Local income tax increase postponed by Bloomington city council until April 27, but $11.6M in bonds OK’d

Bloomington’s city council has postponed its decision on an increase to Monroe County’s local income tax (LIT) rate.

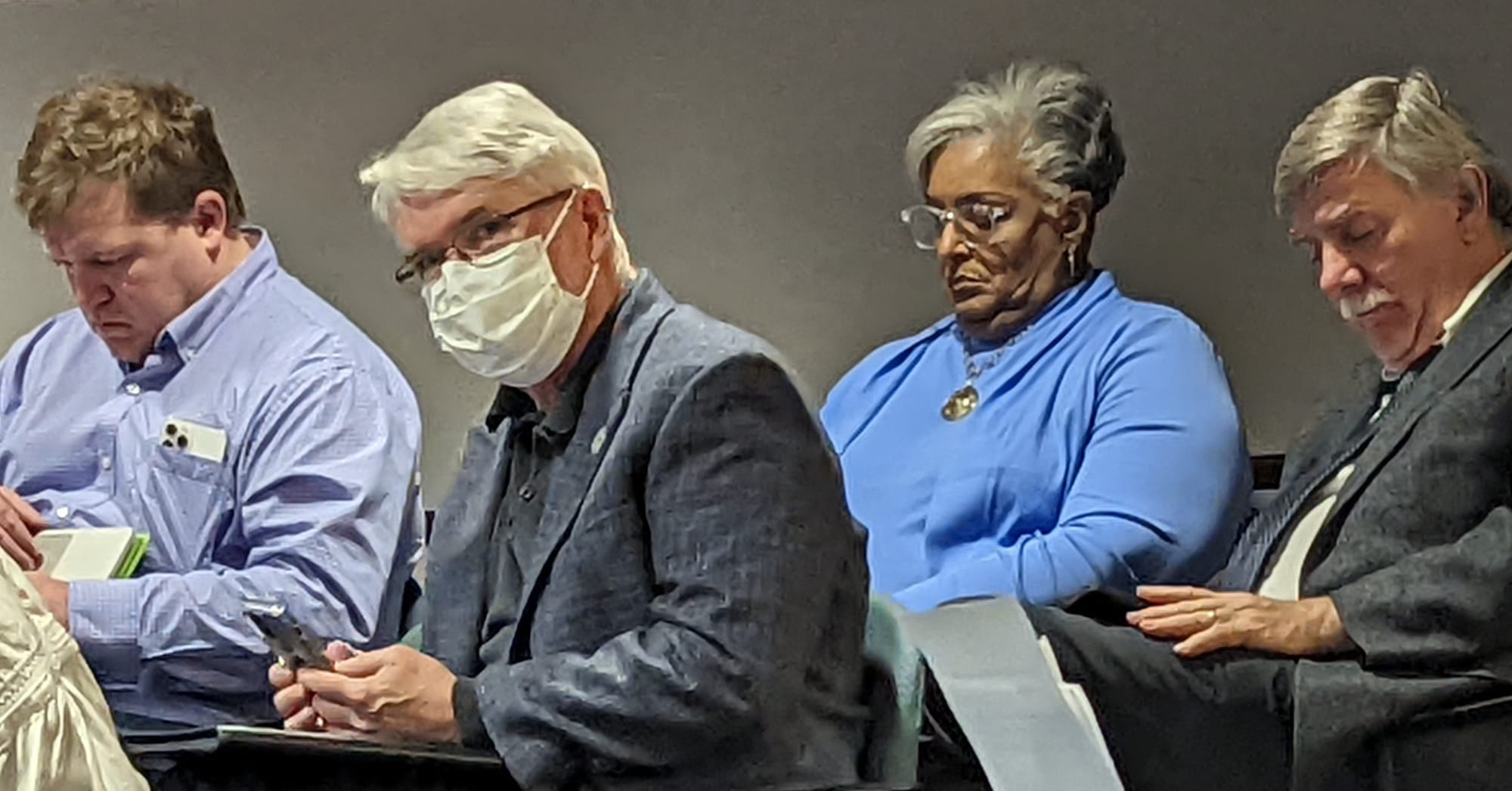

On Wednesday, the vote on the motion to postpone was 8–1 with Steve Volan dissenting. The council will take up the matter again a week from Wednesday, at a special session on April 27.

