Catalent tax break gets just a 6-vote majority from 9-member Bloomington city council, but it’s enough

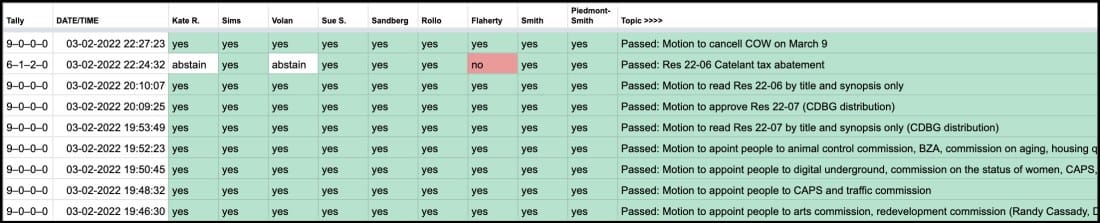

A six-vote majority on Bloomington’s nine-member city council was enough Wednesday night to grant pharmaceutical company Catalent a tax abatement in exchange for a capital investment of $350 million and 1,000 new jobs.

The additional jobs would grow the pharmaceutical company’s local workforce by about one-third.

[Updated April 21, 2022: In a news release Catalent has announced it has chosen Bloomington as the location where it will be making a $350 million investment.]

