Food and Beverage tax notebook: Advisory group OKs $350K more for 2024 capital board’s budget

On Monday afternoon, the expansion project for the Monroe Convention center took a procedural step forward.

At its Monday meeting, the county’s FABTAC (food and beverage tax advisory commission) approved a requested additional expenditure from food and beverage tax revenues, to support the revised 2024 budget for the Monroe County capital improvement board (CIB).

The city of Bloomington’s share of the food and beverage tax, which comes to about 90 percent of what’s collected across Monroe County, is supposed to be the source of funding for the convention center expansion project.

The request in front of the FABTAC on Monday was to use an additional $350,702 in tax revenue, beyond the $250,000 that was in the CIB’s initial 2024 budget.

Most of the additional money came from one line, which was for $255,000 in professional services.

That’s a figure that drew a question from Mark Bell (Trailhead Pizza). Bell is one of three FABTAC members who are required, under state law, to be the owner of an establishment that collects the food and beverage tax.

Bell’s question: “Who’s going to do what for $250,000?” The answer came from CIB controller Jeff Underwood, who described the role of J.S. Held as the CIB’s owner’s representative for the project. It’s the professional services of J.S. Held that account for the $255,000 line in the revised budget.

The other food establishment owner attending Monday’s FABTAC meeting was Galen Cassady (Uptown Café). Rounding out the members at Monday’s meeting were: Cheryl Munson (county councilor); Penny Githens (proxy for county commissioner Julie Thomas); and Gretchen Knapp (Bloomington deputy mayor); and Andy Ruff (Bloomington city council), who chaired the meeting.

An additional $75,000 is listed in the revised budget, to account for Weddle Bros. as construction manager—for preconstruction services. The remainder of the additional expenditure stems from additional legal and controller fees.

Munson put the additional $350,702 request from the CIB in the context of the the city of Bloomington’s food and beverage tax fund balance, which was reported to the FABTAC on Monday by city controller Jessica McClellan as $19.8 million.

Munson called the $350,000 a “drop in the bucket”.

