Financial data notebook: Digesting Bloomington food and beverage tax spending

On Friday at noon, Bloomington’s city council held a work session on the topic of the Monroe Convention Center expansion project.

The B Square will report separately on the substance of the meeting.

The focus of this notebook entry is a request during Friday’s meeting from a city councilmember to city controller Jessica McClellan—for a historical breakdown of expenditures from the city’s food and beverage tax fund.

The food and beverage tax fund is key to discussion of the convention center project, because it is supposed to be the source of the funding for the project.

McClellan will be using the city’s own internal system to provide the requested information to councilmembers. But the city’s publicly accessible online financial information makes it possible for anyone to get the information that was requested from the controller.

Here’s the steps to getting a breakdown of expenditures by fund:

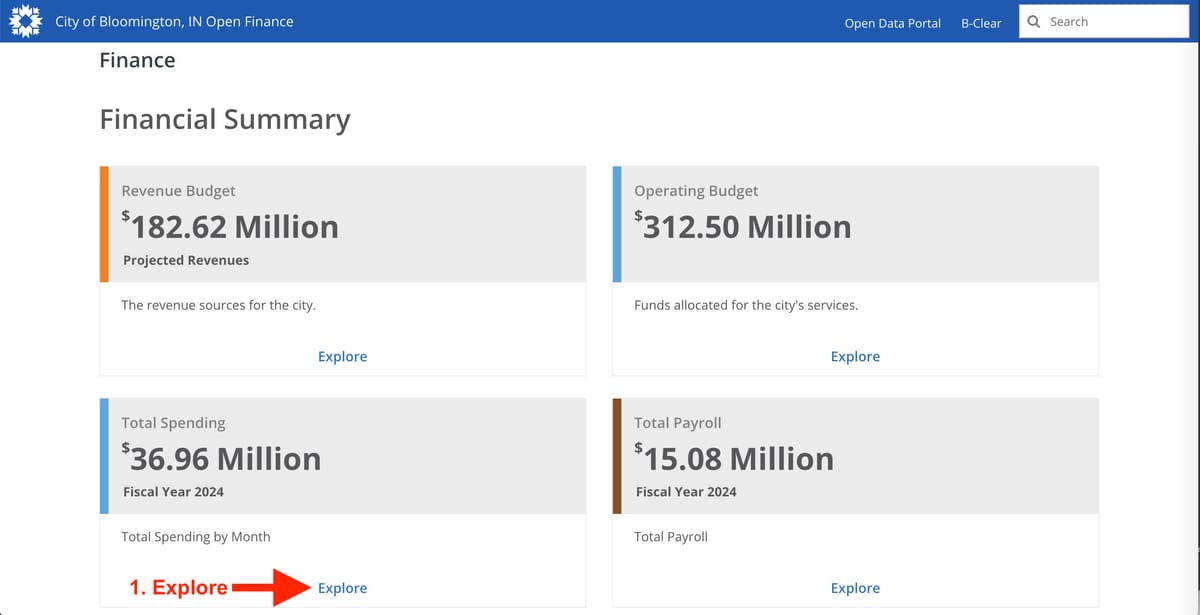

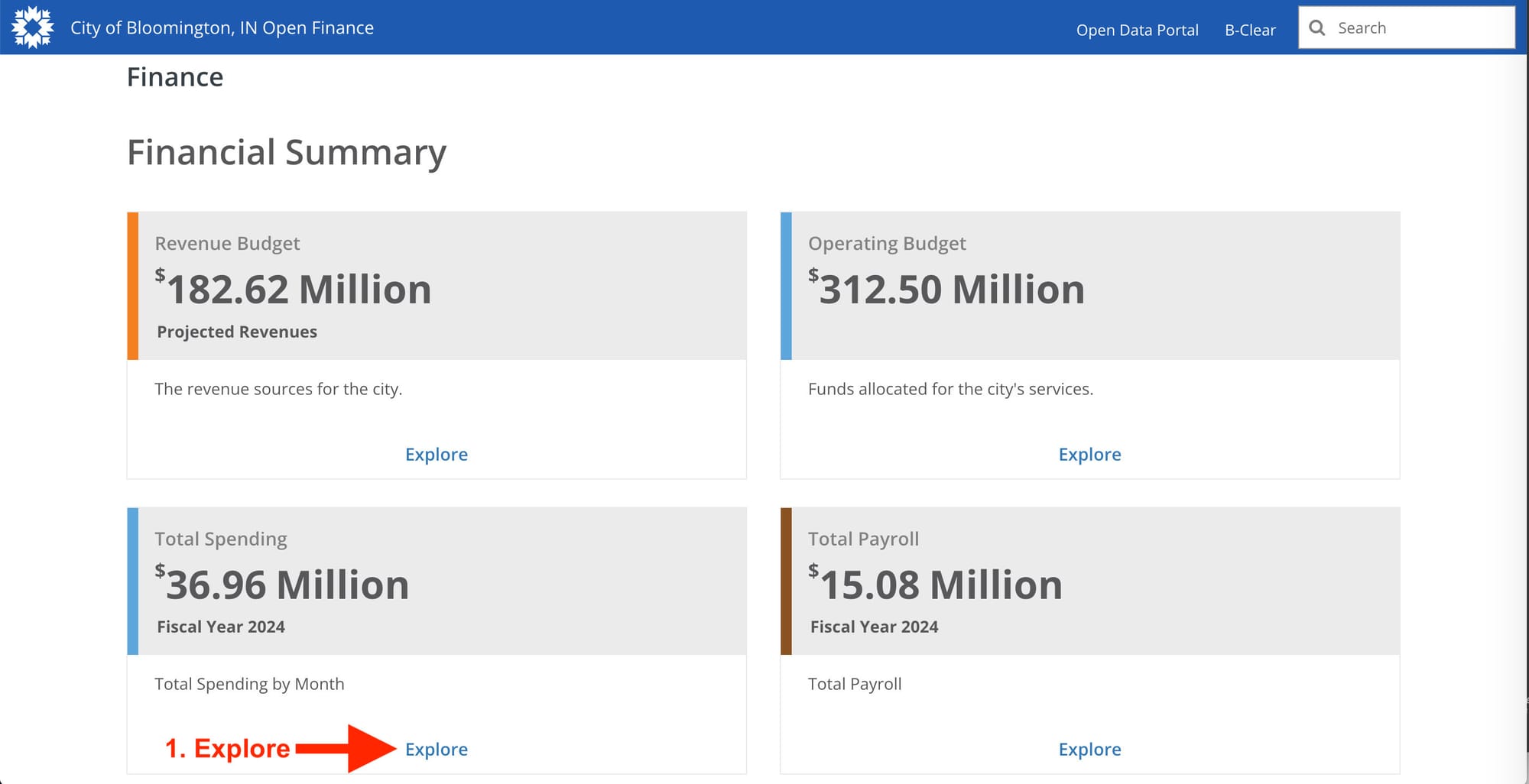

0. Start here https://bloomington.finance.socrata.com/#!/dashboard

1. Click on Explore under Total Spending.

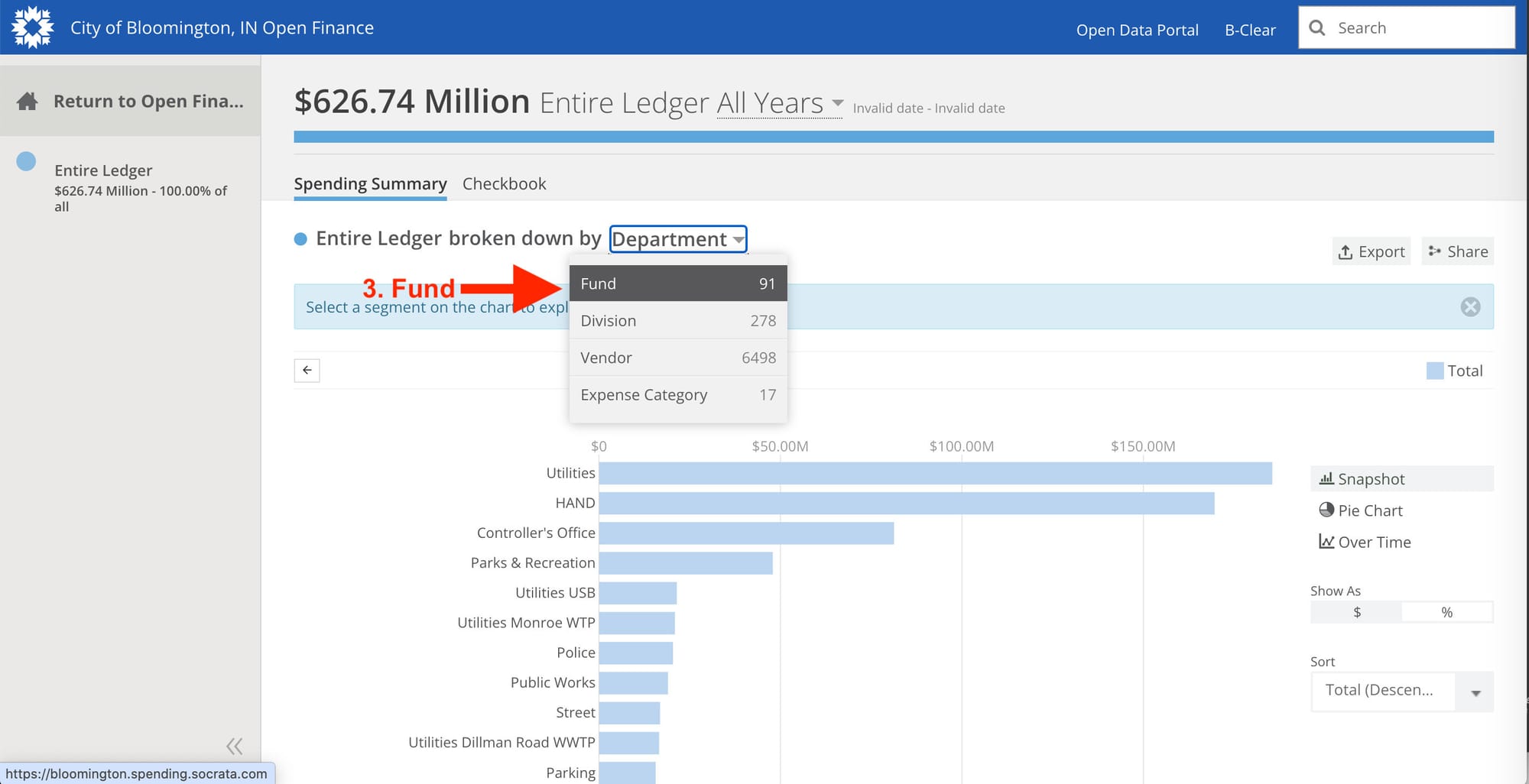

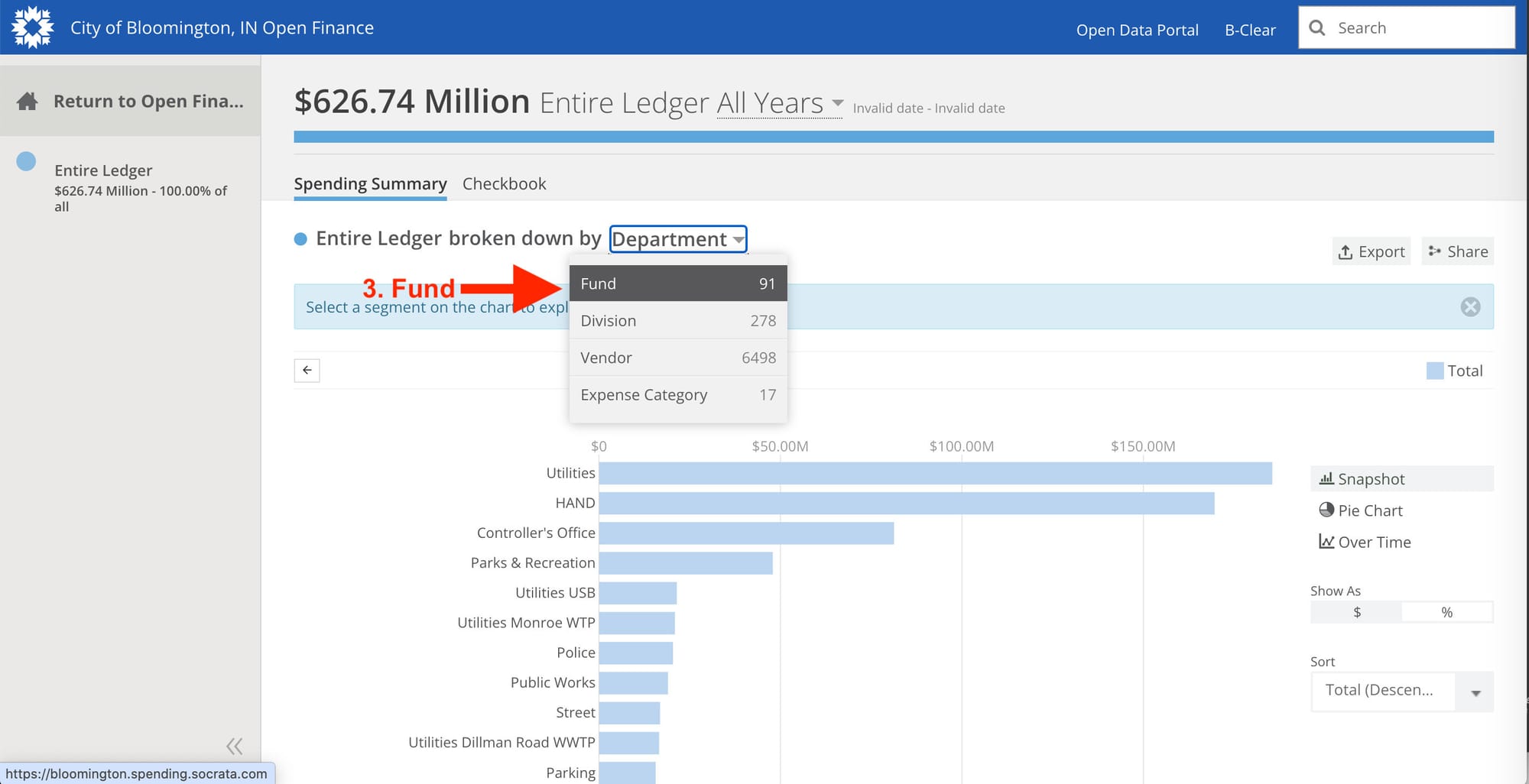