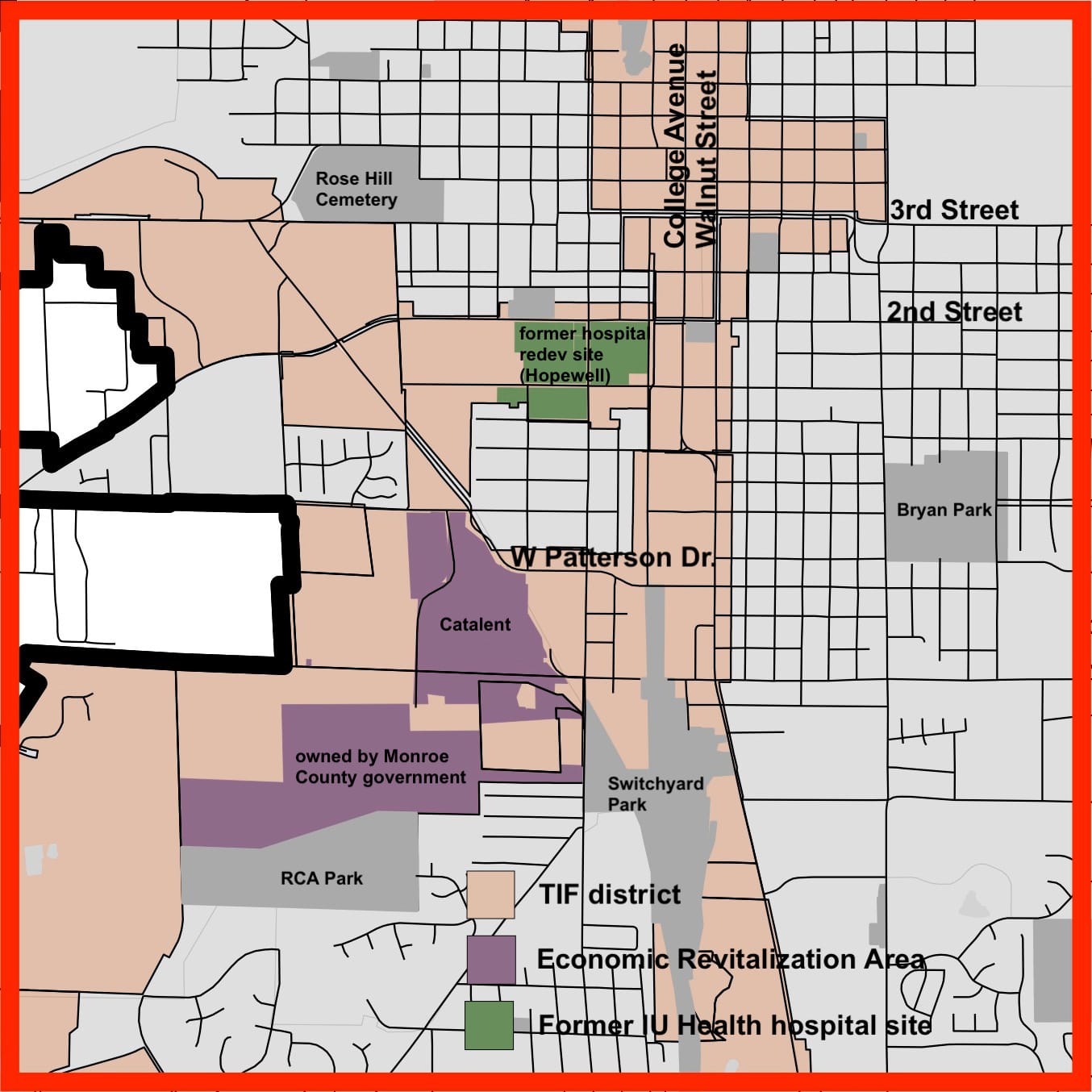

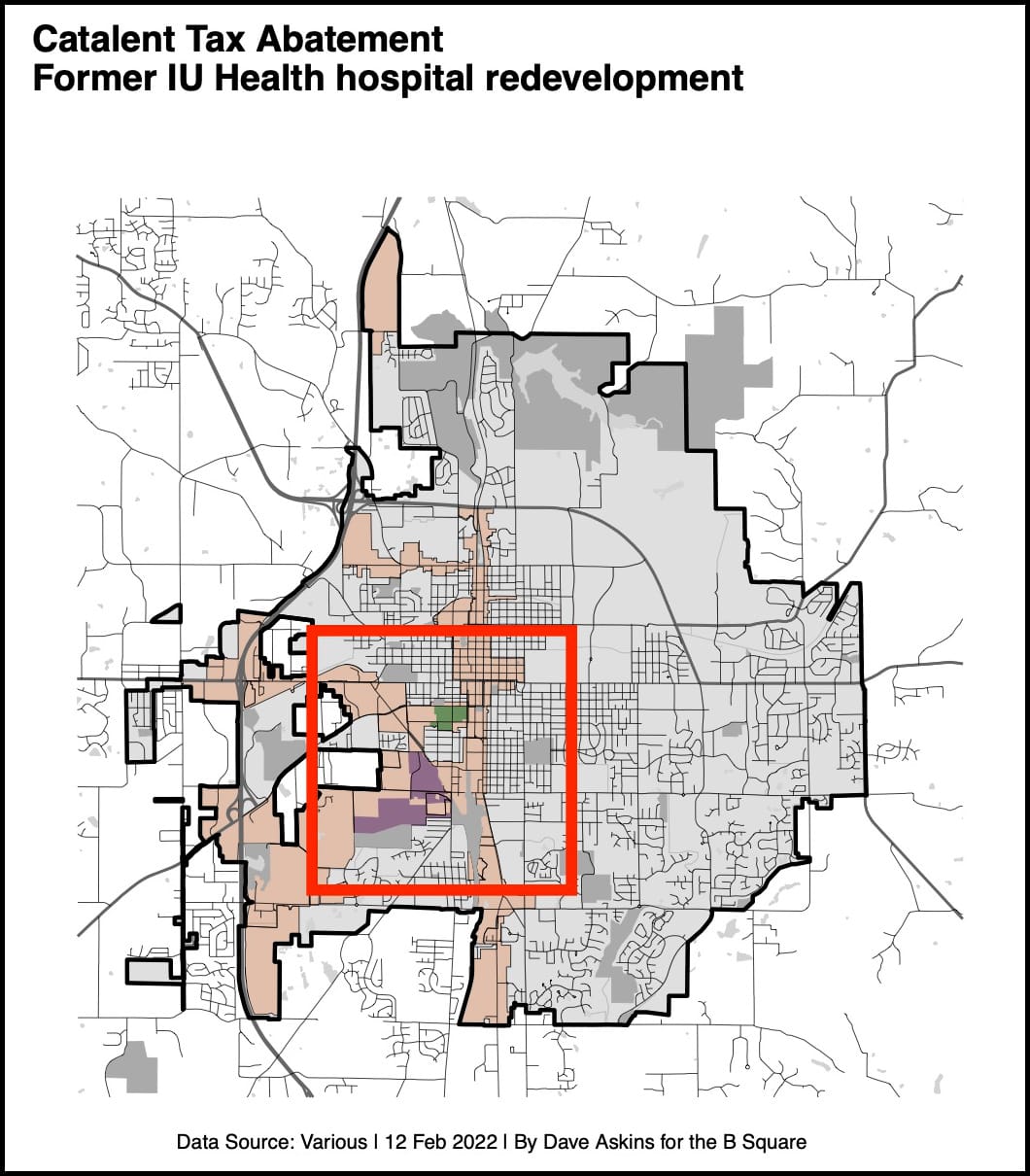

Catalent is looking to spend about $10 million on development of real property, possibly by buying more land. The other $340 million would be invested in personal property, which includes all the non-permanent fixtures inside a building, like manufacturing equipment.

The investment by the pharmaceutical company would be contingent on a tax abatement on the additional value for both real and personal property. Real property would be abated at a rate of 50 percent a year for 10 years, making a total of $826,760 in additional paid property taxes and $826,760 in abatement.

The bigger break comes for the personal property, which is 90 percent for 20 years, and totals an estimated $43,450,785 in abated taxes, which is calculated to have a net present value of about $28.4 million.

Speaking in support of the tax abatement was Bloomington’s director of economic and sustainable development, Alex Crowley, who allowed that the cumulative figure for the abatement is an “eye-popping number.”

