Bloomington’s econ development commish OKs tax abatement report, city council review next

On Friday, Bloomington’s five-member economic development commission (EDC) approved a report from city staff on about a dozen tax abatements that have been granted to companies over the years, as well as a couple of tax abatements that have been approved, but not yet claimed.

The pending abatements are for Real America, the affordable housing developer of the former Night Moves site on South Walnut Street, and for Catalent, the pharmaceutical company.

According to economic and sustainable development director Alex Crowley, Real America has encountered unanticipated delays at the site, where it is building 48 income-restricted apartments. The delays arose from the fact that the former strip club was located on the former dumping ground for limestone cuttings from facilities that were located along the edge of what is now Switchyard Park, according to Crowley.

As for Catalent, the pharmaceutical company had been previously granted some tax abatements, to which another one was added last year by Bloomington’s city council. Crowley described the first of the Catalent abatements as “wildly successful.”

Those abatements are considered successful because the company has exceeded the requirements that it had to meet, in order to receive its break on taxes. For example, Catalent was required to add a combined total of at least 270 jobs, but in fact added 1,594 jobs.

But for the more recent tax abatement, which includes a requirement of adding 1,000 more jobs, Crowley said Catalent has not yet filed to claim the tax break, which was granted by the city council last year,

In addition to the 1,000 new jobs, which are supposed to have average salaries of $66,560, Catalent is supposed to make new real property investments of $10 million, and personal property investments of $340 million. According to Crowley, the construction of a new building (real property investment) is underway.

But according to Crowley, Catalent knows it cannot be compliant with the terms of the abatement in the near future, so does not want to claim the abatement now. Catalent announced 400 layoffs in November last year and another 150 in the last couple of weeks.

Once the company starts receiving the abatement, if it is out of compliance, the city can invoke a clawback provision in the terms of the agreement, Crowley said. If things turn around for Catalent, then the company could eventually claim the tax abatement Crowley said, if that claim is made by the end of 2026.

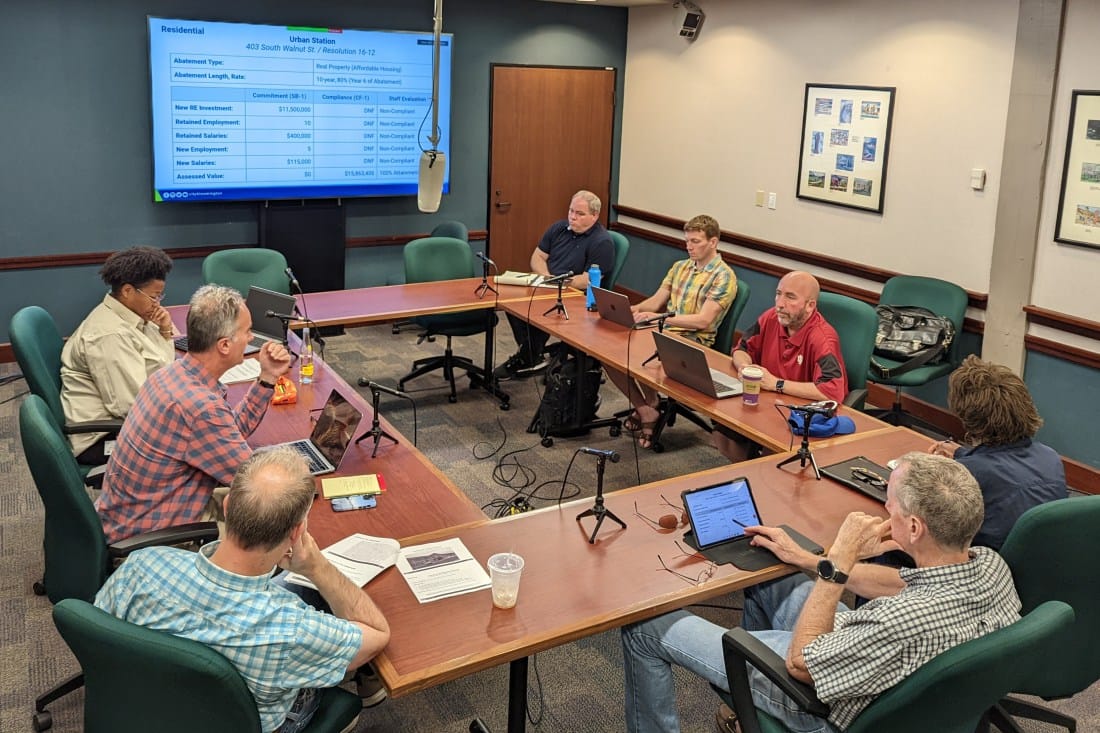

Another abatement got some scrutiny at Friday’s EDC meeting—the one for Urban Station, which is the apartment building on South Walnut that is home to the Chocolate Moose on the ground floor.

Under the terms of its tax abatement, Urban Station has to allocate no fewer than 15 of the bedrooms to households with incomes at or below 80 percent of the area median income (AMI). In 2023, the AMI for Bloomington is $97,400. So Urban Station has to allocate at least 15 bedrooms to households making no more than $78,920 ($97,400*0.80).

But this year, Urban Station did not file any paperwork by the May 15 deadline, according to Crowley. That means he cannot make a recommendation to the city council to find Urban Station in compliance with the terms of the tax abatement.

In the next couple of weeks, Bloomington’s city council will have a chance to start the process to revoke Urban Station’s tax abatement. But Crowley indicated that between now and the time when the council takes up the issue, he hopes to have clarity on the question of whether Urban Station consciously did not file its paperwork, or if it was just an oversight.

Comments ()