Joint Ellettsville–Richland Township government could be on November 2026 ballot

A proposal to merge Richland Township and the Town of Ellettsville into a single government could appear on the Nov. 3, 2026 ballot. The move, prompted partly by state tax changes and talk of eliminating township government, will be discussed Friday in a joint public meeting.

Voters in the Town of Ellettsville and Richland Township could see a referendum on the Nov. 3, 2026 ballot that would determine if the town and the township merge into a single governmental unit. That’s according to a statement posted on the town’s website.

If the measure appears on the ballot and it passes, the merger would be effective starting in 2027.

A public meeting on the topic—a joint work session of the township board and the town council —is set for Friday (Nov. 14) at 3 p.m.

Indiana state law lays out which units are allowed to merge—and a township merging with a town is one of the options.

Friday’s planned meeting and the possible merger got some airtime at Monday’s meeting of the town council. The council voted to authorize the exploration of the possible government reorganization.

Town manager Mike Farmer said on Monday that the idea of the merger was not “hatched” locally, but rather has been suggested by state-level officials, and pointed to the merger last year between the Town of Sheridan and Adams Township as an example. Voters approved the measure with 73% support.

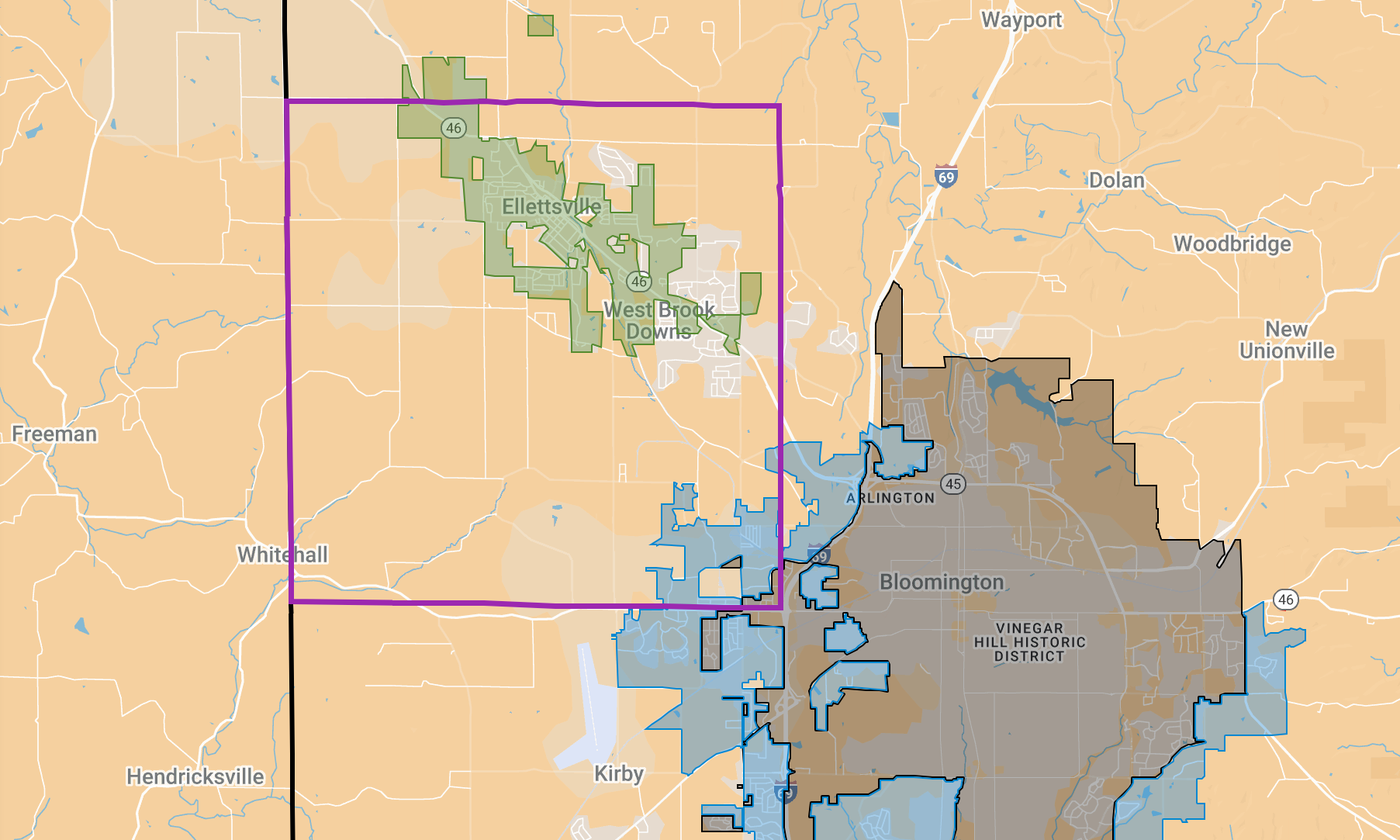

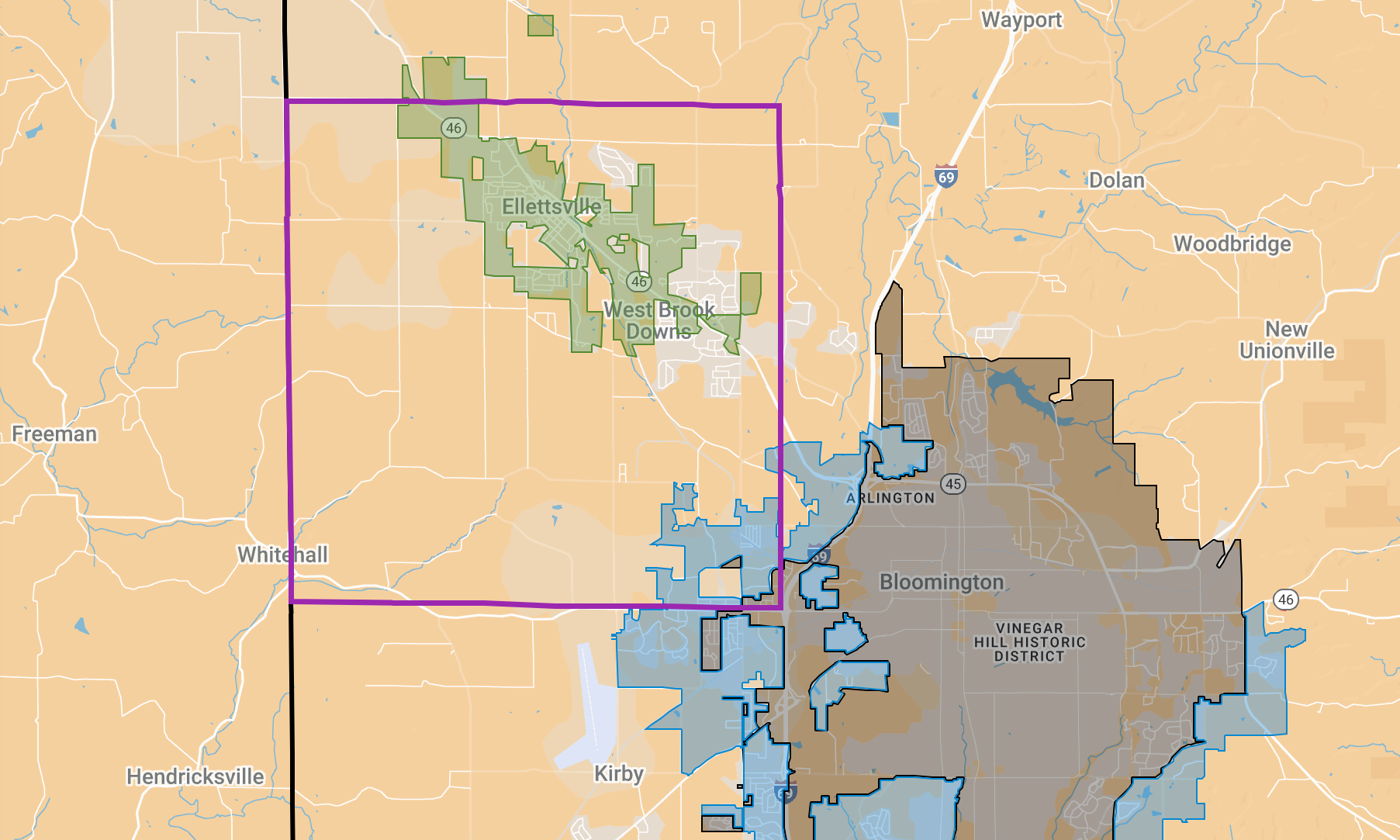

Richland Township, with a population estimated at 15,143 is a roughly 35-square-mile area, which encompasses almost all of the Town of Ellettsville, with an estimated 6,653 residents. (Estimates are from the 2023 American Community Survey done by the U.S. Census.)

The motivation behind the merger on the township’s side stems in part from the revised local income tax structure that is set out in the SEA 1 bill that was passed in this year’s legislative session. Starting in 2028, SEA 1 eliminates the “certified share” portion of the local income tax that townships have received historically, and replaces it with a rate that is contingent on approval by the county council. For 2025, Richland Township was slated to receive $470,163 in certified shares of local income tax.