Volan’s vote against postponement was not based on a desire to take a final vote on the LIT increase that night. Volan wanted some additional deliberation by the council on the question before postponement. The vote to postpone was taken at 10:52 p.m. almost four and a half hours after the meeting started, at 6:30 p.m.

Bloomington mayor John Hamilton has asked the council to consider an increase of 0.855 points, bringing Monroe County’s total rate to 2.2 percent.

If the city council approves the LIT rate increase by a vote of at least 8–1, that will increase the tax for all residents of Monroe County. If the approval gets fewer than eight votes of support, then the proposal would need to pick up some support from the county council and/or the Ellettsville town board.

Even though councilmembers did not take a vote on the LIT increase, they did approve the issuances of two $5.8 million general obligation bonds—one for a set of public works projects and the other for a set of parks projects. The board of park commissioners is set to take a final vote on the parks bonds on April 26.

In other business on Wednesday, the Bloomington city council approved a nominal decrease to the city’s drinking water rate. The decrease driven by the General Assembly’s repeal of the 1.4-percent utility receipts tax. It was a pass-through tax, which means it was collected by utilities and forwarded to the state.

For the residential rate, the decrease is 5 cents—from $4.03 to $3.98 per 1,000 gallons. That works out to 1.2 percent less.

On Wednesday, the city council also passed a resolution of support for the Indiana Graduate Workers Coalition, which has gone on strike in an effort to persuade the Indiana University administration to recognize the coalition as a union. Councilmember Sue Sgambelluri did not participate in deliberations or the vote, because she is director of development for the IU College of Arts & Sciences.

Related to new revenue proposals on Wednesday, Bloomington’s council did approve the issuance of two $5.8 million dollar general obligation bonds—one set of bonds related to public works and the other related to parks.

The original list of public works projects got trimmed down through amendments put forward by councilmembers Matt Flaherty and Isabel Piedmont-Smith. The vote on the amendment to the public works bonds was 5–4 with support from Flaherty, Piedmont-Smith, Steve Volan, Kate Rosenbarger and Sue Sgambelluri. Voting against the amendment were Jim Sims, Susan Sandberg, Dave Rollo, and Ron Smith.

The issuance of the public works bonds was approved by an 8–1 vote. Dissenting was Dave Rollo, who said he was not comfortable with the process because he felt it amounted to the city council relinquishing more control than it should.

The project list for the parks bonds was winnowed down on a unanimous vote. The vote on the issuance of the parks bonds was also unanimous. A table of the amended bond project lists is included below.

The increased property tax rate to pay the debt service on one of the $5.8 million bonds is estimated at 3.3 cents. Bloomington’s current general fund property tax rate is about 61 cents.

For a property with an assessed value of $250,000, subtracting the $45,000 homestead deduction leaves $205,000. The supplemental deduction of 35-percent on that remainder leaves $133,250 as the net assessed value.

So an extra 3.3 cents of tax on that net assessed value ($133,250*.00033) would work out to $43.97 more in property taxes per year. For both bonds, for a property with $250,000 in gross assessed value, the additional property tax would work out to about $88 more a year.

The $5.8 million for each of the bonds is at the limit for a “controlled project” under state law. In 2017 the threshold for controlled projects was raised from $2 million to $5 million plus a growth quotient each year. The amount above $5 million reflects the growth quotient.

They’re called “controlled projects” because any greater general obligation bond issuance would be under the control of potential remonstrators, who could push the issue to a referendum.

At least part of the reason Hamilton’s administration wanted to issue some of the bonds through the board of park commissioners is that they don’t count towards statutory debt limits.

The city generally has a debt limit equal to 2 percent of the adjusted value of taxable property in the city. [IC 36-1-15-6] But the park bonds don’t count toward that limit. [IC 36-10-4-35]

| Bond Type | Item | Min Estimate | Max Estimate |

| Parks GO Bond | |||

| Covenanter Drive Protected Bicycle Lanes (College Mall to Clarizz Blvd) [4] | $2,400,000 | $2,880,000 | |

| W. 2nd Street Modernization, Protected Bike Lanes (Walker St to B-Line) [2] | $1,500,000 | $1,500,000 | |

| N Dunn St Multiuse Path (45/46 Bypass to Old SR 37) [3] | $800,000 | $960,000 | |

| Griffy Loop Trail dam crossing and community access [5] | $375,000 | $375,000 | |

| Replace missing sidewalk on Rogers St. by Switchyard Park [1] | $200,000 | $200,000 | |

