, legal staff will do whatever is needed to make sure the property taxes are paid on time, even if no invoice is received.

As RDC president, Don Griffin, put it, “I guess, you know, we have to pay.”

When the lease arrangement was approved couple of months ago, at its May 18 meeting, RDC members discussed another clause of the agreement—which gives the RDC an option to purchase the land after a year—in 2021.

At the May meeting, Allen said any purchase would still have to go through the standard RDC procedures for the parcels. Allen said appraisals had already been obtained, but that new appraisals would likely be obtained before the purchase.

Griffin wanted to know if the owners, listed on Monroe County property records as Thomas Sicks and Nancy Held, had named a price that they would be comfortable with.

Allen said the owners had not named a price, but said they seemed comfortable, based on the numbers in the initial appraisals, with the idea that they would eventually convey the land to the Bloomington RDC. As the time for negotiations approaches, in 2021, it’s the sort of thing that would probably be addressed in an executive session of the RDC, Allen said.

The term of the lease arrangement, with the option to purchase by the RDC, was meant to allow the owners to get comfortable with the idea of selling, Allen said. The land has been their family for a long time, Allen said.

Some of the historical paperwork provided to the RDC for its May meeting dates back to 1956.

The convention center expansion has been on hold due to the COVID-19 pandemic, which has impacted food and beverage tax revenues. That’s the revenue source meant to pay for the $44 million project.

Both Bloomington and Monroe County have used some of the accumulated food and beverage tax revenues for relief of business and non-profits impacted by COVID-19. Bloomington’s loan program has distributed around $1 million in food and beverage tax revenues. Monroe County’s grant program has distributed around $400,000.

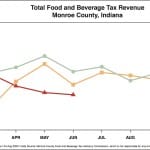

Food and beverage revenues for June, which were released by the county on Tuesday (Aug. 4) show a clear impact, but not as bad as some had expected.

In reports for the three months that show COVID-19 impacts—April, May, and June–the total (city and county) food and beverage tax revenue so far this year is $542,490. That’s about 60 percent of the $906,809 that was collected during the same three months a year ago.

Comments ()