The statement on the town’s website indicates a “growing discussion at the state level about eliminating township government altogether.” At Monday’s town council meeting, council president Scott Oldham said, “And just for clarity, I think one of the things that drove this initial conversation is the state and the governor expressing an overwhelming desire to do away with township governments.”

The website statement describes the basic idea behind the possible merger like this: “This proactive step would be a part of a collaborative effort to protect essential public services, preserve local identity, and create a more efficient and sustainable structure for future growth for the entire township.”

According to the statement, the plan being discussed would create a new Reorganization Committee made up of seven members—three appointed by the township, three by the town, and one additional member. The committee would be tasked with preparing a detailed plan that covers fiscal impacts, service boundaries, governance structure, and integration of personnel and equipment.

According to the statement, the proposal would maintain current service levels for fire protection, police, public works, parks, and other functions. Existing debt would stay with the taxpayers who incurred it, and no new taxes could be imposed without voter approval.

Town council member William Ellis said at the conclusion of Monday’s meeting, “This is probably the most historic and the biggest thing that Ellettsville has considered in their history.” He added that the council is not taking it lightly.

At their Monday meeting, the back and forth among town council members indicated that they want the various committee meetings to be open to the public. They also want the committee meetings to be properly noticed so that any number of town council members can attend, without violating Indiana’s Open Door Law.

Local Income Tax rates after SEA 1

** The sum of these rates can’t be greater than 1.7%, which means that the county council can’t max out the rate for every category.

Comments ()