Bloomington to see $2.5M more in LIT revenue, Monroe County govt $2.1M more

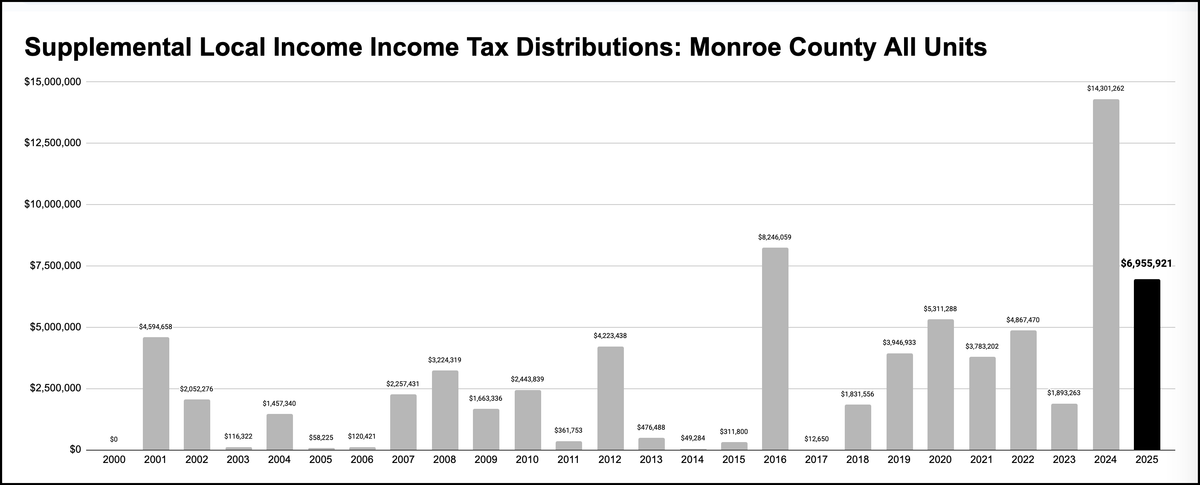

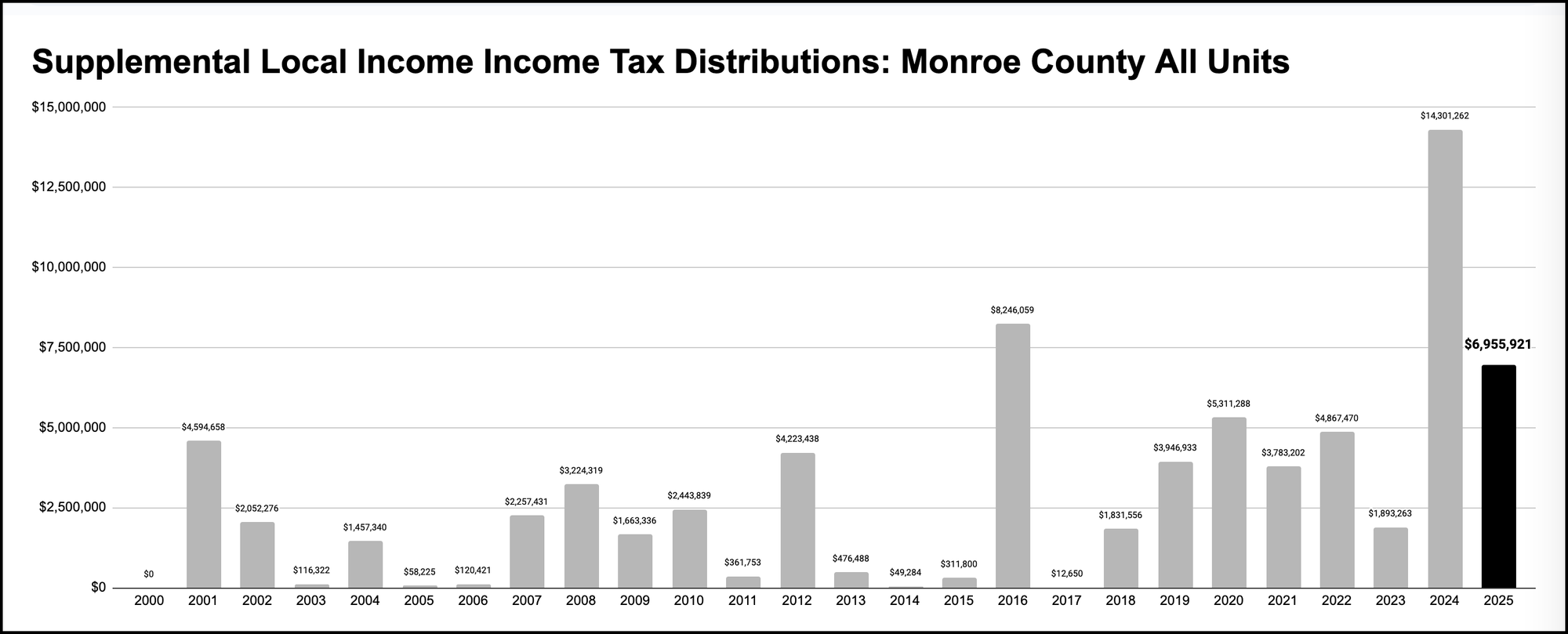

In mid-February, Indiana's State Budget Agency (SBA released the calculations for supplemental amounts of local income tax revenue (LIT) for local government units, broken down by county.

On Friday (May 9), the $6.9 million in total additional revenue for Monroe County units this year got broken down further—by unit.

The takeaway for the mayor and city council of Bloomington is that there'll be about $2.5 million in additional local income tax revenue for basic expenditures that was not included in the numbers calculated for the start of the year.

In the two basic categories of LIT of certified shares and the economic development local income tax (ED LIT) combined, the city of Bloomington was already calculated to receive about $32.6 million this year. The additional $2.5 million in this week's report will bring Bloomington's total in those two categories to around $35.1 million.

The supplemental LIT distribution doesn't come as a surprise, even if the precise amounts by unit count as news.

For Monroe County government, the $27.8 million in LIT that was calculated in certified shares and ED LIT combined will be supplemented by an additional $2.17 million.

The amounts for Bloomington and for Monroe County government don't include additional supplements in the category of public safety income tax revenue.

Ellettsville will see about $182,000 more in LIT. Other local units that will see significant dollar amount bumps include Monroe County Public Library ($241,161), Bloomington Transit ($50,668), and the Monroe Fire Protection District ($293,368). Townships will receive smaller amounts of supplemental LIT revenue.