2. Select All Years from the dropdown menu.

3. Select the breakdown by Fund

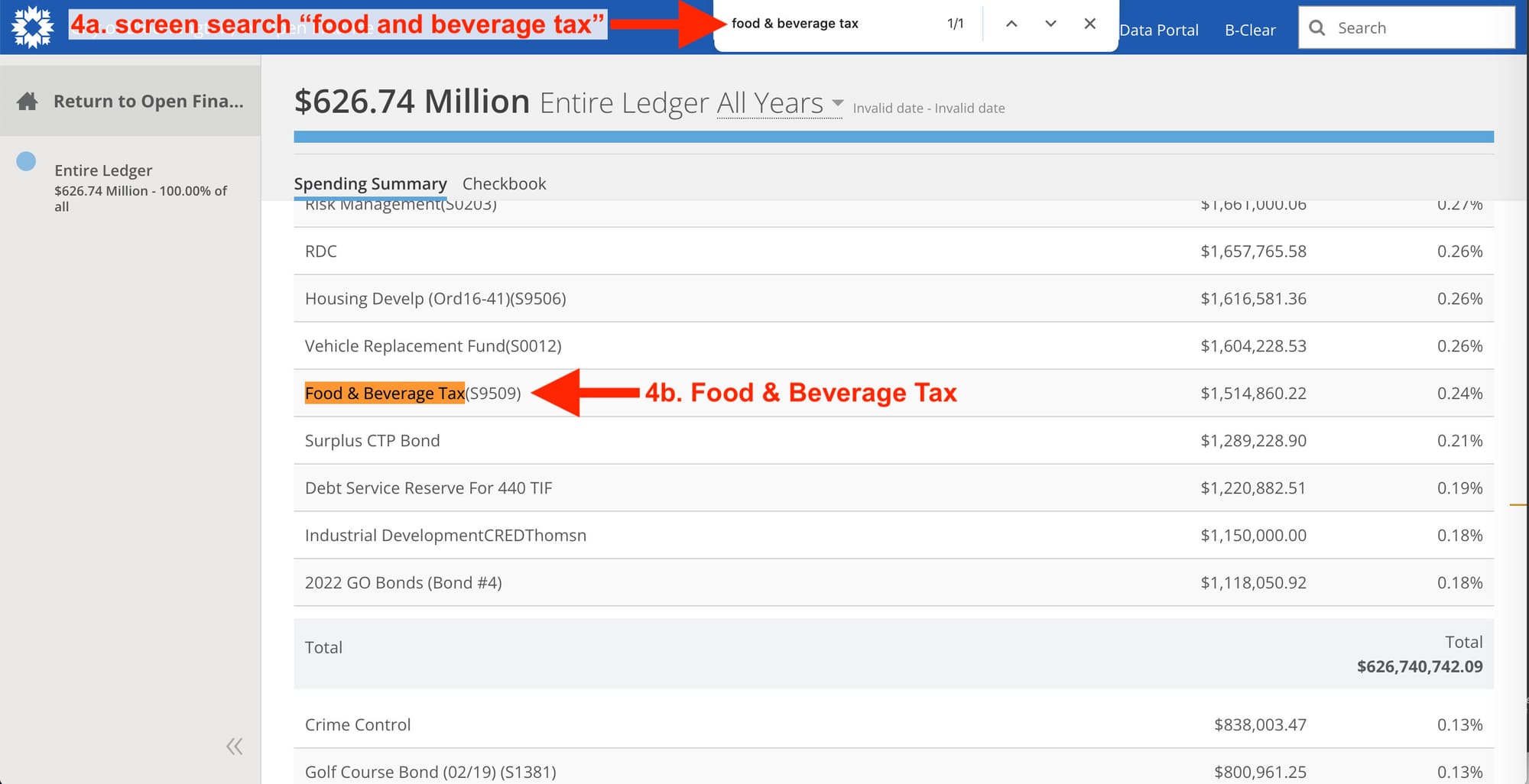

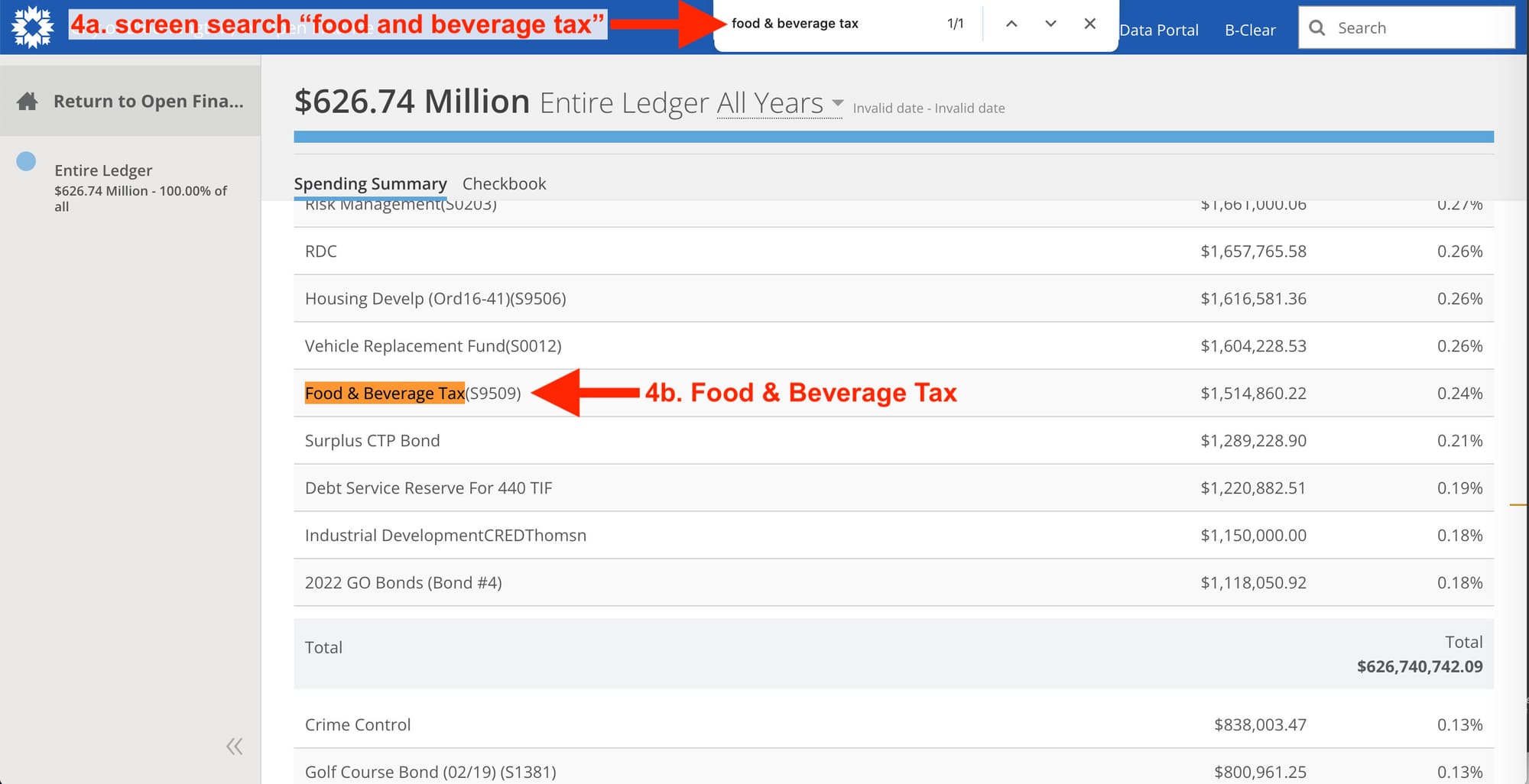

4. Search your screen for “food & beverage” and click on Food & Beverage Tax Fund

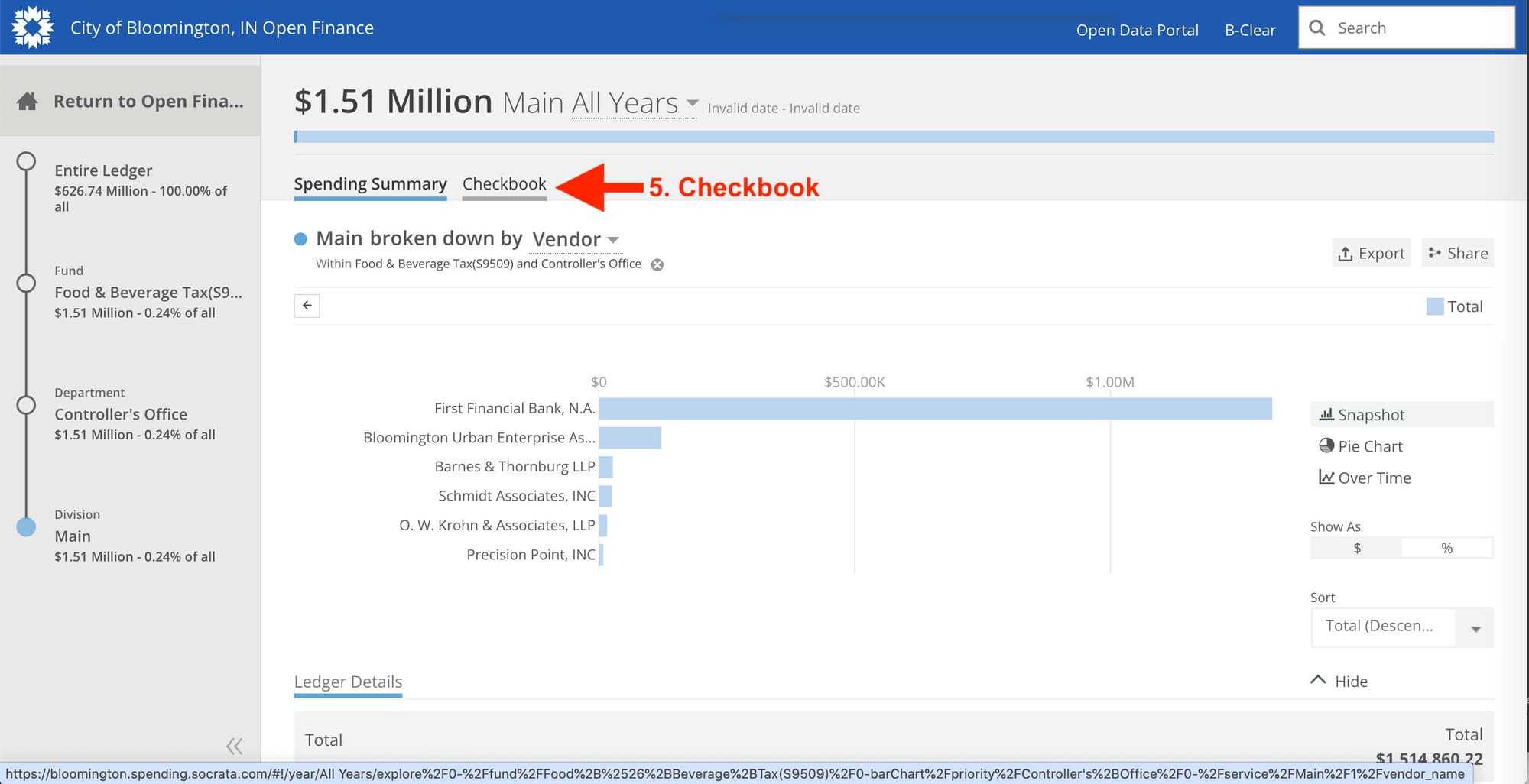

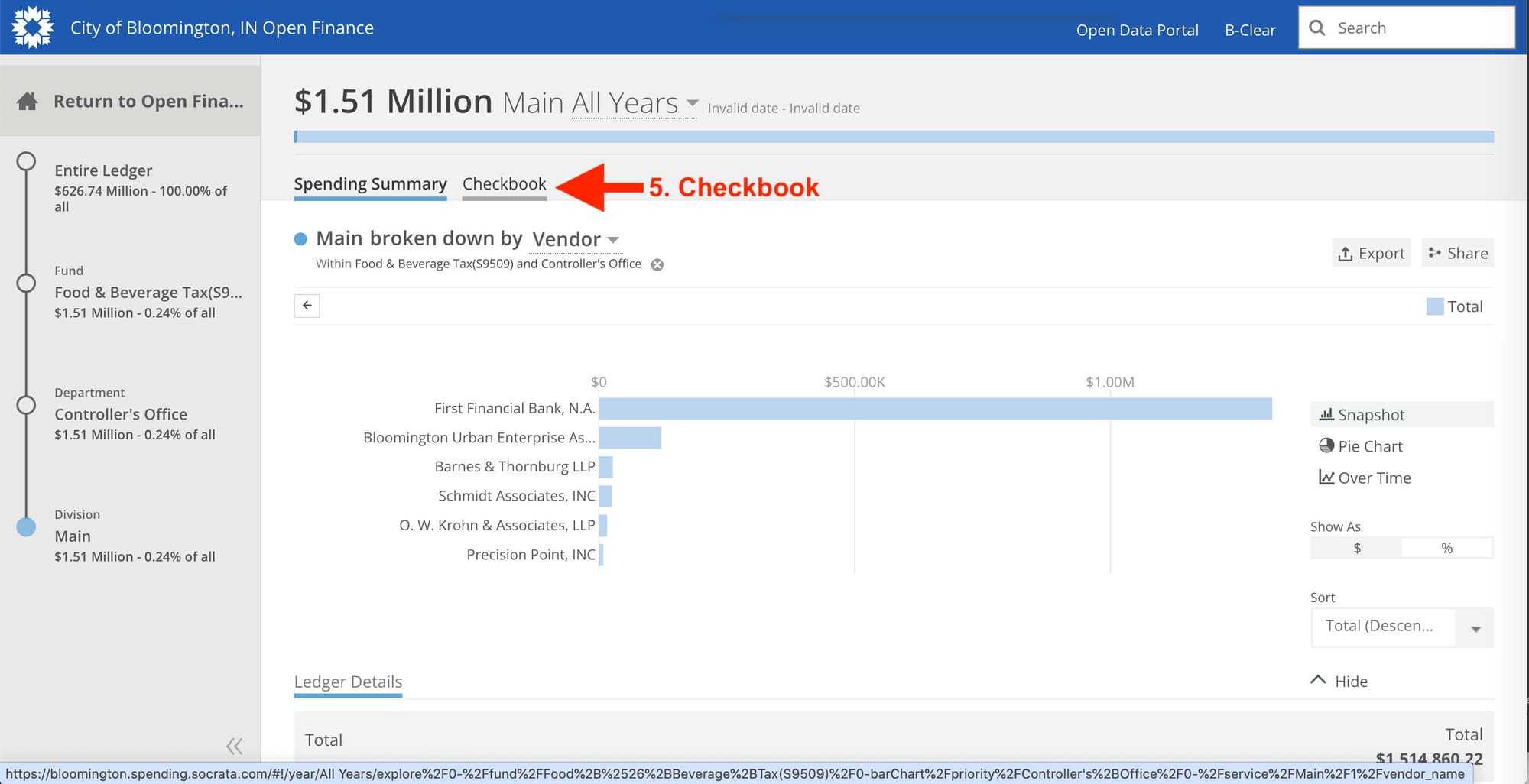

5. Select the Checkbook option

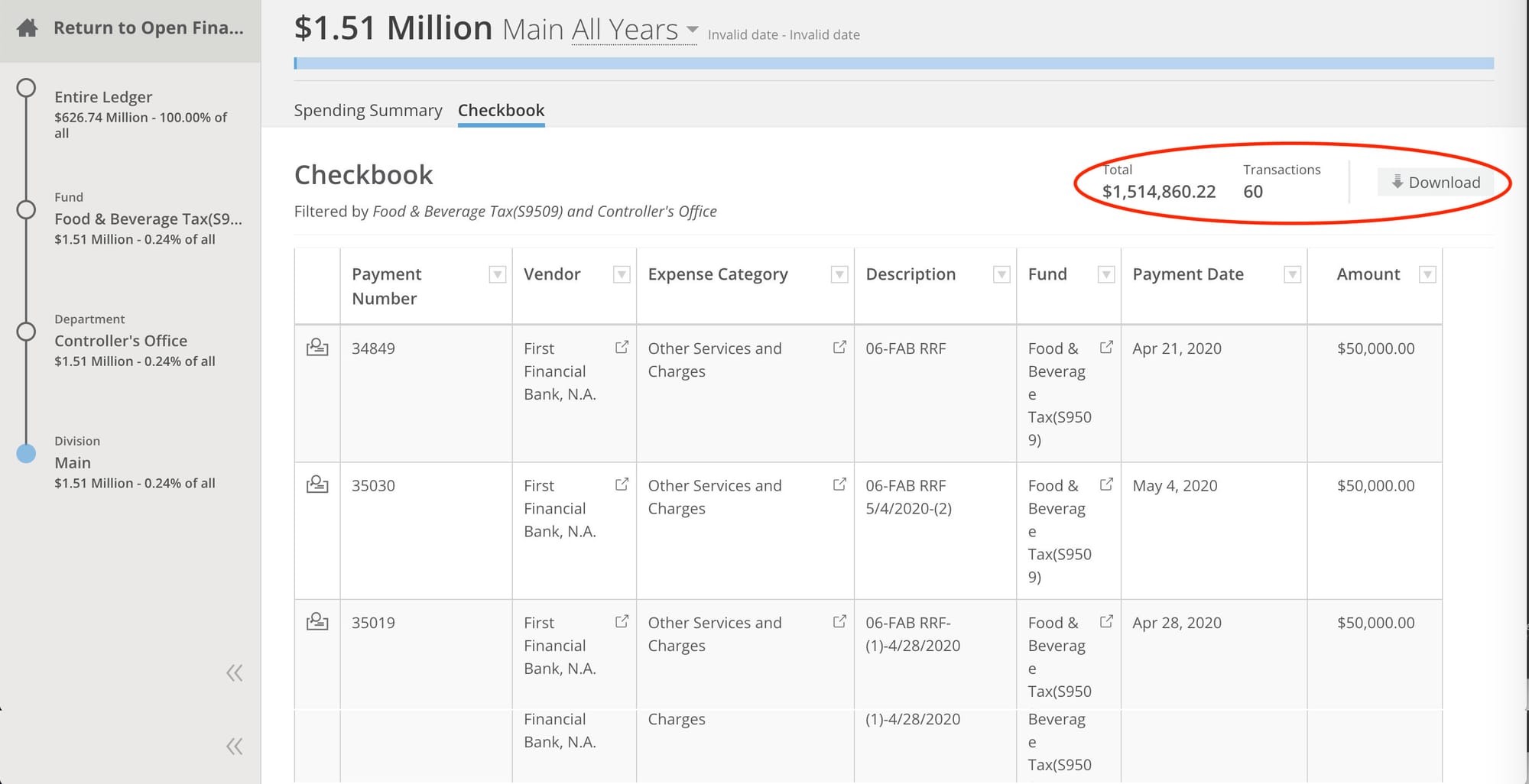

6. View the data onscreen or download it for import into a spreadsheet program.

