Factual corrections to statements about fire protection tax allocations sought by Monroe County councilors

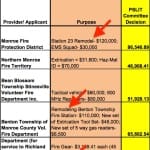

Last week, a committee of the Monroe County tax council voted against a recommendation to allocate $353,700 of public safety local income tax (PS-LIT) money to support requests made by four rural fire departments in the county.

The news was not embraced by the Monroe County council at their regular monthly meeting on Tuesday. The review of applications for funding had been delegated to the county council, and it was the county council’s recommendations that the PS-LIT committee rejected.

County council president Eric Spoonmore called the tax council’s committee vote “incredibly unfortunate, frustrating, disappointing.” Spoonmore added, “I thought the recommendations that were made were thoughtful…and that the proposals that were put forth by the rural fire departments were very much necessary.”

Councilor Geoff McKim said there were some “materially incorrect” statements made during the committee meeting that need to be corrected on the record, before a final vote is taken.

McKim and Cheryl Munson represented the county council on the committee, casting the only two votes in favor of direct allocations to rural fire departments.

The $353,700 in requests by rural departments for mobile repeaters, a station remodel, and exhaust systems had been winnowed down by the county council from $742,000 in requests. That meant the county council’s recommended amount was roughly 4.5 percent of the $7.8 million that the committee was using as a conservative estimate for the total amount it could allocate for 2021.

The 4.5 percent allocation would have been similar in scale to the kind of direct allocations that have been made to rural fire departments in the previous three years—since the 0.25-percent public safety income tax has been levied in Monroe County.

Direct allocations, like the one made to the dispatch center, would come before the certified PS-LIT shares are divided among Bloomington, Ellettsville, Stinesville, and Monroe County, on a property-tax-footprint based formula.

In a Facebook comment about the PS-LIT committee’s vote, Monroe Fire Protection District (MFPD) chief Dustin Dillard said, “Previously there has been time specifically set aside for the fire departments to present. That did not happen this year and there was no invitation. Only notice of the meeting. All departments are upset with the variation from the past practice.”

The committee’s 5–2 vote against direct allocations is just a recommendation.

The final vote on allocations will be taken by the governing bodies that make up the income tax council—Bloomington’s city council, Ellettsville’s town council, and the Monroe County’s council.

Based on the weighting of votes, if at least eight of nine Bloomington city council members vote against direct PS-LIT distributions to rural departments, last week’s committee vote will be confirmed.

McKim said when the Bloomington city council meets to take its vote, some corrections need to be made to statements that he called “materially incorrect.” During the discussions at the committee meeting, several references were made to last year’s awards, and that they were for something much more urgent—the self-contained breathing apparatuses (SCBAs). McKim pointed out that the awards for the SCBAs were made in 2018, not last year. (The table under that link says “for 2019” but it’s evident from the date on the meeting packet that the decision was made in 2018.)

The other inaccurate statement identified by McKim was made by Ellettsville town councilor Scott Oldham, who said at the committee meeting about funding requested for a station remodel: “I’m sorry, I don’t see that as an urgent safety need. That’s not an urgent safety need. And that’s not something we’ve done before.”

McKim pointed to last year’s direct awards to rural departments, which included three station remodel requests—from Monroe Fire Protection District, Benton Township, and Van Buren Township.

A fire station remodel, McKim concluded, is something that the PS-LIT committee “has considered worthy of funding in the very recent past.” McKim said he wants the two factual points to be made at the meeting when the Bloomington city council takes its vote.

McKim also suggested a different term be found for “remodeling” a fire station. “The point is not to spruce up the colors or to make it make it aesthetically prettier,” McKim said. He added, “When they talk about remodeling, it is taking stations and making them livable for full-time professional firefighters.”

At Tuesday’s county council meeting, Munson reiterated a point she’d made during last week’s PS-LIT committee meeting: Rural residents—those in unincorporated areas of the county—will not get any support for their fire department from the income taxes that they pay, unless it’s made as a direct allocation from PS-LIT revenue.

Munson said Bloomington uses its PS-LIT to support fire and police services primarily for the benefit of city residents. She said Monroe County uses the bulk of its certified shares to support the safety of all county residents, including people who live in the city. As examples, she gave expenses at the jail, courts, prosecutor, corrections health department and the emergency management department.

County residents who live outside municipalities pay public safety income taxes, too, Munson said, and deserve a fair return on their payments.

On Tuesday, when Munson delivered her report to her county council colleagues about last week’s PS-LIT committee meeting, she described those who voted against direct funding for the rural fire departments like this: “the four [Bloomington] city council members and also a member of the Ellettsville town board, who works for the Bloomington police department.”

She was referring to Scott Oldham, a captain in the BPD. Arguing against direct allocations to rural fire departments, Oldham suggested during the PS-LIT committee meeting that the rural fire departments could be given sub-awards from the extra money the jurisdictions are allocated, if no direct awards are made to the rural departments.

For example, the Monroe County council could use the additional $160,000 it will receive—if the rural departments don’t get a direct allocation off the top—to pay for the exhaust system and mobile repeaters requested by Bean Blossom’s department ($83,700) and the exhaust system requested by Benton Township’s department ($80,000).

The math for Oldham’s own jurisdiction of Ellettsville does not square up as well. If no direct allocations are made to rural departments, that means an extra $10,540 goes to Ellettsville, based on the property-tax-footprint formula. That’s not enough to cover the $20,000 request from Richland Township for a mobile repeater.

If Ellettsville and Richland Township are considered together, it would translate into a loss of about $9,500, if no direct PS-LIT allocation of $20,000 is made to Richland’s fire department. County councilor Marty Hawk commented on that difference saying, “It makes no logical sense to me whatsoever that somebody representing Ellettsville would turn down an opportunity to bring $10,000 into their budgets.”

Another reason city and town PS-LIT committee members gave, for not supporting direct allocations to rural districts, relates to future consolidations. At the time when the Monroe Fire Protection District (MFPD) consolidates with another department, it can adjust its property tax millage to a rate that is high enough to pay for its needs, they said.

The MFPD looks like it might eventually encompass all rural fire departments. Benton Township is next in the sequence of consolidations. The last of three public meetings on the Benton-MFPD consolidation was held last Saturday. At that meeting, MFPD chief Dustin Dillard presented the case for consolidation.

Comments ()