Budget notebook: Monroe County mulls shift, not increase in local income tax

If Monroe County councilors stay on the course they have now charted out, they could have around $100,000 more to spend on jail operations for the final quarter of this year.

It would also mean in subsequent years about $424,000 more to spend each year to support the county jail.

The council’s vote on Tuesday night was just to direct the county staff to move forward with all necessary means to advertise holding the first reading of a change to the local income tax (LIT), at the “earliest possible possible time,” while following all the direction of state officials.

But the plan is not to increase the LIT—at least not right now. That could come later, once the site of a new jail is selected, its square footage is determined, and its construction cost is dialed in.

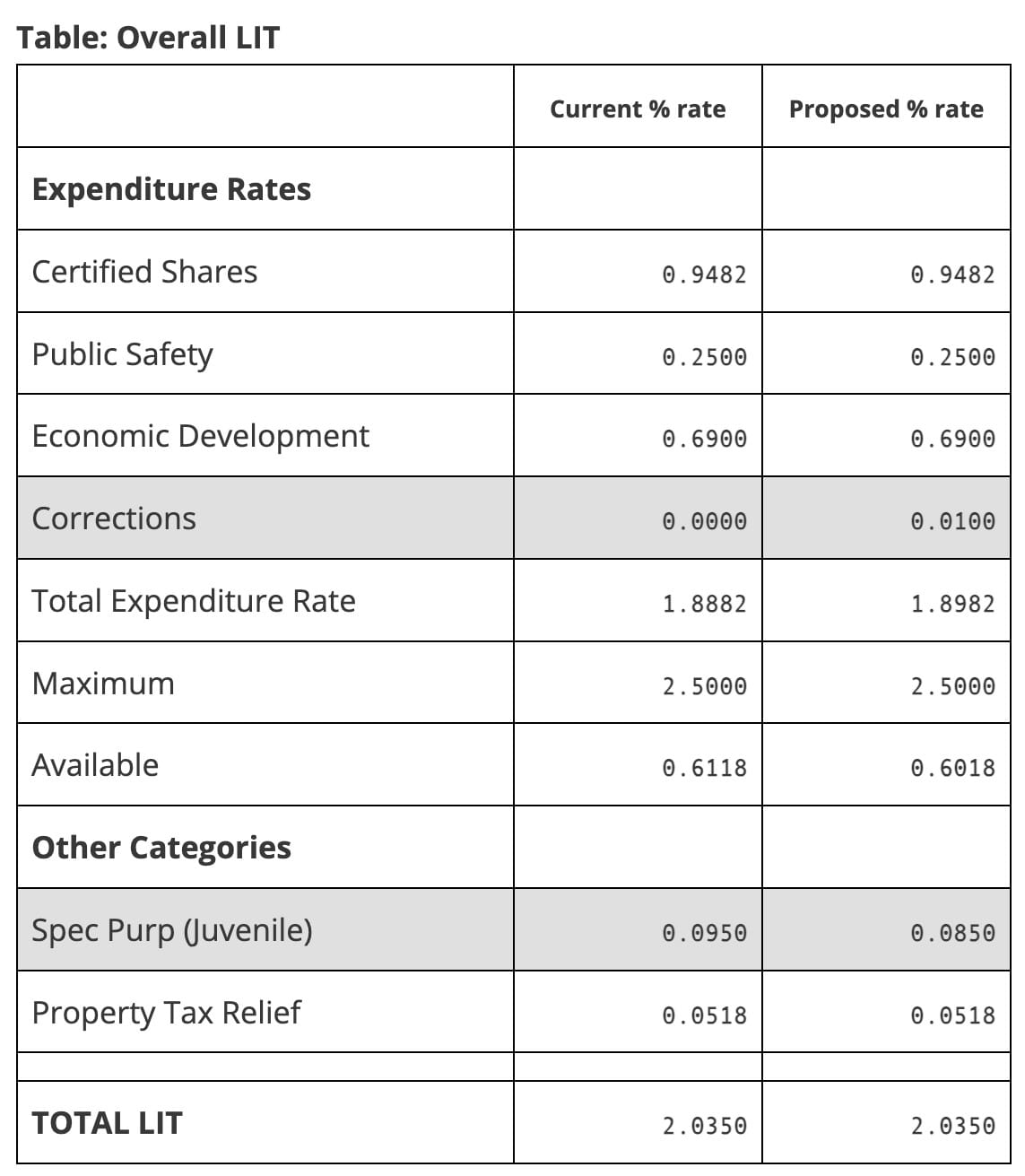

For now, the county council is just looking to shift one category of local income tax to another. The idea is to reduce by 0.01 percent the LIT in a category called the special purpose LIT, but to impose, for the first time, a rate in the corrections LIT by a corresponding 0.01 percent.

That would leave the overall rate paid by taxpayers at 2.0350 percent, the same as it is now.

Councilors Geoff McKim and Marty Hawk have been working on the proposal to shift the LIT rates to make more money available for jail operations.

It is the corrections LIT that could also be used to help pay for the construction of a new jail. The state law [IC 6-3.6-6-2.7] under which the corrections LIT can be imposed was amended by the state legislature this year. The amendment means that all of the revenue, not just 20 percent of it, can be put towards costs of operating a jail.

Passage of changes to the special purpose and the corrections LIT categories would require just a vote of the county council.

How soon the additional revenue stream for jail operations starts—and the corresponding stream for the special purpose is reduced—depends on how swiftly the county council acts.