Public comment in favor of the abatement came from current and former elected officials, including former mayor John Fernandez (1995–2003) who also served as assistant secretary of Commerce for Economic Development Administration in the Obama administration.

Fernandez said, “This decision isn’t so much about Catalent—it’s about creating economic opportunities for our community, for people in our community who are at risk of being left behind in an ever changing dynamic economy.”

Speaking against the abatement during the public hearing was Ariana Gunderson, who said, “Being a company town is a really good situation for a company, but not for a town.” She added, “I am astonished that the city would invest so much money into the profits of a company instead of into its people.”

The one councilmember who cast a no vote was Matt Flaherty. He cited the letter of the law that defines a an “economic revitalization area,” which starts off describing an area that “has become undesirable for, or impossible of, normal development and occupancy.” Flaherty said that a case had not been made that meets those statutory criteria.

Abstaining from the vote—which counts towards the needed majority the same arithmetically as a no vote—were Kate Rosenbarger and Steve Volan. Neither cited a conflict of interest.

Rosenbarger said her no vote “might seem kind of strange.” She said does not support the tax abatement process, adding, “So it’s very hard for me to get behind something that is a system that I don’t agree with.” But she said it would be “silly” for Catalent not to pursue the possibility of a nearly $30-million abatement.

Like Rosenbarger, Volan said he thinks “the entire concept of tax abatements is problematic.” Volan also complained that Bloomington had not made an effort to require information from Catalent about the percentage of its job applicants who come from outside of Monroe County.

At the council’s meeting two weeks ago, Volan had called for a requirement that Catalent allow a developer to build housing on its land, to increase the number of employees who would be paying Monroe County’s local income tax. Volan said he was not voting no, because he hopes Catalent will provide the information about residency and allow construction of housing on what are now surface parking lots.

Volan described his abstention as a “show of good faith to Catalent.”

In the 2017 vote on Cook Group’s payment in lieu of annexation agreement, Volan also abstained.

During deliberations on Wednesday, a few councilmembers said they agreed with the sentiments expressed during the public hearing by Joseph Wynia, who asked, “How much longer do we want to couple ourselves in this community to this type of conventional economic activity?”

Wynia continued, “In the face of a destabilizing climate, a crashing planetary ecosystem and dwindling energy and resources, should we be bringing in more of the same thing that has been driving these for the last century?”

Wynia said he understands the appeal of granting a tax abatement. “But given the current planetary circumstances, I think we’re in a completely different reality and really can’t continue to do this kind of business as usual,” he said. Wynia said, “I’m not going to encourage or ask the council to take a particular stance on this resolution.”

Calling Wynia’s comments “very appropriate” was was councilmember Dave Rollo. He still concluded that on balance, Catalent’s request is an appropriate use of a tax abatement. Rollo said Catalent’s planned explosion doesn’t just rely on a highly skilled employees, adding that wage growth is very important for Bloomington. “We’re job rich, but wage poor,” Rollo said.

Ron Smith’s vote in favor of the abatement was probably the most enthusiastic among the councilmembers. He called it a “no-brainer.”

Rejecting the idea that it was a no-brainer, but still voting for the abatement was Isabel Piedmont-Smith, who said, “This is not a no brainer to me at all—this is a very difficult decision.” She added, “I don’t see it as a win-win. This whole process of tax abatements really is not a good way of running a local government, in my view.”

But Piedmont-Smith said the terms of the abatement would bring a lot of good-paying jobs, adding that Catalent has been “a good community member.” She said, “They have invested a lot in sustainability efforts. They have done a lot of DEI efforts to increase diversity and make people feel like they’re included and belong.” She summed up her view like this: “I’m not crazy about it. But I’m going to vote yes.”

Also explicitly rejecting the idea that the Catalent abatement was an easy decision was Jim Sims, who said, “This is definitely not a no-brainer.” Sims said, “I go to church every week with people that are looking for well-paying jobs.” Sims said that many of them are starting to look at Catalent as a place to work.

Sue Sgambelluri pointed to the fact that Bloomington is now competing with other locations across the country for Catalent’s planned expansion. That’s because Catalent has portrayed its decision to expand in Bloomington, compared to one of its other locations as a choice among other locations.

Sgambelluri said, “Are we an inherently attractive community in which to locate and grow a business? I think so. But I think we’re deeply mistaken if we assume we are the only one.”

About her support for the tax abatement, council president Susan Sandberg said, “We have an opportunity before us to increase that wage floor to a point that it will have a domino effect on other employers in this community. And I believe that it’s an opportunity that we must take advantage of.”

Other Speakers in favor of Catalent’s tax abatement during the public hearing included Monroe County councilor Geoff McKim, former county councilor and current head of the Greater Bloomington Chamber of Commerce Eric Spoonmore, Bloomington Economic Development Corporation president Jennifer Pearl, chair of Bloomington redevelopment commission Cindy Kinnarney, and Cardinal Spirits co-founder Jeff Wuslich.

Comments ()