Finance committee for new Monroe County jail set to take up topic of diversion

“What investments can the county council make for community services to reduce the number of community members entering the justice system?”

That’s the question at the center of the agenda for Monday’s meeting of Monroe County’s justice fiscal advisory committee (JFAC).

The meeting makes up for the one that was blown off the schedule by the windstorm that struck the county a month ago.

When the county council created the JFAC in May, the council’s resolution set a September timeframe as the target for delivering a report to the full council.

The report is supposed to make recommendations on priorities for funding of mental health, substance abuse treatment, and a new correctional facility.

JFAC is also supposed to give guidance on investments to prevent individuals from entering the justice system, reducing recidivism, and promotion of equity. JFAC is also supposed to establish timelines for implementation.

The committee’s report is also supposed to identify funding sources within permissible uses of tax revenues.

The JFAC includes several non-voting members, including some from city government—a city councilmember, a representative from Bloomington’s community and family resource (CFRD) department, and member of the city’s police department.

At the July 3 JFAC meeting, Bloomington mayor John Hamilton sat in as representative for the police department.

Hamilton weighed in for an even split of funding between the bricks and mortar of a new jail facility and preventing people from entering the jail system.

Hamilton put it like this: “I believe that as we move forward as a community with a new, improved jail to build and operate as part of the criminal justice system, that we ought to commit that for every dollar that is invested in that building and operating a new piece of the criminal justice system, that we dedicate another new dollar, to help…reduce the need for incarceration.”

County councilor Jennifer Crossley responded to the mayor’s statement with a question that essentially asked Hamilton if his remark had been about just the county government’s revenues, or if the city government might be willing to help cover costs of preventing incarceration. Crossley asked: “Since we are having a collaborative conversation of sorts, is this something that could possibly be a potential thing that the city can put in their budget, and try to help fund with these things as well?”

Hamilton gave Crossley an extended answer, touching on various commitments the city has made to funding transportation, housing, and economic justice. But Hamilton seemed to indicate what he meant was for the county’s revenue to be evenly divided between building a new jail and preventing incarceration. He said, “These kinds of serious issues need serious money, too. And I think we have it at the county level…”

Monday’s JFAC meeting will come after a week when some bits of incremental progress could be counted on the topic of the jail construction. Last Wednesday, county commissioners approved a $10,000 item to cover additional costs incurred by DLZ for the evaluation of four different sites as potential locations of a new jail.

DLZ is the design-build firm that the county has selected for the jail construction project.

At their March 22 meeting, commissioners had approved a $10,000 agreement with DLZ for the evaluation of four sites, which had, at that time, not yet been determined.

The same wording—about the sites not having been determined—was included with last week’s agenda item. But that was apparently a copy-paste error. After last Wednesday’s meeting county attorney Jeff Cockerill confirmed to The B Square that the second $10,000 was meant to cover the costs that DLZ had incurred in doing the actual review for four potential sites.

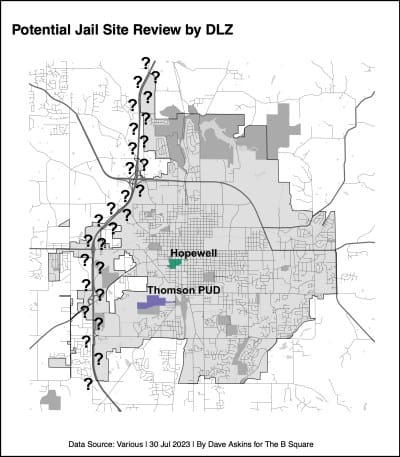

Responding to a B Square followup question, Cockerill confirmed that the four sites that DLZ has reviewed are: the county-owned property west of Rogers Street and south of Catalent; the new Hopewell neighborhood, which is under city of Bloomington control and is the former site of the IU Health hospital at 2nd and Rogers streets; and two other locations, which Cockerill could only describe as somewhere in the I-69 corridor. The sites in the I-69 corridor are privately held, Cockerill said.

Cockerill also touched on two jail-related topics at the county council’s meeting last Tuesday.

First, he sketched out a case for hiring an independent construction manager to oversee the jail construction work. The idea is to have someone with expertise who can confirm that what is supposed to be happening on the construction site is actually happening.

Cockerill also gave the councilors a heads up that probably sometime in August, he would be asking them to approve a significant appropriation to cover the cost of DLZ’s contract. The DLZ contract is not yet signed, even though DLZ was selected as the design-build firm over three months ago. On Tuesday, Cockerill said about the appropriation, “I don’t want that to surprise you. I don’t want that to shock you.”

Second, Cockerill sketched out a ballpark maximum jail construction budget, if the county council taps only the additional revenue to the county government from the 0.69-point increase to the local income tax (LIT) that was enacted by Bloomington last year.

The tax increase was enacted in the economic development (ED) category of local income tax. For 2023, the amount that goes to Monroe County government from that tax increase is $10.8 million. That compares to around $16 million for the city of Bloomington.

If the county council relies just on the ED LIT, to repay a bond issuance, Cockerill told councilors last Tuesday that a conservative jail construction budget figure would be around $60 million.

As councilor Marty Hawk pointed out at Tuesday’s work session, the amount of local income tax revenue that is distributed to county government will decrease as a result of annexation. The percentage of the tax revenues that go to each governmental unit is tied to population. When annexation results in gains of city population, but losses in population in the unincorporated parts of the county, that means more local income tax revenue for city government and less for county government.

The initial estimates for 2024 local income tax revenue from the state department of local government finance (DLGF) shouldn’t be affected by pending annexation, which is still in litigation. The DLGF web page where the estimates will be posted describes the 2024 figures as “coming soon.”

At Tuesday’s work session, Hawk stressed the idea that during the county council’s upcoming budget planning for 2024, councilors should be disciplined enough not to touch the revenue from the ED LIT, because that should be set aside for construction of the jail.

Another source of funding that has yet not received any airtime at public meetings is the possibility of enacting a specific income tax just to construct a jail. Such a tax is possible under IC 6-3.6-6-2.7

Passage of a new jail tax would require just a vote of the county council. Up to 20 percent of the revenue from such a tax could be used for operating expenses for correctional facilities and rehabilitation facilities in the county.

A tax to support a new jail would be limited to 0.2 percent, for no more than 25 years.

Based on the $28.2 million that a 0.69 percent tax is supposed to generate in 2023, a 0.2 percent tax would generate about 8.1 million a year.

Comments ()