The source of the supplemental LIT distribution is the local income tax (LIT) itself. Specifically it is a supplemental distribution from the SBA's trust account for local income tax receipts. Monroe County residents pay local income tax this year at a total rate of 2.14 percent. That includes the 0.17 percent rate for the jail tax, which was enacted by the county council last year.

The supplemental distribution comes from a routine calculation done every year, to ensure that the amount in the trust account does not get too big. The state legislature's idea of what counts as "too big" has evolved to mean that the trust account balance for any county should be no bigger than 15 percent of the total certified distribution of income tax to the county in a given year.

For fiscal year 2025, the total amount of certified distribution to Monroe County units was $94,331,678. The amount in the SBA trust account for Monroe County was $21,105,673. That was too much, because 15 percent of $94,331,678 is just $14,149,752.

To get the trust account balance down to the 15-percent level, the SBA is distributing the difference ($21,105,673 – $14,149,752) to Monroe County units. That's where the $6,955,921 total figure comes from.

In the current system of LIT distributions, the tax is collected across the whole county, then divided up among the units based on either a property tax formula or a population-based formula. Part of this year's SB 1, a property tax law amendment, which has now been signed into law by Indiana governor Mike Braun, revises that approach. Starting in 2028, LIT will be collected based on the actual amounts of income tax paid by residents of each jurisdiction.

Comments ()