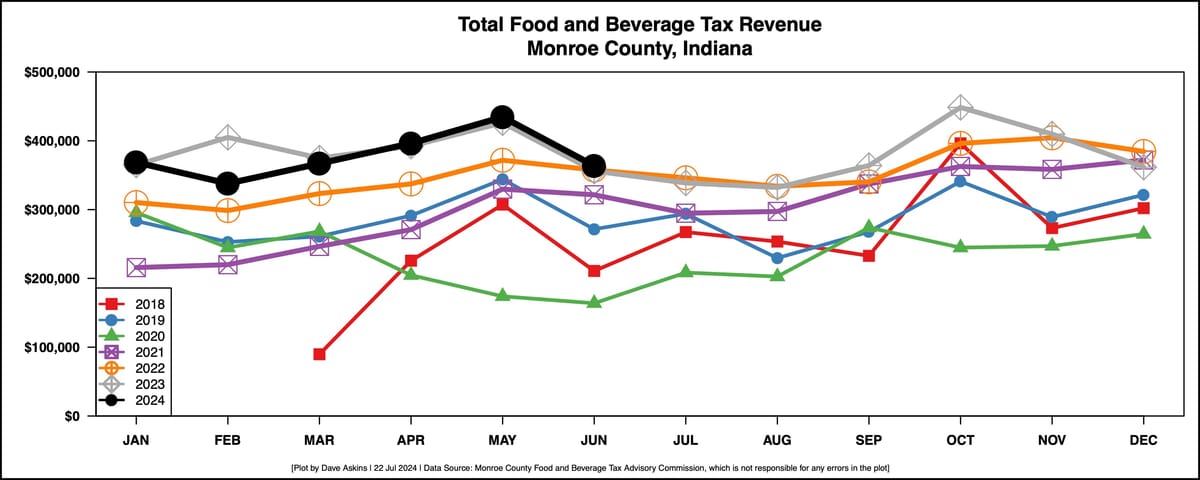

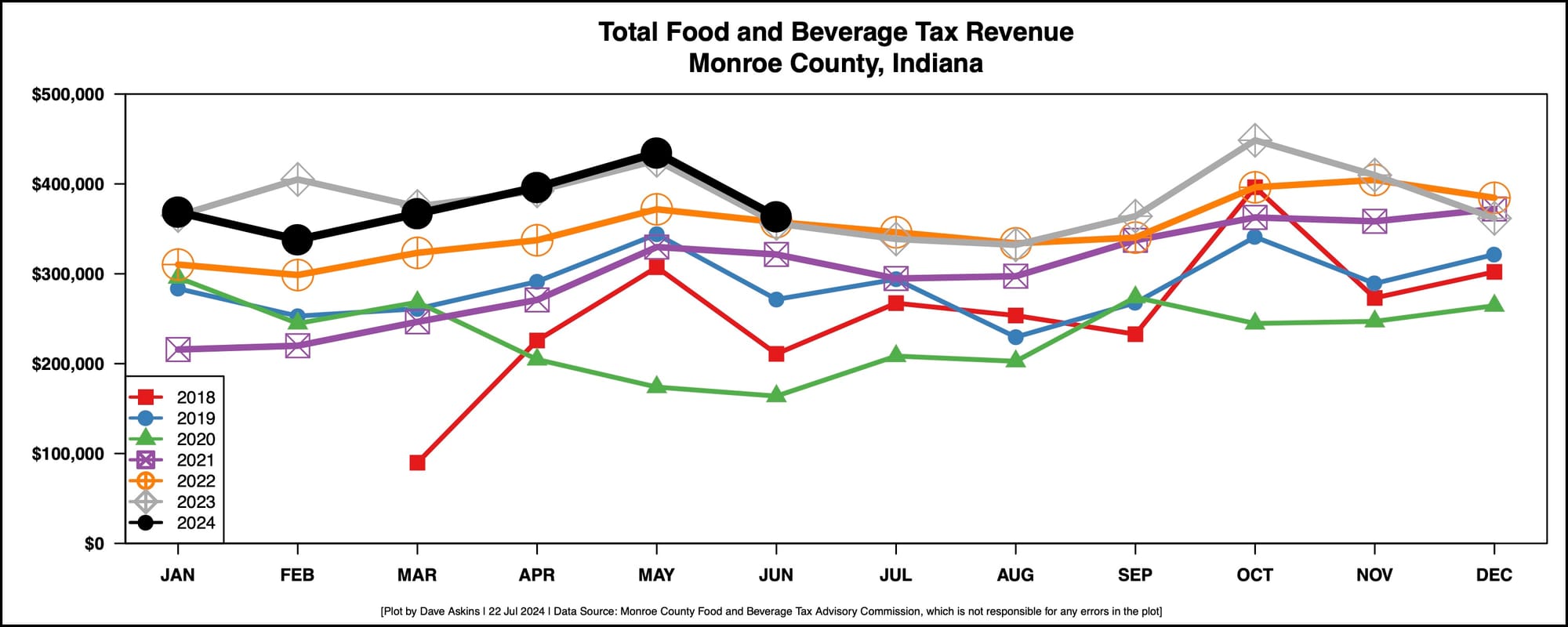

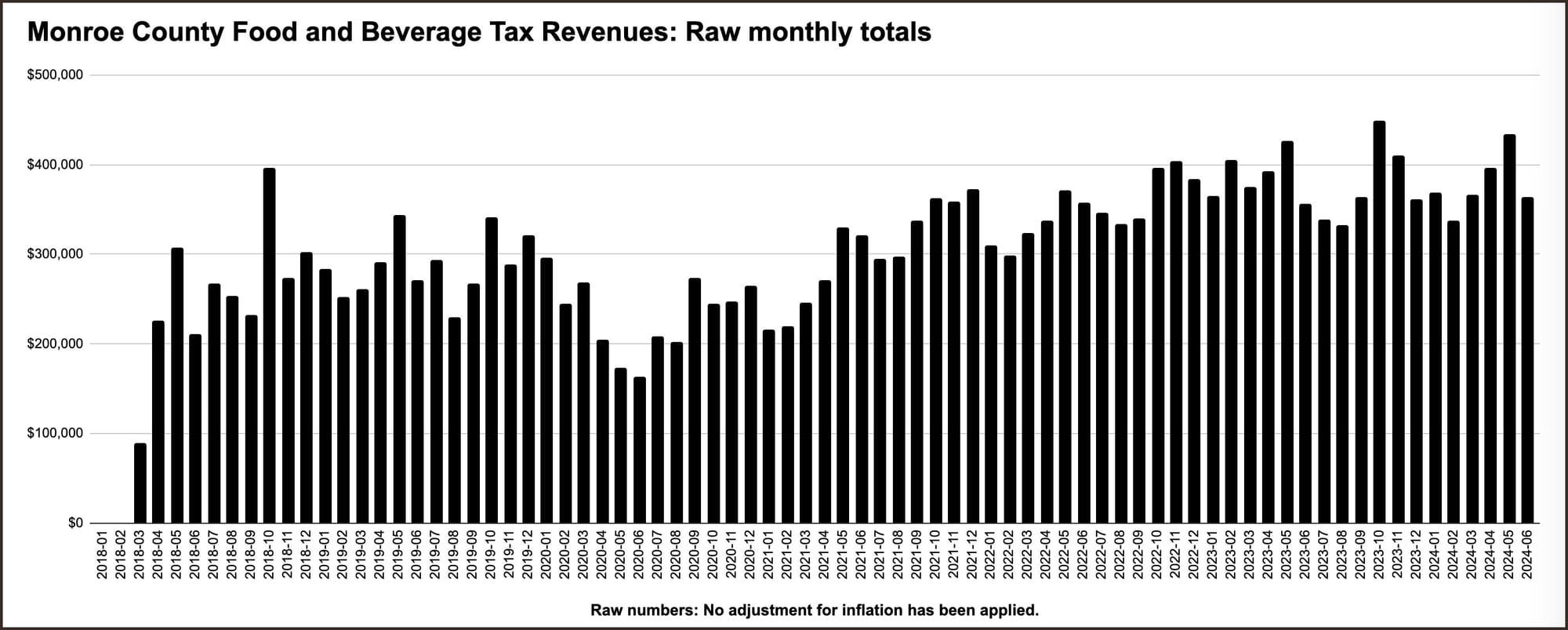

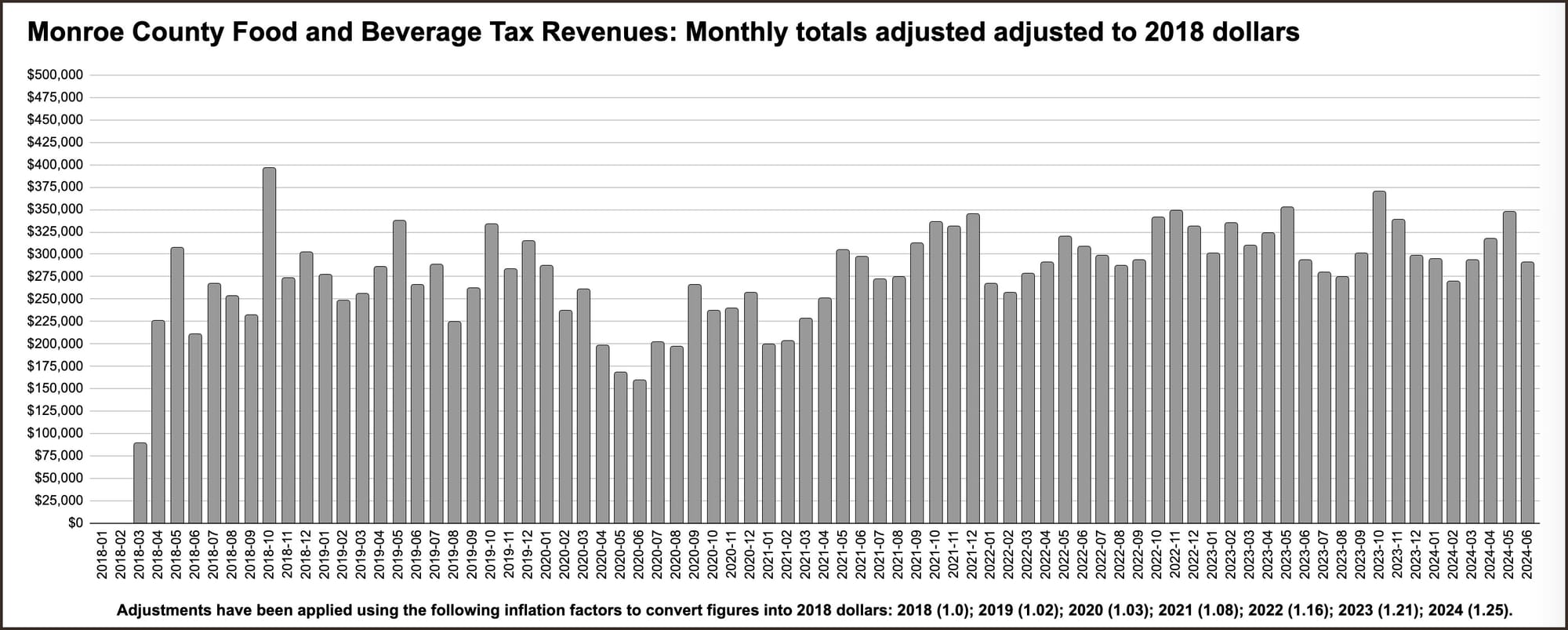

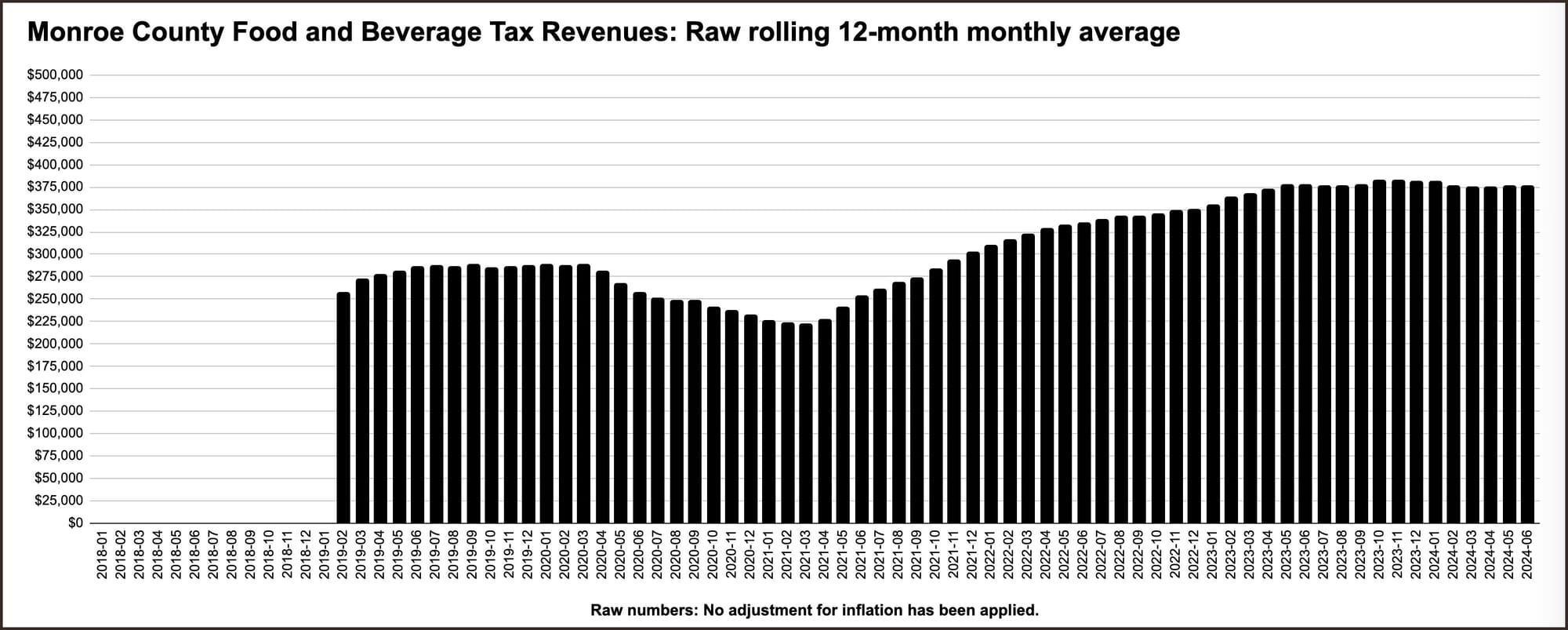

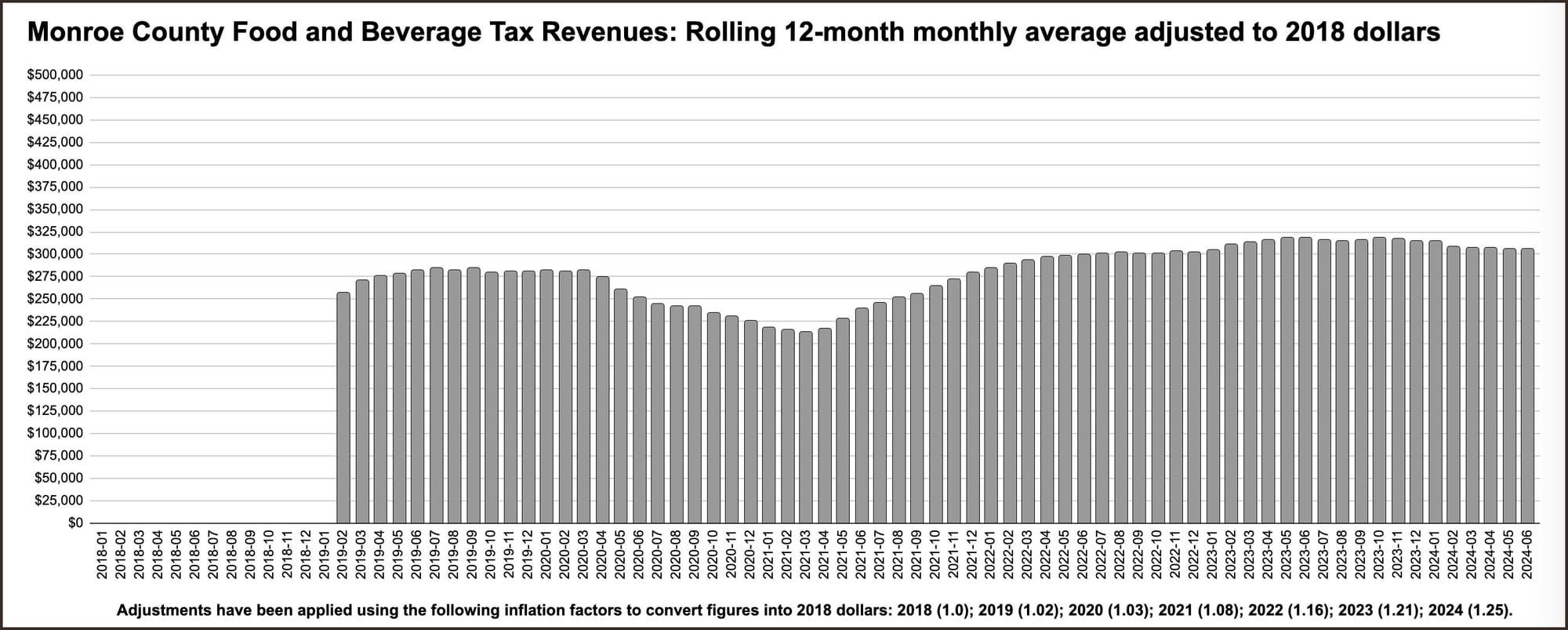

The most recent raw rolling 12-month monthly average of revenues for the food and beverage tax collected countywide is around $375,000. Bloomington’s share (around 90 percent) works out to about $337,000.

Since collections of the food and beverage tax started in early 2018, the initial trend was upward. The impact of the COVID-19 pandemic was significant, but by the end of 2021, the monthly revenues were back on par with pre-pandemic numbers.

