Local income tax increase: Decision delayed by Bloomington city council to May 4

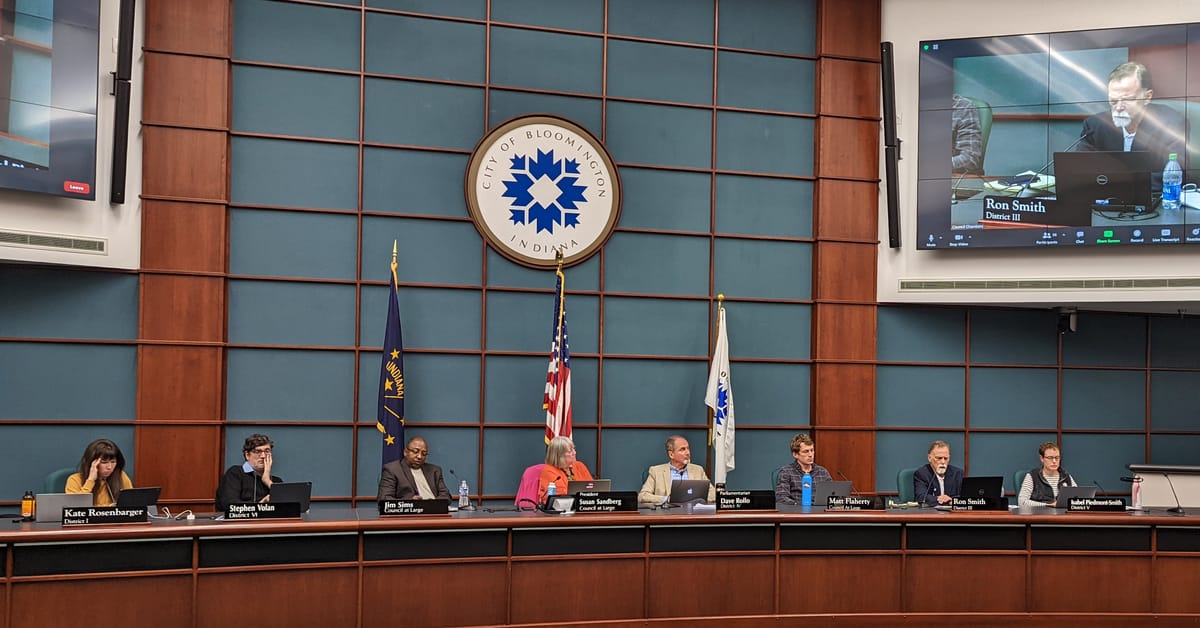

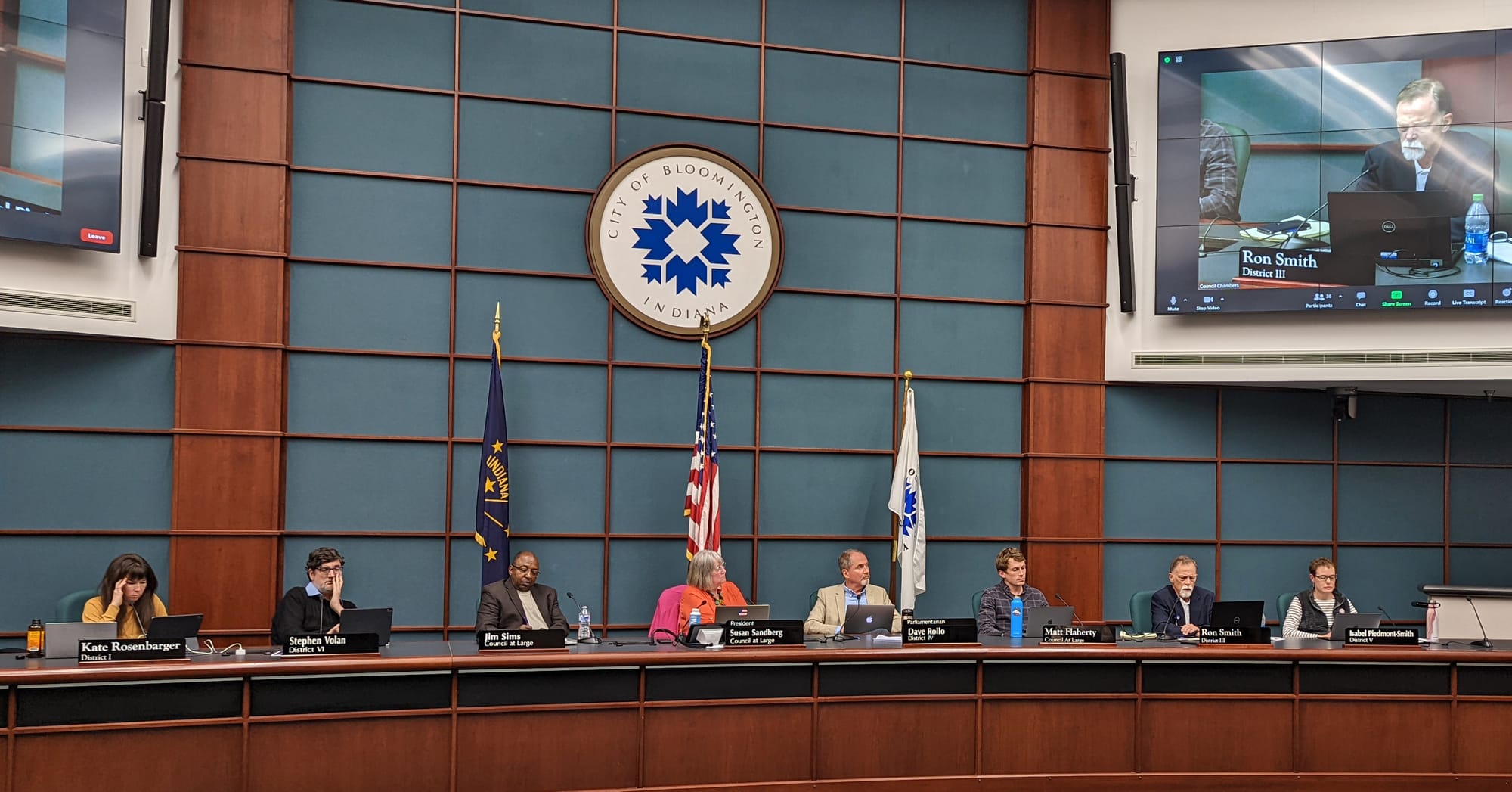

On Wednesday night, Bloomington’s city council voted 8–0 to postpone consideration of a countywide local income tax increase until its next regular meeting, which is scheduled for May 4.

The vote to postpone came a few minutes after 9 p.m. That made for a meeting that lasted about two and a half hours. Councilmembers asked questions of the mayor and staff, heard another round of public commentary, and discussed the proposal among themselves.

It’s the city council’s second postponement of the LIT rate increase in as many weeks. The likely delay in the vote this week was announced by council president Susan Sandberg at the start of Wednesday’s meeting.

Sandberg said there was a “special circumstance” that prevented a councilmember from attending in person. It was Sue Sgambelluri who could not attend in person.

Because the city council was considering a tax increase, that meant Sgambelluri could not participate in the meeting using electronic communication.

Even though general Indiana’s Open Door Law (ODL) allows for remote participation through electronic means, there are some circumstances that preclude a member’s remote participation. Among them are meetings when the governing body is taking final action to “establish, raise, or renew a tax.”

It’s the same part of the ODL that prevented Bloomington’s board of park commissioners from acting the previous day on the issuance of $5.8 million in general obligation bonds. Issuing general obligation bonds has the impact of raising property taxes.

The city council could have still taken a vote on the LIT rate increase this Wednesday. But outright success would have depended on the support of all eight councilmembers present—because of the way votes on countywide LIT increases are allocated to the city council, the county council and the Ellettsville town council.