If the change is enacted before Sept. 1, the revenue shift starts on Oct. 1. That would mean about $100,000 more for jail operations yet this year.

What does the special purpose LIT pay for, and why is the county council content to reduce that funding stream?

The special purpose LIT, which is currently imposed at a rate of 0.0950, is restricted under state statute to funding “the operation and maintenance of a juvenile detention center and other facilities to provide juvenile services.” In 2023, the special purpose tax is supposed to generate about $3.9 million.

If the special purpose rate is reduced by 0.01 percent, to 0.0850, that will reduce the revenue for Monroe County’s juvenile division by about $424,000 a year. That would mean an annual budget deficit of about $371,000 for the juvenile division.

But as McKim pointed out on Tuesday night, it’s a deficit that could be sustained for at least a decade based on the existing operations balance in the special purpose LIT.

The fund’s year-end balance for 2022 was about $5.4 million, according to DLGF (Department of Local Government Finance) numbers.

Hawk pointed out that shifting the funding would, among other things, allow the county to increase its contract for medical services at the jail to cover more mental health services.

| Current % rate | Proposed % rate | |

| Expenditure Rates | ||

| Certified Shares | 0.9482 | 0.9482 |

| Public Safety | 0.2500 | 0.2500 |

| Economic Development | 0.6900 | 0.6900 |

| Corrections | 0.0000 | 0.0100 |

| Total Expenditure Rate | 1.8882 | 1.8982 |

| Maximum | 2.5000 | 2.5000 |

| Available | 0.6118 | 0.6018 |

| Other Categories | ||

| Spec Purp (Juvenile) | 0.0950 | 0.0850 |

| Property Tax Relief | 0.0518 | 0.0518 |

| TOTAL LIT | 2.0350 | 2.0350 |

| LIT Spec Purp Rate | 0.0950 | 0.0900 | 0.0875 | 0.0850 | 0.0800 | 0.0750 |

| Surplus (Deficit) | $53,314 | $(158,816) | $(264,881) | $(370,946) | $(583,076) | $(795,206) |

| Cash Freed Up | $0.00 | $212,130 | $318,195 | $424,260 | $636,390 | $848,520 |

| Corrections Rate | 0.0000 | 0.0050 | 0.0075 | 0.0100 | 0.0150 | 0.0200 |

| Amount Raised | $0.00 | $212,130 | $318,195 | $424,260 | $636,390 | $848,520 |

Comments ()