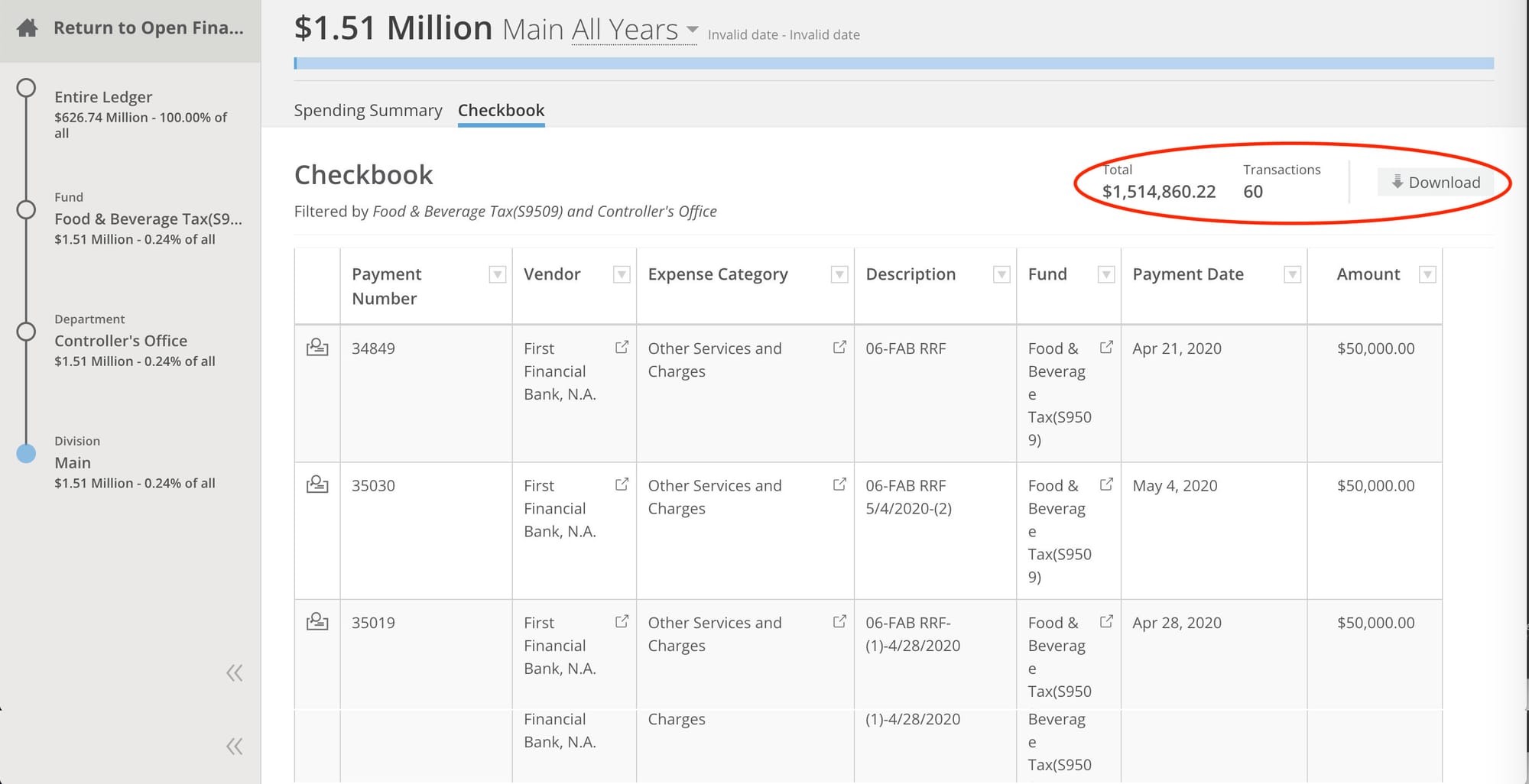

There are 60 total transactions in the ledger for expenditures from the food and beverage tax fund. Here’s a link: shared Google Sheet of the 60 transactions. Here’s a summary by “vendor,” which just means the entity to which the money was paid.

| Vendor | Total Amount |

| First Financial Bank, N.A. | $1,316,600 |

| Bloomington Urban Enterprise Association | $121,627 |

| Barnes & Thornburg LLP | $27,305 |

| Schmidt Associates, INC | $24,828 |

| O. W. Krohn & Associates, LLP | $16,000 |

| Precision Point, INC | $8,500 |

| Grand Total | $1,514,860 |

The payments to First Financial Bank and the Bloomington Urban Enterprise Association were part of the COVID-19 loan program, which the city offered to hospitality-related local businesses. Barnes & Thornburg is an Indianapolis law firm. Schmidt Associates provided architectural services. O. W. Krohn & Associates provided financial analysis. Precision Point provided mapping services.

Bloomington’s 2024 food and beverage tax plan, which was filed with the state, indicates that as of Nov. 28, 2023, loan recipients have repaid Bloomington $736,672.44, or about half of the money.

If the amount paid to Schmidt Associates for architectural services seems low, that’s because a different fund has been used to pay the firm for most of its work related to the convention center.

Bloomington’s online system also makes it easy to break down expenditures by vendor. For work related to the convention center, the city has used the consolidated TIF (tax increment finance) fund to pay Schmidt Associates $183,737.07.

Steps for getting breakdown for expenditures by fund

Comments ()