If there are just seven city council votes in favor of the increase, which is currently proposed at 0.855 points, the proposal would need to pick up support from some county councilors and/or some town councilors.

Even with Sgambelluri’s participation, the votes on the city council could fall short of the eight that would mean automatic enactment of the LIT increase, with no additional support from other governmental units.

In any event, the Bloomington city council did not appear in a mood on Wednesday to allow the decision to come down to the absence of one of its members.

Another factor that contributed to the decision to delay was a lack of consensus. No amendments were proposed on Wednesday night.

Saying on Wednesday they would support the full 0.855-point increase proposed by Bloomington mayor John Hamilton were four councilmembers: Kate Rosenbarger, Steve Volan, Matt Flaherty, and Isabel Piedmont-Smith.

Also expressing support for some amount of increase was Jim Sims. But Sims also talked about the need for compromise. “What is the priority? What is the compromise? And what can we all live with?” Sims asked.

On Wednesday, councilmember Matt Flaherty did not add much to what he’d said at a previous meeting, when he stated that he’d be willing to support a LIT increase as low as 0.65 points, in order to reach some kind of common ground.

Those who appear most reluctant on the council to go along with the full amount of the mayor’s proposal are Ron Smith, Dave Rollo and council president Susan Sandberg.

The LIT increase was the sole item on this Wednesday’s special meeting of the Bloomington city council. The proposal is to increase the countywide income tax by 0.855 points, which would bring Monroe County’s total rate to 2.2 percent.

Bloomington mayor John Hamilton re-floated the idea of a local income tax increase at his “state of the city” address this February. It was an idea he had unsuccessfully pitched in 2020. The mayor gave details of this year’s proposal in early April.

Comments ()