| Parks GO Bond Total | $5,275,000 | $5,915,000 | |

| Public Works GO Bond | High Street Multiuse Path, Intersection Modernize (Arden Dr to 3rd St) [1] | $2,500,000 | $5,000,000 |

| Citywide LED conversion of street lights [4] | $1,500,000 | $2,000,000 | |

| Sidewalk projects (TBD) [3] | $ |

$1,000,000 | |

| Downtown ADA Curb Ramps (e.g., W Kirkwood and Indiana Ave) [2] | $500,000 | $1,000,000 | |

|

Public Works GO Bond Total

|

$5,000,000 | $9,000,000 | |

| TOTAL | $10,275,000 | $14,915,000 | |

The kinds of projects included in the mayor’s request for a local income tax increase, to be considered at the city council’s April 27 session, are listed out in the table below.

| Category | Description | Annual Cost |

| Climate Change | Major new service providing 15 minute frequency across a priority East/West corridor. This route addition would boost attractiveness and convenience for riders and reduce automobile use | $2,100,000 |

| Multiple efforts toward climate change prevention and preparedness. See Proposed Climate Action Plan Investments in “New Revenue FAQs” for more detail | $1,500,000 | |

| Increase access/improve equity for people who can’t ride fixed-route BT, qualify for paratransit, require special accommodations while enhancing convenience, and expand those services. City-wide service expansion. | $1,400,000 | |

| Improve convenience for all riders, boost ridership, reduce automobile use | $820,000 | |

| Achieve 7-day service for greater consistency and reliability in an effort to boost ridership and reduce single occupancy vehicle use | $300,000 | |

| Focus on workforce partners to develop pilot program in collaboration with the Transportation Demand Management program; explore a potential “Park and Ride” program for special event traffic management |

$125,000 |

|

| Improve access to public transportation with a focus on workforce and low-income riders | $100,000 | |

| Climate Change Total | $6,345,000 | |

| Essential Services | Offer incentives to attract and retain talented City employees, such as pay adjustments, hiring bonuses, creation of new positions, tuition reimbursement, relocation allowance, longevity bonuses, and/or housing assistance. | $1,000,000 |

| Replace shortfall resulting from decreased Cable Franchise Fees (cable fees lost to streaming) to fund essential IT infrastructure replacements, cybersecurity, and CATS | $500,000 | |

| Meet obligations for city property & liability Insurance, materials & supplies, repair & maintenance. | $500,000 | |

| Maintain aging facilities and other physical assets and replace when required | $500,000 | |

| Essential Services Total | $2,500,000 | |

| Public Safety | Replace or repair damaged and aging facilities with new or upgraded facilites, in order to attract and retain employees and meet safety standards | $1,500,000 |

| Fund the costs associated with the contingent Fraternal Order of Police (FOP) contract | $1,500,000 | |

| Consolidate public safety headquarter operations to replace current damaged and inadequate facilities and to benefit from efficiencies of scale. | $1,000,000 | |

| Tailor response options for 911 calls, health and wellness checks, etc. to divert more 911 calls to non-sworn personnel. Explore combining police/fire non-sworn. | $250,000 | |

| Expand the roles and increase the number of Police Social Workers and Community Service Specialists to respond to some non emergency calls for service and those calls that do not require a law enforcement response. Provide ongoing support for the STRIDE center. | $250,000 | |

| Public Safety Total | $4,500,000 | |

| Quality of Life | Improved access to housing equity through funding assistance for the Housing Security Group/homeless; low/mod income renters; low/mod homeowners; support missing housing types | $2,000,000 |

| Direct support of low income working residents / families – possible Individual Development Accounts to match savings; focused on direct impact, possibly thru SSCAP, MCUM, Trustees, others | $750,000 | |

| Funding for workforce development initiatives, including workforce reentry, re-skilling and up-skilling, and entrepreneurship training, as well as operations and infrastructure funding for the Trades District Technology Center. | $500,000 | |

| Funding to improve food access and nutrition insecurity. Funding support will focus on partnerships with food service providers to address gaps in local food access for low income and food insecure residents. | $200,000 | |

| Funding for maintenance of existing arts spaces, execution of the recommendations of the City’s Arts Feasibility Study and Public Arts Master Plan, and support for arts organizations. | $200,000 | |

| Quality of Life Total | $3,650,000 | |

| Grand Total | $16,995,000 | |

Comments ()