Local income tax notebook: Impact on public library, public bus depending on distribution method

Community discussion of Bloomington mayor John Hamilton’s proposed increase to the countywide local income tax (LIT) has not included much mention of category of LIT called the “certified shares” category.

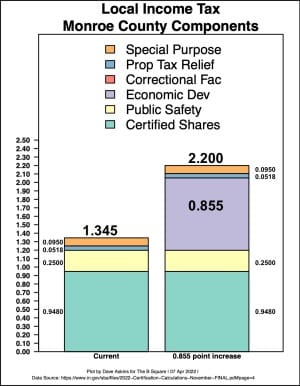

But the certified shares category makes up the biggest part of the current countywide local income tax rate. It’s the green chunk of the bars in the chart that accompanies this article.

The certified shares category has a current rate of 0.9482 percent.

For Monroe County, the total current LIT rate is 1.345 percent, which comes from adding an additional 0.25 points in the public safety category, 0.0518 points in the property tax relief category, and another 0.0950 points in a special purpose category. The special purpose LIT revenues are used for juvenile services.

It’s the certified shares category of LIT that many other units of local government rely on for some of their basic operating expenses.

Among those units are all the townships, the Monroe County Public Library, Bloomington Transit, and the Monroe Fire Protection District.

In the evolving frequently asked questions (FAQ) document produced by the city of Bloomington, the certified shares category gets only a cursory mention. [March 29, 2022 FAQ] [April 13, 2022 FAQ]

The city’s information about the various alternatives for imposing a tax increase has focused on Bloomington’s share of additional revenues—if the LIT increase were imposed in a different category than certified shares.

The different category proposed by Bloomington is called “economic development”—which would mean splitting the additional revenue with just three other government units: Monroe County, Ellettsville, and Stinesville.

There are two different methods for splitting the extra revenue from an economic development LIT—one based on proportion of population, and the other on “property tax footprint.” Most of the information and discussion provided by Bloomington administration and city councilmembers has focused on which of those two methods to use.

From a pure revenue perspective, the choice for the city of Bloomington looks easy. If the rate is increased by 0.855 points in the economic development category, the population distribution method would yield about $17.5 million in new annual revenue for the city of Bloomington, compared to $14.5 million using the property tax method.

If it’s the economic development category that is used for the increase, it’s easy to see why the city of Bloomington would prefer the population method: It would mean more revenue for Bloomington—even if it means less for Monroe County, Ellettsville and Stinesville.

Generally, if Bloomington presupposes that it wants $X in new revenue, then the way to keep the rate as low as possible, which is paid by all Monroe County residents, is to use a method of distribution that maximizes revenue to Bloomington.

If the increase is 0.855 points in the economic development category, then no matter how the economic development LIT pie is sliced, it would mean at least $14.5 million more for the city of Bloomington.

Assuming the same 0.855-point increase, but in the certified shares category, would mean about $11.3 million in additional annual revenue for Bloomington.

If Bloomington’s choice between methods of distribution within the economic development category of LIT seems easy, then the choice between LIT categories—economic development versus certified shares—seems even easier. It’s a choice between potentially $17.5 million and $11.3 million.

But the choice between the methods of distribution within the economic development category—population versus property tax footprint—is a different kind of choice than the choice of category.

The first is a decision about how to divide an extra pie between four units of government: Bloomington, Monroe County, Ellettsville, and Stinesville. The other is a decision about which units of government get any extra pie at all.

The choice for economic development as a category is a choice against allocating any extra pie to the townships, the Monroe County Public Library, Bloomington Transit, or the Monroe Fire Protection District. The school districts would not receive any extra revenue on any of these scenarios.

When two years ago, Bloomington mayor John Hamilton pitched a 0.5-point increase in the economic development category, part of the logic behind the choice of category depended on the kind of spending that was planned for the increased LIT revenue. At that time it was purely a proposal to increase spending on climate change initiatives.

The idea was to limit the increased revenue to just four units of government, creating four relatively large pools of funding, which would be the size that could fund the kind of ambitious projects that climate change mitigation would require. The incremental increases of revenue that a township, or the public library, might receive would not add up to enough for those units to launch substantive climate change initiatives by themselves—so the thinking went.

The current 0.855-point increase is nearly 70-percent more than the 0.5-point increase that was proposed in early 2020. And the scope of the planned expenditures by the city this time around is broader than climate change. It includes basic operational expenditures.

What kind of boost would a 0.855-point increase provide to the budgets of other units if it were enacted in the certified shares category?

Here’s a table, based on the current proportion of certified shares received by each unit, as applied to the roughly $30.87 million that a 0.855-point increase would generate. The rows are sorted by amount of revenue.

The numbers in the column labeled “2022 Cert Shares” are from Indiana’s Department of Local Government Finance certified shares report.

The numbers in the “Percent of Total” column are calculated by taking the number in the first column and dividing by the total of $34,232,607.

The numbers in the column labeled “Share of Additional $30,867,832” are calculated by applying the percentage in the second column to the total amount of additional revenue that a rate increase of 0.855 would generate countywide—which is $30,867,832.

Table: Breakdown of increased revenue to local units, if category of 0.855-point increase were certified shares

| Unit | 2022 Cert Shares | Percent of Total | Share of Additional $30,867,832 |

| MONROE COUNTY | $13,366,875 | 39.05% | $12,053,025 |

| BLOOMINGTON CIVIL CITY | $12,564,300 | 36.70% | $11,329,336 |

| MONROE FIRE PROTECTION DIST | $2,708,994 | 7.91% | $2,442,723 |

| MONROE COUNTY PUBLIC LIBRARY | $2,541,913 | 7.43% | $2,292,065 |

| ELLETTSVILLE CIVIL TOWN | $739,319 | 2.16% | $666,650 |

| BLOOMINGTON TRANSPORTATION | $533,666 | 1.56% | $481,211 |

| RICHLAND TOWNSHIP | $352,196 | 1.03% | $317,578 |

| VAN BUREN TOWNSHIP | $333,552 | 0.97% | $300,767 |

| BLOOMINGTON TOWNSHIP | $296,178 | 0.87% | $267,066 |

| PERRY TOWNSHIP | $258,144 | 0.75% | $232,771 |

| WASHINGTON TOWNSHIP | $143,867 | 0.42% | $129,726 |

| BENTON TOWNSHIP | $139,708 | 0.41% | $125,976 |

| CLEAR CREEK TOWNSHIP | $85,145 | 0.25% | $76,776 |

| SALT CREEK TOWNSHIP | $82,544 | 0.24% | $74,431 |

| BEAN BLOSSOM TOWNSHIP | $50,257 | 0.15% | $45,317 |

| POLK TOWNSHIP | $21,361 | 0.06% | $19,261 |

| INDIAN CREEK TOWNSHIP | $10,420 | 0.03% | $9,396 |

| STINESVILLE CIVIL TOWN | $4,168 | 0.01% | $3,758 |

| RICHLAND-BEAN BLOSSOM CSC | $0 | 0.00% | $0 |

| MONROE COUNTY CSC | $0 | 0.00% | $0 |

| MONROE COUNTY SOLID WASTE DIST | $0 | 0.00% | $0 |

| TOTAL | $34,232,607 | 100% | $30,867,832 |

Comments ()