Letter from Monroe County to state lawmakers in limbo as jail size could face fresh look

Debate about the wording of a letter from Monroe County to the state legislature asking for changes to state tax law might now include the question of whether to send a letter at all. There’s also now a question about rethinking the scope of the planned new justice center.

Internal debate within Monroe County government about the wording of a letter to the state legislature, asking for changes to state tax law, might now include the question of whether to send a letter at all.

And if a letter is sent, there’s now a question about whether it should be sent ahead of potentially rethinking of the scope of the county’s planned new jail and justice center, which is the project that prompted the idea of a letter.

That’s based on discussions at this past Friday’s (Aug. 1) meeting of the county council’s long-term finance committee. County council president Jennifer Crossley asked Greg Guerrettaz, with Financial Solutions Group, the county’s consultant: “I’ll just ask the direct question, is it really worth it doing this letter?” Guerrettaz’s response, based on his regular dealings with state legislators, was affirmative: “My belief is [state legislators] want to hear … what dilemmas have been created …”

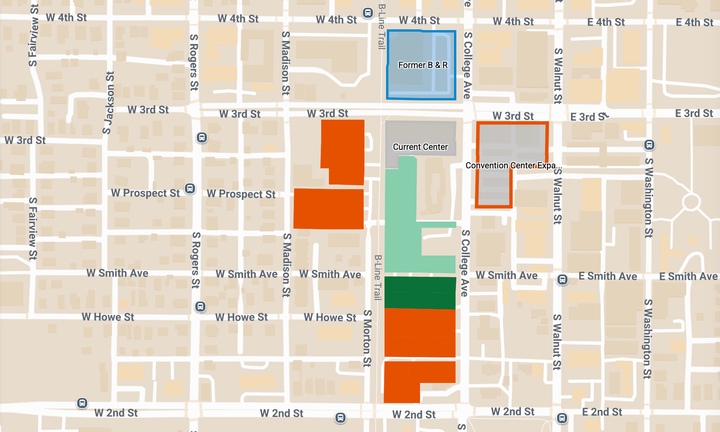

The dilemma that has been created for Monroe County government is the impact of the new tax law on the county’s financing plan for its new justice center project. Under the new law, only 25% of revenue from the county’s local income tax (LIT) can be pledged for debt service, and the county will need close to 50% of its LIT revenue to cover the debt on its planned $225-million project.

The $225-million figure is based on a 500-bed jail, and it’s still the number included in the financial planning documents that Guerrettaz provided to the committee on Friday, even though the estimated cost of the project has grown to as much as $280 million, as county officials have worked behind the scenes to ratchet costs back down.

Set for next Friday (Aug. 8) is a meeting of county councilors to discuss the wording of the letter to state legislators. The letter, which was initially drafted by county commissioners, has been a point of friction since late June. County commissioners are also expected to attend the Aug. 8 letter writing meeting.

After Friday’s committee meeting, Crossley confirmed to The B Square that next Friday’s meeting could include the question of whether to even send a letter. Asked if and when county electeds might discuss a possible reduction in scope of the project, Crossley pointed to a possible meeting on Aug. 19, which has been spitballed as a possible date to receive a presentations of schematic drawings, but has not yet been put on the county’s online calendar.

Crossley said that the new state law had forced the county government to take a pause in its justice center planning, and during that time, county officials should “really take a look at the scope of what it is that we’re doing.” Guerrettaz indicated to councilors that they needed to be able to justify the scope of the justice center project, in case they were asked by state legislators. Responding to a question from councilor Kate Wiltz, who joined the committee meeting through a Microsoft Teams interface, Guerrettaz said, “Just be prepared for that, if you send a letter, there may be some follow up on why this size and things like that …”

The Aug. 19 presentation would make up for a missed meeting that was supposed to happen on May 29, based on a timeline presented by DLZ Corporation in February.

At Friday’s committee meeting, councilor David Henry floated the idea of focusing a letter to the state legislature just on the general issues of fiscal control that the new tax law raises, like bond ratings, given the new requirement that LIT rates be reapproved every year. Henry asked Guerrettaz: “[What] if we took the language about the jail and justice center out of the letter and it was just focused solely on the impact of the counties to use the instruments to service any debt?”

Guerrettaz told Henry, “Frankly, I have mentioned what we’re doing here to Representative [Jeff] Thompson. And I think the response was: ‘We want to hear specifics. We want to know what the challenges are so that we can address them.’”

Of the three justice center financing options that Guerrettaz listed out for the committee on Friday, the one involving a referendum had no traction at all with committee members. Guerrettaz himself told the committee he did not see the referendum as a “real viable option.” Councilor Marty Hawk confirmed to Guerrettaz that she didn’t think he was taking it seriously.

About the referendum option, Crossley told The B Square before the meeting started, “That’s a no from me,” and confirmed after the meeting that was still her view. Councilor Trent Deckard also indicated to The B Square after the meeting he did not support the idea of a referendum.

The only option on the list that appears feasible is one that would require the help of state legislators. That’s an scenario that would include a $225 million 20-year bond issue assuming a 5% interest rate with annual payment of around $18 million. To achieve that revenue from LIT, the county would need a LIT rate of 0.41%, according to Guerrettaz’s estimates.

Under the new tax law, counties have the ability to impose a LIT rate up to 1.2% to cover their own operating expenses. According to Guerrettaz’s calculations, just for Monroe County to make ends meet under the new LIT scheme, which takes effect in 2028, it would have to impose a LIT rate of 0.95%. So the county could not fund the new justice center out of the basic LIT structure provided by the new tax law.

Included in the handout that Guerrettaz gave the committee on Friday, was a scenario where the county government uses its authority under the new tax law to benefit a town with fewer than 3,500 residents, namely Stinesville. Monroe County could impose a 1.2% LIT rate on all residents of the county that don’t have a rate imposed on them by Bloomington or Ellettsville. Of the $22.4 million that would generate per year, the county government could take up to 75% of it, which would generate $16.8 million for the county government and $5.6 million for Stinesville.

At Friday’s committee meeting, councilor Marty Hawk commented on the possibility of using that part of the new tax law by saying, “Of course, we’re never going to put in place a property tax across the board for every county taxpayer … to cover Stinesville.” But Hawk indicated that the council should keep in mind the idea of imposing a rate lower than 1.2%—as Hawk put it, “the smallest amount that we could”—only to make up for the property tax revenue that the county government will lose under the new tax law.

Local income tax rate scheme under SEA1

In the table below sum of the actual amounts with an asterisk (*) cannot exceed 1.7%. (The table is based on a presentation from Reedy Financial Group to the Bloomington Transit board.)

Comments ()