Food and beverage revenues up in Monroe County, as state legislators “make sausage” on time limiting tax

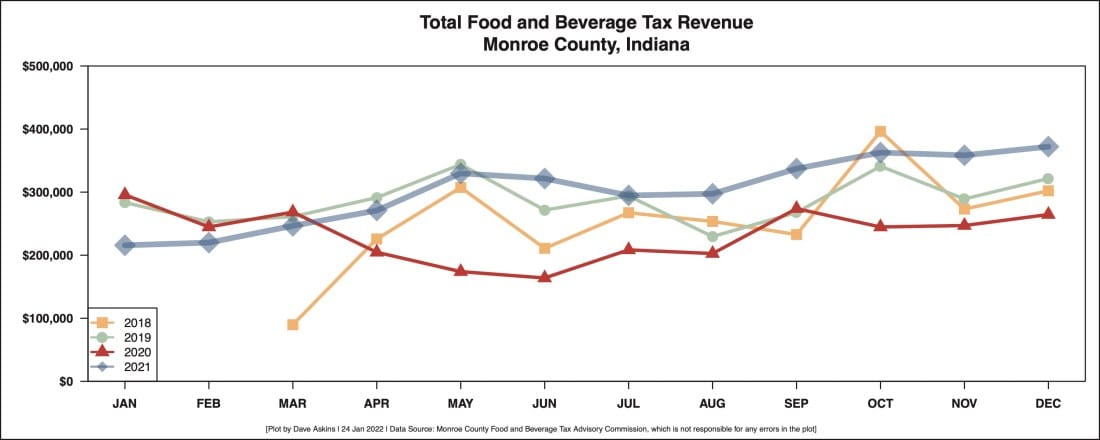

Food and beverage tax revenues for Monroe County were better in 2021 than 2019, the most recent year not impacted by the COVID-19 pandemic.

The $3.63 million collected in 2021 is about 5 percent more than the $3.45 million generated by the tax in 2019. Based on just the last six months of the year, 2021 was about 16 percent better than 2019.

That’s based on the December numbers reported by the county, which got a passing mention at the end of the Monroe County council’s meeting on Tuesday.

About the $372,000 figure from December, county councilor Cheryl Munson said the numbers indicate that the public is supporting restaurants. “This is just good news for us in terms of our local economy,” Munson said.

The tax is divided between Bloomington and Monroe County government, based on where the business is located. The tax collected from customers by businesses located inside the city limits goes to Bloomington, the rest to Monroe County government.

The December numbers broke down like this: $331,340 (89 percent) for Bloomington) and $40,781 (11 percent) for Monroe County.

The 1-percent tax has been paid by the purchasers of prepared food and drinks countywide since early 2018. Under the state statute that enables the tax for Monroe County, the revenue from the tax can be used only to “finance, refinance, construct, operate, or maintain a convention center, a conference center, or related tourism or economic development projects.”

Bloomington is planning to use its share of the tax to fund the expansion of the existing convention center, in collaboration with the county government. Monroe County controls some of the neighboring land that has been in the mix for planning purposes.

In early March of 2020, the city of Bloomington and Monroe County officials had reached another rough patch in their collaboration. When the pandemic arrived shortly after that, the project was easy to put aside for a while.

Depending on what the state legislature does with SB 390 this session, Bloomington and Monroe County might not have more than a couple of more decades to collect food and beverage tax revenues. On Tuesday, the bill got a “do pass” recommendation from the senate’s committee on tax and fiscal policy.

Among other things the bill would provide an expiration date for food and beverage taxes, like Monroe County’s, that do not have an end date. SB 390 would make the end date Jan. 1, 2042 or the date on which all bonds or lease agreements outstanding on March 15, 2022, are completely paid—whichever is later.

The planning for the Monroe County convention center expansion is not far enough along for Bloomington to have issued bonds. A 20-year bonding scenario was reviewed in 2019 by the city’s consultant, who concluded that there would be sufficient bonding capacity from the food and beverage tax revenue to come close to covering the cost of the project as it was conceived at the time.

At the end of the county council’s Tuesday meeting, it was councilor Marty Hawk, the sole Republican on the seven-member group, who mentioned SB 390. Hawk was following up on Munson’s remarks. Hawk said it is important to keep an eye on SB 390. About the state legislators, Hawk said, “They’re making sausage up there like nobody’s business in the short session.”

SB 390 would still need a vote by the full senate, and favorable consideration by the state house, in order to be passed.

Comments ()