Since May 2023, the rolling 12-month monthly average revenue has been basically flat, at around $375,000 a month. If those numbers are adjusted to 2018 dollars, the flattish trend dates back a year earlier, to June 2022.

From a procedural perspective, the revision to the CIB’s 2024 budget now needs to be approved by Bloomington’s city council. It’s expected to appear on the council’s Aug. 7 meeting agenda.

The cost of the $4.4 million design contract with Schmidt Associates, the project architect, does not appear in the 2024 budget, because the purchase order for the work, which is still open, dates back to 2019.

In 2019, the Bloomington city council requested that the FABTAC review a $6.25 million expenditure of food and beverage tax revenue. After getting an approval from the FABTAC, the council appropriated the money.

The CIB hopes to see the convention center expansion completed by the end of 2026.

Food and beverage tax revenue trends

[Current food and beverage revenue report from Monroe County]

Revised 2024 CIB Budget

| Revised 2024 Budget | Approved Budget | Revised Budget | Additional Request | |

| Category 1 – Personnel Services | $0 | $0 | $0 | |

| Category 2 – Supplies | $1,000 | $500 | -$500 | |

| Category 3 – Services | ||||

| Professional Fees – Internal | Legal | $90,000 | $122,858 | $32,858 |

| Professional Fees – Internal | Controller | $40,000 | $46,844 | $6,844 |

| Professional Fees – External | Owner’s Rep | $50,000 | $305,000 | $255,000 |

| Architectural & Design Fees | $50,000 | $50,000 | $0 | |

| Insurance | $15,000 | $0 | -$15,000 | |

| Other | Website | $4,000 | $500 | -$3,500 |

| CMC preconstruction services | $0 | $75,000 | $75,000 | |

| Category 4 – Capital | $0 | $0 | $0 | |

| Total | $250,000 | $600,702 | $350,702 |

Comments ()